Texas Correction Grantor Contract With The Bank

Description

How to fill out Texas Correction Deed - Prior Deed From An Individual To An Individual?

- Start by logging into your US Legal Forms account. If you're new, create an account to benefit from the extensive library.

- Explore the available templates. Utilize the Preview mode to ensure you select the correct Texas correction grantor contract template that meets your local jurisdiction requirements.

- If necessary, conduct a search for additional templates that might suit your needs more closely.

- Proceed to purchase the selected document by clicking the Buy Now button and selecting an appropriate subscription plan.

- Complete your purchase securely using a credit card or PayPal for hassle-free access.

- Once the transaction is successful, download your Texas correction grantor contract and store it on your device for easy access in the My Forms menu.

By following these steps, you can swiftly navigate the process, ensuring that your legal documents are well-prepared and compliant.

Don't hesitate—start your journey with US Legal Forms today and access all the resources you need for effective legal document management.

Form popularity

FAQ

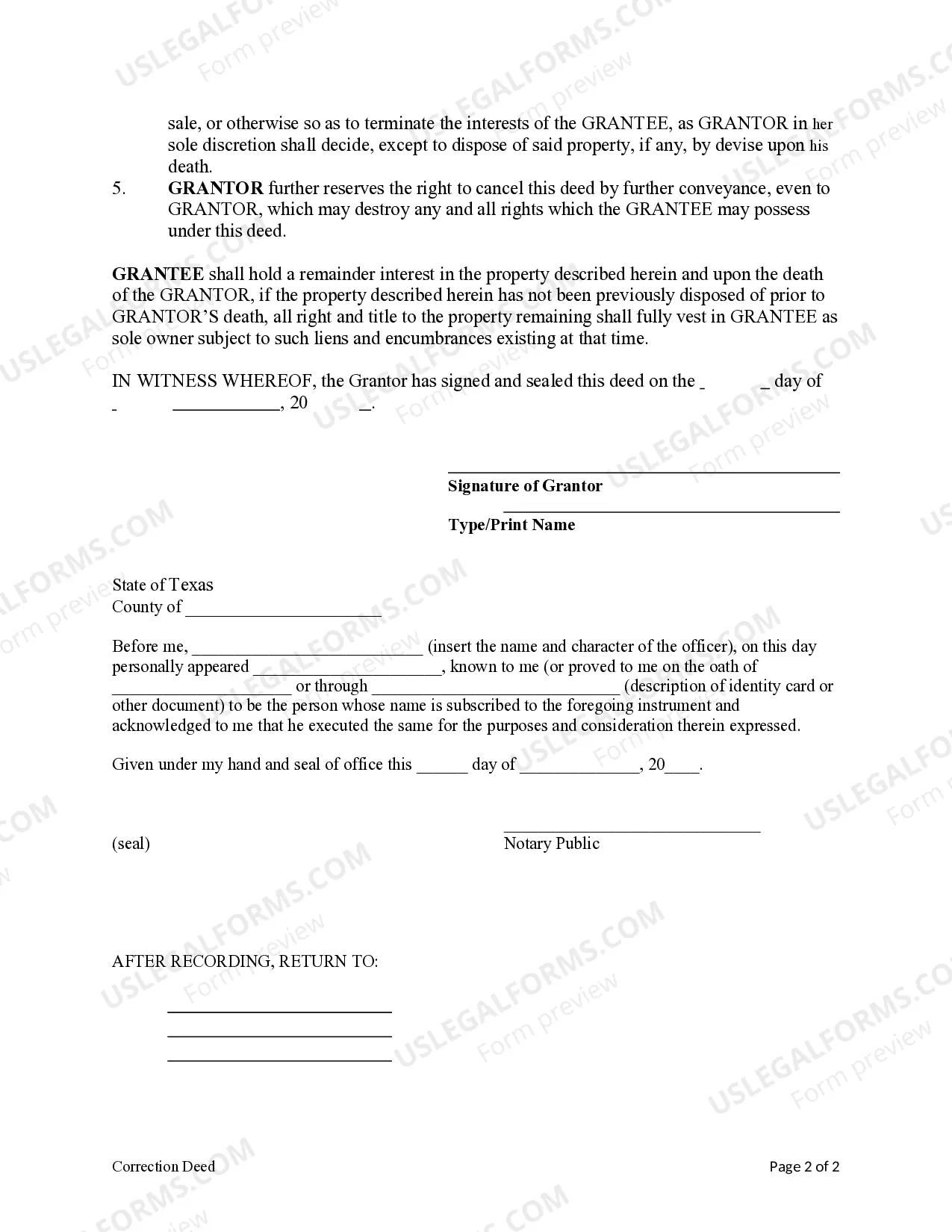

A correction deed is a legal document used to amend a previously recorded deed, rectifying any inaccuracies or omissions. This document helps clarify the intended transaction and can protect the rights of both parties involved. If you are navigating a Texas correction grantor contract with the bank, utilizing a correction deed is an important step to ensure clarity and legal standing.

A corrective deed is intended to fix errors in the original deed, such as typographical mistakes or incorrect legal descriptions. In contrast, a confirmatory deed reaffirms the original intent of the grantor and does not alter any existing terms. Understanding these differences is crucial, especially when dealing with a Texas correction grantor contract with the bank.

To correct a deed in Texas, you must prepare a correction deed that details the mistakes in the original document. Once prepared, you will need to have the correction deed signed by the grantor and then file it with the appropriate county clerk's office. Taking this step ensures that any issues related to the Texas correction grantor contract with the bank are resolved and recorded appropriately.

In the context of a Texas correction grantor contract with the bank, the grantor is not necessarily the bank. The grantor is typically the property owner who is conveying the property. However, banks may act as parties to the contract in certain situations, such as when they have a lien on the property.

In Texas, any party who has an interest in the property can file a correction deed. This includes the seller or the buyer, but typically it is the party who holds the original deed that seeks to correct it. Filing a Texas correction grantor contract with the bank can help clarify any discrepancies and protect all involved parties.

If a seller does not record the contract for deed in Texas, it may lead to significant legal issues. The failure to record can make it difficult for the buyer to assert their rights and can result in issues regarding ownership claims by third parties. Additionally, not recording the Texas correction grantor contract with the bank can complicate financing and future sales of the property.

Section 12.002 of the Texas Code refers to the regulations governing various types of legal documents and their potential implications. This includes information relevant to real estate transactions and corrections. If you need to address a property issue, knowing this section can enhance your understanding of a Texas correction grantor contract with the bank.

A lis pendens in Texas requires a written notice that must be filed with the county clerk, indicating pending litigation concerning a property. This notice alerts potential buyers or financiers about existing legal claims on the property. It's crucial to understand these requirements, particularly if you are involved in property disputes related to a Texas correction grantor contract with the bank.

To correct a deed in Texas, you generally file a correction deed that specifies the errors in the original deed. This correction must be signed by the grantor and recorded with the county clerk. Utilizing a Texas correction grantor contract with the bank can simplify this process and provide legal reassurance.

The 40 or 48 rule refers to a guideline in Texas property law regarding certain deadlines for correcting deeds. Specifically, it indicates the timeframe within which corrections must be filed to avoid potential disputes. Familiarizing yourself with this rule is vital when executing a Texas correction grantor contract with the bank.