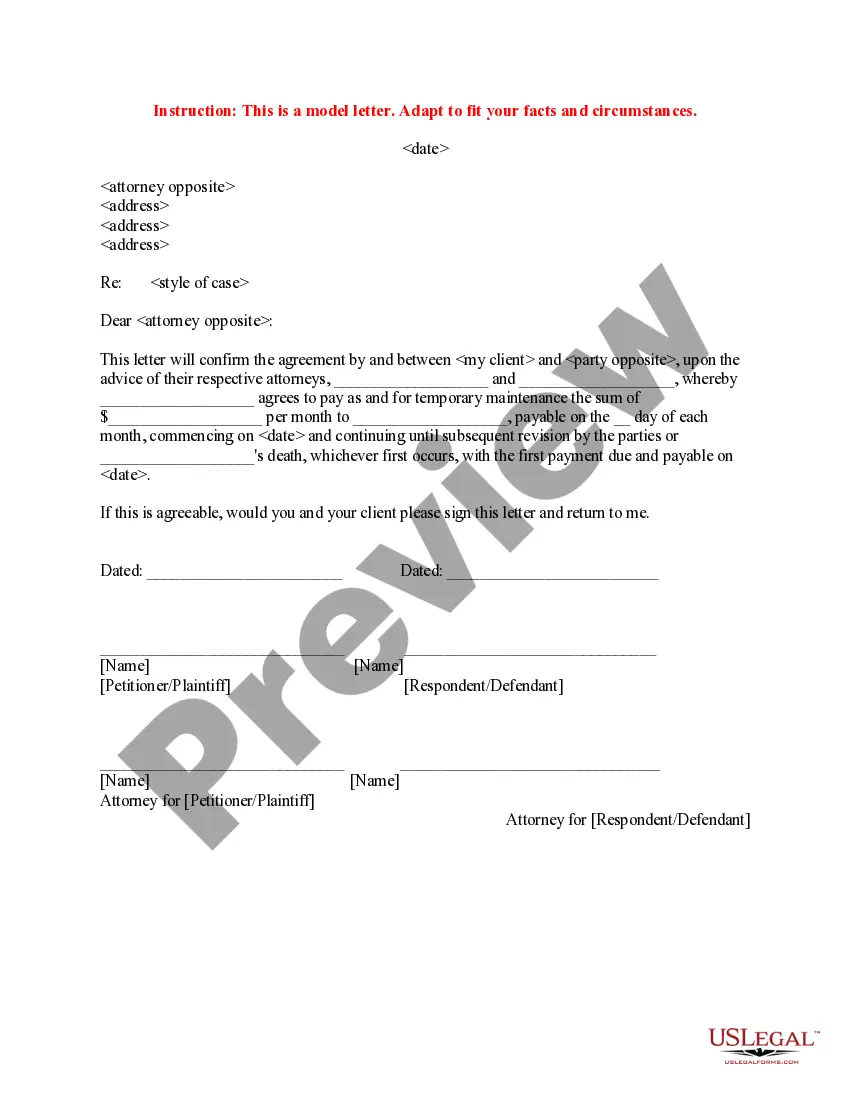

Tx Spousal Maintenance Texas Withholding

Description

How to fill out Texas Motion For Order Of Contempt For Failure To Pay Spousal Maintenance?

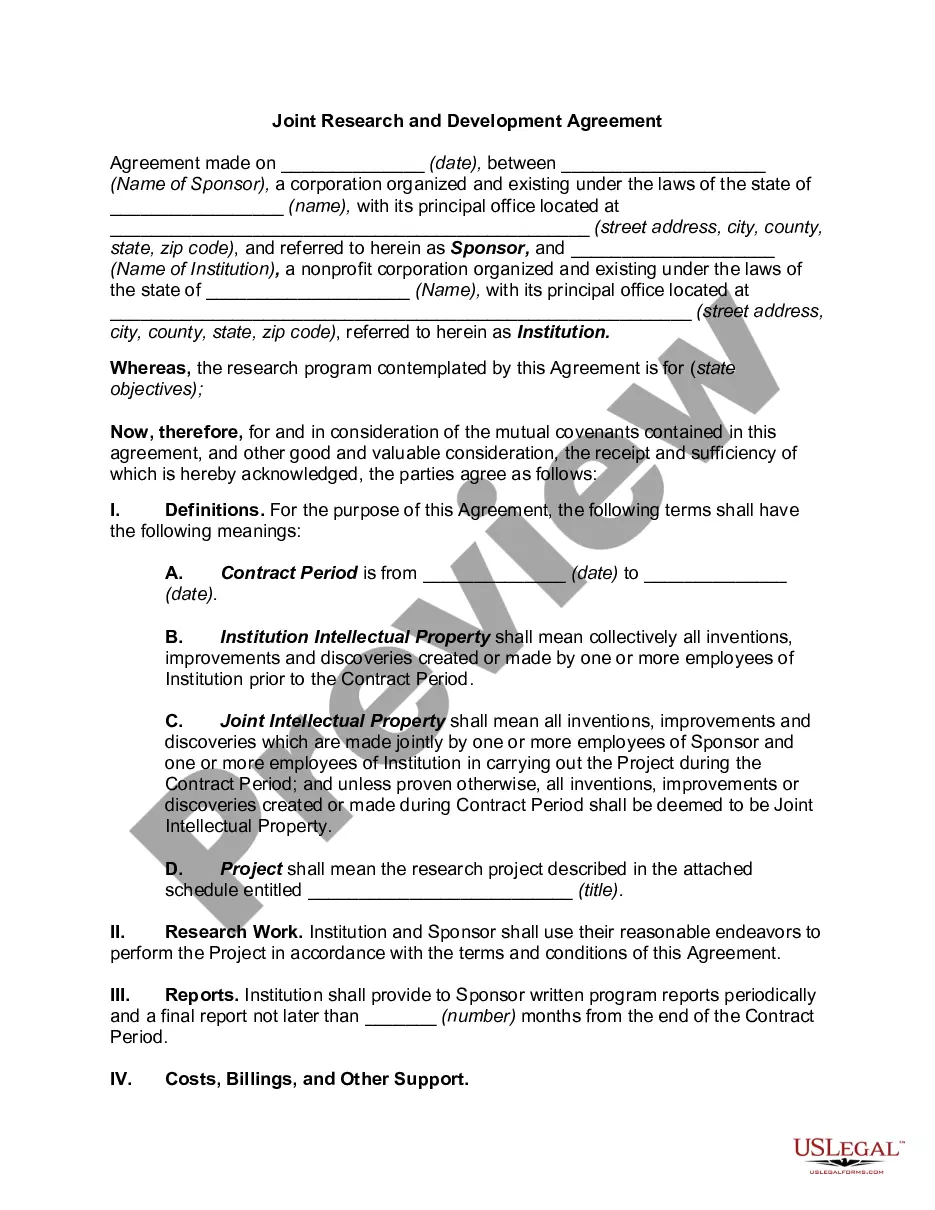

The Tx Spousal Maintenance Texas Withholding you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and state laws and regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, easiest and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Tx Spousal Maintenance Texas Withholding will take you only a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it fits your requirements. If it does not, utilize the search bar to find the correct one. Click Buy Now when you have located the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Pick the format you want for your Tx Spousal Maintenance Texas Withholding (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your paperwork again. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Texas treats spousal support differently from many states in several ways. For one thing, Texas sets strict limits on how much support a spouse can receive. No matter how much the paying spouse earns, support can never exceed $5,000 per month or 20% of their average monthly income, whichever is smaller.

As mentioned before, the court will award only 20% of the supporting spouse's average monthly income, up to $5,000 per month, no matter how these various factors weigh. That means that even if the supporting spouse earns $1 million per month, support will not exceed $5,000 by law.

What is an Income Withholding Order in Texas? Texas law provides for a court to enter a wage withholding order as a tool to help in collecting spousal maintenance (alimony) payments and child support payments. The order requires the employer of the party obligated to pay to withhold a portion of his paycheck.

Taxes and Contractual Alimony If you receive contractual alimony in Texas, you no longer need to declare it as income. The Internal Revenue Service tax code used to provide that the payor spouse could deduct the payments from their taxes, while the receiving spouse had to declare them as income.

Texas courts cap spousal maintenance payments at $5,000 or 20% of the payer's gross monthly income, whichever is smaller. But a judge can use their discretion to set the amount much lower depending on factors such as marriage length, the quality of the relationship, and employment potential.