Special Power Of Attorney Coupled With Interest

Description

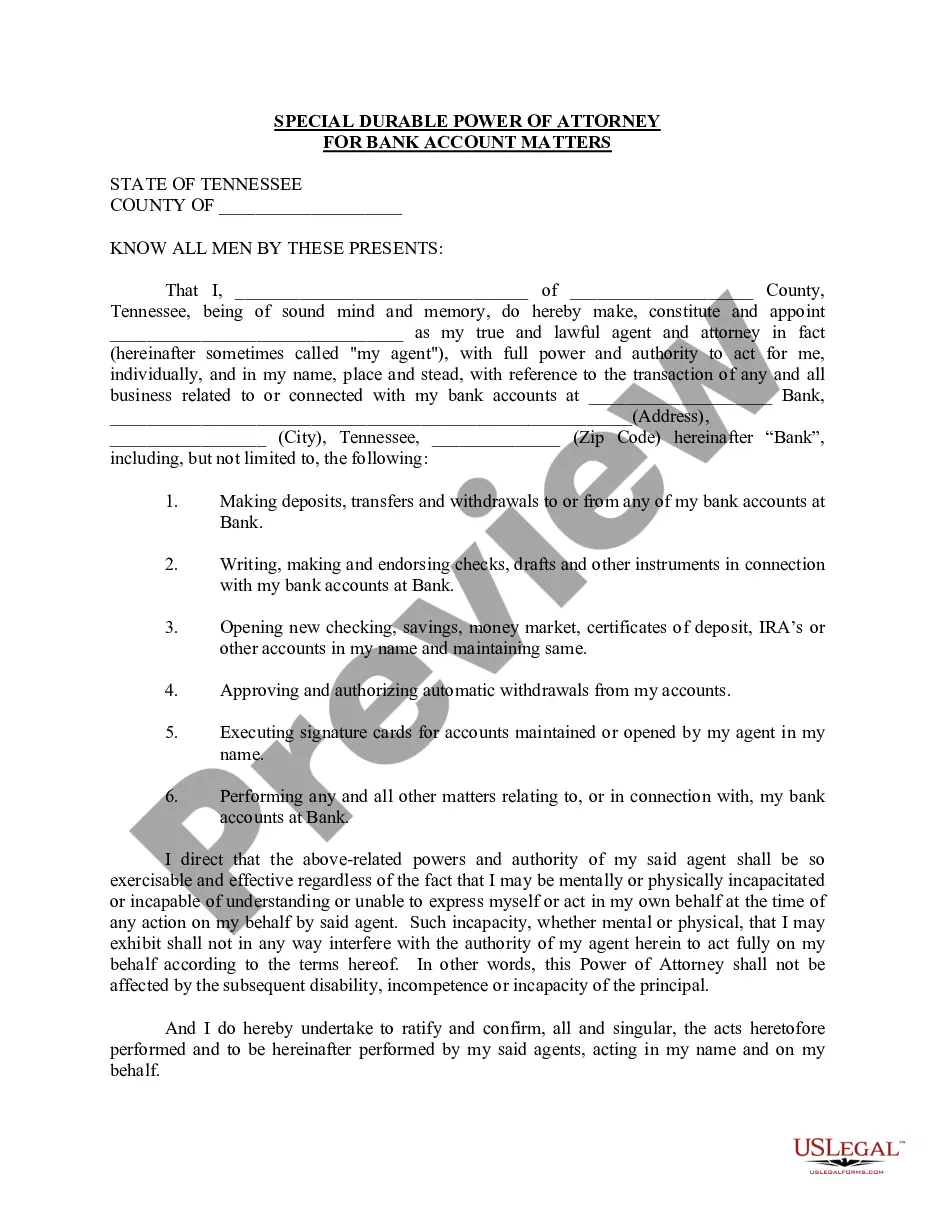

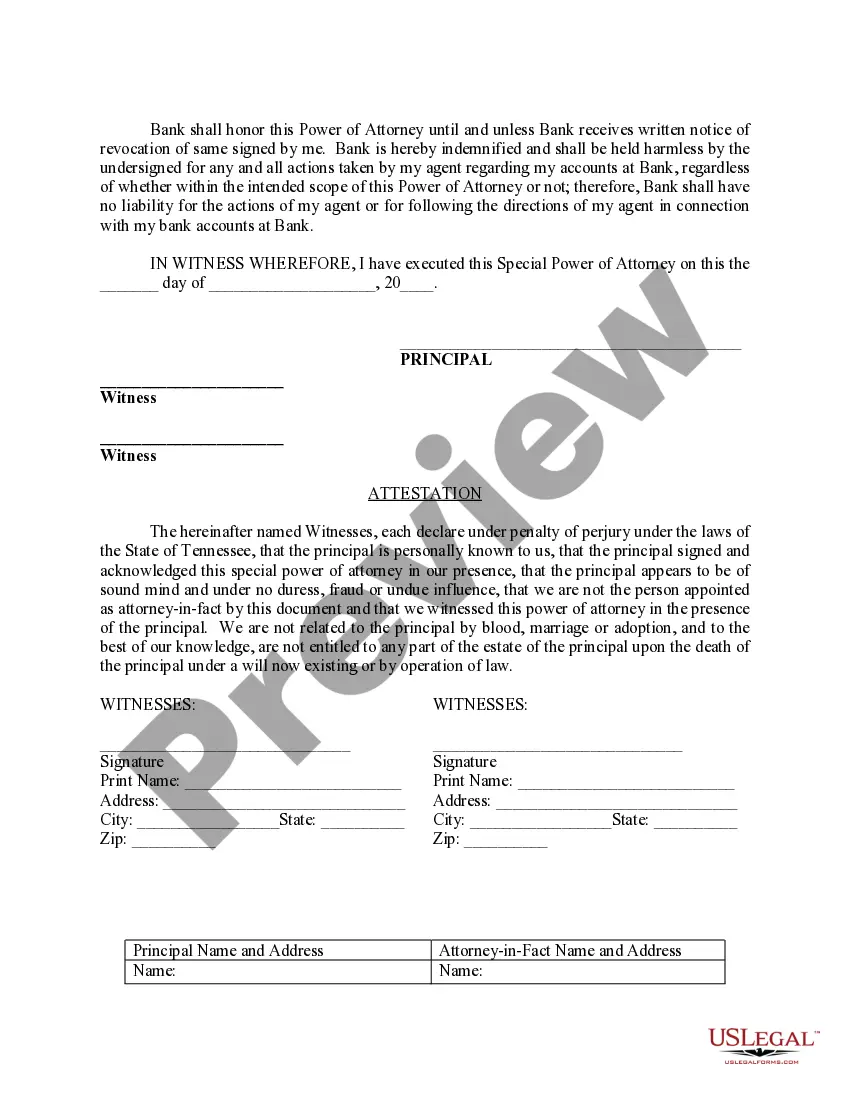

How to fill out Tennessee Special Durable Power Of Attorney For Bank Account Matters?

- Login to your US Legal Forms account if you're a returning user. Ensure your subscription is still valid, or renew it as needed.

- Examine the Preview mode and description of the form to ensure it aligns with your specific needs and local jurisdiction requirements.

- If necessary, utilize the Search tab to find additional templates that might suit your situation.

- Purchase the document by selecting your preferred subscription plan and registering for an account.

- Complete your transaction using your credit card or PayPal account to finalize your subscription.

- Download the special power of attorney coupled with interest form to your device and access it anytime from the 'My Forms' menu in your account.

In conclusion, US Legal Forms provides a user-friendly platform with an extensive collection of legal documents. Their resources empower both individuals and attorneys to generate precise, enforceable legal documents quickly.

Don’t wait any longer; start your journey to legally sound documents today with US Legal Forms!

Form popularity

FAQ

A special power of attorney coupled with interest means that the agent has a vested interest in the transactions they handle on your behalf. This type of arrangement can offer specific advantages, especially in real estate transactions or business dealings. With this power, the agent acts not just as your representative but also stands to gain from the outcome, aligning their incentives with your goals. For more assistance with creating a special power of attorney coupled with interest, consider using US Legal Forms to access tailored legal documents.

A license coupled with an interest is a legal term describing a situation where a party has permission to use another's property, combined with a specific interest in that property. This arrangement grants rights that are usually conditional upon the property owner and may enhance the licensee's ability to act. Deciding how to address this concept can be crucial when drafting a special power of attorney coupled with interest.

For an attorney, a conflict of interest typically arises when they represent clients with opposing interests or when personal interests affect their professional obligations. This situation can hinder their ability to provide unbiased advice and representation. Seeking assistance from professionals who specialize in special power of attorney coupled with interest can help clarify and mitigate such conflicts.

A conflict of interest in a power of attorney occurs when the agent faces a situation where their interests might compromise their ability to act faithfully for the principal. Such conflicts can lead to decisions that favor the agent over the principal, affecting trust. When drafting a special power of attorney coupled with interest, clearly outlining potential conflicts can prevent future issues.

Power of attorney coupled with interest refers to a situation where the agent has a vested interest in the property or transaction they are managing on behalf of the principal. This type of authority allows the agent to make decisions that directly affect their stake, providing an incentive to act in the best interest of the principal. Properly addressing this in legal documentation can help avoid conflicts and confusion.

A legal power of attorney cannot make healthcare decisions if such authority is not granted, change a will, or vote on behalf of the principal. The special power of attorney coupled with interest explicitly defines the scope of authority, ensuring transparency. Understanding these limitations helps avoid misunderstandings regarding the agent's powers.

When a power of attorney is coupled with an interest, it means that the agent’s authority is not only to act on behalf of another but also to protect their own investment. This arrangement provides the agent with certain protections, ensuring their actions are in line with both their role and their financial stake. Understanding the significance of a special power of attorney coupled with interest can help you decide how best to utilize these powerful legal tools, and platforms like US Legal Forms can assist you in creating one that meets your needs.

A common example of agency coupled with interest is when a real estate agent receives power of attorney for a property they are selling, allowing them to make decisions that benefit their sale and commission. In this case, the agent holds both the authority to act on behalf of the owner and a financial interest in the successful transaction. This aligns their objectives, illustrating the concept inherent in a special power of attorney coupled with interest.

Appointments that are coupled with an interest typically involve financial transactions or property management where the agent also benefits from the actions taken. A special power of attorney coupled with interest is a prime example, where the agent's authority is linked to the property they have a financial interest in. This type of appointment ensures that the agent acts in a manner consistent with both their authority and personal stake.

An agency coupled with an interest refers to a legal relationship where the agent has a personal interest in the subject of the agency. Unlike ordinary agencies, an agency coupled with an interest cannot be revoked easily, as doing so would harm the agent's interest. This is particularly relevant for powers of attorney, such as a special power of attorney coupled with interest, where the agent's authority strengthens due to their financial stake.