Texas Foreclosure Adverse Possession

Description

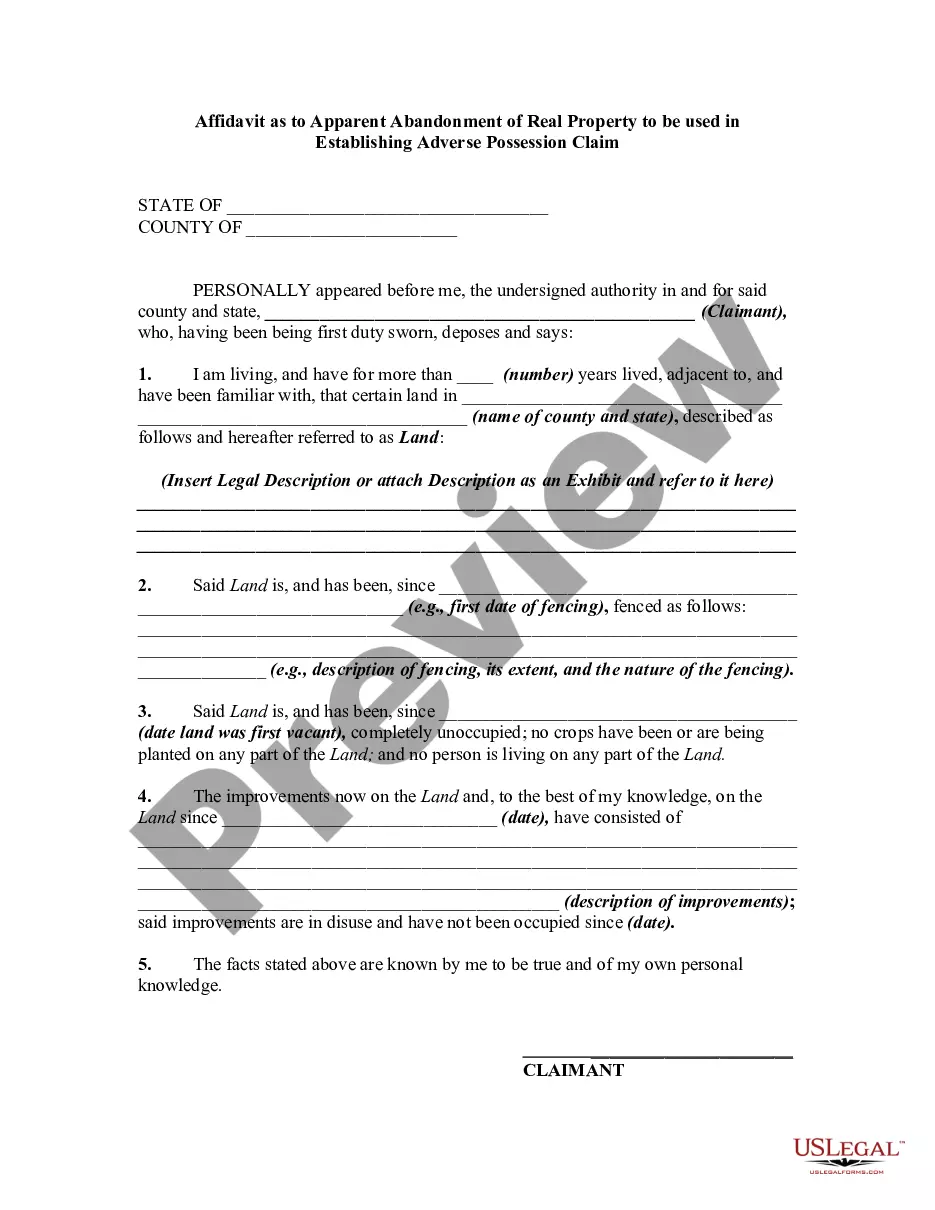

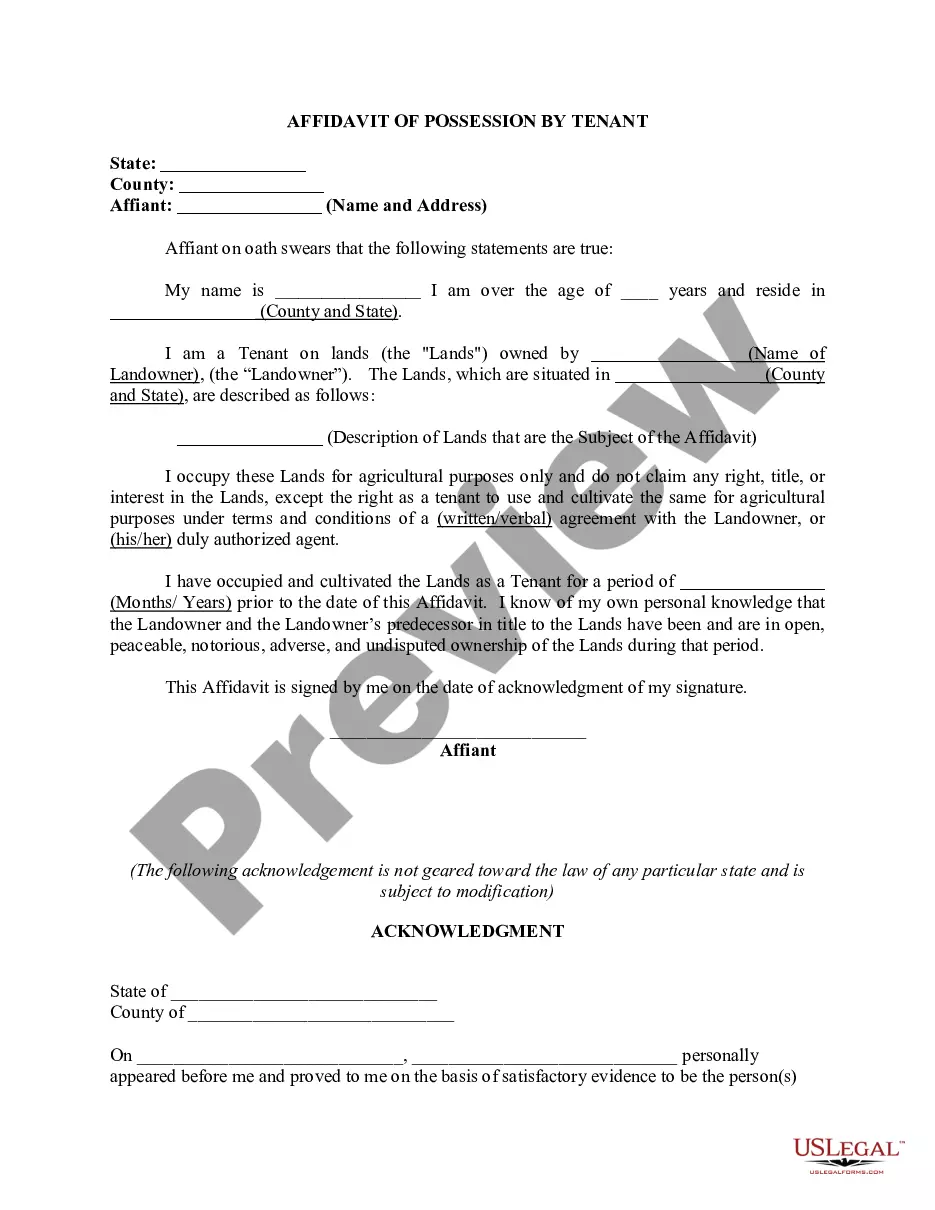

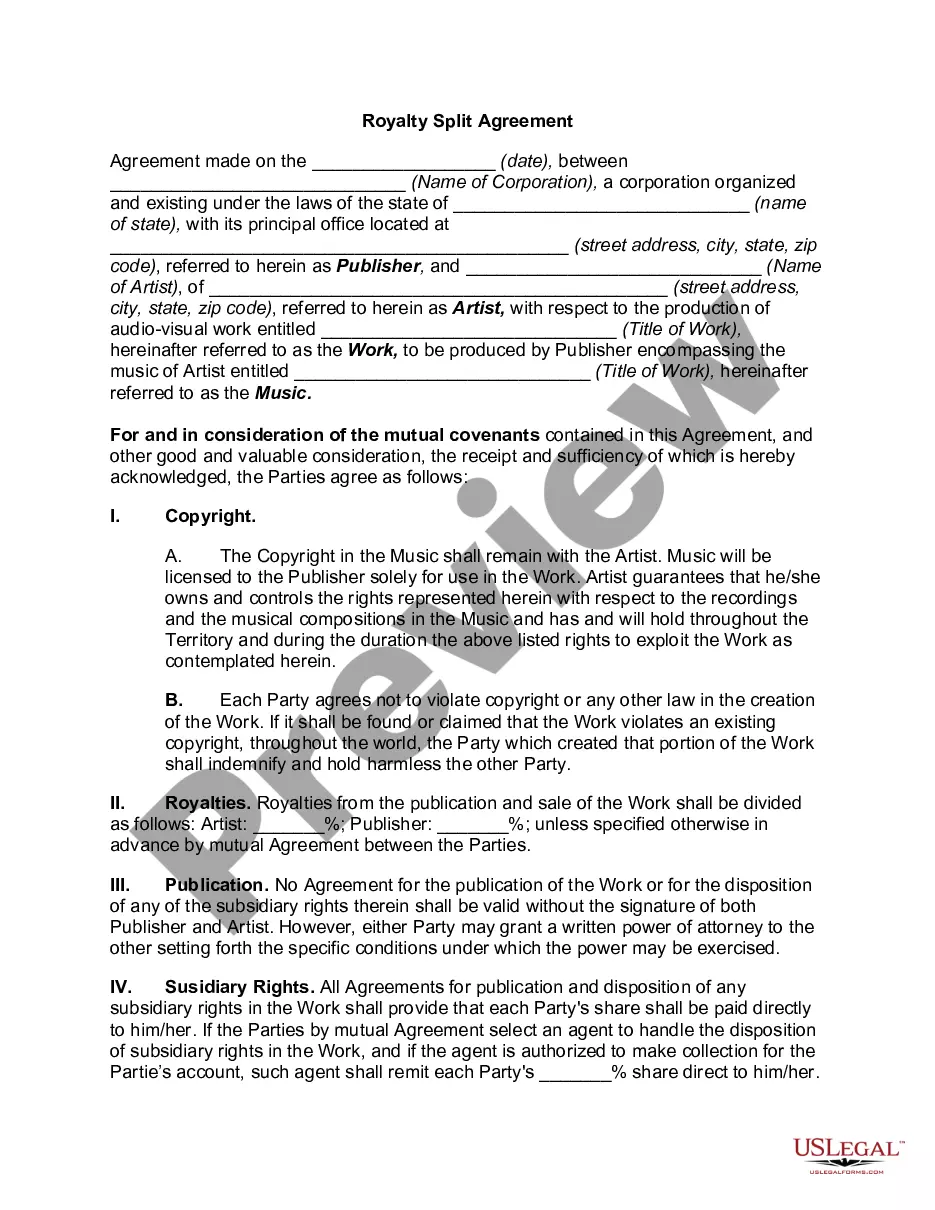

How to fill out Texas Adverse Possession Affidavit - Squatters Rights?

Locating a reliable source to acquire the most up-to-date and pertinent legal templates is a significant part of managing bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it is essential to procure samples of Texas Foreclosure Adverse Possession exclusively from credible providers, such as US Legal Forms.

Eliminate the complications associated with your legal documents. Browse the comprehensive US Legal Forms database to discover legal templates, evaluate their applicability to your circumstances, and download them instantly.

- Leverage the directory navigation or search box to find your document.

- Access the form’s details to verify if it meets the criteria of your state and county.

- View the document preview, if available, to confirm that the template is indeed the one you seek.

- Return to the search to seek the suitable document if the Texas Foreclosure Adverse Possession does not fulfill your requirements.

- If you are confident about the form’s appropriateness, proceed to download it.

- As an authorized user, click Log in to verify and access your chosen templates in My documents.

- If you do not have an account, click Buy now to obtain the document.

- Choose the pricing plan that aligns with your needs.

- Continue to the registration to complete your purchase.

- Conclude your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Texas Foreclosure Adverse Possession.

- Once the form is on your device, you can modify it with the editor or print it out and fill it in by hand.

Form popularity

FAQ

LLCs will file the Statement of Dissolution, which lets the state know of its intention to dissolve. Once the LLC finishes winding up, it can file a Statement of Termination affirming that its affairs have all closed. You'll provide the name of the company and the date on which it dissolved.

"Winding Up" Under California's LLC Act, key winding up tasks include: prosecuting and defending actions by or against the LLC in order to collect and discharge obligations. disposing of and conveying the LLC's property; and. collecting and dividing the LLC's assets.

Dissolution, also called winding up, is a process that members of an LLC will go through in preparation to cancel with the secretary of state and terminate the existence of the LLC. Cancellation is on the secretary of state's side, which terminates the rights, privileges, and powers of an LLC.

Nebraska requires domestic corporations to publish notice of dissolution. The notice must include: the terms and conditions of dissolution, the names of the persons who are to wind up and liquidate its business and affairs and their official titles, and a statement of assets and liabilities of the corporation.

To reinstate your domestic LLC, please contact our office at sos.corp@nebraska.gov to receive the reinstatement application, report and fee worksheet. Submit the application and report by filing either in-person or by mail. Online filing is not available.

A statement of authority is a two-page document filed with the Secretary of State (currently a $50 filing fee) alerting third parties which members or employees of a limited liability company (LLC) have authority to bind the company in its business dealings with third parties.

These 2021 forms and more are available: Nebraska Form 1040N ? Personal Income Tax Return for Residents. Nebraska Form 2210 ? Underpayment of Estimated Tax. Nebraska Form 2441N ? Child and Dependent Care Expenses.

To dissolve an LLC in Nebraska you need to file the Statement of Dissolution with the Nebraska Secretary of State through mail or online for $10 + $5 per page.