3rd Party Financing Companies

Description

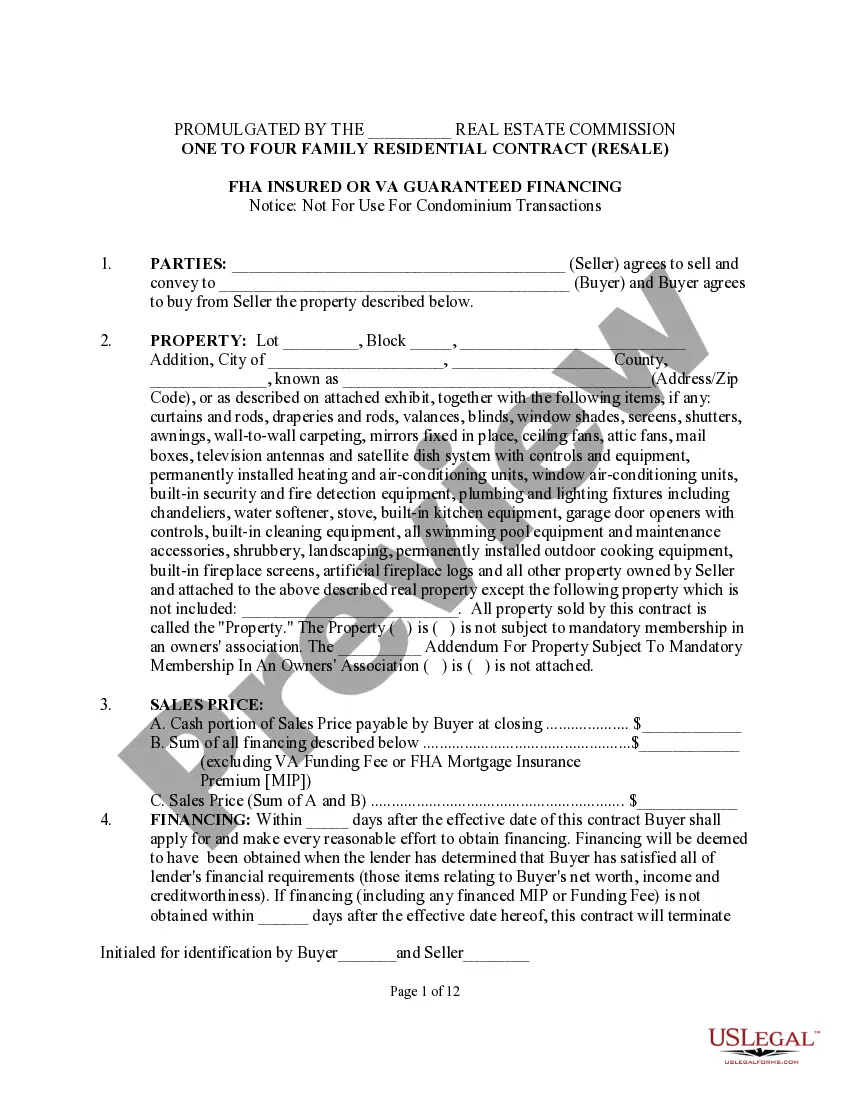

How to fill out Texas One To Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional Or Seller Financing?

- Visit the US Legal Forms website and log in to your account if you're already a subscriber. If your subscription is expired, renew it based on your payment plan.

- For first-time users, start by browsing the comprehensive form library. Utilize the Preview mode and ensure the selected form meets your local jurisdiction's specifications.

- If the desired form doesn’t meet your requirements, utilize the Search feature to find an alternative that suits your needs.

- Once you find the appropriate document, click on the 'Buy Now' button, and select your preferred subscription plan.

- Complete your purchase by providing your payment details through a credit card or PayPal.

- After successful payment, download your form and save it to your device. You can access it later in the 'My Forms' section of your profile.

By following these straightforward steps, you can leverage US Legal Forms to create legally sound documents with confidence. Their user-friendly interface ensures that you find the right forms tailored to your needs.

Start streamlining your legal documentation process today by leveraging the resources available at US Legal Forms!

Form popularity

FAQ

The top three holding companies typically include Berkshire Hathaway, Alphabet Inc. (Google's parent company), and Johnson & Johnson. Holding companies own a significant stake in multiple businesses across different industries. They often look for partnerships with innovative 3rd party financing companies to further diversify their investment strategies.

The leading finance firms often consist of Berkshire Hathaway, JP Morgan Chase, and Goldman Sachs. These firms excel in various sectors, catering to both individual and corporate financial needs. By engaging with 3rd party financing companies, they enhance their flexibility and expand their service offerings.

The top three financing companies often include companies like PayPal, Affirm, and Square. These companies focus on providing consumer-friendly financing solutions, allowing users to access funds easily. They represent a growing trend toward leveraging technology to improve the customer experience in the realm of 3rd party financing.

The top five finance companies globally often include firms like Citigroup, Berkshire Hathaway, BlackRock, Vanguard, and Allianz. Each of these companies plays a significant role in the financial market, offering diverse services ranging from investment management to insurance. They frequently collaborate with 3rd party financing companies to enhance their service offerings.

The top four financial firms typically include JPMorgan Chase, Goldman Sachs, Bank of America, and Wells Fargo. These institutions are well-known for their robust financial services and products. They often partner with various 3rd party financing companies to provide comprehensive solutions to their clients.

party financial site offers a platform where consumers can access various financing options from different lenders. These sites serve as intermediaries, connecting users with thirdparty financing companies that can meet their borrowing needs. Users benefit from comparing rates and terms all in one place, streamlining the decisionmaking process.

Understanding how third party financing companies operate is important for making informed decisions. Typically, a third party financing company assesses your financial situation and project requirements before providing the necessary funds. You can then use this funding to cover costs related to services, equipment, or other expenses, facilitating smoother project execution without immediate financial strain.

Third party financing companies provide various benefits that can enhance your financial flexibility. They offer access to funds without needing to rely solely on your savings or personal assets, allowing you to manage your budget more effectively. Moreover, these companies often streamline the approval process, making funding quicker and easier, which is essential when time-sensitive projects arise.

The third party financing addendum is typically completed by the buyer, as they are the party seeking financing for the transaction. However, sellers should review the document to ensure its terms align with their agreement. Once both parties agree on the financing conditions, signing the addendum becomes a critical step in the process. Having clarity here is vital, especially when working with 3rd party financing companies.

3rd party lenders are financial institutions or companies that offer loans to individuals or businesses for various purposes. This category includes banks, credit unions, and specialized financing firms. These lenders assess creditworthiness and provide funding options according to their established guidelines. Connecting with reliable 3rd party financing companies ensures you secure the best possible terms and conditions.