Tennessee Limited Partnership Foreign Investors

Description

Form popularity

FAQ

Yes, LLCs in Tennessee are required to file an annual report. This report keeps your business information updated with the state. For Tennessee limited partnership foreign investors, timely submission of this report ensures compliance and good standing with state regulations.

In Tennessee, you do need to file a business tax return if your LLC has taxable income. Whether you are a local entrepreneur or a Tennessee limited partnership foreign investor, filing this return is essential to avoid penalties. Your tax obligations should be clearly outlined based on your business activities and income.

Yes, LLCs must file a tax return in Tennessee if they are generating income. This requirement holds for all LLCs, whether domestic or comprised of Tennessee limited partnership foreign investors. Understanding when and how to file is crucial to maintain compliance and avoid potential fines.

Yes, having a registered agent is a requirement for LLCs in Tennessee. This agent serves as your business's official point of contact, handling essential documents and legal notices. For Tennessee limited partnership foreign investors, appointing a registered agent can also help navigate U.S. business regulations smoothly.

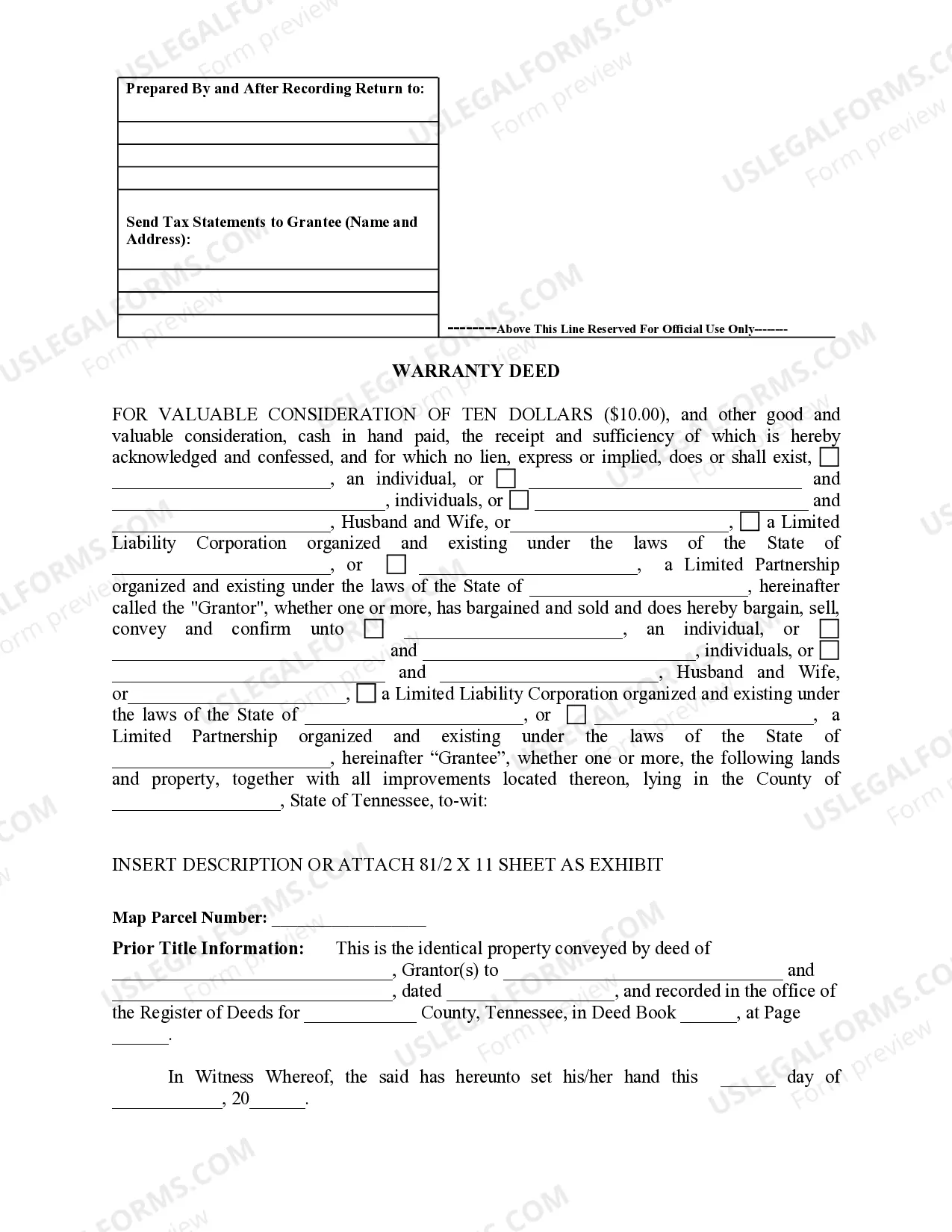

Yes, a U.S. LLC can be owned by a foreign company. This arrangement can be advantageous for Tennessee limited partnership foreign investors seeking to enter the U.S. market. It's essential to understand the legal and tax implications when structuring such ownership.

A foreign LLC must register in Tennessee to conduct business in the state. This involves filing a Certificate of Authority with the Tennessee Secretary of State. By doing so, Tennessee limited partnership foreign investors can gain access to various market opportunities while ensuring legal compliance.

Yes, registering an LLC in Tennessee is necessary before you can operate legally. This step ensures that Tennessee limited partnership foreign investors are compliant with state business laws. Without registration, your LLC may face legal challenges in its operations.

Yes, foreigners can register an LLC in the United States. For Tennessee limited partnership foreign investors, this is achievable through the completion of necessary forms and compliance with state regulations. However, having a registered agent in the U.S. is often required to assist with legal matters.

To form a partnership in Tennessee, you should first establish a partnership agreement that delineates each partner's roles and responsibilities. While formal registration is not required for general partnerships, Tennessee limited partnership foreign investors may need to register with the state if they wish to form a limited partnership. Consulting legal guidelines is advisable to ensure compliance.

Having an LLC does not exempt you from tax responsibilities in Tennessee. If your LLC generates income, you must file taxes, irrespective of your investment status as a Tennessee limited partnership foreign investor. Not filing could lead to fines or penalties, so it’s essential to stay compliant.