Limited Liability Company For Dummies

Description

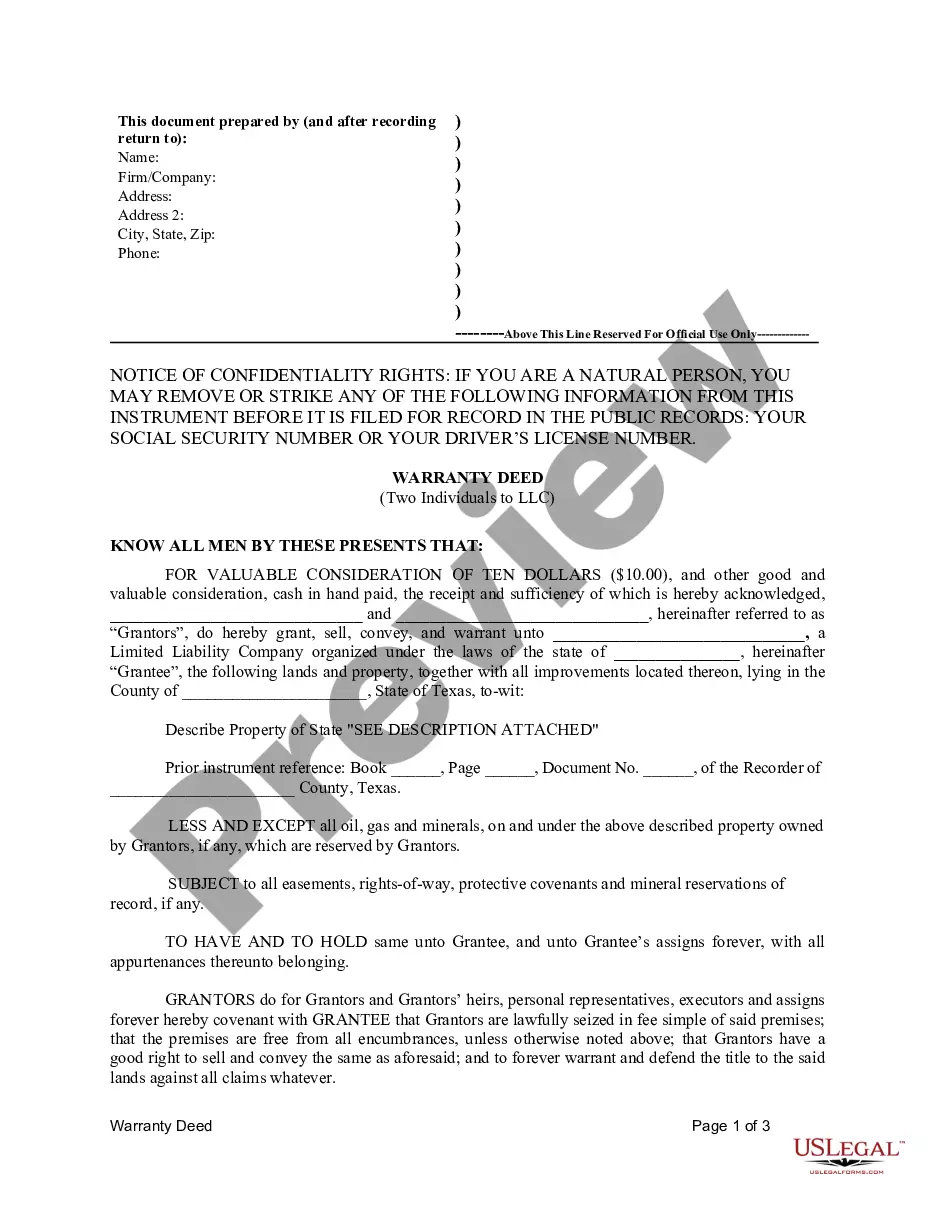

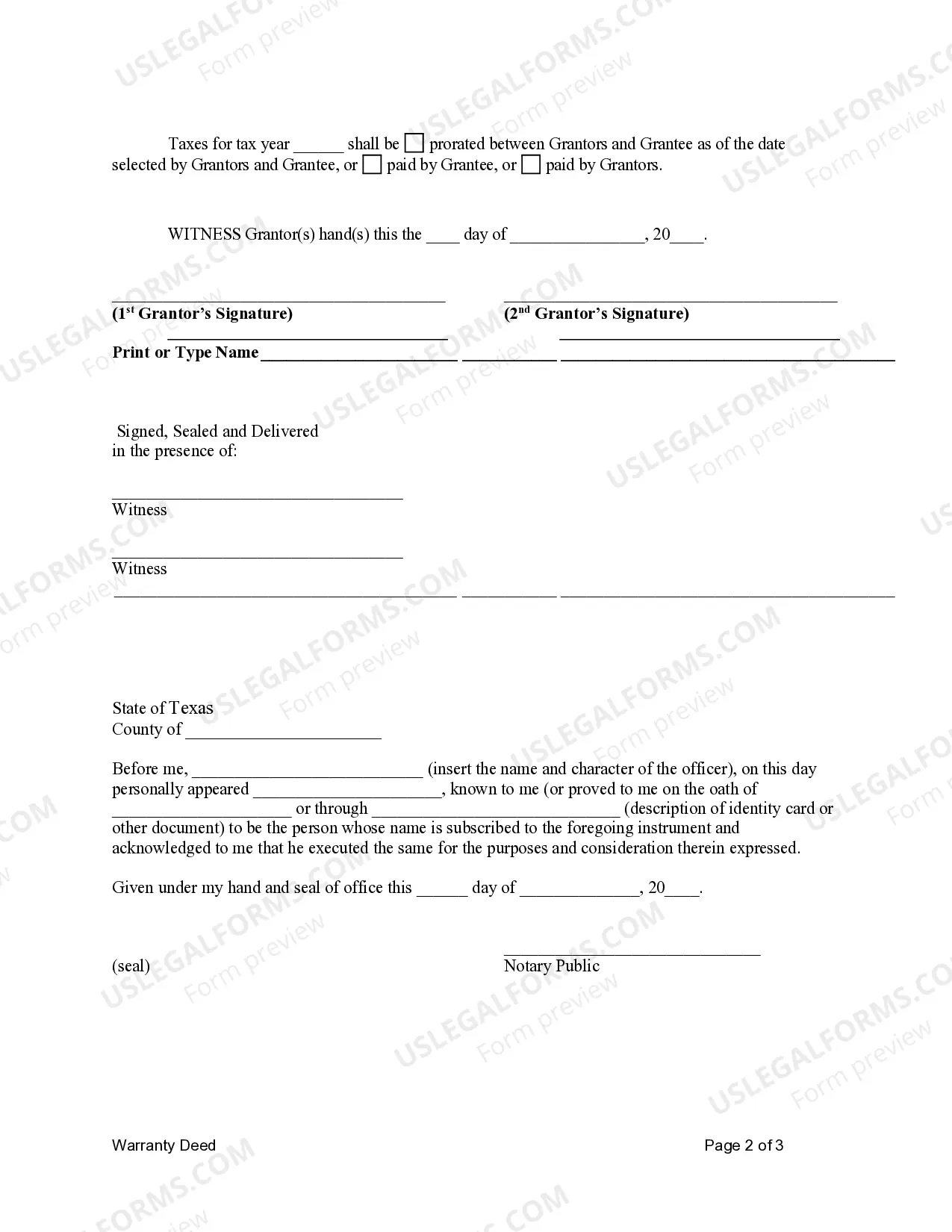

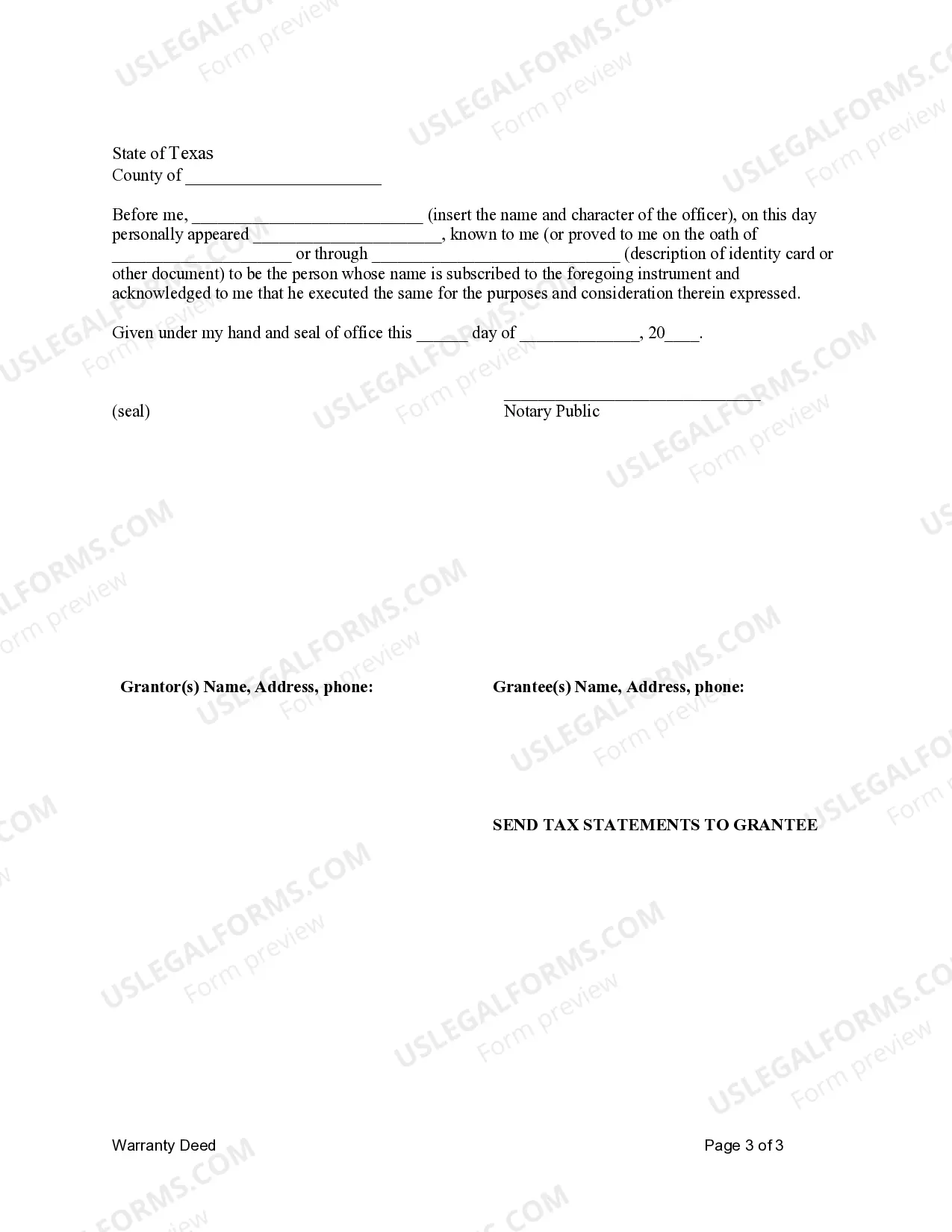

How to fill out Texas Warranty Deed From Two Individuals To LLC?

- Log in to your US Legal Forms account if you're a returning user and check the validity of your subscription.

- If you're a new user, start by previewing the relevant LLC form and its description to ensure it meets your local requirements.

- Search for alternative templates if necessary using the Search tab, ensuring you find the most suitable option.

- Select 'Buy Now' to choose a subscription plan and register your account for full library access.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Download your completed form and save it for further use, available anytime in the 'My Forms' section of your account.

In conclusion, US Legal Forms provides a stress-free approach to creating legal documents, especially for LLCs. With a collection of over 85,000 editable forms and access to legal experts, you can be assured of precise and compliant documents.

Start your journey to form your LLC today with US Legal Forms, where clarity meets convenience!

Form popularity

FAQ

The easiest limited liability company for dummies to start usually involves minimal paperwork and follows state guidelines. Typically, a single-member LLC is simpler because it doesn't require much structure or complexity. Platforms like US Legal Forms can guide you through the process, making it straightforward to complete your filings and meet your state's requirements. Simplifying this journey allows you to focus more on your business.

Forming a limited liability company for dummies is often worth it for small businesses. The liability protection, combined with flexible tax options, can provide significant benefits that outweigh the initial setup costs. Moreover, having an LLC can enhance your credibility with customers and suppliers. Ultimately, it offers a balanced approach to managing risks while growing your business.

Limited liability means that your personal assets are protected from business debts and legal actions. In simple terms, if your limited liability company for dummies faces financial issues, creditors cannot go after your personal belongings, like your home or savings. This protection allows you to take business risks without fearing personal financial ruin. It's a central advantage of forming an LLC.

Some individuals may choose not to form a limited liability company for dummies due to its associated costs and administrative requirements. An LLC typically involves filing fees, ongoing state fees, and compliance tasks. Moreover, if someone operates a business with minimal risk, they might feel the benefits of an LLC do not justify the expenses. Understanding your specific business needs can help you make the right choice.

Yes, owning a limited liability company for dummies can affect your taxes. Generally, an LLC has pass-through taxation, meaning profits and losses are reported on your personal tax return. This setup can simplify your tax process, allowing you to avoid double taxation seen in corporations. Therefore, it's essential to understand how an LLC interacts with your personal taxes to make informed decisions.

The best filing status for a limited liability company for dummies typically depends on your specific situation. Single-member LLCs are often treated as sole proprietorships, while multi-member LLCs can be taxed as partnerships. Understanding your needs and consulting resources like USLegalForms can help you determine the optimal tax status for your LLC.

Filing taxes for a limited liability company for dummies involves understanding how the IRS treats your LLC. Generally, your LLC will be taxed as a pass-through entity, meaning profits and losses pass through to your personal tax return. It's beneficial to consult tax professionals or use resources from USLegalForms to grasp your responsibilities and maximize your benefits.

Yes, you can file your limited liability company by yourself, but it may require careful attention to detail. As a beginner, consider using resources and templates from USLegalForms, which can provide clarity and support. Even if you choose to go solo, ensure you keep up with state regulations to avoid potential pitfalls.

The best program to start a limited liability company for dummies includes online services such as USLegalForms, which simplifies the filing process. This platform offers user-friendly guidance and comprehensive resources, ensuring you understand each step fully. Choosing a reliable program can save you time and ensure your paperwork is processed correctly.

The best way to file for a limited liability company for dummies is to start by selecting the right state for your LLC. After that, visit the state’s Secretary of State website to obtain the necessary forms. It’s essential to provide correct information and consider using a service like USLegalForms to guide you through the filing process to avoid errors.