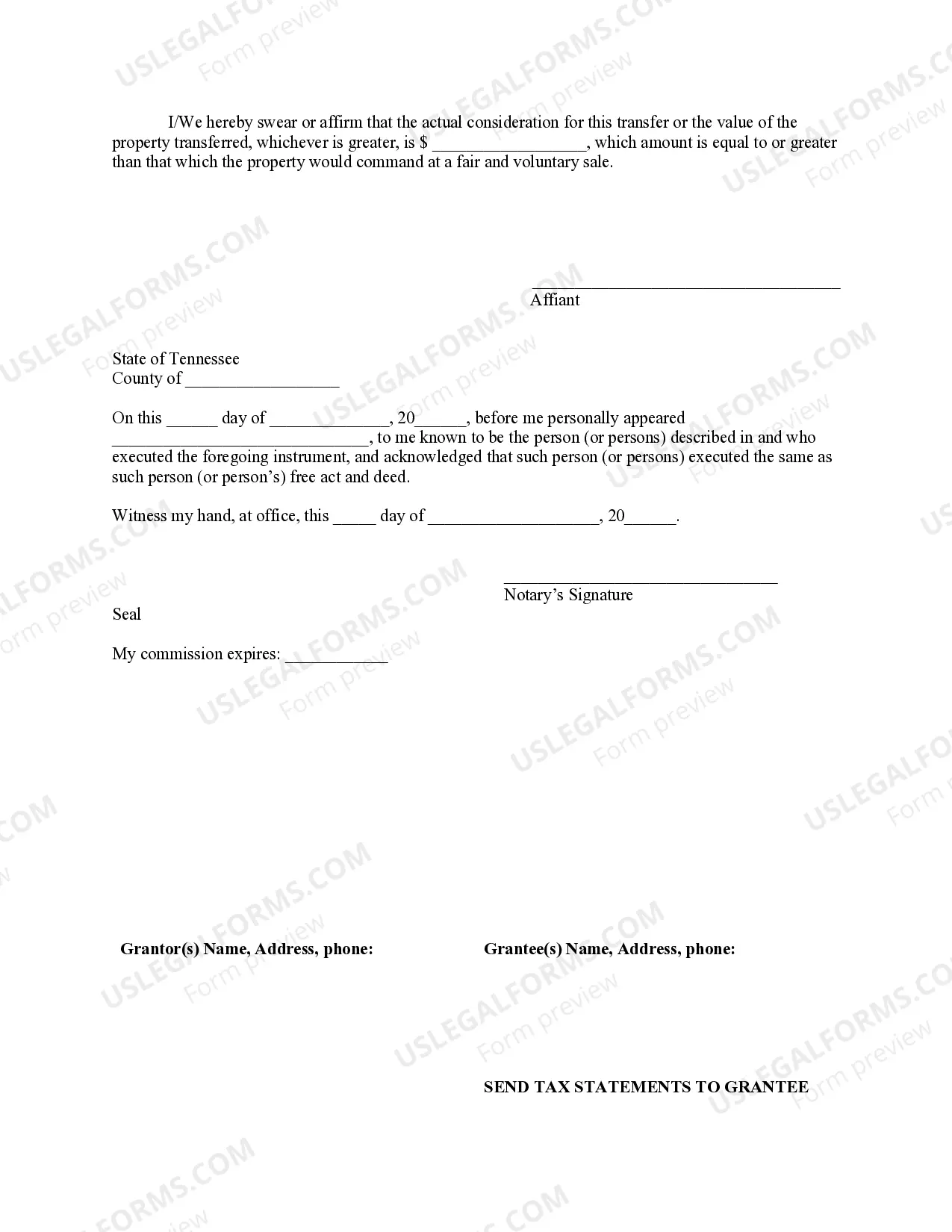

This form is a Warranty Deed where the grantor is an individual(s) and the grantee is an individual. The grantor(s) has/have reserved a life estate(s) in the described property.

Form Legal Which Withholding

Description

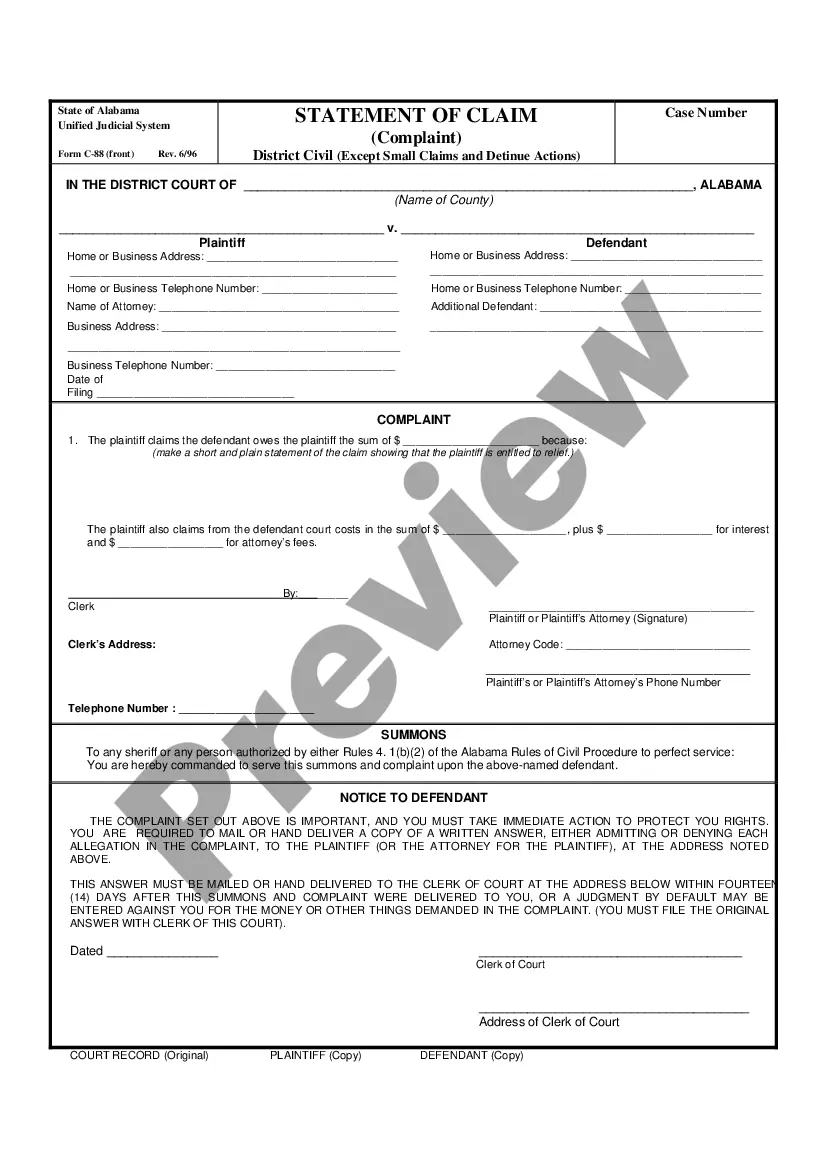

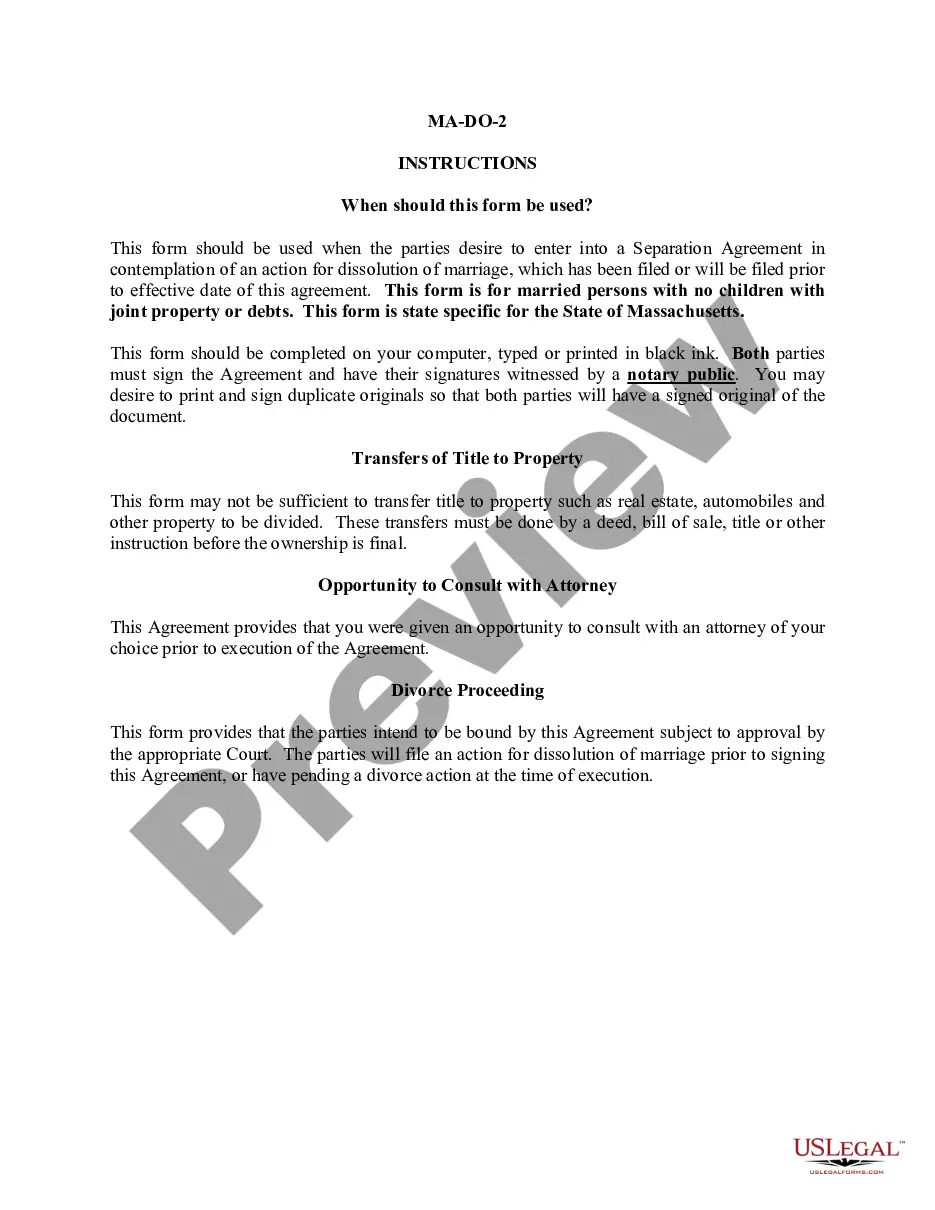

How to fill out Tennessee Warranty Deed For Individuals To Individual With Reserved Life Estates?

- If you're a returning user, log in to your account and download the specific form template by selecting the Download button. Ensure your subscription is active to access the needed documents.

- For first-time users, begin by reviewing the preview mode to verify that the chosen form aligns with your needs and adheres to local jurisdiction requirements.

- Should you find that your selected template is not suitable, utilize the Search feature to find the correct form that matches your criteria.

- Once you have the appropriate document, click on the Buy Now button and select your preferred subscription plan. You'll need to create an account for full access.

- Complete your purchase by entering your payment information. You can opt to make your payment using a credit card or PayPal.

- Finally, download your completed form and store it on your device. You can always return to the My Forms section of your profile to access it again when needed.

US Legal Forms provides an efficient platform that empowers both individuals and legal professionals to generate documents swiftly, boasting a library of over 85,000 fillable and editable forms.

Take advantage of our extensive resources today and ensure your legal documents are both precise and compliant. Start now to experience the ease of US Legal Forms!

Form popularity

FAQ

A 0 tax return can raise questions about your income situation. If you earn no taxable income, it might indicate that you don't owe taxes, but this varies based on specific circumstances. However, if you're fully employed and reporting a 0 tax return, it's vital to reassess your financial strategy. Platforms like uslegalforms provide valuable insights into navigating these issues effectively with Form legal which withholding.

Putting zeros on your tax return might seem tempting, but it can create confusion about your actual income and tax obligations. If you have no taxable income, filing a return with zeros could be acceptable, but it's important to understand the implications. The IRS may flag your return for scrutiny, so it's always wise to ensure that you are accurately reporting your finances. Using the Form legal which withholding can help clarify your situation.

When filling out your tax withholding form, start by gathering your financial information, including your income and deductions. Accurately complete each section, paying special attention to the number of allowances you claim. Consider consulting resources like uslegalforms for guidance on the Form legal which withholding to ensure your submission is correct and complete.

Whether to claim 0 or 1 on your tax form largely depends on your financial situation. If you prefer a larger paycheck every month, claiming 1 might be beneficial. On the other hand, if you anticipate owing taxes, claiming 0 could help you avoid a tax bill later. To make the best decision, consider using the Form legal which withholding to evaluate your options.

The difference between claiming 0 and claiming 1 on your tax withholding form primarily impacts how much you take home each paycheck. Claiming 1 allows for slightly less tax withholding, which can increase your net income. However, claiming 0 might lead to a bigger refund during tax time. Understanding this difference is crucial for managing your finances effectively.

Claiming 0 on your tax withholding form means you are having the maximum amount of taxes taken out of your paycheck. However, if you do not earn enough income to justify this withholding, or if you have other sources of income, you might still owe taxes. Remember, claiming 0 does not exempt you from tax liability; use the Form legal which withholding to ensure accuracy.

Choosing the appropriate tax withholding depends on your income situation and financial goals. Using the IRS’s withholding calculator can provide clarity on what amount to withhold. Additionally, reviewing your financial needs on an annual basis can help ensure that you choose the right level of withholding. For tailored assistance, USLegalForms offers resources that can guide you in making informed decisions.

Yes, many tax forms can be filled out online, which simplifies the process significantly. Using an online service like USLegalForms not only allows you to fill out forms but also ensures that your information is secure. This method helps eliminate common errors and provides a convenient way to manage your tax obligations. Take advantage of modern technology to make your tax filing less stressful.

Calculating the taxable portion of your Social Security benefits can be done by adding half of your benefits to your other income. If this total exceeds a specific threshold, you may owe taxes on a portion of your benefits. Understanding this calculation is important for your overall tax planning. For additional resources, consider accessing helpful tools on platforms like USLegalForms.

Filling out the AW-4 form online is quite simple and efficient. First, gather your personal information and tax details, then access a trusted platform like USLegalForms to complete the process. The online format enhances accuracy and reduces the likelihood of errors compared to filling it out manually. Once completed, you can easily submit the form according to your needs.