Tx Company Formation For Non Resident

Description

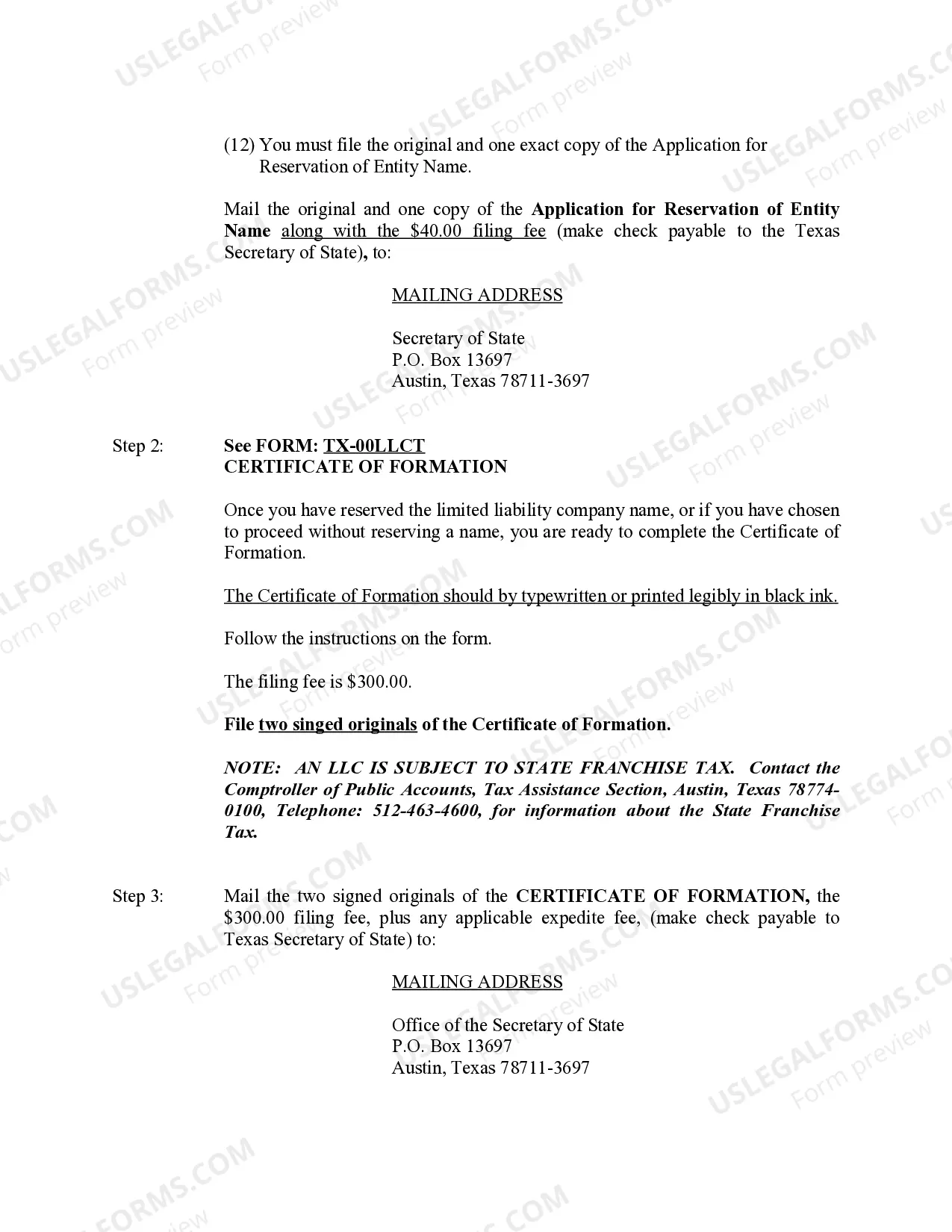

How to fill out Texas Limited Liability Company LLC Formation Package?

Managing legal paperwork can be daunting, even for experienced professionals.

When you are searching for a Texas Company Formation for Non-Residents and lack the time to seek out the correct and current version, the processes can become overwhelming.

Explore a repository of articles, guides, and materials relevant to your circumstances and needs.

Conserve time and energy searching for the documents you require, and make use of US Legal Forms’ advanced search and Preview feature to locate Texas Company Formation for Non-Residents and acquire it.

Ensure that the template is acknowledged in your state or county. Once you are set, click Buy Now. Choose a monthly subscription package. Select your preferred format, and Download, complete, eSign, print, and dispatch your documents. Leverage the US Legal Forms web catalog, backed by 25 years of expertise and reliability. Transform your daily document management into a streamlined and user-friendly experience today.

- If you possess a monthly subscription, Log In to your US Legal Forms account, find the form, and obtain it.

- Check the My documents tab to view the documents you have previously retrieved and manage your folders as needed.

- If this is your initial experience with US Legal Forms, register for a free account to gain unrestricted access to all platform benefits.

- Here are the steps to follow after obtaining the form you desire.

- Verify this is the correct form by previewing it and reviewing its details.

- Utilize state- or county-specific legal and organizational documents.

- US Legal Forms addresses all the needs you may have, from personal to business paperwork, in one platform.

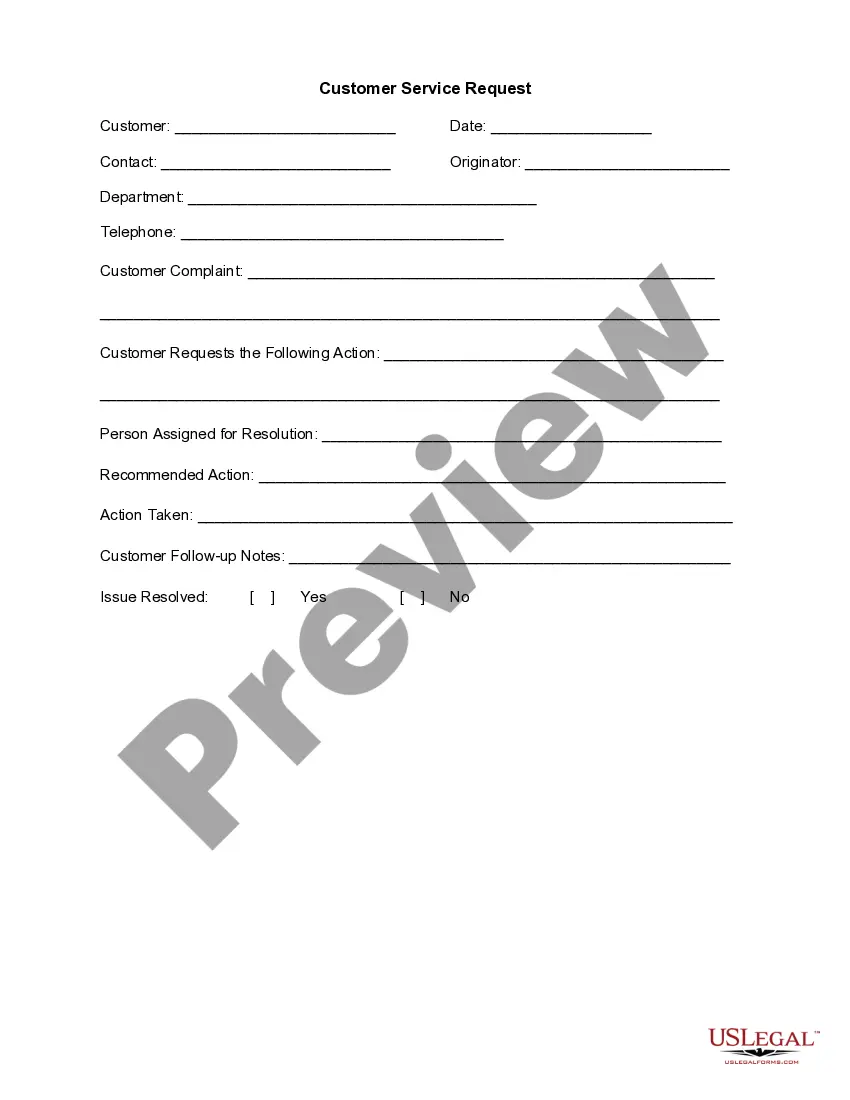

- Leverage sophisticated tools to accomplish and manage your Texas Company Formation for Non-Residents.

Form popularity

FAQ

To open a non-resident LLC in America, start by choosing your business name and ensuring it meets state requirements. Next, you must file the Articles of Organization with the state of Texas as part of the Tx company formation for non resident process. Our platform, USLegalForms, simplifies this process, offering step-by-step instructions and essential documentation to help you smoothly establish your LLC.

A Texas foreign LLC does business in Texas but was organized in another state or jurisdiction. To register as a Texas Foreign LLC, you'll need to submit an Application for Registration to the Texas Secretary of State and pay the state a filing fee of $750 (add 2.7% for all credit card transactions).

Provisions. This form and the information provided are not substitutes for the advice and services of an attorney and tax specialist. To transact business in Texas, a foreign entity must register with the secretary of state under chapter 9 of the Texas Business Organizations Code (BOC).

To register as a Texas Foreign LLC, you'll need to submit an Application for Registration to the Texas Secretary of State and pay the state a filing fee of $750 (add 2.7% for all credit card transactions).

Yes. Non-U.S. corporations, LLCs, LPs and financial institutions must register with the secretary of state before transacting business in Texas. Such entities are subject to state franchise tax and federal income tax on certain income.

If you are considering moving your business to Texas from another state, you will want to register it once you choose a location. If your business is a separate legal entity, you will need to register it with the Texas Secretary of State's Office in order to transact business in Texas.