Limited Liability Company Agreement Meaning

Description

How to fill out Texas Assumption Warranty Deed - Husband And Wife To Limited Liability Company?

- Log into your US Legal Forms account if you're already a member. Ensure your subscription is up-to-date before proceeding.

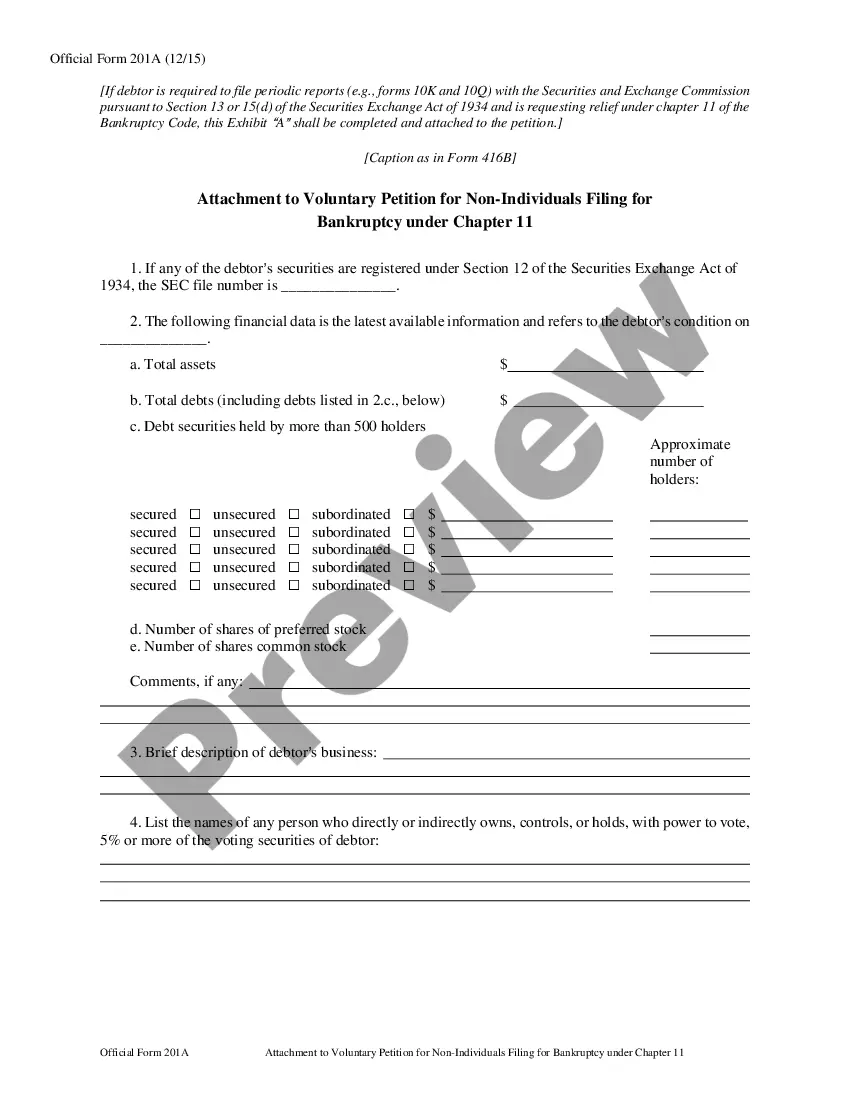

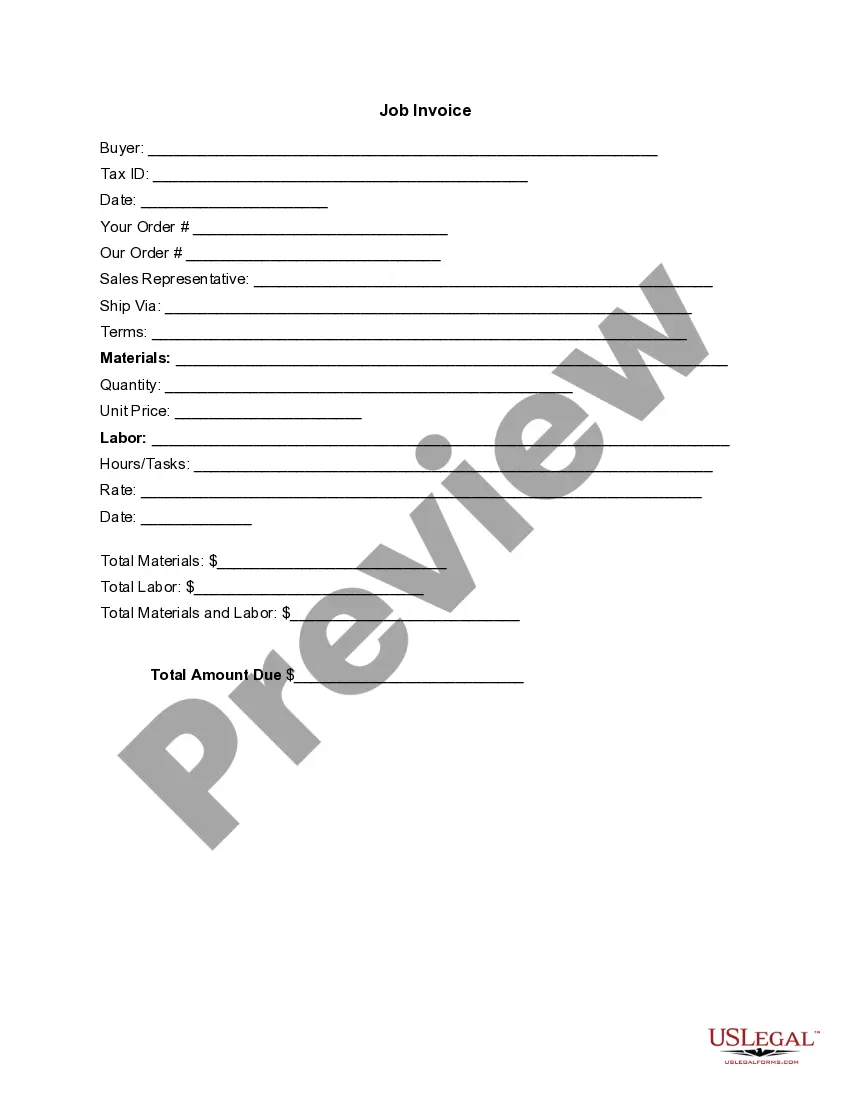

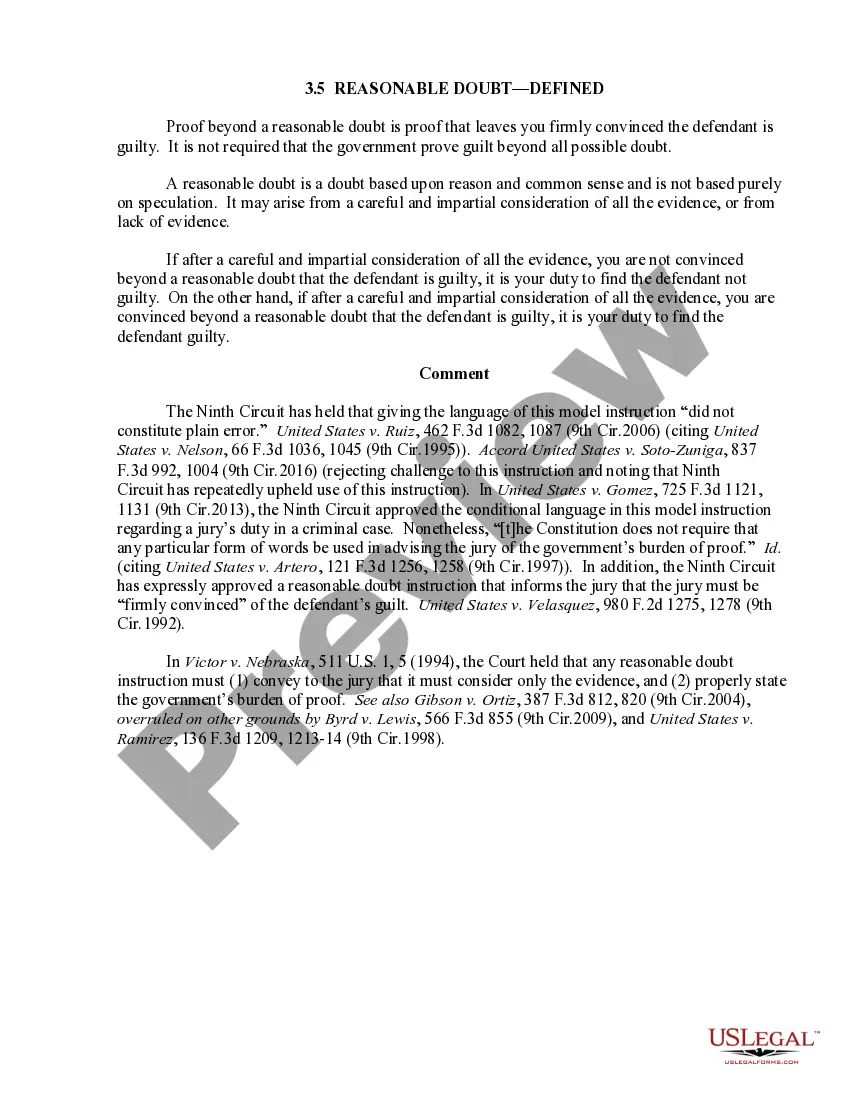

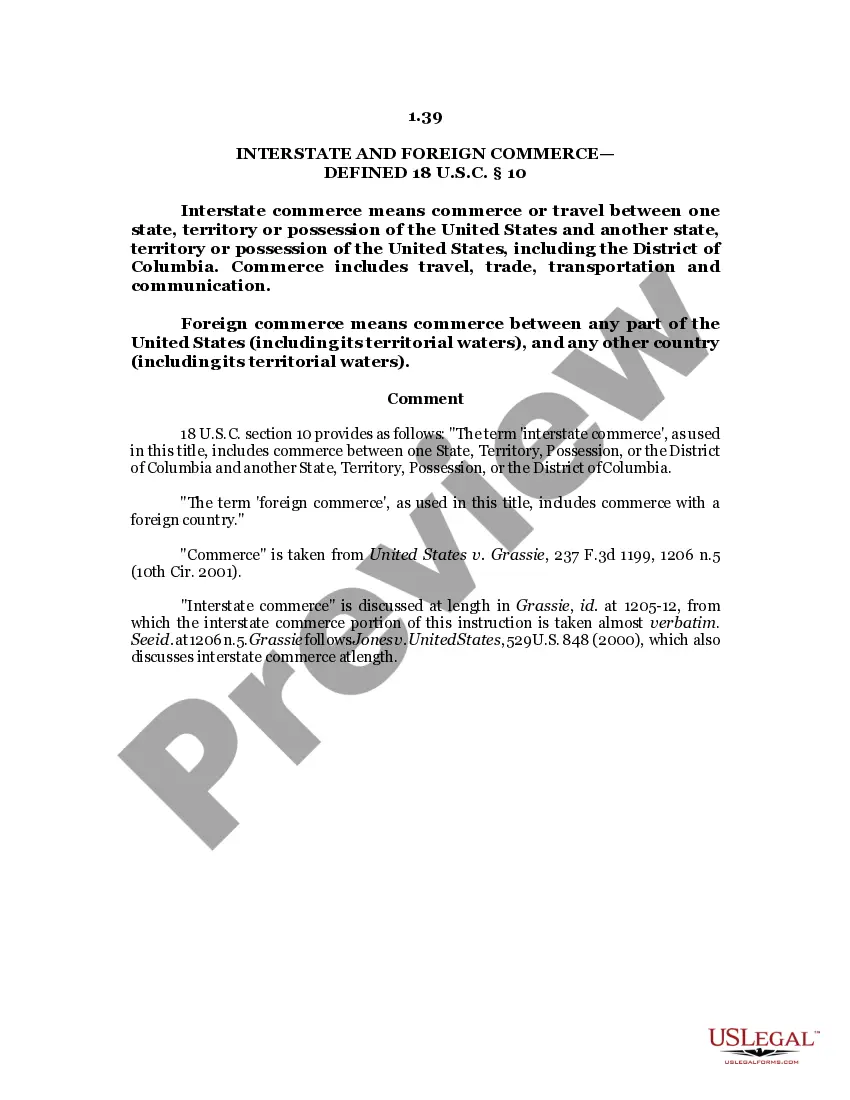

- Explore the library to find the specific limited liability company agreement template that suits your needs. Make sure it complies with local jurisdiction requirements by reviewing the Preview mode.

- If you can’t find what you need, utilize the Search feature to locate an alternative template that fits your requirements.

- Select the desired document and click the Buy Now button. Choose a subscription plan that best aligns with your needs and create an account if you're a new user.

- Complete your purchase by entering your payment information or using PayPal for a seamless transaction.

- Download your completed form and save it on your device. Access it anytime through the My Forms section in your account.

By following these simple steps, you will efficiently gain access to the right limited liability company agreement that meets your specific business needs.

Don't wait; streamline your legal document processes today with US Legal Forms' vast resource library!

Form popularity

FAQ

Yes, you can add an operating agreement later if your LLC initially operated without one. However, it’s smart to adopt this agreement sooner rather than later, as it helps clarify roles and responsibilities among members. Grasping the limited liability company agreement meaning will aid you in drafting an effective document that suits the evolving needs of your business.

Without an operating agreement, your LLC may face challenges in governance and dispute resolution, relying solely on state laws. This can create ambiguity and lead to unintended consequences among members. By understanding the limited liability company agreement meaning, you can recognize the importance of drafting this document to protect your interests.

An LLC operating agreement is vital for establishing clarity among members regarding their rights and obligations. It helps prevent misunderstandings and sets a clear process for decision-making. Knowing the limited liability company agreement meaning guides you in drafting a comprehensive document, which strengthens the foundation of your business.

A limited liability company agreement is a foundational document that outlines the management structure and operational rules of your LLC. It addresses member roles, responsibilities, and distributions of profits or losses. Understanding the limited liability company agreement meaning ensures you create a robust framework that guides your business in accordance with state laws.

If your LLC does not have an operating agreement, the default state laws will govern the functioning of your business. This means you might face uncertainties regarding management decisions, profit distributions, and other critical areas. A clear operating agreement, which reflects the limited liability company agreement meaning, helps prevent disputes among members and ensures smoother operations.

Yes, you can write your own operating agreement for your LLC. This document is essential for outlining your business's management structure and member responsibilities. However, it's beneficial to understand the limited liability company agreement meaning to ensure that your operating agreement complies with state laws and addresses your specific needs.

To create a limited liability corporation, you need to choose a name that complies with your state’s regulations. Next, file the necessary paperwork with your state’s Secretary of State office, which typically includes articles of organization. Once you have your paperwork approved, consider drafting a limited liability company agreement, as this document clarifies internal operations and member roles.

All members of an LLC benefit from limited liability protection. This includes individual owners and investors who are involved in the business. Understanding the limited liability company agreement meaning helps ensure that you, as an owner, can safeguard your personal assets from the LLC's liabilities, allowing you to focus on growing your business.

The limited liability company agreement is a document that outlines the ownership and operating procedures of the LLC. It serves as an essential guide for members, detailing their rights, responsibilities, and profit-sharing arrangements. Familiarity with the limited liability company agreement meaning is vital, as it clarifies the operational guidelines that govern your business.

An LLC, or limited liability company, is a business structure that combines the flexibility of a partnership with the liability protection of a corporation. Essentially, it protects your personal assets while providing tax benefits. Understanding the limited liability company agreement meaning can help simplify its role in business. It’s a smart choice for many entrepreneurs.