This detailed sample Texas Gift Deed (Individual to Individual)complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Tx Gift Deed Texas For Property Transfer

Description

How to fill out Texas Gift Deed For Individual To Individual?

Drafting legal paperwork from scratch can sometimes be daunting. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for a more straightforward and more affordable way of preparing Tx Gift Deed Texas For Property Transfer or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual collection of more than 85,000 up-to-date legal documents addresses virtually every element of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-compliant forms carefully put together for you by our legal experts.

Use our platform whenever you need a trustworthy and reliable services through which you can easily find and download the Tx Gift Deed Texas For Property Transfer. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and navigate the library. But before jumping directly to downloading Tx Gift Deed Texas For Property Transfer, follow these recommendations:

- Check the form preview and descriptions to make sure you are on the the form you are searching for.

- Check if template you choose conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to purchase the Tx Gift Deed Texas For Property Transfer.

- Download the form. Then complete, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us now and transform form execution into something easy and streamlined!

Form popularity

FAQ

However, Texas does not impose a gift tax on transfers of real estate between family members nor is there a capital gains tax in Texas, so you may only be liable for federal taxes. When transferring a house after death through a will or trust, estate taxes may come into play.

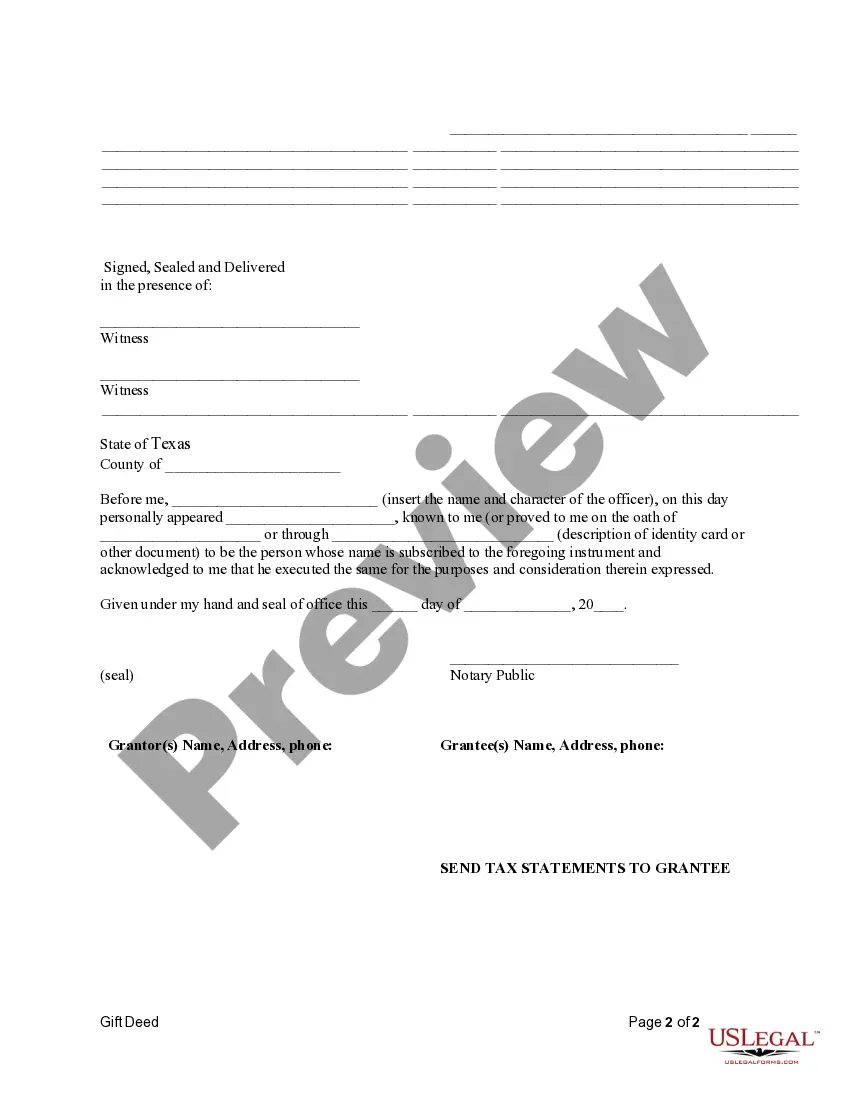

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

Good to know: To be valid and enforceable, the transfer must be in writing and signed by the owner. The document should be filed with the County Clerk for the County in which the property is located. For example, you cannot simply say that your grandfather said he wanted you to have the property.

In order to transfer property to a family member as a gift, you'll need to execute a ?Deed of Gift?. This is also known as a ?Transfer of Gift?. This legal process ends with the family member(s) classified as the property's legal proprietors. The new owners' names will then appear on the Land Registry.

Texas also has no gift tax, meaning the only gift tax you have to worry about is the federal gift tax. The gift tax exemption for 2022 is $16,000 per year per recipient, increasing to $17,000 in 2023.