Texas Supporting Form Purchase Withholding

Description

How to fill out Texas Sworn Statement Supporting Claim Against Estate?

Legal papers management can be mind-boggling, even for knowledgeable professionals. When you are interested in a Texas Supporting Form Purchase Withholding and do not have the time to devote trying to find the correct and up-to-date version, the procedures can be stress filled. A strong web form catalogue could be a gamechanger for anybody who wants to deal with these situations efficiently. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you anytime.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any needs you may have, from individual to organization documents, all in one location.

- Utilize innovative resources to complete and handle your Texas Supporting Form Purchase Withholding

- Gain access to a resource base of articles, instructions and handbooks and resources related to your situation and needs

Help save time and effort trying to find the documents you need, and utilize US Legal Forms’ advanced search and Review tool to get Texas Supporting Form Purchase Withholding and get it. In case you have a membership, log in to the US Legal Forms account, search for the form, and get it. Review your My Forms tab to find out the documents you previously downloaded and to handle your folders as you see fit.

If it is your first time with US Legal Forms, register an account and obtain unrestricted access to all advantages of the library. Here are the steps for taking after accessing the form you want:

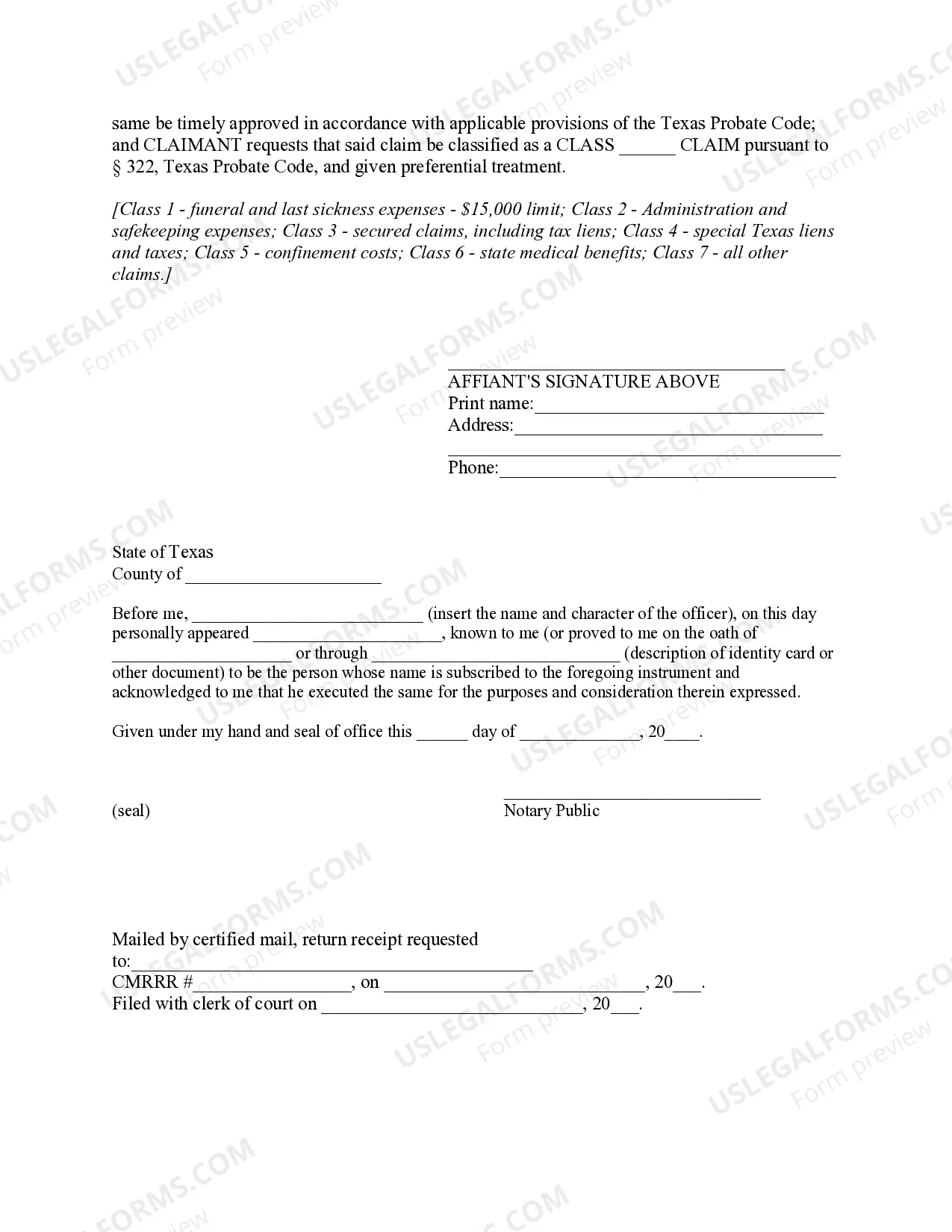

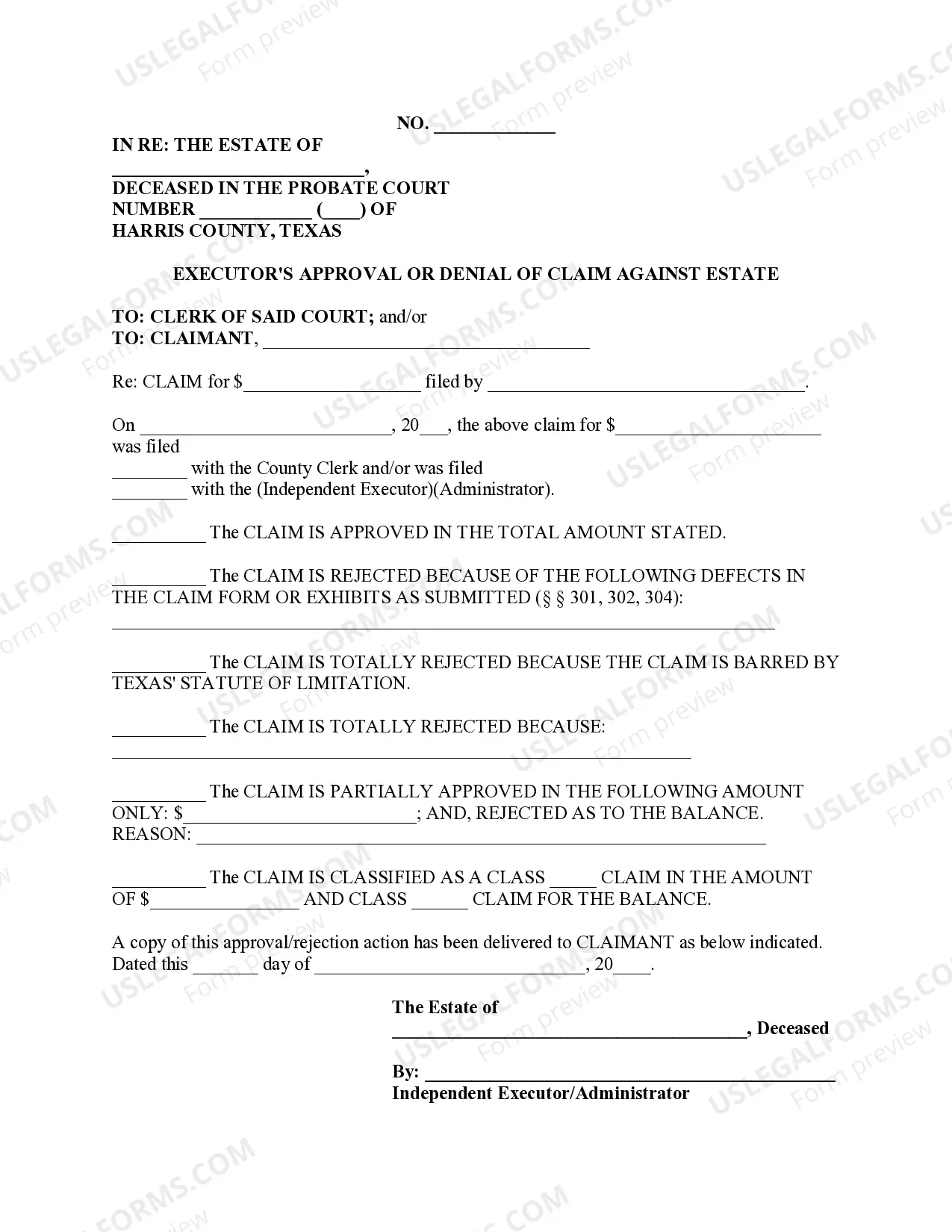

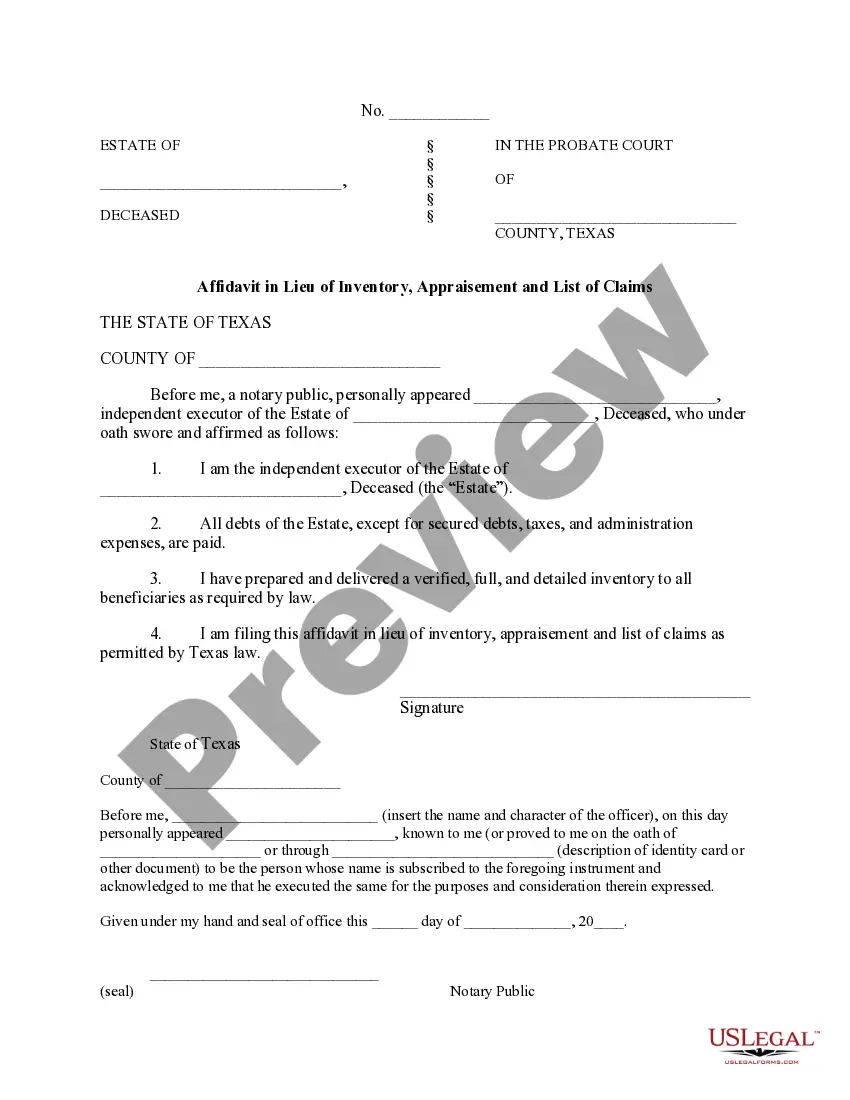

- Confirm it is the correct form by previewing it and looking at its description.

- Ensure that the sample is recognized in your state or county.

- Choose Buy Now once you are ready.

- Choose a monthly subscription plan.

- Pick the format you want, and Download, complete, eSign, print out and deliver your document.

Benefit from the US Legal Forms web catalogue, supported with 25 years of experience and trustworthiness. Enhance your day-to-day document managing in to a easy and easy-to-use process right now.

Form popularity

FAQ

Your company (employer) receives an "Order to Withhold Income for Child Support? from the Child Support Division. Your payment amount is deducted from your paycheck. Your employer sends the payment directly to us (each pay period). We process your payment and send it to the custodial parent.

The law in Texas requires child support to be taken directly out of the obligor's paycheck. When child support is established, an order called an Employer's Order to Withhold Income for Child Support, also called the Withholding Order, will be signed by the judge and sent to the obligor's employer.

An employer who does not comply with the order/notice is liable for the following: To the obligee for the amount not paid. To the obligor/employee for the amount withheld and not paid. For reasonable attorney's fees and court costs.

Texas does not have an individual income tax. Texas does not have a corporate income tax but does levy a gross receipts tax. Texas has a 6.25 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 8.20 percent.

The question "Does the entity have zero Texas Gross Receipts?" is asking whether or not the business entity has earned any money from its operations in Texas. If the answer is "yes," it means that the business has not earned any money from its operations in the state of Texas.