Power Attorney Powers With A Will

Description

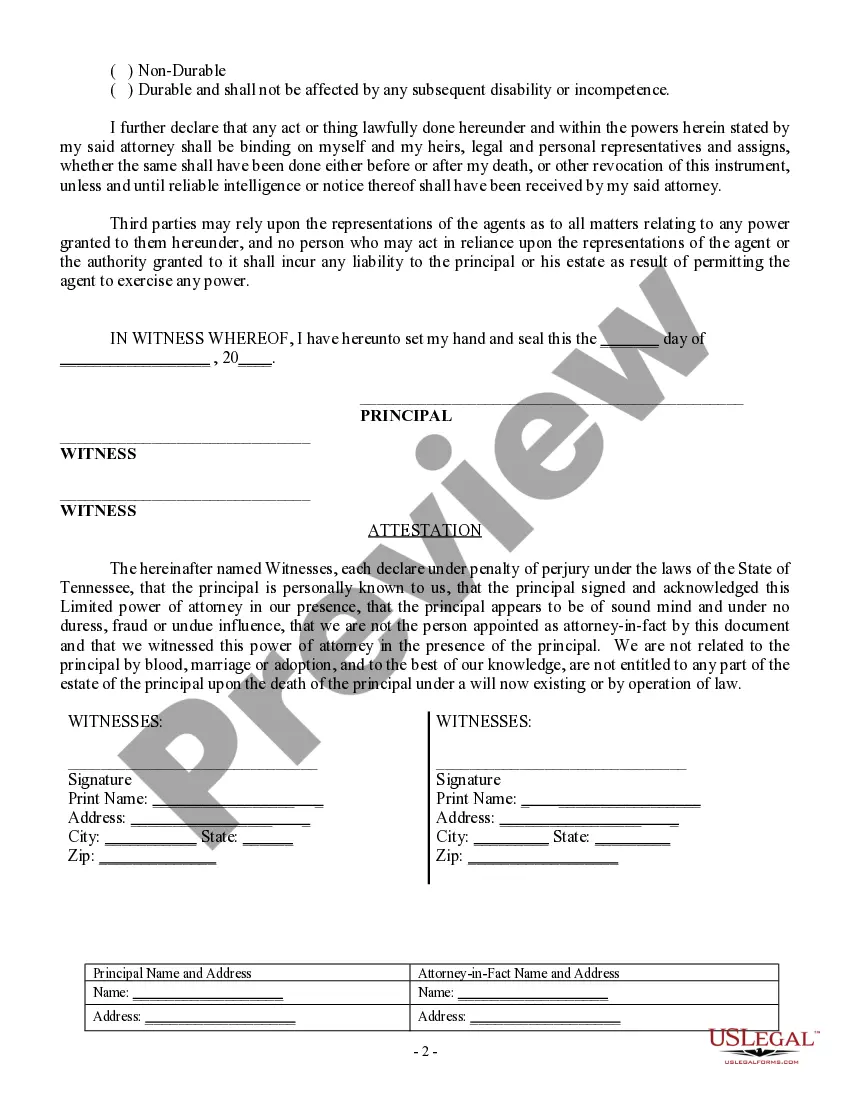

How to fill out Tennessee Limited Power Of Attorney For Stock Transactions And Corporate Powers?

- Visit the US Legal Forms website and explore the extensive library of legal forms.

- Select the power of attorney form that is compatible with your will. Preview the form to ensure it meets your requirements and complies with local laws.

- If you do not find the suitable form, utilize the search feature to locate alternative templates.

- Choose the form and click on the Buy Now button. You will need to create an account to access the document library.

- Complete your purchase by entering your payment information, either with a credit card or PayPal.

- After purchase, download your power of attorney form and save it to your device. You can access it anytime in the My Forms section of your account.

In conclusion, utilizing US Legal Forms allows you to efficiently prepare the necessary legal documents such as power attorney powers with a will. Their extensive resources ensure you have access to precisely what you need.

Start your journey towards legal empowerment today—visit US Legal Forms and secure your documents with ease!

Form popularity

FAQ

Yes, having a power of attorney is still important even if you have a will. A will only takes effect after your death, while a power of attorney allows someone to act for you during your lifetime. This can be crucial if you become unable to make decisions for yourself. Together, these documents provide a robust framework for managing your affairs.

Power of attorney may be needed in various situations such as illness, injury, or when you are unable to manage your own finances. It grants someone you trust the authority to make critical decisions on your behalf. This could include handling bank transactions, managing property, or making healthcare decisions. Consider using Uslegalforms for simple templates to establish power attorney powers with a will.

Yes, you can have a will without a power of attorney. A will serves to distribute your assets after your death, while a power of attorney grants someone legal authority to manage your affairs during your lifetime. However, having both documents can provide comprehensive protection for your decisions. Uslegalforms offers templates to create both documents easily.

Both power of attorney and a will are essential legal tools, but each serves a distinct purpose. Power of attorney powers with a will allow individuals to manage financial and healthcare decisions when someone cannot do so themselves. Conversely, a will outlines how assets will be distributed after death. Ultimately, the importance of each depends on your specific circumstances.

Power of attorney does not trump a will; both serve distinct purposes. The power of attorney allows for decisions while you are alive, whereas a will distributes assets after death. Understanding these separate yet complementary roles is crucial when planning your estate, ensuring that you effectively utilize power attorney powers with a will.

The best person for power of attorney is someone you trust deeply. This individual should understand your values and wishes regarding health and financial decisions. It is wise to discuss your intentions with them ahead of time to ensure they are comfortable with accepting responsibility and can act in line with power attorney powers with a will.

No, a power of attorney does not overturn a will. The power of attorney allows someone to make decisions on your behalf while you are alive, but it becomes invalid after your death. A will remains functional for distributing your assets after you pass away, making it vital to use power attorney powers with a will appropriately.

You cannot obtain power of attorney for a deceased person because this authority ceases upon death. Instead, you will need to follow the process of probate to administer the deceased's estate. Consider visiting US Legal Forms for resources and templates to navigate the probate process effectively while keeping your power attorney powers with a will in mind.

Choosing between power of attorney and a will depends on your needs. Power of attorney is crucial for managing your affairs while you are still alive. A will, on the other hand, outlines the distribution of your assets after you pass away. Ideally, having both documents ensures effective management of your estate and decisions, utilizing power attorney powers with a will.

Power of attorney is not included in a will. A power of attorney allows someone to make decisions on your behalf while you are alive, while a will outlines how to manage your estate after death. It is essential to have both documents to ensure a comprehensive plan for your financial and health decisions with power attorney powers with a will.