Deed Correction Form With Mortgage

Description

How to fill out Texas Correction Deed - Prior Deed From An Individual To An Individual?

Locating a preferred source to obtain the latest and pertinent legal templates is half the challenge of navigating bureaucracy.

Selecting the correct legal documents requires accuracy and meticulousness, which is why it is crucial to acquire samples of Deed Correction Form With Mortgage solely from trustworthy providers, such as US Legal Forms. An incorrect template will squander your time and prolong your current situation. With US Legal Forms, you have minimal concerns. You can access and review all the specifics regarding the document’s applicability and significance for your situation and in your state or county.

After obtaining the form on your device, you may modify it using the editor or print it out and complete it manually. Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms library where you can discover legal templates, verify their relevance to your situation, and download them instantly.

- Utilize the library navigation or search bar to find your sample.

- Review the form’s description to ensure it aligns with your state and region's needs.

- Examine the form preview, if accessible, to confirm that the template is what you require.

- Return to the search and find the appropriate document if the Deed Correction Form With Mortgage does not suit your needs.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Select the pricing plan that suits your preferences.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Deed Correction Form With Mortgage.

Form popularity

FAQ

It is important for the deed and mortgage to be consistent, as discrepancies can create legal issues. If the names or details differ, it might lead to complications during a sale or transfer. Using a deed correction form with mortgage can help align these documents. Always verify that both documents reflect the same information to avoid potential disputes.

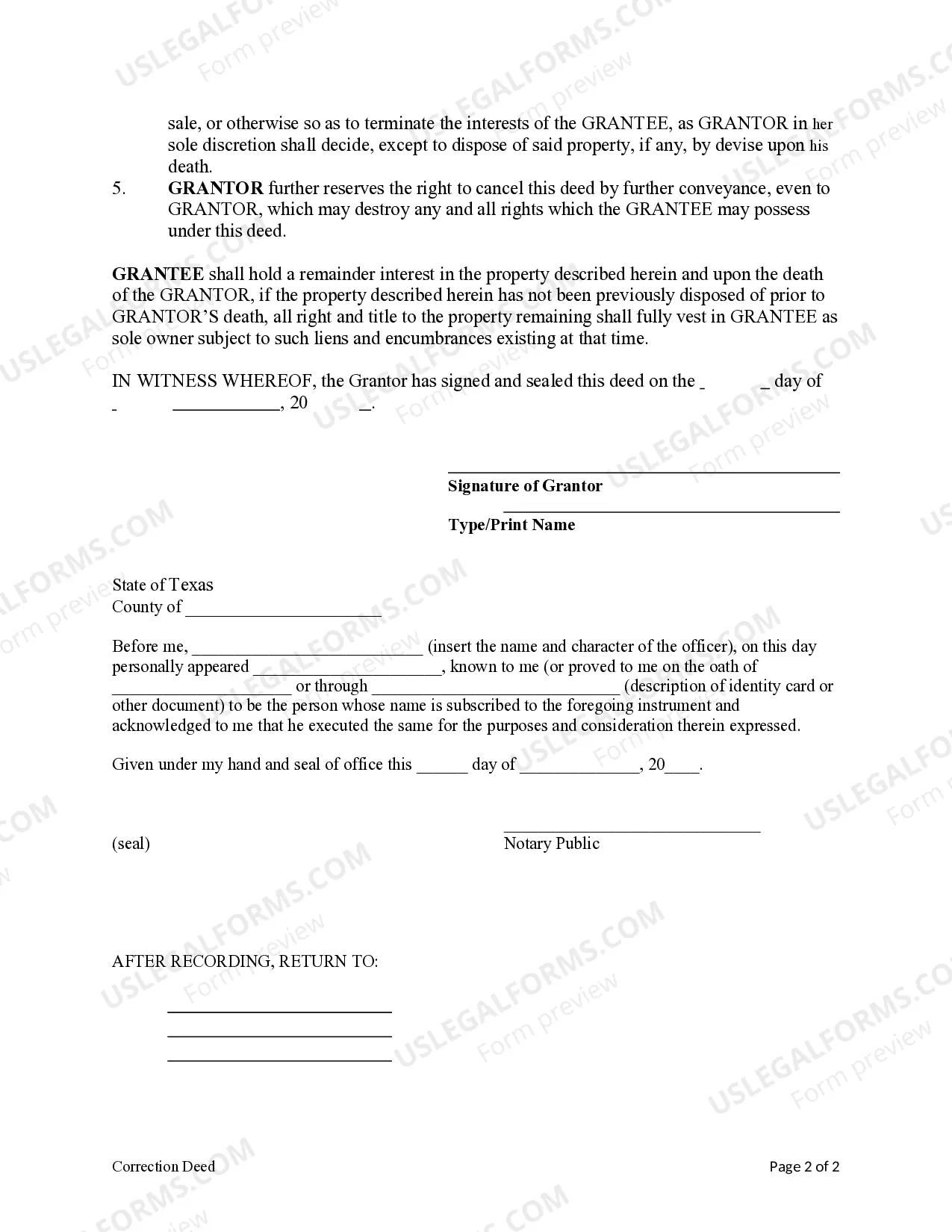

Yes, a correction deed typically needs to be notarized to be legally binding. Notarization adds an extra layer of verification, ensuring that all parties involved have agreed to the changes. When using a deed correction form with mortgage, include notarization to validate the document. Consulting a legal expert can ensure that all requirements are met.

Transferring ownership during an active mortgage can lead to complications. The lender may have specific requirements, and you might need to obtain their approval before proceeding. Using a deed correction form with mortgage can help clarify the transfer process. Always consult with your lender to understand the implications and necessary steps before making any changes.

To remove a name from both a deed and a mortgage, you typically need to refinance the mortgage or obtain consent from the lender. This process often involves submitting a deed correction form with mortgage to officially update the ownership records. It is crucial to consult with your lender and possibly a legal expert to navigate this process effectively.

Changing a deed while a mortgage exists is possible, but it requires careful consideration. You need to ensure that the lender is informed and that the change does not violate the mortgage agreement. Using a deed correction form with mortgage can help streamline the necessary steps. It is advisable to work with professionals to manage the transition smoothly.

Yes, you can change a deed even if there is a mortgage in place. However, it is important to follow the proper legal procedures to ensure the deed correction is valid. A deed correction form with mortgage can help facilitate this process. Consulting with a legal professional can provide additional guidance.

On the corrective deed, give the recording information from the previously filed document, then identify which section contains the error. Provide the correct details in the body of the deed. The corrective deed states the nature of the error and recites the date and recording information of the erroneous deed.

Go to your local county recorder's office to find out the correct papers to file to transfer or change the title to your property. Because each county may have specific procedures, it is best to talk with your local recorder or enlist the assistance of an experienced real estate or estate planning attorney.

Obvious description errors in a recorded deed, deed of trust, or mortgage purporting to convey or transfer an interest in real property may be corrected by recording an affidavit in the land records of the circuit court for the jurisdiction where the property is located or where the deed, deed of trust, or mortgage ...

Obtain the original signature(s) of the Grantor(s) of the deed. Re-execute a deed or record a correction deed with property notarization and witnessing as required. Ensure that your selected instrument is recorded with the appropriate county office. Be sure to pay the required recording fees.