Correction Deed Example With Mortgage

Description

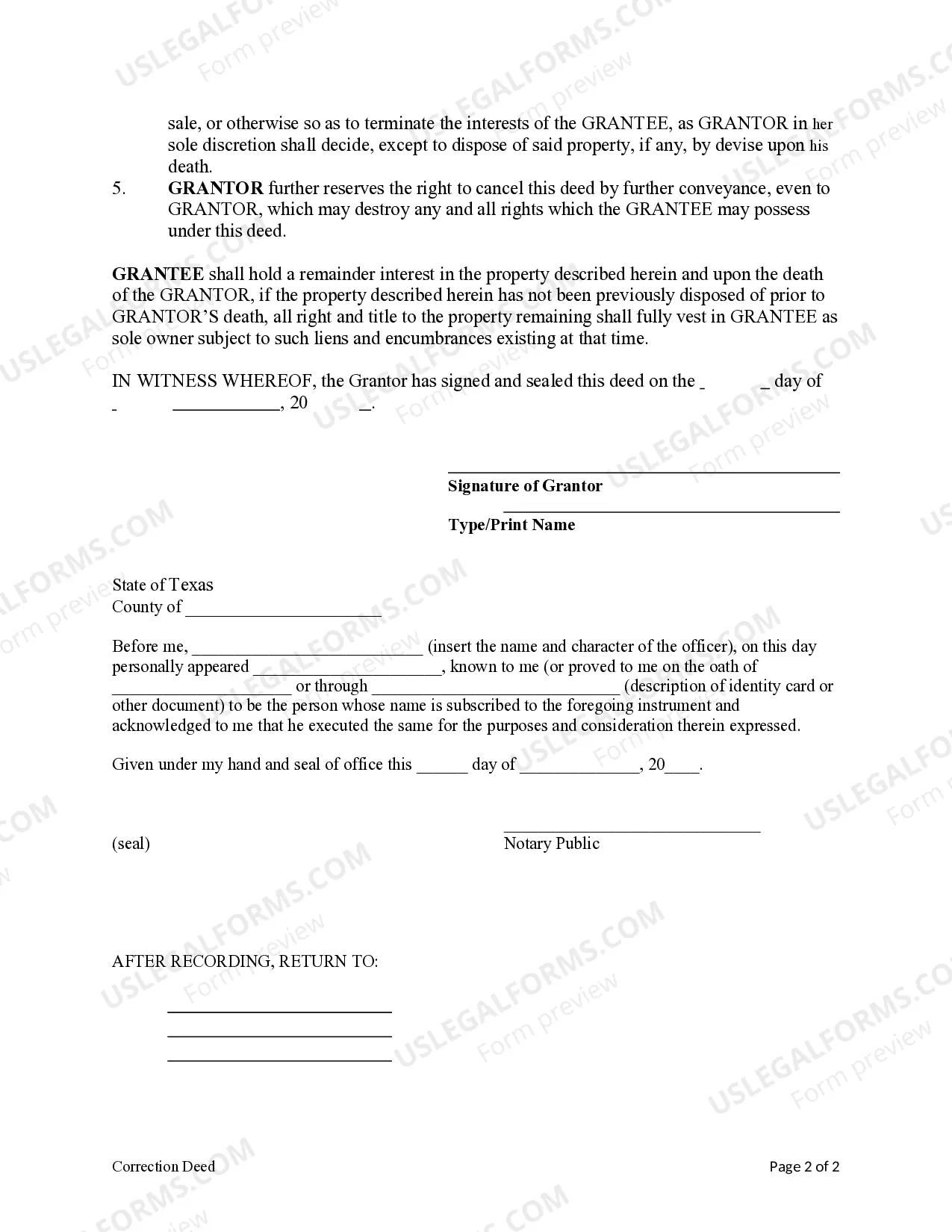

How to fill out Texas Correction Deed - Prior Deed From An Individual To An Individual?

Whether for commercial reasons or personal matters, everyone must confront legal issues at some stage in their existence. Finalizing legal documents requires meticulous care, starting from selecting the correct template example. For instance, if you choose an incorrect version of the Correction Deed Example With Mortgage, it will be rejected upon submission. Hence, it is essential to have a reliable source of legal documents like US Legal Forms.

If you need to acquire a Correction Deed Example With Mortgage template, follow these straightforward steps: Find the document you require by utilizing the search box or catalog browsing. Review the form’s description to ensure it aligns with your scenario, jurisdiction, and county. Click on the form’s preview to view it. If it is the wrong document, return to the search tool to find the Correction Deed Example With Mortgage template you need. Download the document when it fulfills your criteria. If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents. If you don’t have an account yet, you can obtain the document by clicking Buy now. Choose the suitable pricing option. Complete the profile registration form. Select your payment method: utilize a credit card or PayPal account. Choose the file format you desire and download the Correction Deed Example With Mortgage. Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

With a vast US Legal Forms catalog available, you won’t waste time searching for the suitable template online. Utilize the library’s user-friendly navigation to discover the correct form for any occasion.

- Whether for commercial reasons or personal matters, everyone must confront legal issues at some stage in their existence.

- Finalizing legal documents requires meticulous care, starting from selecting the correct template example.

- For instance, if you choose an incorrect version of the Correction Deed Example With Mortgage, it will be rejected upon submission.

- Hence, it is essential to have a reliable source of legal documents like US Legal Forms.

- If you need to acquire a Correction Deed Example With Mortgage template, follow these straightforward steps.

- Find the document you require by utilizing the search box or catalog browsing.

- Review the form’s description to ensure it aligns with your scenario, jurisdiction, and county.

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search tool to find the Correction Deed Example With Mortgage template you need.

- Download the document when it fulfills your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you don’t have an account yet, you can obtain the document by clicking Buy now.

Form popularity

FAQ

Yes, a deed can be changed even if there is an existing mortgage. However, it is crucial to follow the proper legal procedures to avoid complications with the lender. A correction deed example with mortgage can provide a clear framework for making these changes. Consulting with a legal professional or using resources like USLegalForms can make this process easier.

A correction deed is commonly used to rectify mistakes in the original property deed, such as misspellings or inaccurate descriptions. This type of deed ensures that the public record accurately reflects the property's true ownership. If you encounter issues related to ownership transfer, a correction deed example with mortgage can be beneficial. Using platforms like USLegalForms can simplify this process.

Yes, you can transfer ownership of a mortgaged property. However, the mortgage lender may need to approve the transfer, especially if it includes a new owner. A correction deed example with mortgage can help clarify the ownership change and ensure all parties are informed. It is wise to consult with a legal professional to navigate this process.

A corrective deed in New Jersey is a legal document used to rectify errors in a previously recorded deed. This can include mistakes such as misspellings or incorrect property descriptions. If you are dealing with a correction deed example with mortgage, it is important to follow the proper procedures to ensure the document is valid. Utilizing platforms like USLegalForms can assist you in preparing the necessary documents accurately.

Yes, an Affidavit of correction typically needs to be notarized to be considered valid. Notarization adds an extra layer of authenticity and ensures that the document is legally enforceable. This is particularly important when dealing with matters such as a correction deed example with mortgage. It is advisable to consult with a legal expert to ensure all requirements are met for your specific situation.

To complete a Scrivener's affidavit, you need to clearly identify the document that contains the error and explain the nature of the mistake. This affidavit serves as a sworn statement affirming the corrections and should include a correction deed example with mortgage if applicable. After drafting the affidavit, you must sign it in front of a notary public. This step adds credibility and ensures the document is recognized legally.

Yes, you can change a deed even if there is a mortgage in place. When doing this, it is essential to prepare a correction deed example with mortgage to ensure that the changes do not violate any terms of the mortgage agreement. Consulting with your lender beforehand can help avoid any complications. It is advisable to work with a legal professional to navigate this process effectively.

To make a correction on a legal document, you typically need to prepare a correction deed example with mortgage. This document outlines the specific errors and provides the correct information. You should ensure that all parties involved review and agree to the changes. Once completed, the correction deed must be signed and notarized to be legally binding.

Yes, you can change a deed without altering the mortgage. Changes to the deed, such as adding or removing an owner's name, can often be made independently. However, it's wise to understand how these changes might impact your mortgage situation, especially when considering a correction deed example with mortgage.

Yes, a correction deed generally needs to be notarized to ensure its validity. Notarization helps authenticate the signatures and confirms that the parties involved are acting voluntarily. If you're drafting a correction deed example with mortgage, utilizing a platform like uslegalforms can help streamline the process and ensure all legal requirements are met.