Failure Spousal Withholding Rate

Description

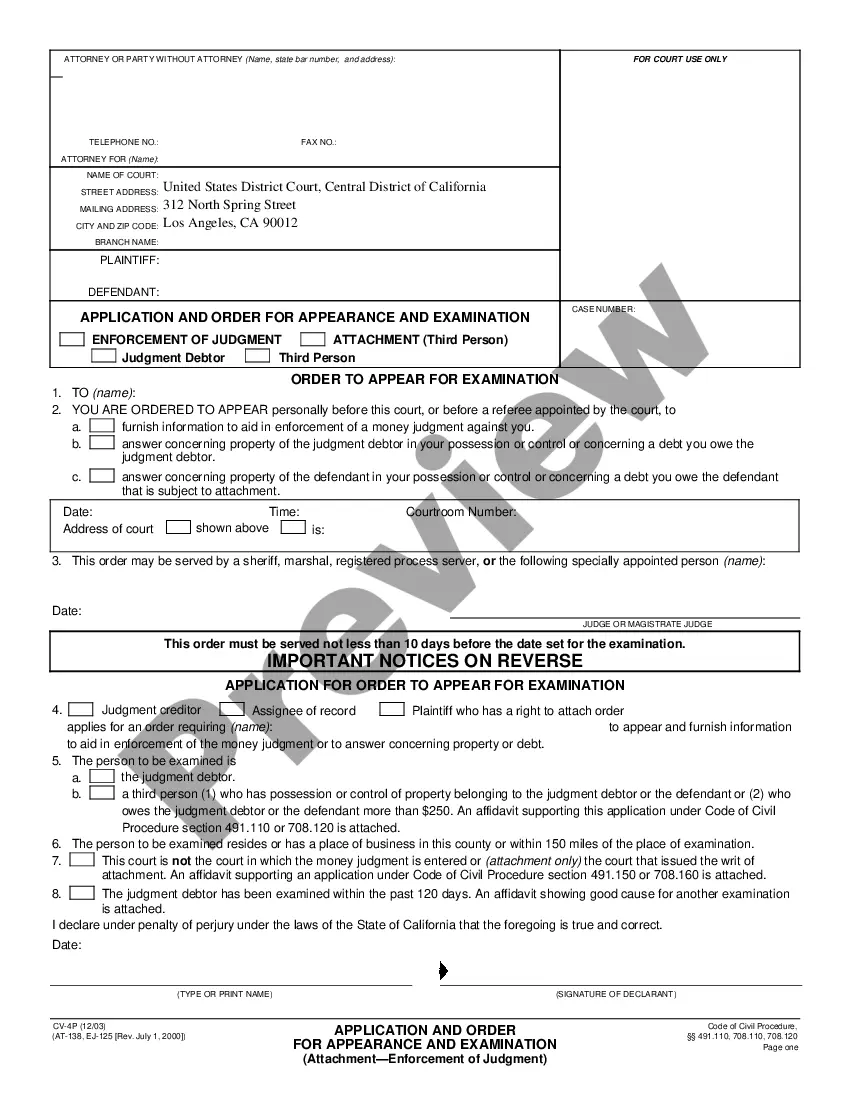

How to fill out Texas Motion For Order Of Contempt For Failure To Pay Spousal Maintenance?

Acquiring legal documents that adhere to national and local laws is crucial, and the web provides numerous alternatives to consider.

However, what is the use of spending time searching for the suitable Failure Spousal Withholding Rate template online when the US Legal Forms digital repository already consolidates such documents in one location.

US Legal Forms is the largest online legal database with more than 85,000 editable templates created by lawyers for every business and personal scenario.

Review the template using the Preview function or through the text outline to ensure it satisfies your requirements.

- They are straightforward to navigate with all files categorized by state and intended use.

- Our experts stay informed about legal updates, so you can be assured that your form is current and compliant when procuring a Failure Spousal Withholding Rate from our site.

- Acquiring a Failure Spousal Withholding Rate is quick and easy for both existing and new users.

- If you already have an account with a valid subscription, Log In and save the document sample you need in the desired format.

- If you are a new user, adhere to the steps outlined below.

Form popularity

FAQ

Protecting yourself from your husband's debt involves understanding your financial rights and obligations. Filing separately can help, but it's important to be aware of how the failure spousal withholding rate plays into your tax strategy. Additionally, seeking professional advice can help you structure your finances more safely. Tools and resources from uslegalforms can guide you in safeguarding your assets.

Married couples who file together often face higher withholding rates compared to those who file separately. This phenomenon can occur due to combined incomes being taxed at a higher bracket. By recognizing the failure spousal withholding rate, couples can better strategize their tax filings. Platforms such as uslegalforms make it easy to explore various tax scenarios based on marital status.

Failure to withhold refers to not deducting the correct amount of taxes from employee wages. This can lead to significant tax liabilities for both the employer and the employee. Understanding the failure spousal withholding rate can assist in effectively navigating withholdings and liabilities. For tailored advice, consider utilizing platforms like uslegalforms to ease your tax concerns.

Yes, tax debt can affect your spouse, particularly if you file joint returns. The IRS can place holds or liens on joint assets, which can complicate your financial landscape. Awareness of the failure spousal withholding rate is essential to understanding how these debts impact both partners. Using resources like uslegalforms can help you manage potential tax implications.

In most cases, you are not liable for your husband's tax debt, especially if you file separately. However, joint tax returns can lead to shared responsibility. It’s crucial to understand how the failure spousal withholding rate can impact your financial situation. Seeking guidance from professionals or platforms like uslegalforms can provide insight into your obligations.

When you file separately, responsibility for your husband’s tax debt generally remains his. However, the IRS can still pursue both of you for joint debts from previous years. Understanding the implications of the failure spousal withholding rate can help you navigate your tax responsibilities carefully. Consulting with a tax professional may clarify how filing status affects liability.

Determining your tax withholding involves evaluating your income, expenses, and possible deductions. A great starting point is to refer to the IRS withholding calculator, which provides personalized estimates based on your financial scenario. If you want extra assurance on complying with requirements like the failure spousal withholding rate, uslegalforms has tools and insights that can make your decision easier.

To fill out your withholding form effectively, begin by paying attention to the instructions provided on the form itself. Ensure you include your filing status and estimated number of dependents. Taking care to calculate any deductions can also help you avoid complications related to failure spousal withholding rates, and using uslegalforms can guide you through each step seamlessly.

Deciding whether to claim 0 or 1 on your withholding form depends on your anticipated tax liability. Claiming 0 may be beneficial if you want to have a larger refund, while claiming 1 can lead to smaller tax withholdings throughout the year. Evaluating your unique situation can help you find the right choice, and resources like uslegalforms can provide clarity on how your decision affects your failure spousal withholding rate.

Claiming 1 or 0 depends on your financial situation. If you claim 0, more taxes will be withheld, which can lead to a refund at tax time. On the other hand, claiming 1 will reduce your withholding, potentially leading to a tax bill if not enough tax is covered. Understanding how these choices affect your failure spousal withholding rate can make a significant difference.