Texas Deed Tx Foreclosure

Description

How to fill out Texas Gift Deed For Individual To Individual?

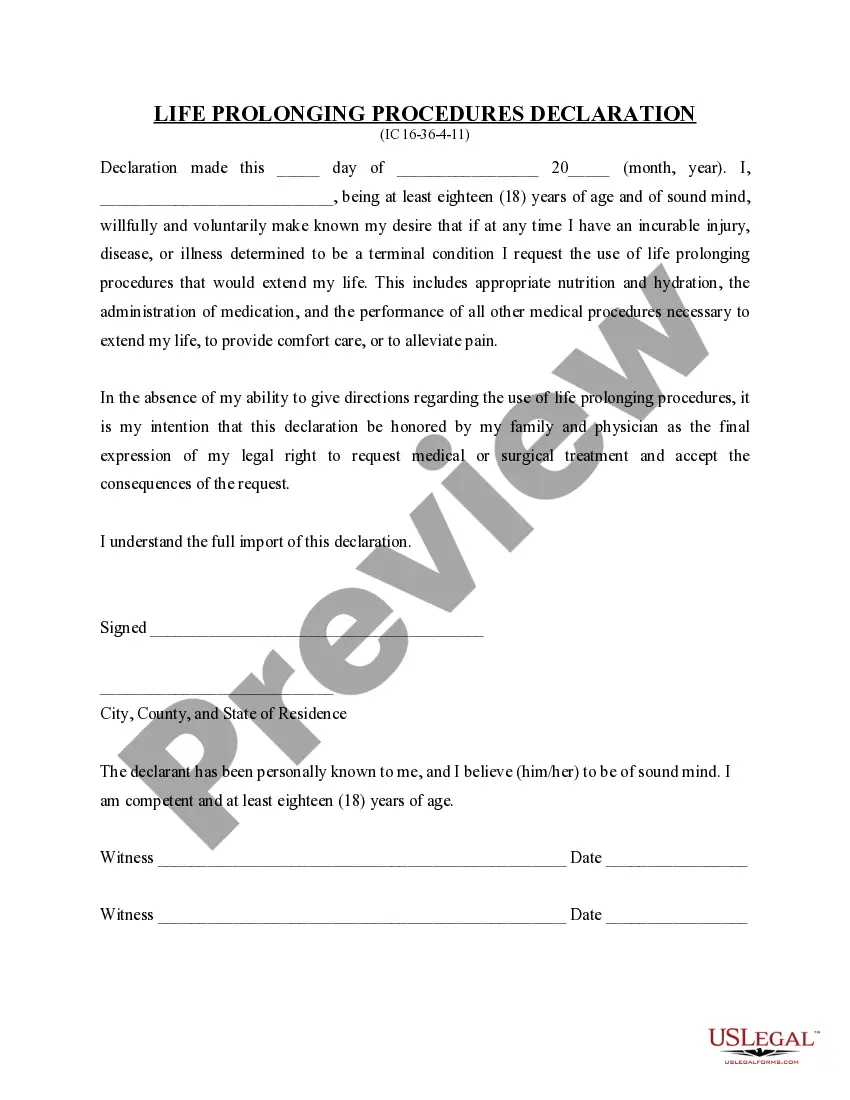

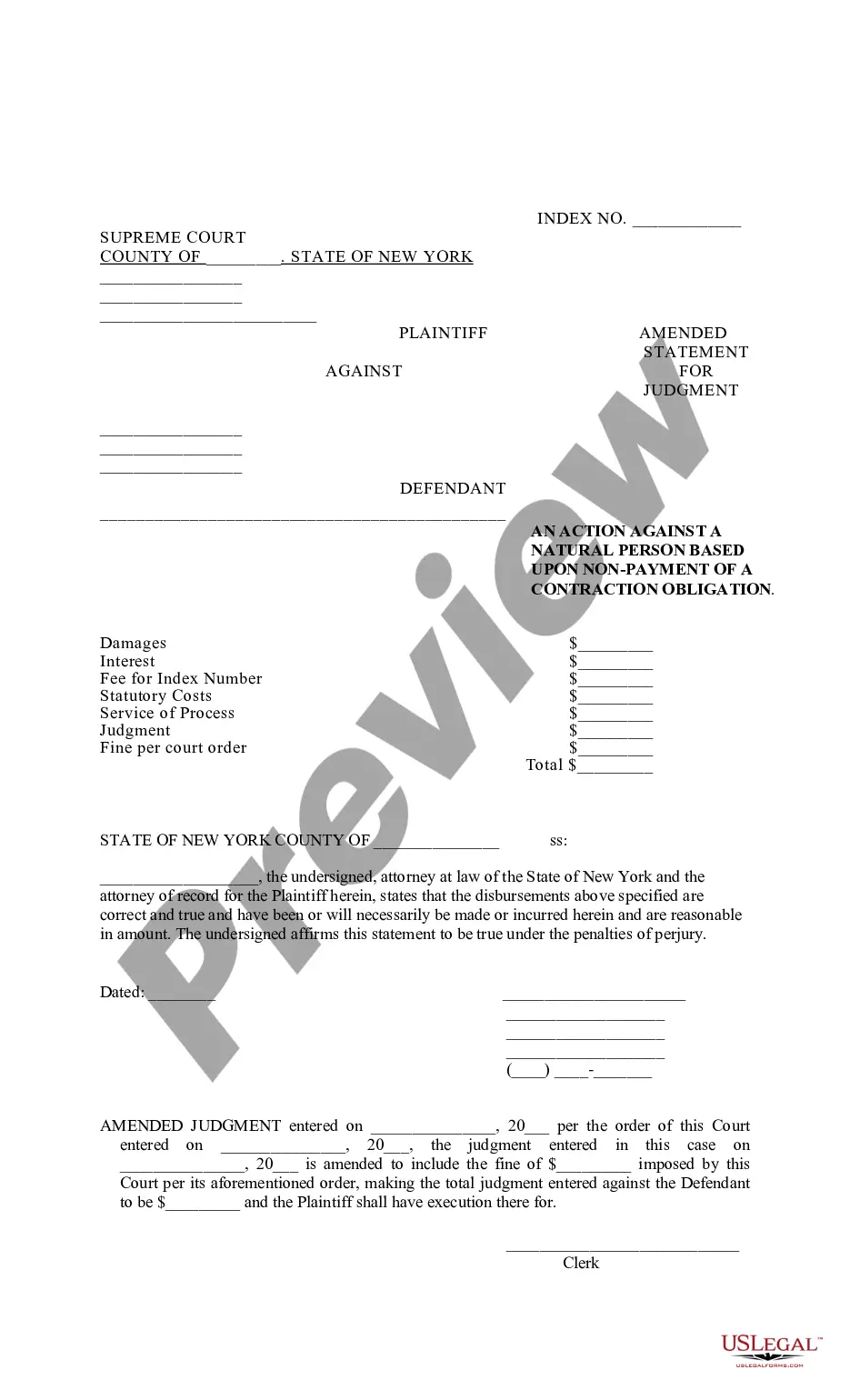

Whether for business purposes or for personal matters, everyone has to deal with legal situations sooner or later in their life. Completing legal paperwork needs careful attention, starting with choosing the correct form sample. For instance, when you select a wrong edition of the Texas Deed Tx Foreclosure, it will be declined once you send it. It is therefore important to have a reliable source of legal files like US Legal Forms.

If you have to obtain a Texas Deed Tx Foreclosure sample, stick to these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s information to make sure it suits your case, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect document, go back to the search function to find the Texas Deed Tx Foreclosure sample you require.

- Get the file when it meets your needs.

- If you already have a US Legal Forms account, click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Pick the document format you want and download the Texas Deed Tx Foreclosure.

- When it is saved, you are able to fill out the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not need to spend time seeking for the right template across the web. Utilize the library’s easy navigation to find the proper template for any occasion.

Form popularity

FAQ

In order to qualify for a non-judicial foreclosure, the lienholder must have a deed of trust with a "power of sale" clause, giving them the authority to sell the property. These foreclosures are governed by Section 51.002 of the Texas Property Code as well as the contractual documents.

Under Texas law, a lender has to use a quasi-judicial process to foreclose a home equity loan. In this process, the lender must get a court order approving the foreclosure before conducting a nonjudicial foreclosure. Also, Texas law doesn't allow deficiency judgments following the foreclosure of a home equity loan.

When it comes to foreclosures, Texas generally follows non-judicial proceedings, as long as the deed contains a power of sale clause. The foreclosure process in Texas is a relatively quick process, usually around 6 months.

How To Buy Foreclosed Homes in Texas Do Your Research. To get started with buying foreclosed homes, consider pre-foreclosures or REOs which allow for traditional funding and due diligence. ... Secure Funding. ... Work With Realtors. ... Conduct as Much Due Diligence as Possible. ... Submit an Offer and Complete the Closing Process.

Notices to a Residential Borrower Foreclosure notices must be given to a residential borrower in ance with Property Code Sections 51.002 et seq. and the deed of trust. Both apply. The deed of trust should be reviewed to make sure that it does not contain special requirements in excess of the statutory minimums.