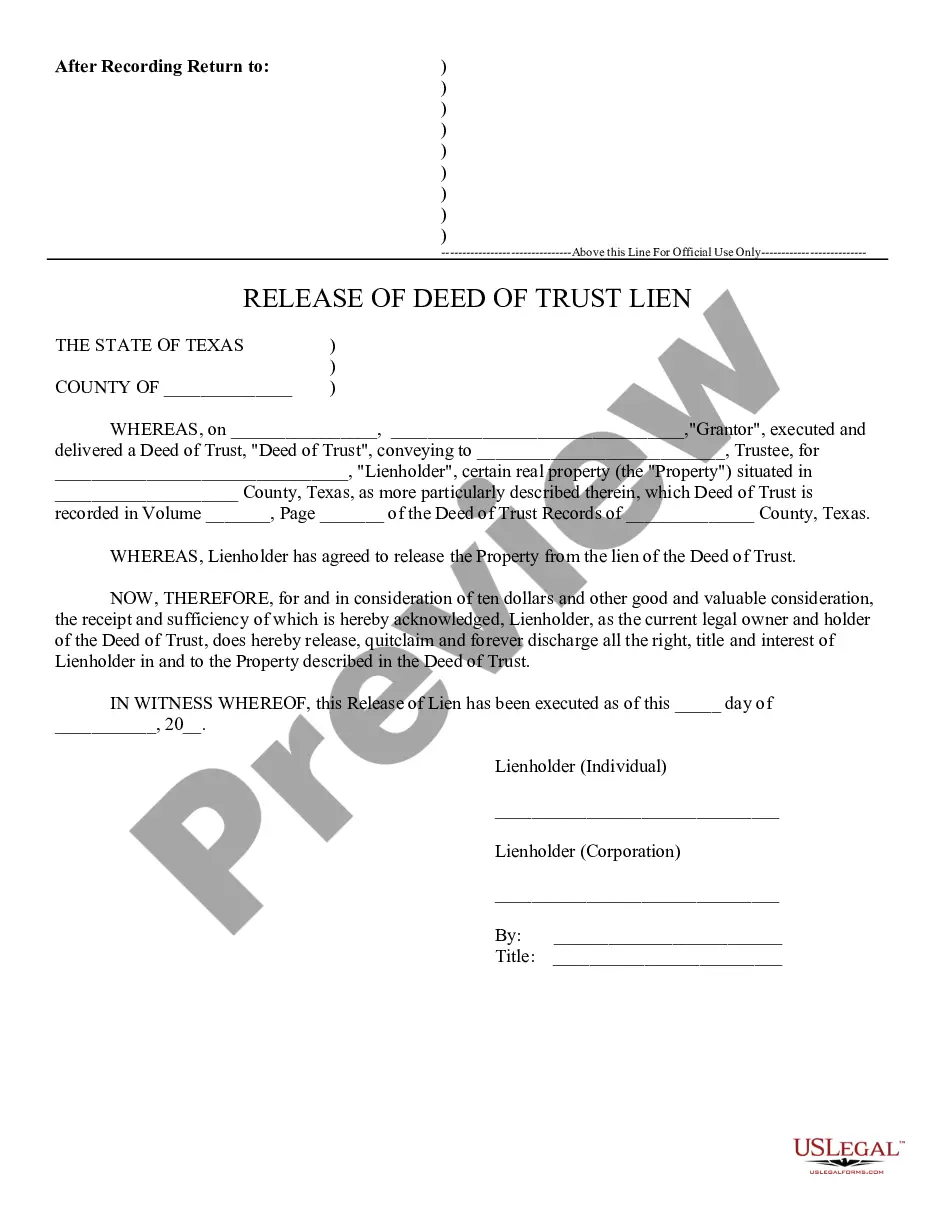

Lien Release Form Texas With Lienholder

Description

How to fill out Texas Release Of Lien?

Handling legal paperwork and processes can be a lengthy addition to your schedule.

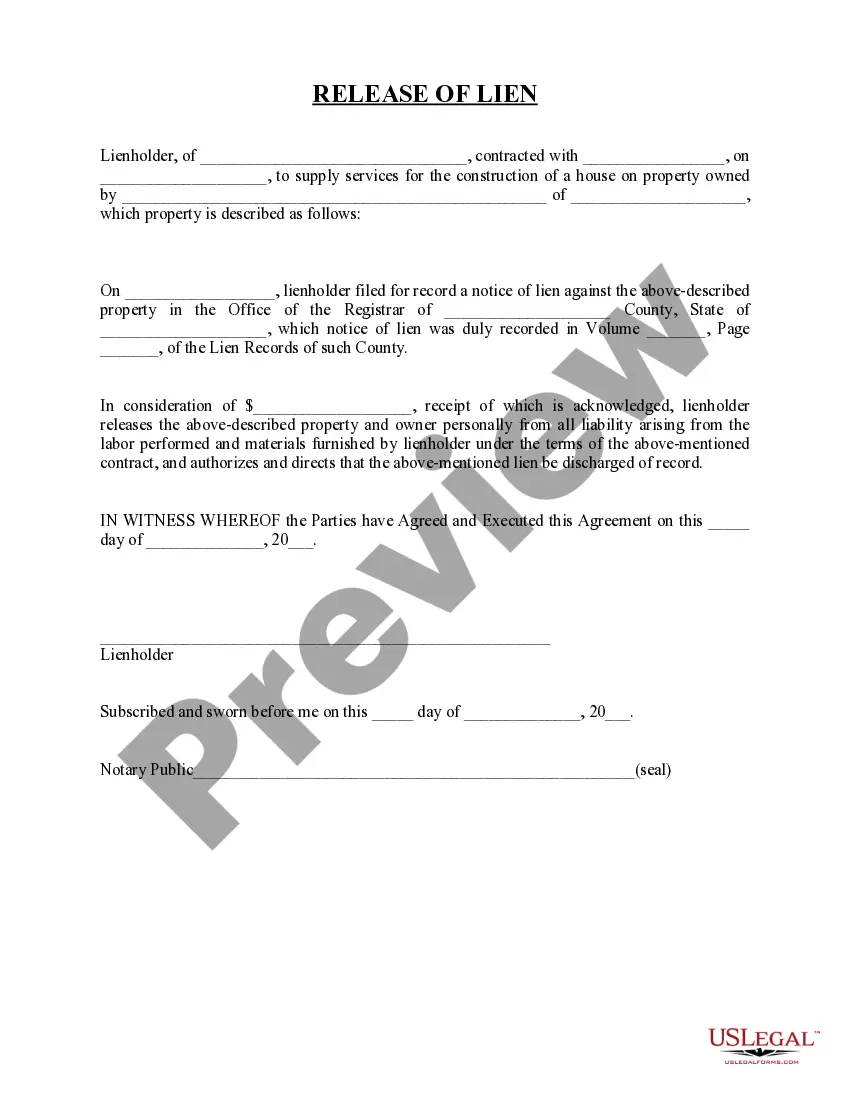

Lien Release Form Texas With Lienholder and similar forms usually necessitate that you locate them and figure out how to fill them out correctly.

Consequently, whether you are managing financial, legal, or personal issues, having an extensive and user-friendly online library of forms readily available will significantly help.

US Legal Forms is the leading online platform for legal documents, featuring over 85,000 state-specific templates and various tools to help you finalize your paperwork swiftly.

Simply Log In to your account, locate Lien Release Form Texas With Lienholder, and obtain it directly from the My documents section. Additionally, you can access previously downloaded forms. Is this your first time using US Legal Forms? Create an account in just a few minutes to gain access to the form library and Lien Release Form Texas With Lienholder. Then, follow the steps below to complete your form: Ensure you have found the correct form using the Preview option and reviewing the form details. Click Buy Now when ready, and select the subscription plan that suits you best. Press Download, then fill out, sign, and print the form. US Legal Forms has 25 years of experience assisting users with their legal paperwork. Obtain the form you require now and streamline any process effortlessly.

- Uncover the collection of relevant documents accessible with just one click.

- US Legal Forms offers you state- and county-specific templates available for downloading at any time.

- Protect your document management processes with a quality service that enables you to prepare any form in a matter of minutes without extra or hidden costs.

Form popularity

FAQ

You may determine if you need to pay estimated tax to North Dakota using Form ND-1ES Estimated Income Tax ? Individuals. If you are required to pay estimated income tax to North Dakota, and fail to pay at least the required minimum amount, you will be charged interest on any underpayment.

Form 307 - North Dakota Transmittal of Wage and Tax Statement 2022.

North Dakota participates in the Internal Revenue Service's Federal/State Modernized E-File program. This allows you to file and pay both your federal and North Dakota income tax return at the same time.

If you are not required to file electronically, complete Form 306 ? Income Tax Withholding Return. Form 306 ? Income Tax Withholding Return must be filed even if an employer did not pay any wages during the period covered by the return.

Efile North Dakota Tax Return Form Name:Instructions:ND-1OFMail in ND-1OF to: Electronic Filing Coordinator Office of State Tax Commissioner 600 E Boulevard Ave, Dept. 127 Bismarck, ND 58505-0599

You may determine if you need to pay estimated tax to North Dakota using Form ND-1ES Estimated Income Tax ? Individuals. If you are required to pay estimated income tax to North Dakota, and fail to pay at least the required minimum amount, you will be charged interest on any underpayment.

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Yes, you can typically e-file the currently due tax year and two prior years, except during an IRS closure. For example, once the IRS has opened e-filing for tax year 2022 returns, you'll still be able to e-file 2021 and 2020 business returns.