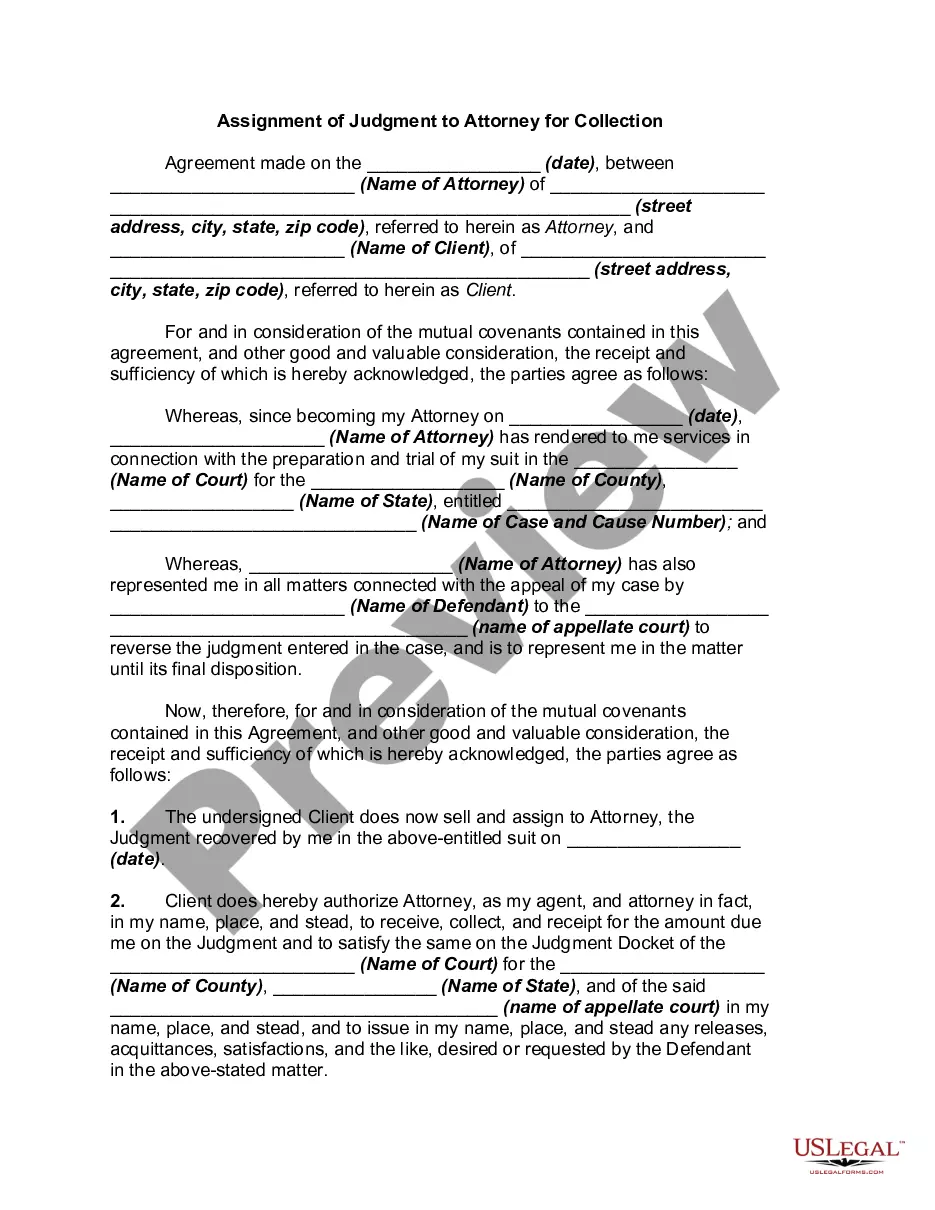

Motion Order Form With Envelope Attached

Description

How to fill out Texas Motion For Order Of Contempt For Failure To Pay Spousal Maintenance?

Creating legal documents from the ground up can occasionally feel a bit daunting.

Some situations may require extensive research and significant financial investment.

If you are looking for a more straightforward and economical method of preparing Motion Order Form With Envelope Attached or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of more than 85,000 current legal documents addresses nearly every aspect of your financial, legal, and personal matters.

Before rushing to download the Motion Order Form With Envelope Attached, keep these recommendations in mind: Review the form preview and descriptions to make sure you have the correct form. Ensure the selection complies with the legalities of your state and county. Choose the most suitable subscription plan to acquire the Motion Order Form With Envelope Attached. Download the document, then complete, validate, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Sign up today and simplify your form execution process!

- With just a few clicks, you can promptly obtain state- and county-compliant templates meticulously crafted for you by our legal experts.

- Utilize our platform whenever you require a dependable service through which you can conveniently locate and download the Motion Order Form With Envelope Attached.

- If you are familiar with our site and have set up an account previously, simply Log In to your account, find the form, and download it or re-download it anytime from the My documents section.

- Not signed up yet? No worries. Registering takes minimal time and allows you to browse the catalog effortlessly.

Form popularity

FAQ

Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. Tangible personal property is always depreciated over either a five- or seven-year period using straight-line depreciation but is eligible for accelerated depreciation as well.

Real property includes: all lots and land; buildings, improvements, and fixtures (except trade fixtures); and mobile homes that are used for residential, office, commercial, or agricultural purposes. See Neb. Rev. Stat.

Personal property is all property other than real property and franchises. Recovery Period. The recovery period is the federal Modified Accelerated Cost Recovery System (MACRS) recovery period over which the Nebraska adjusted basis of property will be depreciated for property tax purposes.

The Personal Property Tax Relief Act allows for an exemption of the first $10,000 of value of taxable tangible personal property in each tax district in which a Personal Property Return is filed.

The term tangible personal property also includes trade fixtures, which means machinery and equipment, regardless of the degree of attachment to real property, used directly in commercial, manufacturing, or processing activities conducted on real property, regardless of whether the real property is owned or leased, and ...

It is the Nebraska adjusted basis of the tangible personal property multiplied by the appropriate depreciation factor for the recovery period and year. The property tax is imposed on the net book value of tangible personal property.