Tennessee Corporate Powers With Different Bases

Description

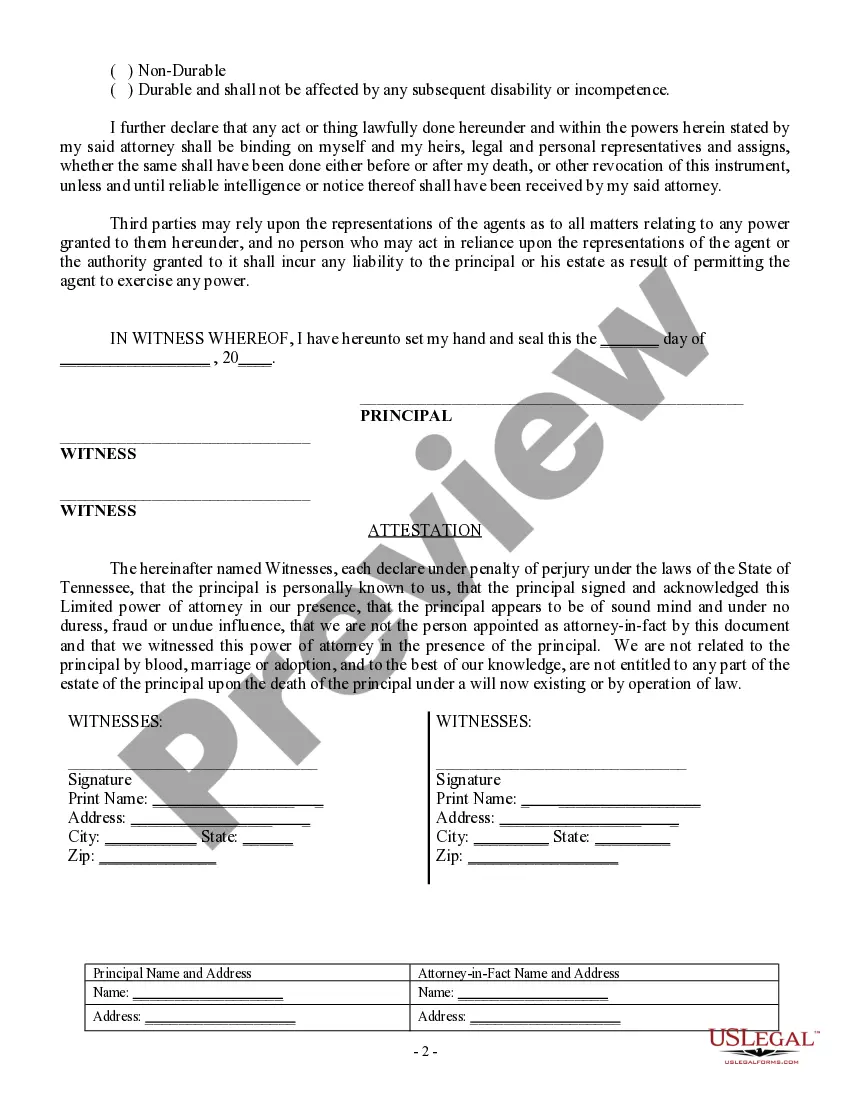

How to fill out Tennessee Limited Power Of Attorney For Stock Transactions And Corporate Powers?

- Log in to your US Legal Forms account. If you're a returning user, ensure your subscription is active to access necessary templates.

- If you're new, start by checking the Preview mode and form descriptions to choose the appropriate document that fits your local jurisdiction.

- If the form doesn't meet your needs, use the Search tab to locate an alternative template.

- Proceed to purchase your selected document by clicking the 'Buy Now' button and selecting a suitable subscription plan.

- Complete your purchase by entering your payment details or using your PayPal account to finalize the transaction.

- Download the completed form onto your device and access it anytime from the 'My Forms' section of your profile.

Utilizing US Legal Forms empowers users by providing a comprehensive library of over 85,000 easily fillable legal documents. This extensive collection not only saves time but also ensures legal precision.

Take advantage of the expertise available and secure the right forms for your needs today. Start your journey with US Legal Forms and transform your legal documentation experience!

Form popularity

FAQ

Determining your need to file a business tax return hinges on your business's income and structure. Generally, if your business generates revenue, filing will be necessary. By exploring Tennessee corporate powers with different bases, you can better assess your specific circumstances and ensure timely filings.

Yes, if your business operates or earns income in Tennessee, you are responsible for filing a TN business tax return. This requirement varies based on the business structure and revenue. Understanding how Tennessee corporate powers with different bases apply can clarify your obligations and assist in fulfilling them effectively.

If your business is generating income in Tennessee, you will likely need to file a state business tax return. Compliance is crucial to avoid penalties and maintain good standing. Utilizing insights into Tennessee corporate powers with different bases can simplify the filing process and enhance your business strategies.

Individuals and entities earning income in Tennessee generally need to file a state tax return. This includes both residents and non-residents with income sourced from Tennessee. Ensuring you understand Tennessee corporate powers with different bases helps identify if you fall within these filing requirements.

Tennessee primarily taxes corporations through a franchise and excise tax structure. Corporations are assessed based on their net worth and revenue, requiring a thorough understanding of your financials. Familiarizing yourself with Tennessee corporate powers with different bases can help you comply efficiently with these tax obligations.

In most cases, yes, Tennessee requires a business license even for self-employed individuals. Licensing ensures compliance with local regulations and marks your legitimacy in the marketplace. By understanding how Tennessee corporate powers with different bases apply to self-employment, you can navigate the requirements smoothly.

Yes, Tennessee allows a Foreign Direct Investment (FDIi) deduction under specific conditions. This deduction applies to businesses engaging with foreign entities and can enhance your financial strategy. By leveraging Tennessee corporate powers with different bases, you can potentially reduce your taxable income and increase your investment's impact.

To withdraw a foreign corporation from Tennessee, you must file a notice of withdrawal with the Secretary of State. This process involves submitting the appropriate forms and ensuring all taxes and obligations are settled. Understanding Tennessee corporate powers with different bases can aid in this process. For detailed guidance through withdrawal procedures, US Legal Forms can be a valuable resource.

The choice between a corporation and an LLC depends on various factors, including taxation and management structure. Corporations might suit larger businesses with significant income, while LLCs can offer simpler management and tax benefits for smaller entities. Evaluating Tennessee corporate powers with different bases will help clarify which option aligns with your business needs. US Legal Forms provides information to assist in making the best decision.

A corporation is a legal entity separate from its owners, while an LLC offers flexibility in management and taxation that is not available with a corporation. Corporations are generally more complex to administer due to regulatory requirements. In the context of Tennessee corporate powers with different bases, both options provide unique benefits depending on your business goals. For clarity on these differences, consider utilizing resources like US Legal Forms.