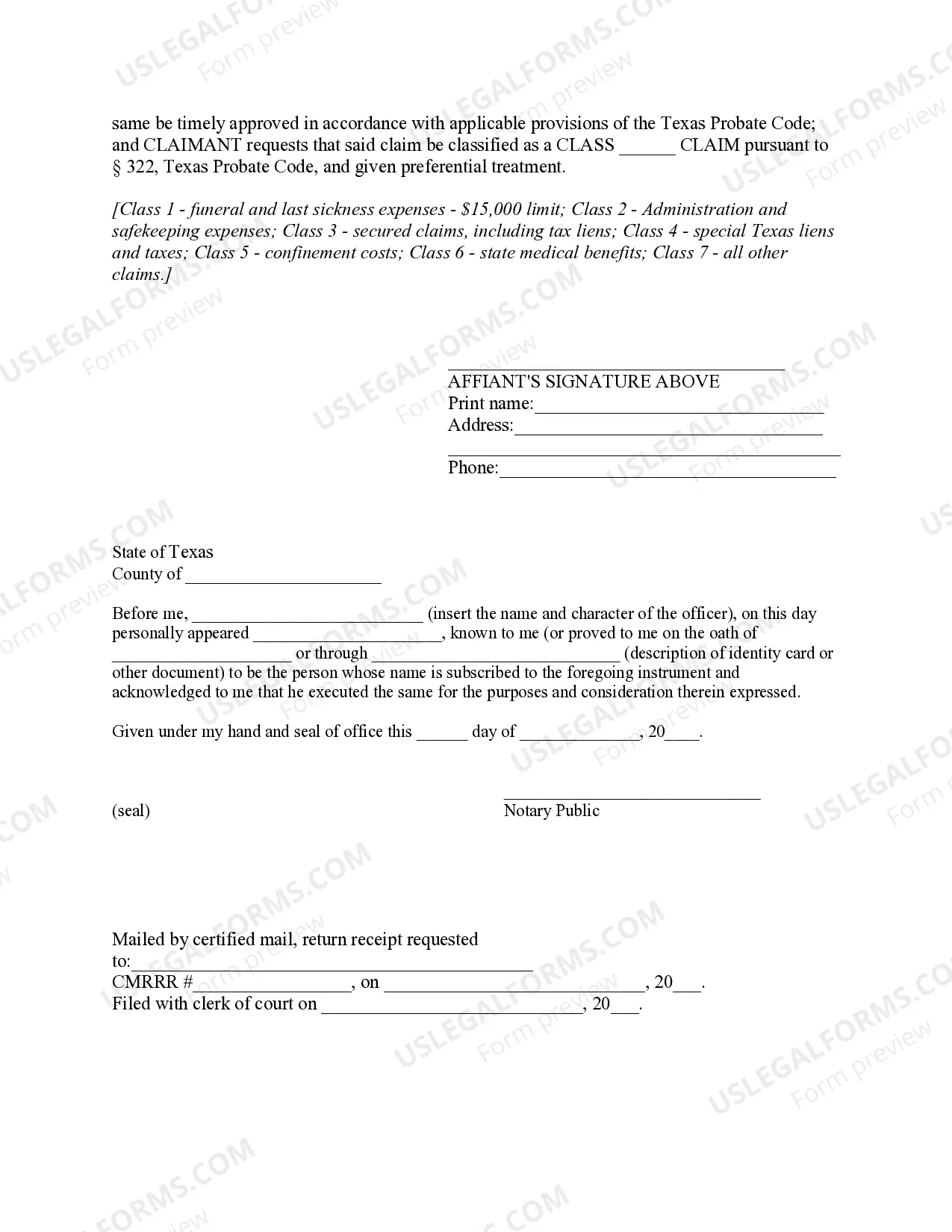

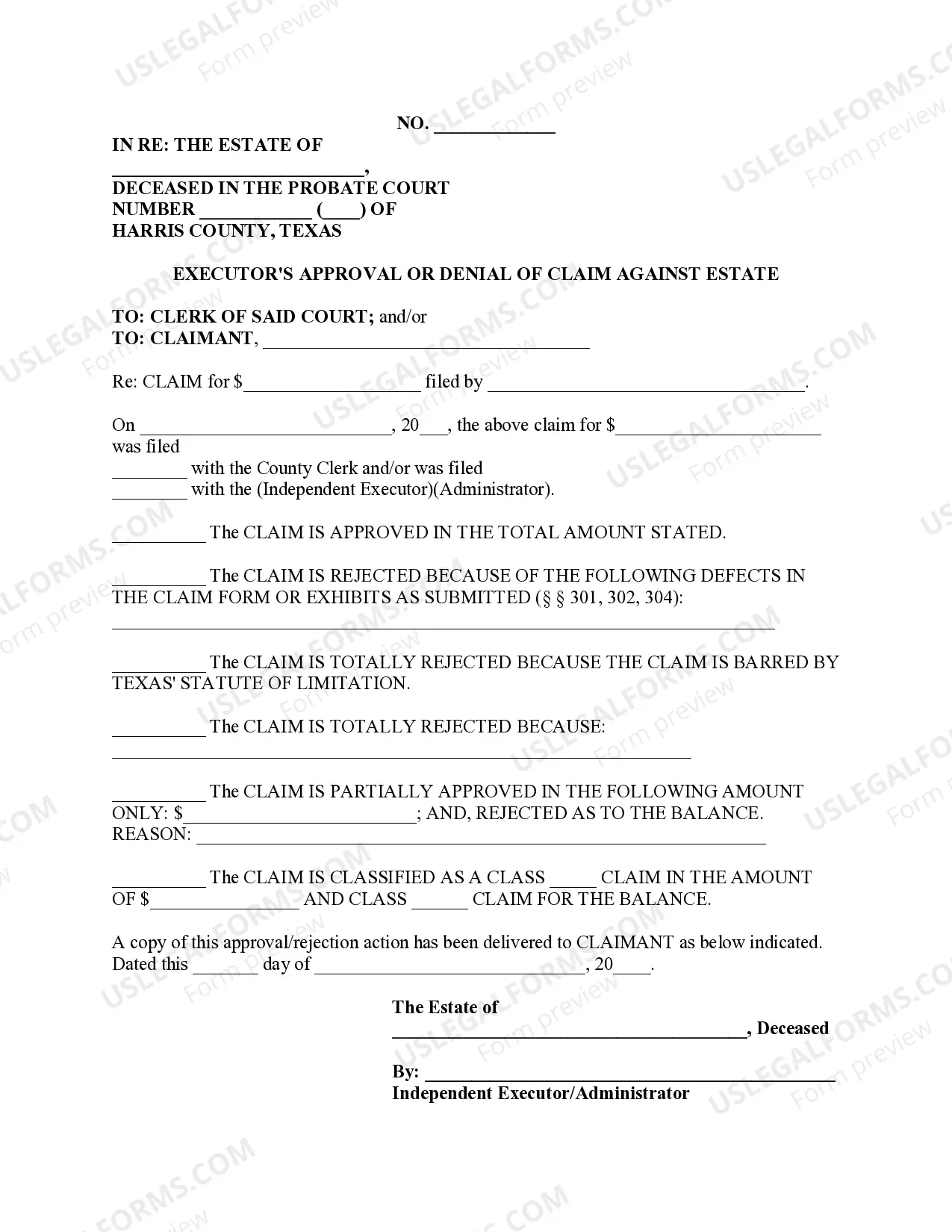

A Sworn Declaration Sample for BIR (Bureau of Internal Revenue) is a written statement that affirms the truthfulness and accuracy of the information provided on various documents or reports submitted to the BIR. It serves as a legal instrument to authenticate and validate the contents of the accompanying documents. The Sworn Declaration Sample for BIR is commonly used in different situations, such as: 1. Sworn Declaration for Income Tax Return (IT) Submission: This type of declaration is necessary when submitting annual income tax returns to the BIR. It attests to the accuracy and correctness of the financial information provided in the IT, including income, deductions, and tax payments. 2. Sworn Declaration for Value-Added Tax (VAT) Compliance: VAT-registered businesses are required to file periodic VAT returns. The sworn declaration accompanying these returns ensures the accuracy of the declared sales, output VAT, input VAT, and other related details. 3. Sworn Declaration for Withholding Tax Compliance: Withholding agents are obliged to deduct and remit the correct amount of taxes from payments made to their employees, suppliers, or service providers. This declaration confirms the proper withholding and truthfulness of the reported amounts. 4. Sworn Declaration for Documentary Stamp Tax (DST) Transactions: Certain documents, such as deeds, certificates, contracts, and agreements, may be subject to DST. A sworn declaration is often required to affirm the nature and value of the transaction to determine the appropriate DST. 5. Sworn Declaration for Tax Amnesty or Voluntary Disclosure Programs: Whenever taxpayers avail themselves of tax amnesty schemes or voluntary disclosure programs, they may need to provide a sworn declaration. This declares the intention to settle all outstanding tax liabilities and ensure the accuracy and completeness of the disclosure. In any of these situations, the Sworn Declaration Sample for BIR must include crucial information such as the declaring's name, taxpayer identification number (TIN), address, and contact details. Additionally, it should state that the declaring understands the legal consequences of providing false information and that all the information contained in the accompanying documents is true and correct to the best of their knowledge. The use of sworn declarations helps maintain the BIR's integrity by encouraging full compliance and deterring tax evasion. It ensures transparency and accountability in tax-related matters, promoting a fair and equitable tax system.

Sworn Declaration Sample For Bir

Description

How to fill out Sworn Declaration Sample For Bir?

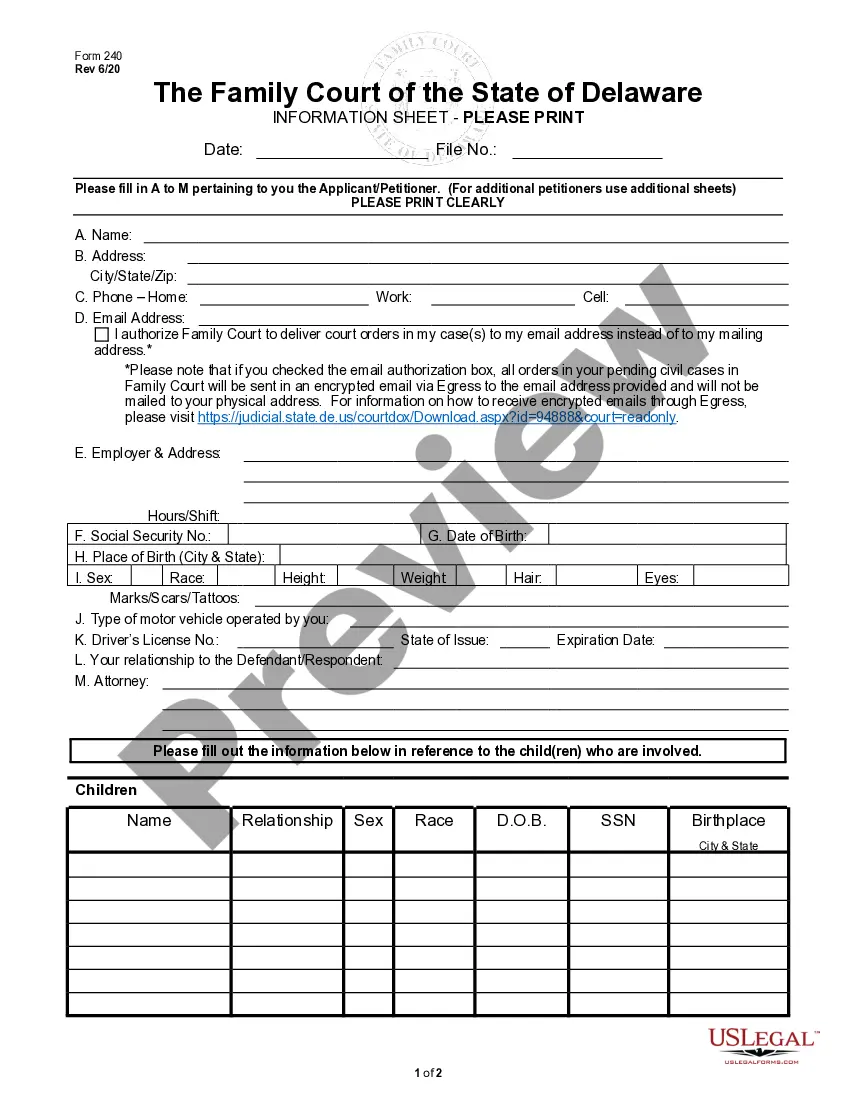

Using legal templates that comply with federal and state regulations is a matter of necessity, and the internet offers numerous options to choose from. But what’s the point in wasting time searching for the correctly drafted Sworn Declaration Sample For Bir sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal case. They are simple to browse with all papers grouped by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your paperwork is up to date and compliant when obtaining a Sworn Declaration Sample For Bir from our website.

Obtaining a Sworn Declaration Sample For Bir is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, adhere to the instructions below:

- Examine the template utilizing the Preview feature or through the text description to make certain it meets your requirements.

- Browse for another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the right form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Sworn Declaration Sample For Bir and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

A sworn declaration (also called a sworn statement or a statement under penalty of perjury) is a document that recites facts pertinent to a legal proceeding. It is very similar to an affidavit but is not witnessed and sealed by an official such as a notary public.

This includes: Your full name, signature, and date. Your Guarantor's full name, position, title, organization, full address, contact details, signature, and the date they sign. And remember: On your Sworn Declaration Form, make sure the date of the Claimant signature matches the date of the Guarantor signature.

What is a Sworn Statement? A sworn statement is a written statement of fact related to a legal proceeding. It is signed by the declarant to state that all the content is true, and that they acknowledge that the penalty of perjury may follow if they do not tell the truth.

A sworn statement, also known as a sworn affidavit, is a written document that is signed and certified by the person making the statement in the presence of a person authorized to administer oaths.

A sworn declaration (also called a sworn statement or a statement under penalty of perjury) is a document that recites facts pertinent to a legal proceeding. It is very similar to an affidavit but is not witnessed and sealed by an official such as a notary public.