Petition For Excess Proceeds For Claim

Description

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

Utilizing legal document examples that adhere to national and local regulations is crucial, and the web provides numerous alternatives to select from.

However, what is the benefit of spending time searching for the correct Petition For Excess Proceeds For Claim example online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with more than 85,000 editable templates created by attorneys for any business and personal situation.

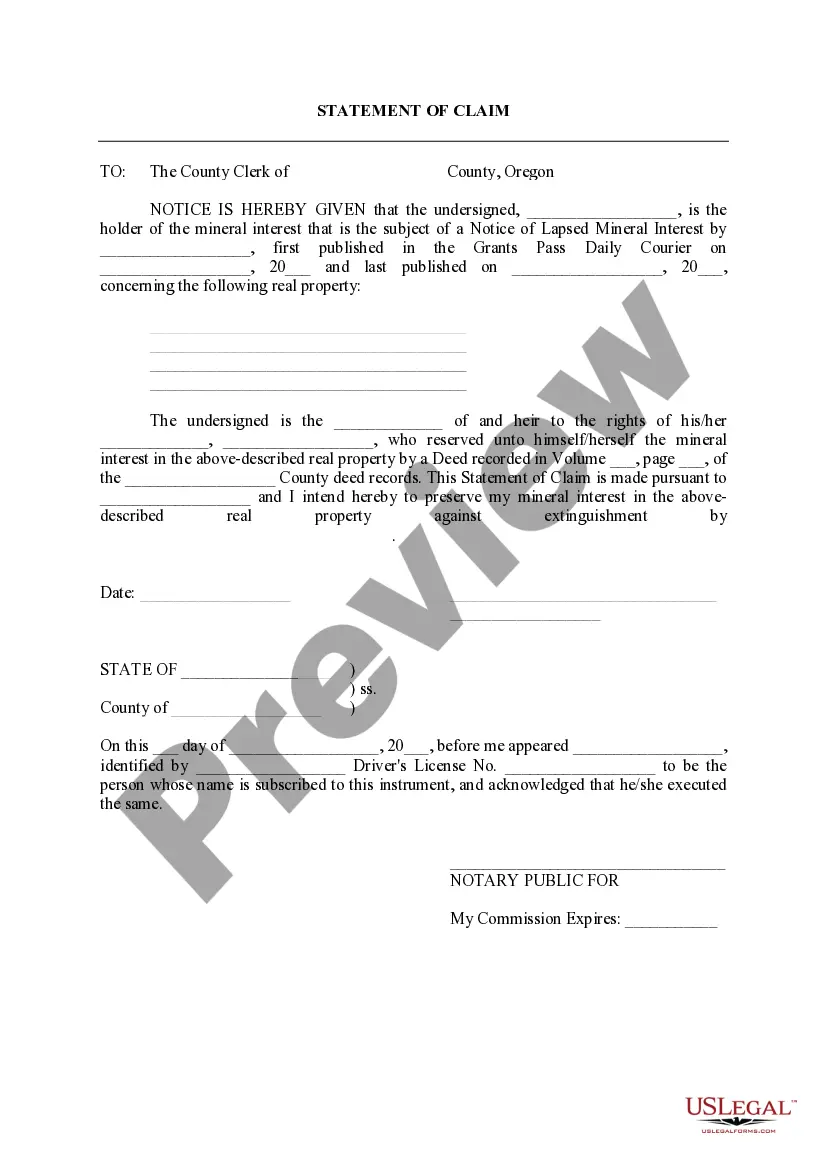

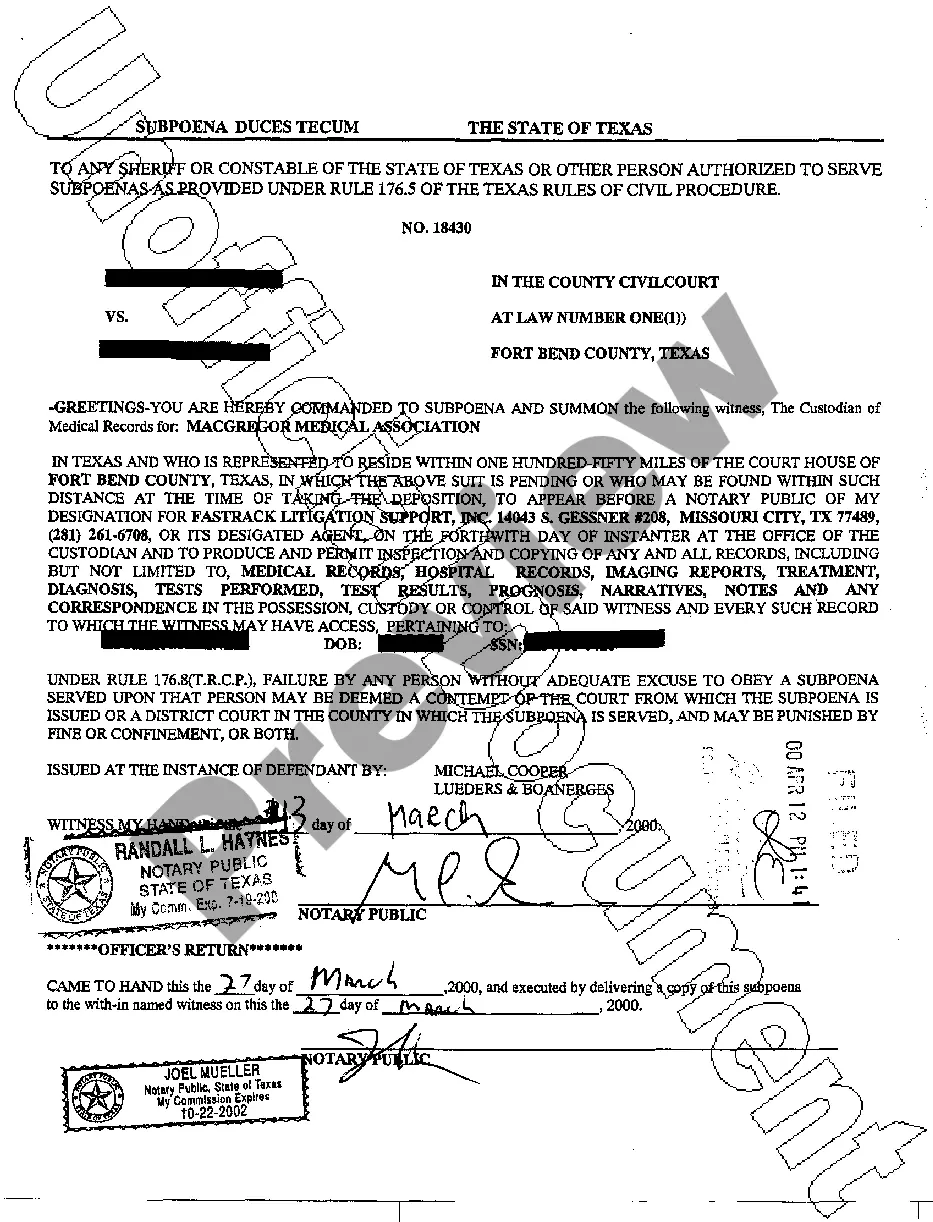

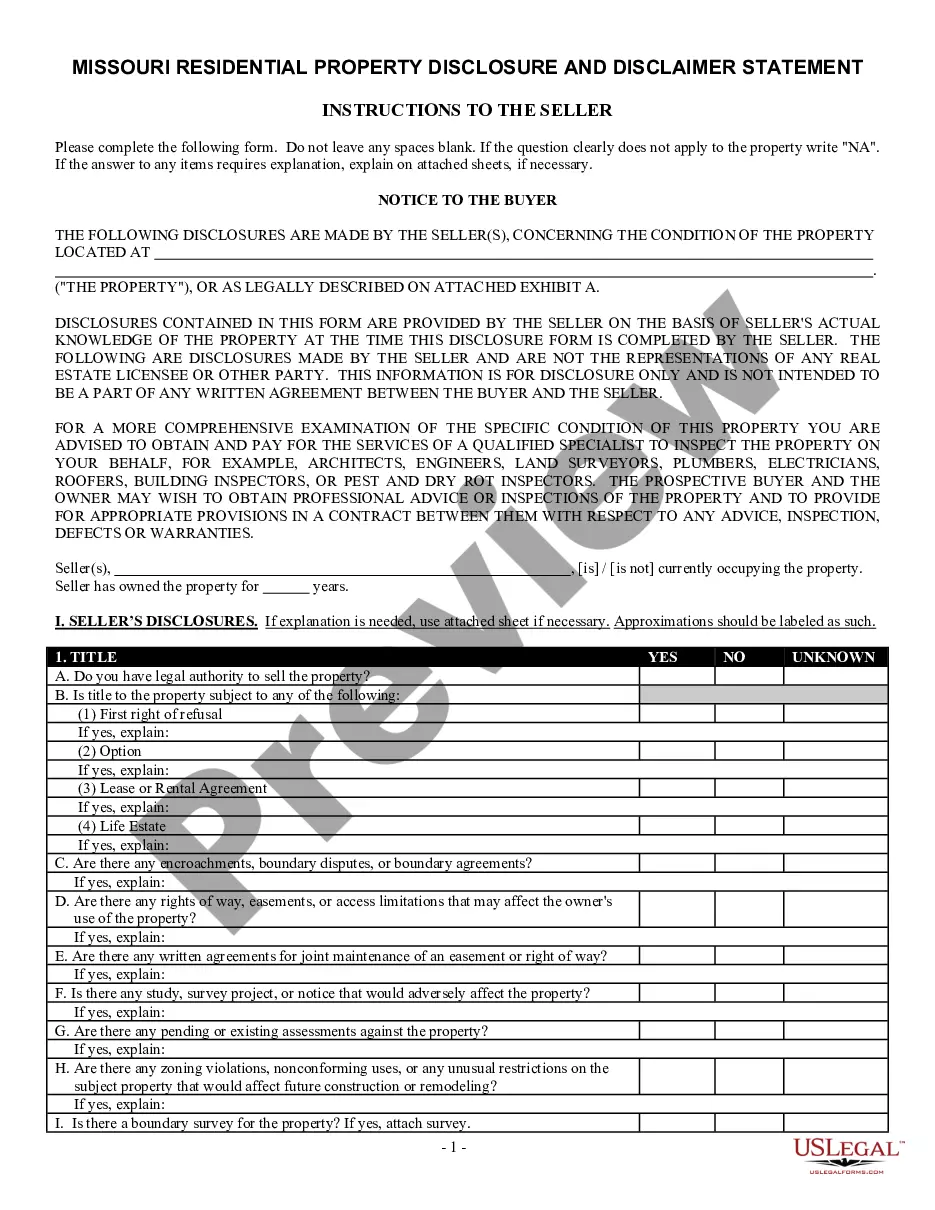

Examine the template using the Preview feature or through the text description to ensure it fulfills your requirements.

- They are simple to navigate with all documents categorized by state and intended use.

- Our experts stay updated with legislative modifications, ensuring your documentation is current and compliant when obtaining a Petition For Excess Proceeds For Claim from our site.

- Acquiring a Petition For Excess Proceeds For Claim is straightforward and rapid for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document template you need in the correct format.

- If you’re unfamiliar with our website, follow the steps outlined below.

Form popularity

FAQ

Section 34.04 - Claims for Excess Proceeds (a) A person, including a taxing unit and the Title IV-D agency, may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds. The petition must be filed before the second anniversary of the date of the sale of the property.

How to Claim Excess Tax Funds Gather the Required Documents. There are a number of documents that you'll need to gather and submit along with your claim form. ... Complete the Claim Form. Once you have your documents gathered, you can fill out the claim form. ... Submit Your Claim.

EXCESS PROCEEDS RULES Tax delinquent properties are sold in a Tax Foreclosure sale each month in each Texas county. If the property is sold for more than the amount of taxes owed the various taxing agency, the excess amount remains in the county unless the previous owner petitions for their money.

1. Excess Proceeds: If more than $25 is left from the foreclosure sale of your home after the lien and any costs are paid, you are entitled to claim that money. 2. Time Limits: You must file a claim for excess proceeds within two years of the sale of the property.

Excess Proceeds is the amount of funds remaining after the Treasurer and Tax Collector sells a tax-defaulted property and recovers the taxes, penalties and costs.