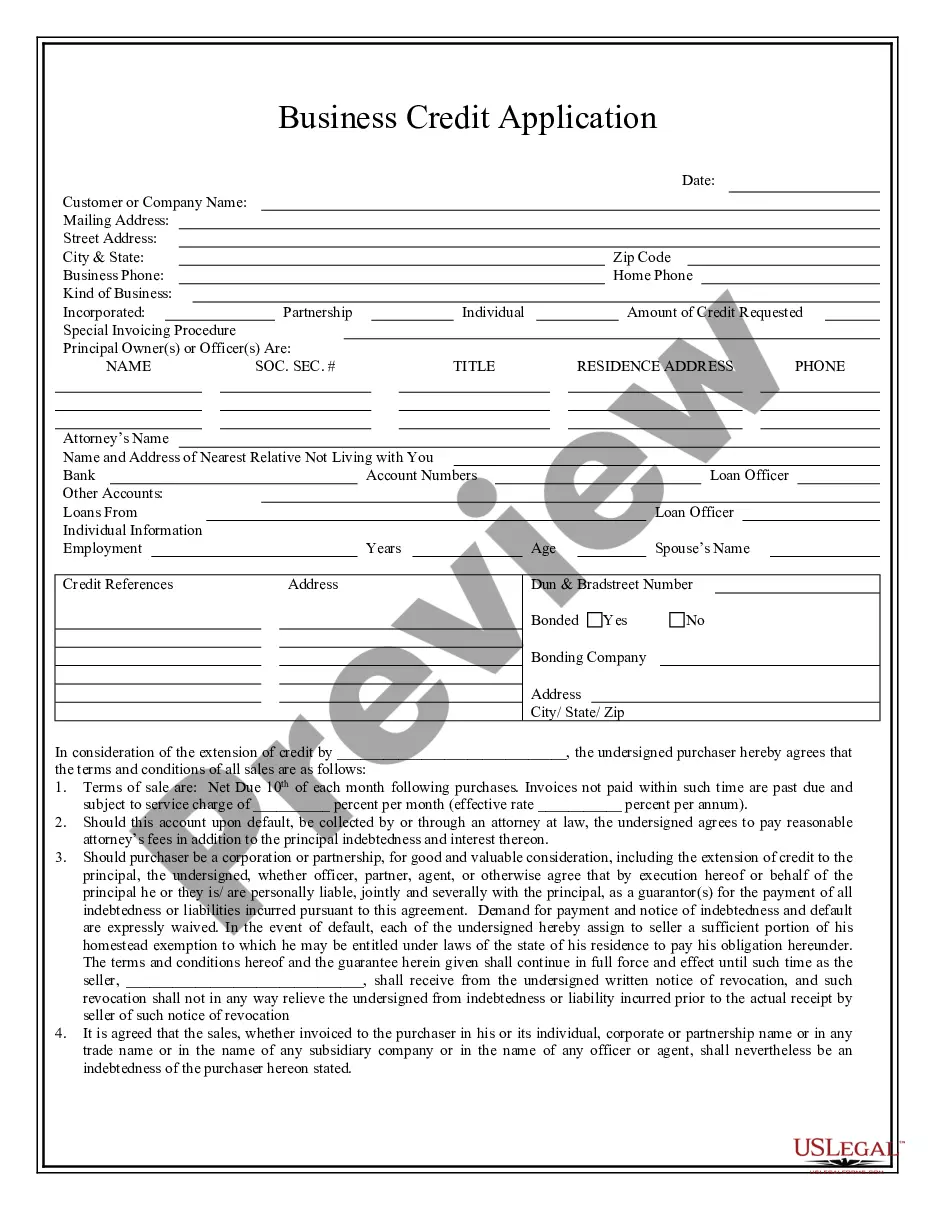

This form is a release of a deed of trust lien. Grantor executed and delivered a deed of trust to the trustee for the lienholder. The lienholder has agreed to release the property from the lien of the deed of trust and discharge all right and title to the property.

Release Of Lien On Real Property Form For California

Description

How to fill out Texas Release Of Lien?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and significant financial investment.

If you seek a simpler and more cost-effective method of preparing the Release Of Lien On Real Property Form For California or any other paperwork without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of more than 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously crafted for you by our legal experts.

Review the form preview and descriptions to confirm that you have located the form you are looking for. Ensure that the form you choose meets the criteria of your state and county. Select the most suitable subscription option to purchase the Release Of Lien On Real Property Form For California. Download the document. Then complete, sign, and print it out. US Legal Forms enjoys a solid reputation and over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- Utilize our platform whenever you require a dependable and trustworthy service from which you can effortlessly locate and download the Release Of Lien On Real Property Form For California.

- If you are already familiar with our services and have set up an account with us before, simply Log In to your account, choose the template, and download it or re-download it at any time later in the My documents section.

- Not yet registered? No worries. It only takes a few minutes to create an account and browse the library.

- But before proceeding to download the Release Of Lien On Real Property Form For California, follow these guidelines.

Form popularity

FAQ

To remove a lien from your property in California, start by paying off the debt associated with the lien. Next, request the release of lien on real property form for California from your lien holder and ensure it is properly signed. Finally, file this form with your local county recorder’s office to officially erase the lien from your property records.

In California, a release of lien is typically required to be notarized to ensure its authenticity. This notarization helps protect against fraud and confirms that the parties involved agreed to the release. Be sure to follow any specific requirements laid out in the release of lien on real property form for California to streamline your process.

You can obtain a lien release form from various sources, including your lien holder, local government offices, or online platforms. Platforms like uslegalforms offer easy access to the release of lien on real property form for California, simplifying the process for you. Just ensure the form complies with California's legal requirements before you complete and submit it.

To obtain a lien release in Kansas, you need to contact the lien holder, which is usually the lender or creditor. They must provide you with the necessary documentation confirming that the debt is satisfied. After you receive the release of lien on real property form for California, ensure it is filed with the appropriate county office to remove the lien from public records.

An unconditional release on final payment is a document that permanently waives the right to claim a lien upon full payment of a contract. Unlike conditional releases, it applies irrespective of whether the payment has been made or not, giving assurance to the property owner. This can protect both the contractor and property owner from future claims. You can find a clear template for this using the Release of lien on real property form for California on uslegalforms.

To fill out a conditional waiver and release on progress payment, start by entering the name of the party waiving the lien and the property details. Include the amount of the progress payment being referenced, and confirm that the payment has been received or will be received. You must sign the document and often have it notarized for legal purposes. Using the Release of lien on real property form for California can help ensure that you correctly fill out this legal document.

Yes, a conditional waiver often must be notarized to be considered valid and enforceable. Notarization serves as a verification step, confirming that the signer is who they claim to be and that they are signing willingly. It’s essential to check the specific requirements for your state when preparing such documents. Exploring the Release of lien on real property form for California through uslegalforms can guide you in ensuring compliance with notarization.

A conditional waiver and release on a progress payment is a legal document that relinquishes a lien on a property, conditioned upon receiving payment. This means that as long as the payment is made, the lien rights are waived. It's crucial for contractors and subcontractors to understand this document's implications when taking payment. Although this relates to Texas, using the Release of lien on real property form for California can offer insight into similar processes in your state.

Preparing a release of lien involves drafting a document that states the lien is no longer valid. Begin by identifying the lienholder and the property in question, and then clearly state that the lien is being released. It is essential to have this document signed by the lienholder and, when possible, to have it notarized. Utilizing the Release of lien on real property form for California can simplify your preparation process.

To fill out a lien affidavit, start by gathering the necessary information about the property and the parties involved. Next, accurately complete all fields in the affidavit form, ensuring that you include details such as the property's legal description and the amounts owed. Finally, sign the affidavit in front of a notary to validate the document. Using the Release of lien on real property form for California can streamline this process.