Deed From To Trust Without A Lawyer

Description

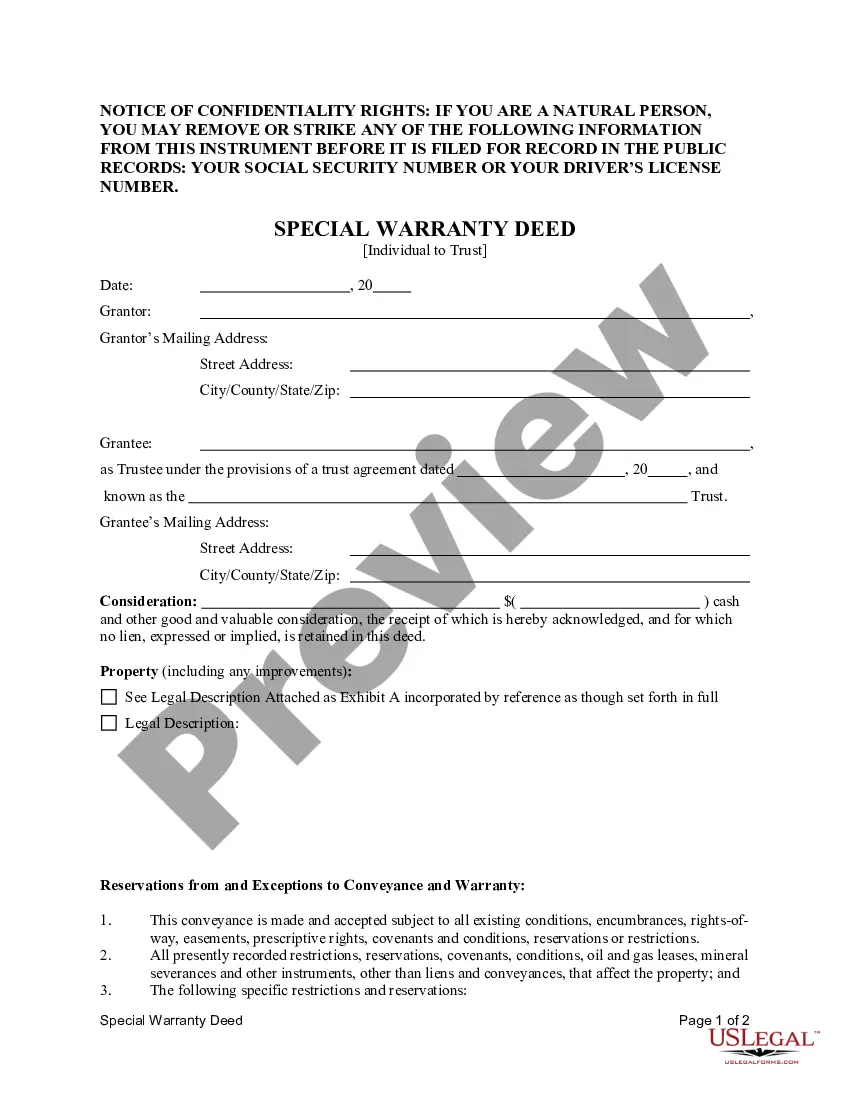

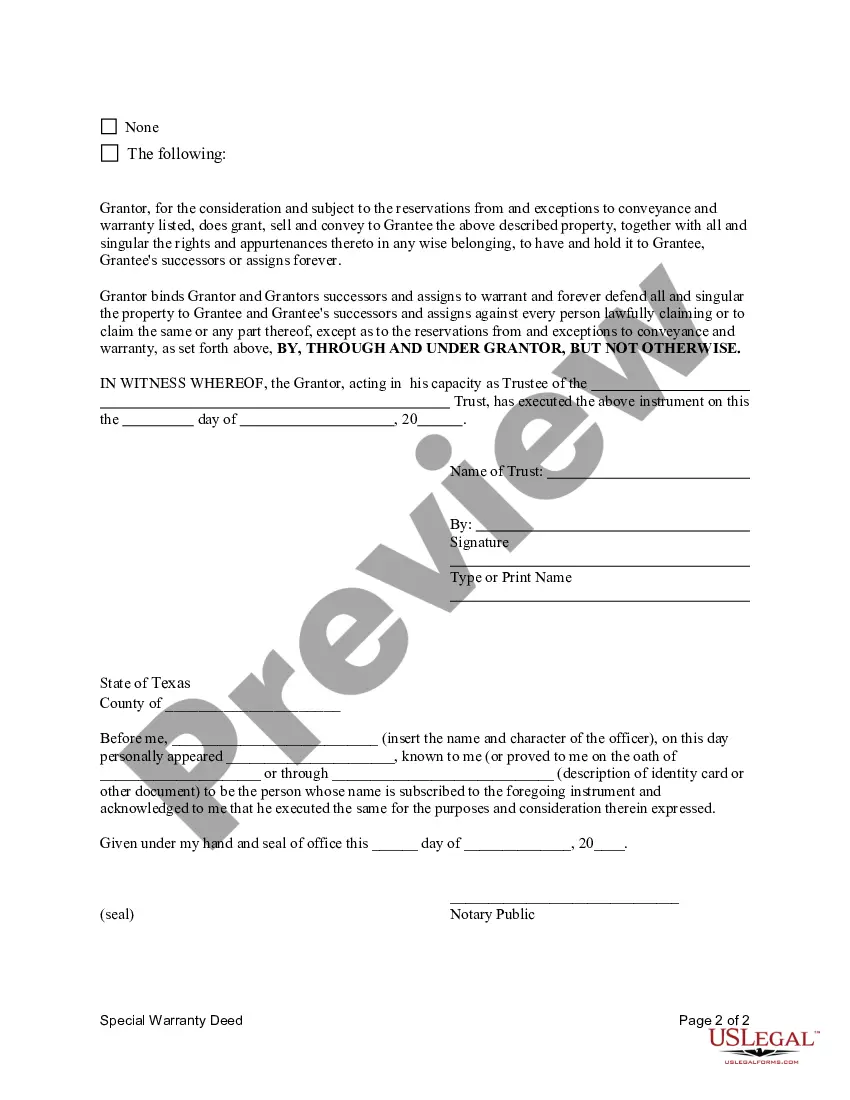

How to fill out Texas Special Warranty Deed From An Individual To A Trust?

Whether for business purposes or for personal affairs, everyone has to manage legal situations sooner or later in their life. Completing legal papers needs careful attention, starting with picking the correct form template. For instance, if you select a wrong version of the Deed From To Trust Without A Lawyer, it will be declined when you send it. It is therefore important to get a trustworthy source of legal papers like US Legal Forms.

If you have to get a Deed From To Trust Without A Lawyer template, stick to these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Look through the form’s information to ensure it suits your case, state, and region.

- Click on the form’s preview to see it.

- If it is the incorrect form, get back to the search function to locate the Deed From To Trust Without A Lawyer sample you require.

- Download the template when it matches your needs.

- If you have a US Legal Forms account, simply click Log in to access previously saved files in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the proper pricing option.

- Finish the account registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Pick the document format you want and download the Deed From To Trust Without A Lawyer.

- After it is downloaded, you can complete the form with the help of editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you do not need to spend time seeking for the appropriate sample across the web. Take advantage of the library’s straightforward navigation to get the proper template for any situation.

Form popularity

FAQ

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.

The cost to prepare and file a Short Form Deed of Trust in California is $375.00* total. The flat rate pricing includes filing fees. *Our flat rate pricing covers filing fees for up to 5 pages and do not include notary fees. Additional pages or non-conforming documents will accrue an additional filing fee.

Transfers to an irrevocable trust are generally subject to gift tax. This means that even though assets transferred to an irrevocable trust will not be subject to estate tax, they will generally be subject to gift tax.

A revocable trust does not pay taxes. For federal and California income tax purposes, the assets in the trust are treated as belonging to you.