Tax Certificate Texas Without Degree

Description

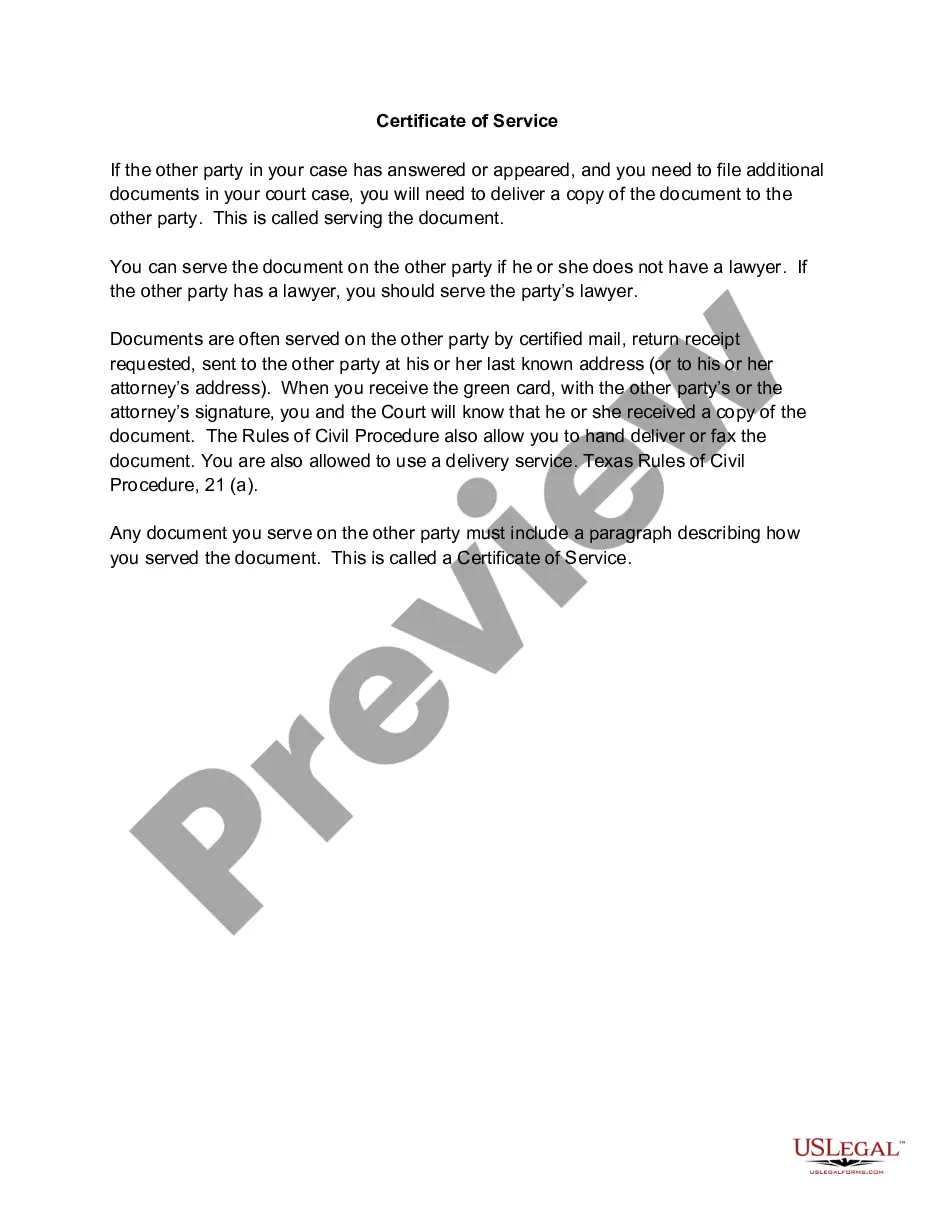

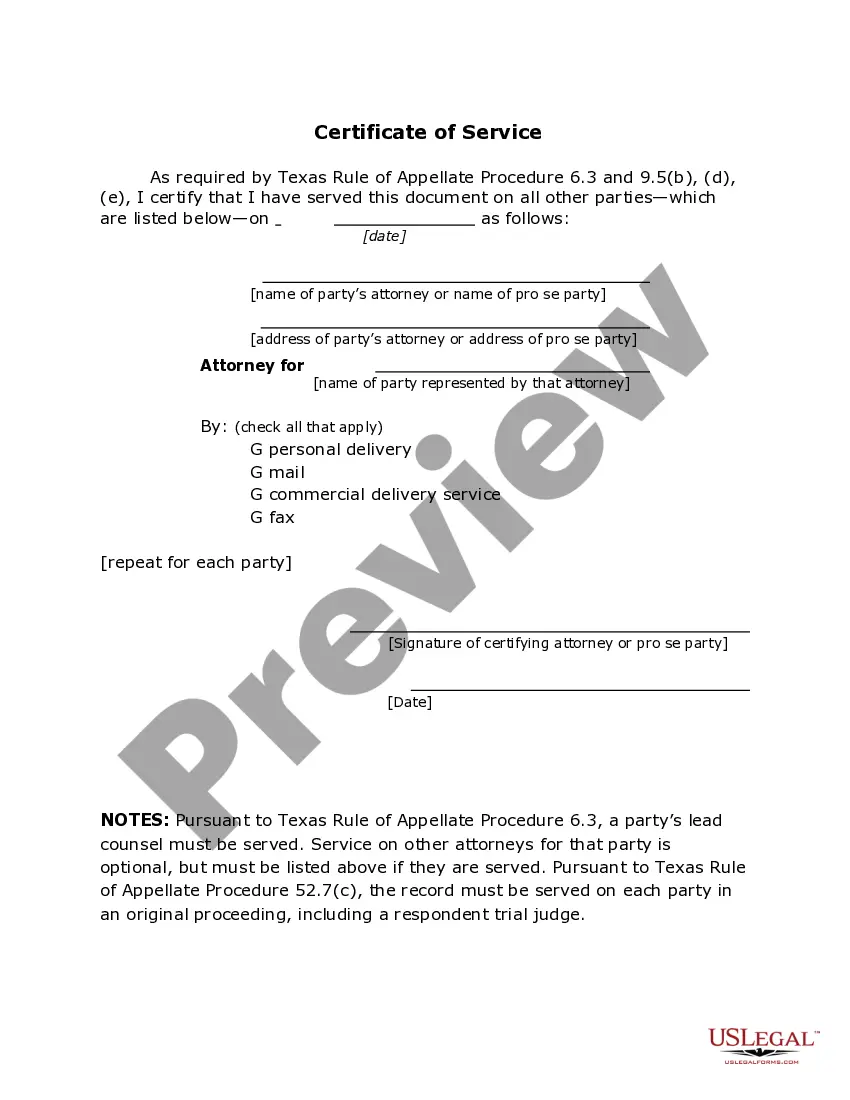

How to fill out Texas Certificate Of Service - TX R.App.Proc. 6.3?

Regardless of whether it’s for corporate reasons or private affairs, everyone eventually needs to handle legal issues at some point in their lives.

Completing legal documents requires meticulous care, starting with choosing the appropriate form template.

After downloading, you can complete the form using editing software or print it and fill it out by hand.

- For instance, if you select an incorrect version of a Tax Certificate Texas Without Degree, it will be rejected upon submission.

- Thus, it is vital to obtain a trustworthy source of legal documents such as US Legal Forms.

- If you wish to acquire a Tax Certificate Texas Without Degree template, adhere to these straightforward steps.

- Locate the template you require via the search bar or catalog browsing.

- Review the form’s description to confirm it aligns with your circumstance, state, and county.

- Click on the form’s preview to view it.

- If it is not the correct form, return to the search feature to find the Tax Certificate Texas Without Degree template you need.

- Obtain the template when it meets your criteria.

- If you have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you lack an account, you can download the form by hitting Buy now.

- Select the appropriate pricing plan.

- Fill out the profile registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you prefer and download the Tax Certificate Texas Without Degree.

Form popularity

FAQ

To become a tax preparer in Texas, you need to possess a valid preparer tax identification number (PTIN). While formal education is not mandatory, having a background in tax law and accounting can be beneficial. Familiarize yourself with IRS guidelines and state requirements to ensure compliance. Resources at USLegalForms can guide you through the necessary steps to start your career.

In Texas, several groups qualify for property tax exemptions, including homeowners, disabled individuals, and senior citizens. Non-profit organizations and certain types of businesses may also qualify under specific circumstances. It’s essential to check with your local tax authority to understand the exact qualifications for your situation. USLegalForms can assist in clarifying these qualifications.

Applying for a Texas resale certificate can be accomplished by completing the Texas Sales and Use Tax Resale Certificate form. This form requires you to provide information about your business and the items you intend to resell. Ensure that you submit it to your supplier when making purchases for resale. Platforms like USLegalForms offer resources to help streamline this application process.

The processing time for a property tax exemption in Texas can vary depending on the workload of the local tax authority. Typically, it may take anywhere from a few weeks to a couple of months for approval. If you submit a complete application with all required documents, the process might move faster. Stay informed by checking in with your local authority for status updates.

To qualify for exempt taxes in Texas, you generally need to meet specific criteria set by the state. Common qualifications include being a non-profit organization, having a religious purpose, or owning a homestead that meets exemption requirements. You will need to provide documentation supporting your claim. Remember, you can leverage resources like USLegalForms to understand qualification criteria better.

In Texas, getting a tax exempt certificate involves completing the appropriate application form available online or at your local tax office. You must provide valid identification and specific details about your property. Once you submit your application and any required documentation, your local tax office will process it. This process makes it easier to secure a tax exemption certificate in Texas without a degree.

To obtain a tax exemption certificate, you need to fill out an application provided by your state or local tax authority. This application usually requires information about your property and the reason for the exemption. After submitting your application, it will be reviewed for approval. Utilizing platforms like USLegalForms can simplify this process, ensuring you have all necessary documents.

To fill out a Texas resale certificate, start by writing your business name and address clearly at the top of the form. Next, provide your Texas Sales and Use Tax Permit number, and describe the types of items you intend to resell. With USLegalForms, you can find helpful resources that guide you through this process, ensuring you complete your tax certificate in Texas without degree smoothly.

Filling out a tax exemption certificate requires you to state your reason for claiming tax-exempt status accurately. Provide details about your organization and the specific type of tax exemption you are applying for. Using USLegalForms simplifies this process by offering ready-made templates and guidelines, making it easier to ensure your tax certificate in Texas without degree is processed correctly.

Filling out a general resale certificate involves providing essential information about your business and the products you wish to resell. You will need to include your business name, address, and a description of the items. Using USLegalForms, you can access step-by-step instructions and sample forms for clarity. Completing this correctly helps you acquire a tax certificate in Texas without degree efficiently.