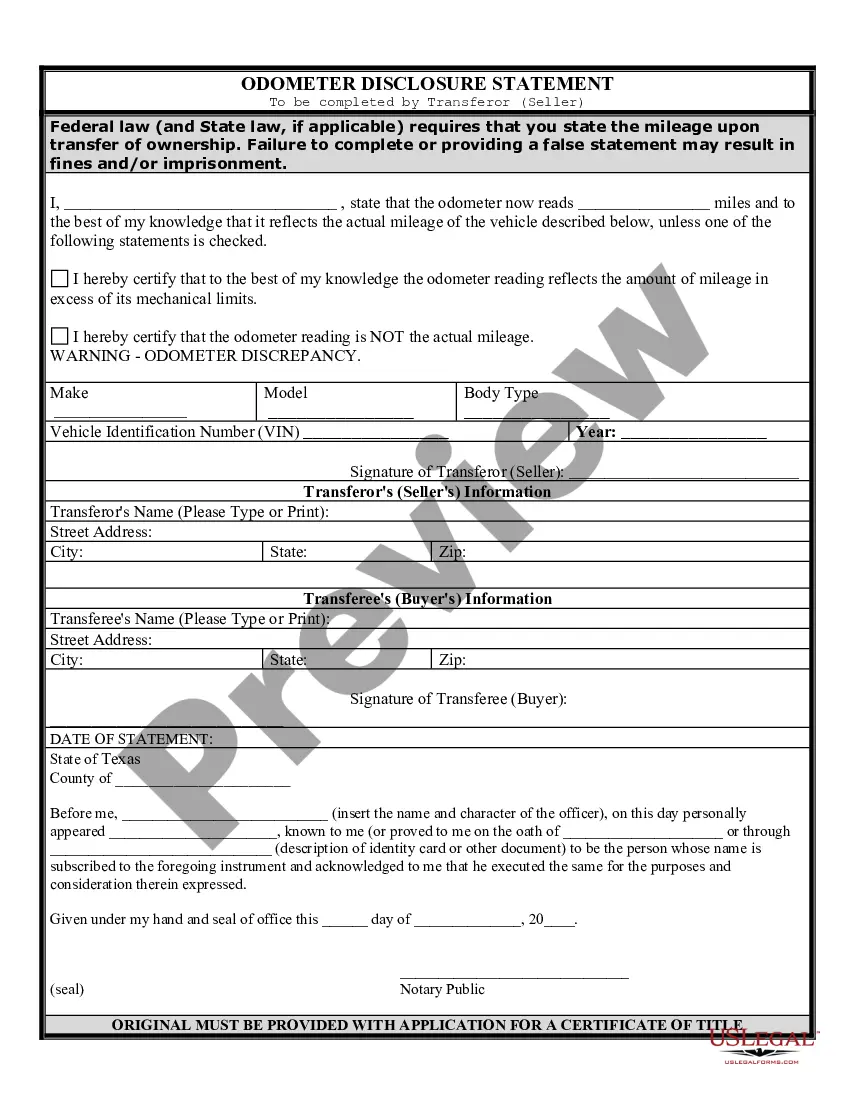

This Bill of Sale of Automobile contains the following information: the make/model of the car, VIN number and other information. Seller guarantees that the property is his/her own and is free of all claims and offsets of any kind. The form also contains the Odometer Disclosure Statement required by Federal Law and State Law, where applicable, which must be signed in the presence of a notary public.

A Texas automobile odometer statement without title is a legal document used to disclose the mileage or odometer readings of a vehicle when transferring ownership without a title. This statement is necessary in situations when the previous owner cannot provide a title due to reasons such as lost or stolen title, lien holder refusal, or other complications. The Texas Department of Motor Vehicles (DMV) requires this statement to prevent odometer fraud and ensure accurate mileage representation during vehicle transactions. By completing this document, both the seller and the buyer acknowledge the vehicle's true mileage at the time of sale, providing transparency and protecting the buyer from potential misrepresentations. There are different types of TX automobile odometer statements without title, including: 1. DMV Form VTR-329: This is the standard form used for a regular vehicle sale without a title. It requires the seller to provide the vehicle's description, year, make, model, vehicle identification number (VIN), and the accurate odometer reading. The buyer and seller must sign and date the form to signify their agreement on the disclosed mileage. 2. DMV Form VTR-61: This form is specifically used when transferring a vehicle without a title due to a deceased registered owner. In addition to the vehicle and odometer information, it also requires the seller to provide the details of the deceased registered owner, including their name, date of birth, and date of death. The form must be signed by the executor or administrator of the estate or an heir-at-law. 3. DMV Form VTR-331: This form is utilized when a vehicle is transferred without a title due to the sales tax exemption for a motor vehicle gifted within the family. It requires the same vehicle information and odometer reading as Form VTR-329, but the buyer must sign a statement of exemption and provide their relationship to the seller. It is crucial to note that a TX automobile odometer statement without title does not replace the need for an actual title. Furthermore, it serves as a temporary document that transfers the ownership legally until a title can be obtained. The buyer must initiate the process of obtaining a replacement title from the DMV. If a vehicle is sold without a title, the buyer should exercise caution, perform a thorough inspection, and consider obtaining a vehicle history report to ensure there are no undisclosed liens, salvaged titles, or other potential issues that may affect the vehicle's value or legality. It is advisable to consult with the DMV or a legal professional to navigate the process correctly and avoid any complications.