Texas Life Estate With Powers

Description

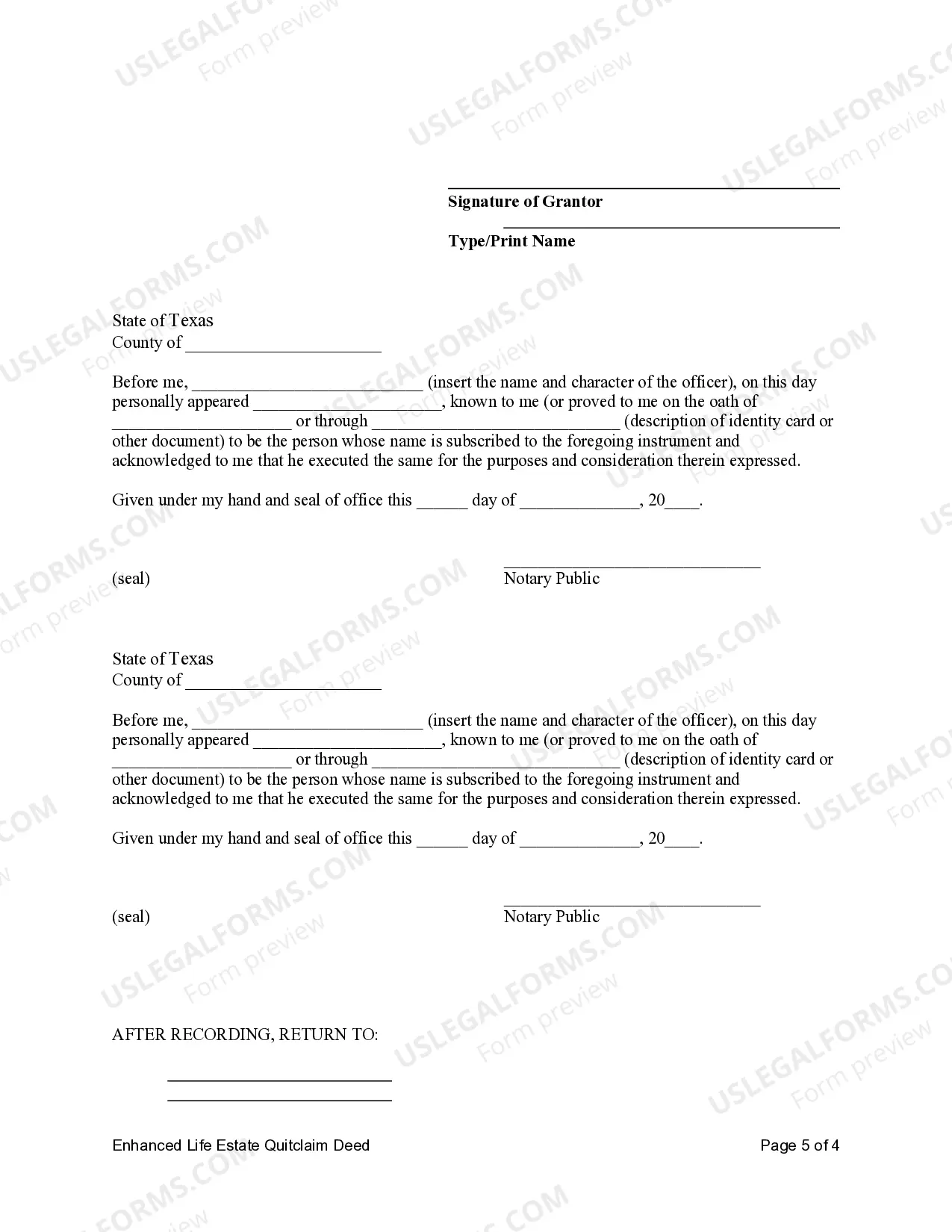

How to fill out Texas Enhanced Life Estate Or Lady Bird Quitclaim Deed From Two Individuals, Or Husband And Wife, To An Individual?

Properly formulated official documentation is one of the crucial assurances for preventing issues and legal disputes, but acquiring it without legal assistance can be time-consuming.

Whether you need to swiftly locate a current Texas Life Estate With Powers or any other forms for employment, family, or business purposes, US Legal Forms is consistently available to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you need only to Log In to your account and click the Download button next to the desired document. Furthermore, you can access the Texas Life Estate With Powers anytime afterward, as all documents acquired on the platform remain accessible within the My documents section of your profile. Save time and money on preparing formal documents. Experience US Legal Forms today!

- Ensure that the document is appropriate for your situation and location by reviewing the description and preview.

- Search for a different template (if necessary) using the Search bar in the page header.

- Click Buy Now once you find the suitable template.

- Choose a pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX format for your Texas Life Estate With Powers.

- Click Download, then print the document to fill it in or upload it to an online editor.

Form popularity

FAQ

Now, people can convey clear title to their property by completing a transfer on death deed form, signing it in front of a notary, and filing it in the deed records office in the county where the property is located before they die at a cost of less than fifty dollars.

While in possession of the land, a life tenant owes the following duties to future interest holders: The duty to pay ordinary taxes on the land and interest on a mortgage: A life tenant has a duty to pay taxes to the extent the property produces income.

Upon your death, all that is required for full title to be transferred to the names of these beneficiaries is the filing of an affidavit in the county property records reflecting the date of your death, and that there are no outstanding debts of the estate and no estate or inheritance tax due.

The life estate deed removes the property from the life tenant's estate and transfers the property upon the death of the life tenant. This eliminates the property from probate. Once this deed is created, the life tenant usually CANNOT make changes to title of the property.

Pur autre vie (per o-truh vee) is a French legal phrase which means for another's life. This phrase is durational in meaning as it is another's life, not that of the possessor, that is used to measure the amount of time someone has a right to possess real property.