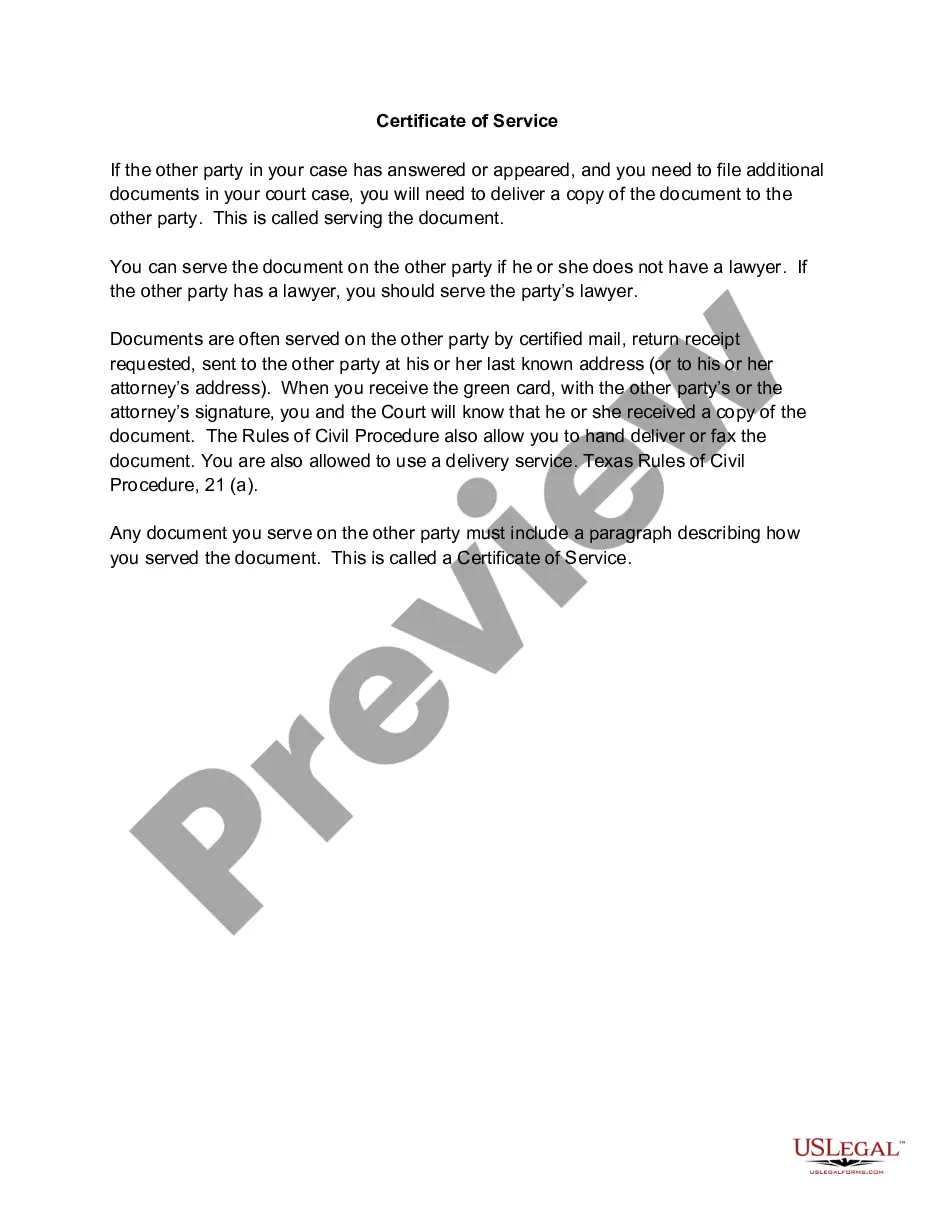

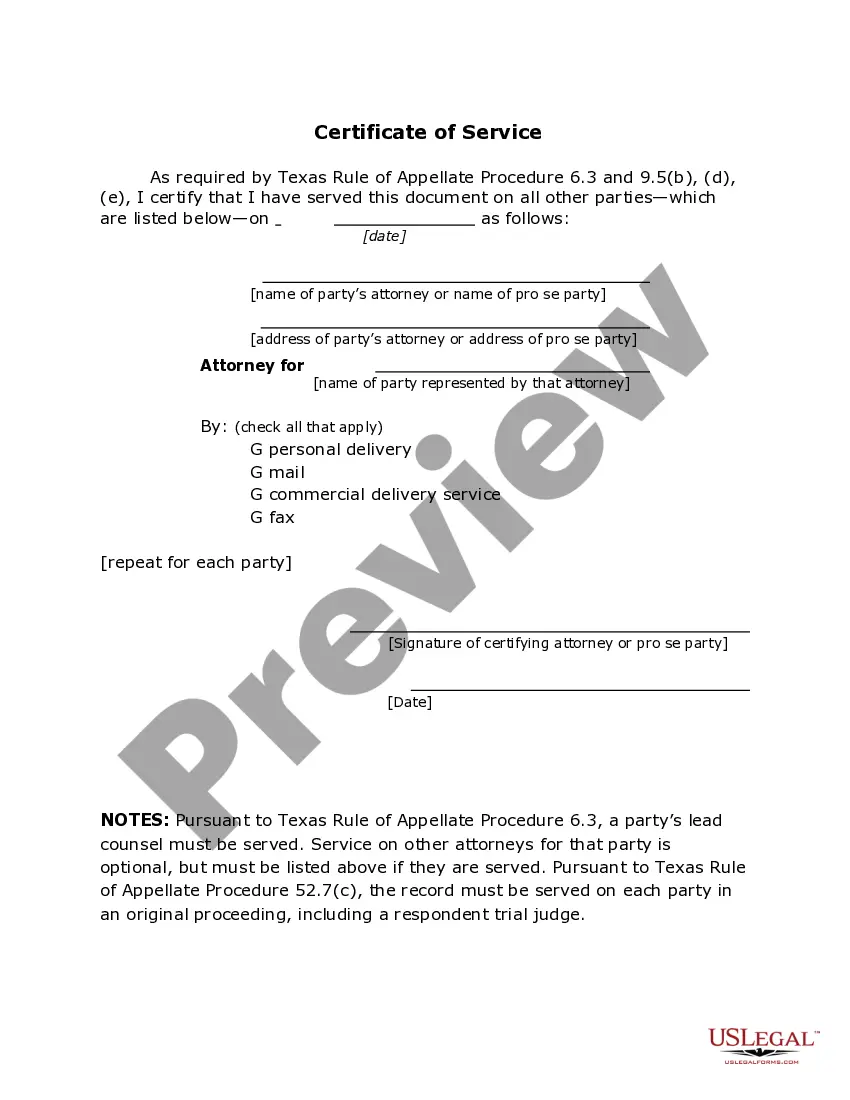

This form is a Certificate of Service and is used to establish the method used to serve documents on other parties to an action.

Texas Certificate Of Service

Description

How to fill out Texas Certificate Of Service - TX R.App.Proc. 6.3?

The Texas Certificate of Service displayed on this page is a versatile legal template crafted by experienced attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and lawyers with more than 85,000 validated, state-specific forms for various business and personal events. It’s the quickest, easiest, and most reliable method to acquire the documents you require, as the service guarantees the highest standards of data security and anti-malware measures.

Re-utilize the same document whenever necessary. Access the My documents tab in your profile to redownload any forms you have previously obtained. Subscribe to US Legal Forms to have verified legal templates for all of life’s situations readily available.

- Search for the document you require and review it.

- Browse through the sample you found and preview it or read the form description to ensure it meets your needs. If it doesn’t, utilize the search feature to locate the correct one. Click Buy Now once you’ve identified the template you need.

- Choose a pricing plan that works for you and create an account. Use PayPal or your credit card for swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Select the format you prefer for your Texas Certificate of Service (PDF, DOCX, RTF) and save the copy to your device.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature.

Form popularity

FAQ

What is the Cost to File an Annual Report to the State of Hawaii? All businesses filing a report in Hawaii will pay the basic fee of $15, regardless if they are foreign or domestic. However, nonprofits and LPs will only have to pay $5 for their filing.

Hawaii doesn't have a general business license at the state level, so there are no fees there. But your required Hawaii Tax ID Number registration with the Department of Taxation has a $20 filing fee.

Form N-196 is an Annual Summary and Transmittal of Hawaii Information Returns used to report total number of 1099 forms and total amount reported.

The Hawaii Annual Report can be filed online, by mail, or in person. To file online: Go to the Hawaii Business Express ? Annual Reports page and enter your business name in the search box. Select your business from the search results.

You can register a business in Hawaii online through Hawaii Business Express, which will walk you through the information and forms you need to provide. You start by creating a free eHawaii.gov account with your email address. The cost to file your articles for an LLC or corporation in Hawaii is $50.

To file Hawaii Articles of Incorporation with standard processing is only $50. Hawaii's Business Registration Division (BREG) handles all registrations with no need for separate county filings.

Hawaii LLCs are classified as pass-through tax entities by default, which means they don't pay corporate income tax. Instead, LLC revenue passes through the business to the members/owners, who report their share of the profits as personal income on their taxes.

How much does an LLC in Hawaii cost per year? All Hawaii LLCs need to pay $15 per year for the Annual Report. These state fees are paid to the Business Registration Division. And this is the only state-required annual fee.