Claim Texas State With Cabins

Description

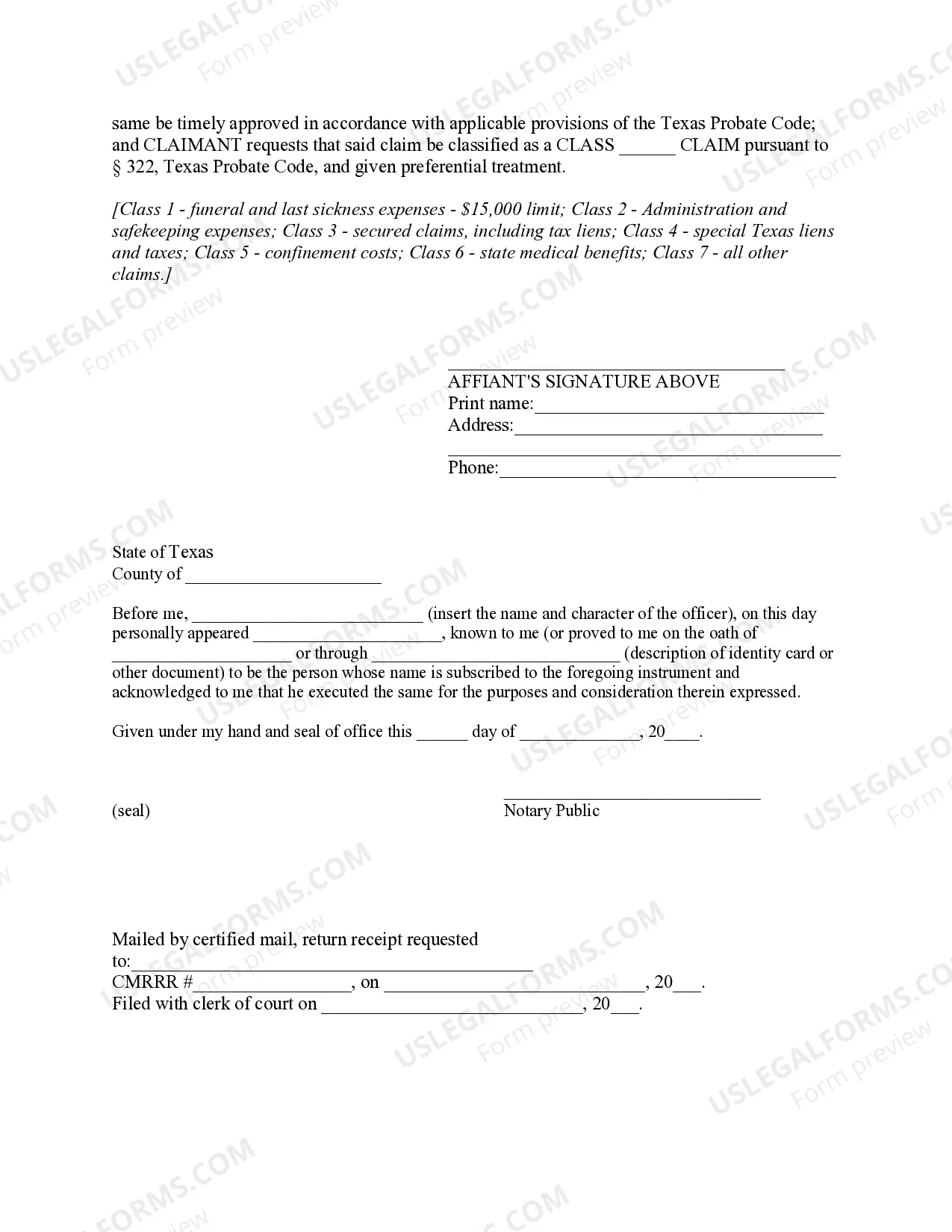

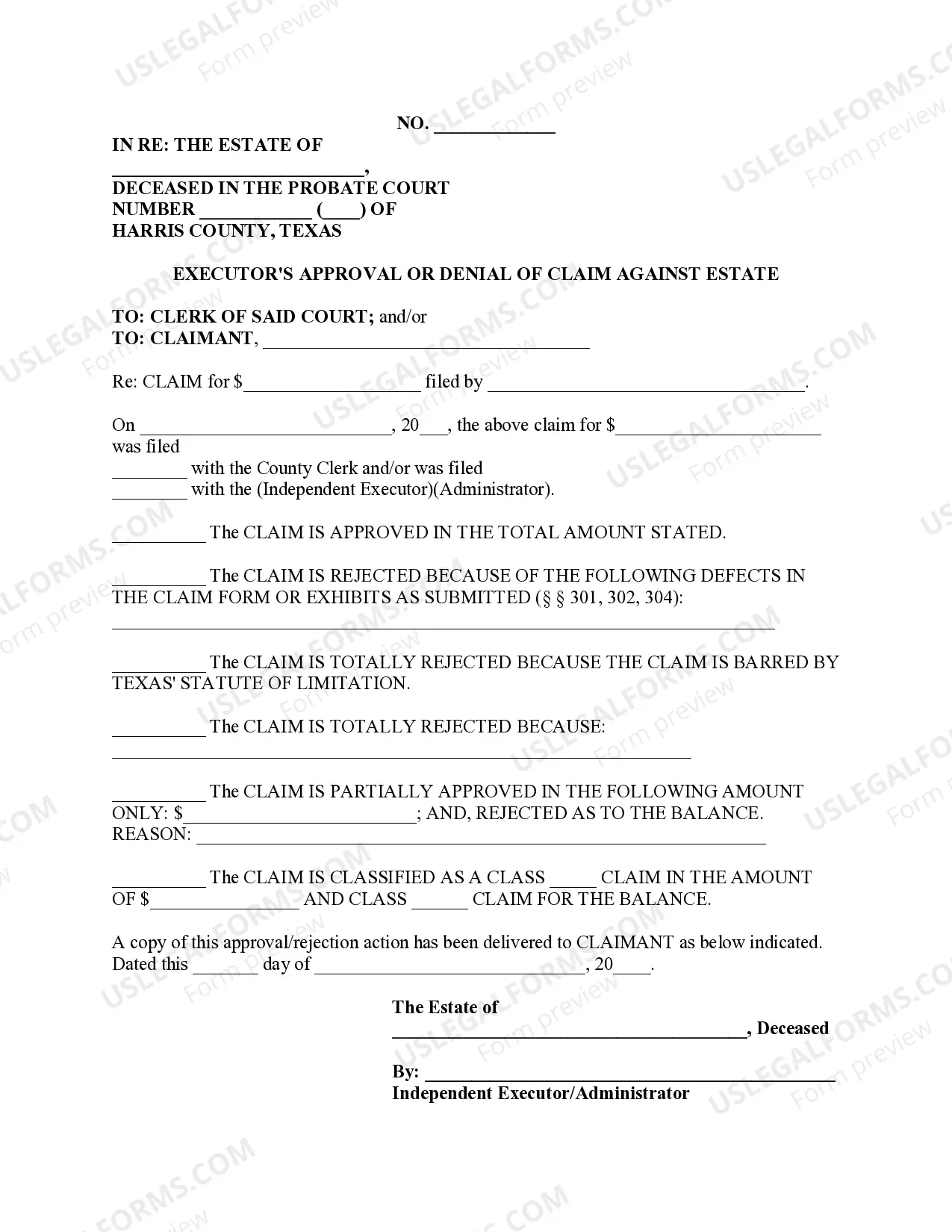

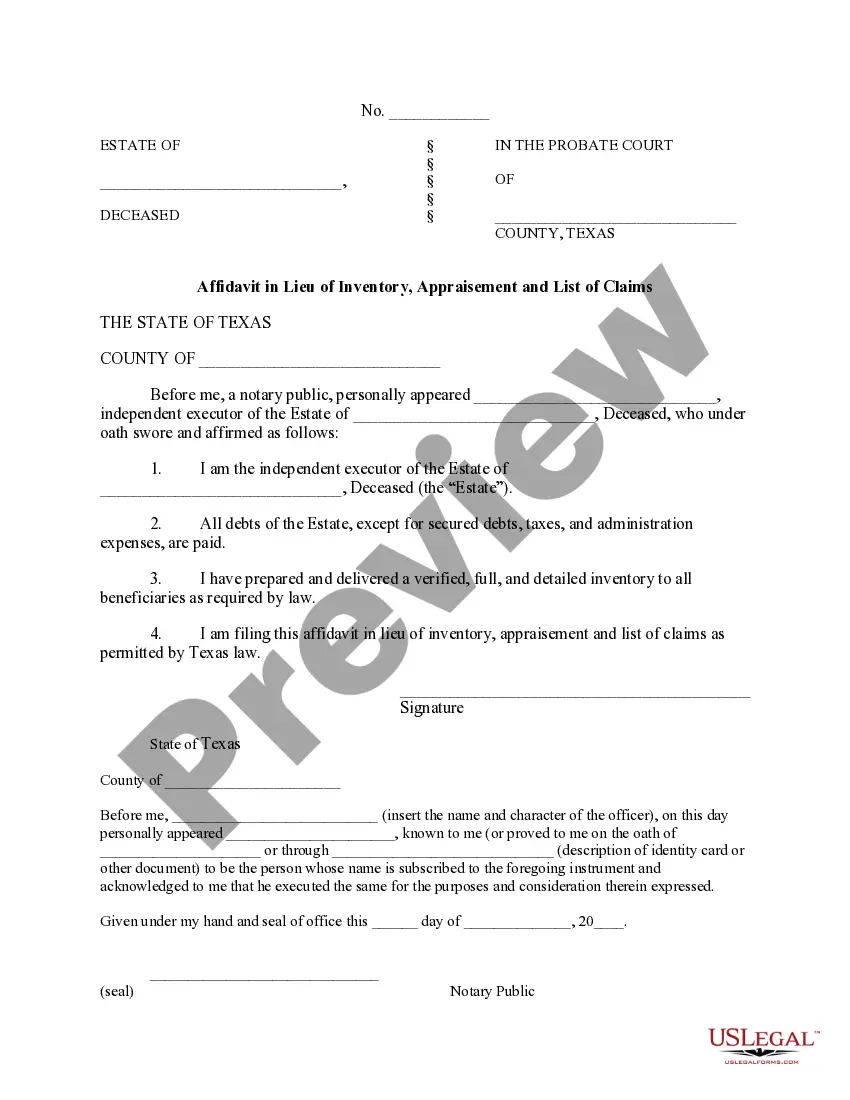

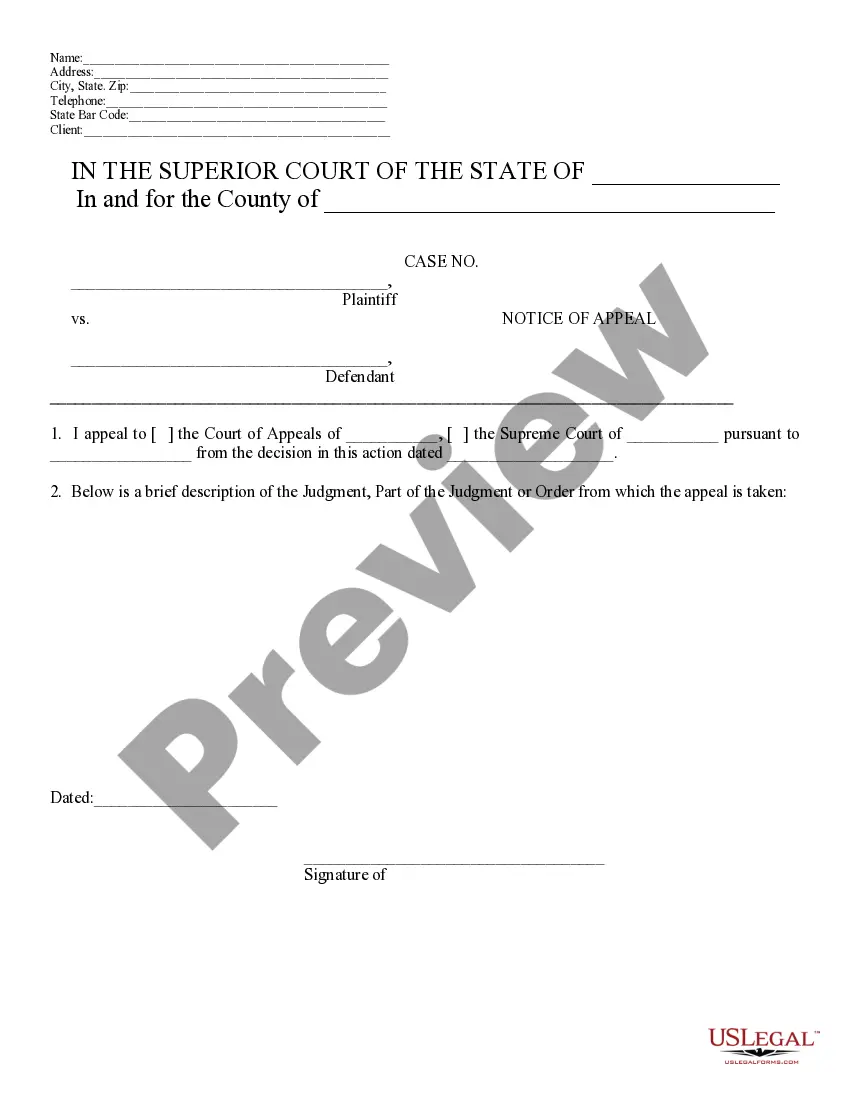

How to fill out Texas Sworn Statement Supporting Claim Against Estate?

Whether for business purposes or for individual matters, everyone has to deal with legal situations sooner or later in their life. Completing legal papers requires careful attention, starting with choosing the appropriate form template. For example, if you choose a wrong version of the Claim Texas State With Cabins, it will be declined when you submit it. It is therefore important to get a dependable source of legal papers like US Legal Forms.

If you have to obtain a Claim Texas State With Cabins template, stick to these simple steps:

- Find the template you need by using the search field or catalog navigation.

- Check out the form’s information to make sure it matches your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect form, return to the search function to find the Claim Texas State With Cabins sample you need.

- Download the file if it meets your requirements.

- If you already have a US Legal Forms account, simply click Log in to access previously saved documents in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you want and download the Claim Texas State With Cabins.

- Once it is saved, you are able to complete the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time looking for the appropriate template across the internet. Take advantage of the library’s easy navigation to get the appropriate template for any occasion.

Form popularity

FAQ

Rates. The state hotel occupancy tax rate is 6 percent (. 06) of the cost of a room. Cities and certain counties and special purpose districts are authorized to impose an additional local hotel tax that the local taxing authority collects.

You can use Texas Comptroller Form 50-114 to apply for the General Homestead Exemption. If you turn 65 or become newly disabled, you need to submit new application to obtain the extra exemption. These exemptions use the same Form 50-114 along with Supplemental Affidavit Form 50-144-A.

Beginning in 2005, if your date of birth was on your original residence homestead application or other written correspondence to the appraisal district about your residence homestead you will automatically receive the age 65 or older exemption without applying, if you are entitled to the general residence homestead ...

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption ? Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Contractors and city and county government employees working for the State of Texas or the federal government are not exempt from state or local hotel taxes. Guests who occupy a hotel room for 30 or more consecutive days with no payment interruption are considered permanent residents and are exempt from hotel tax.