Petition To Close Estate With Irs

Description

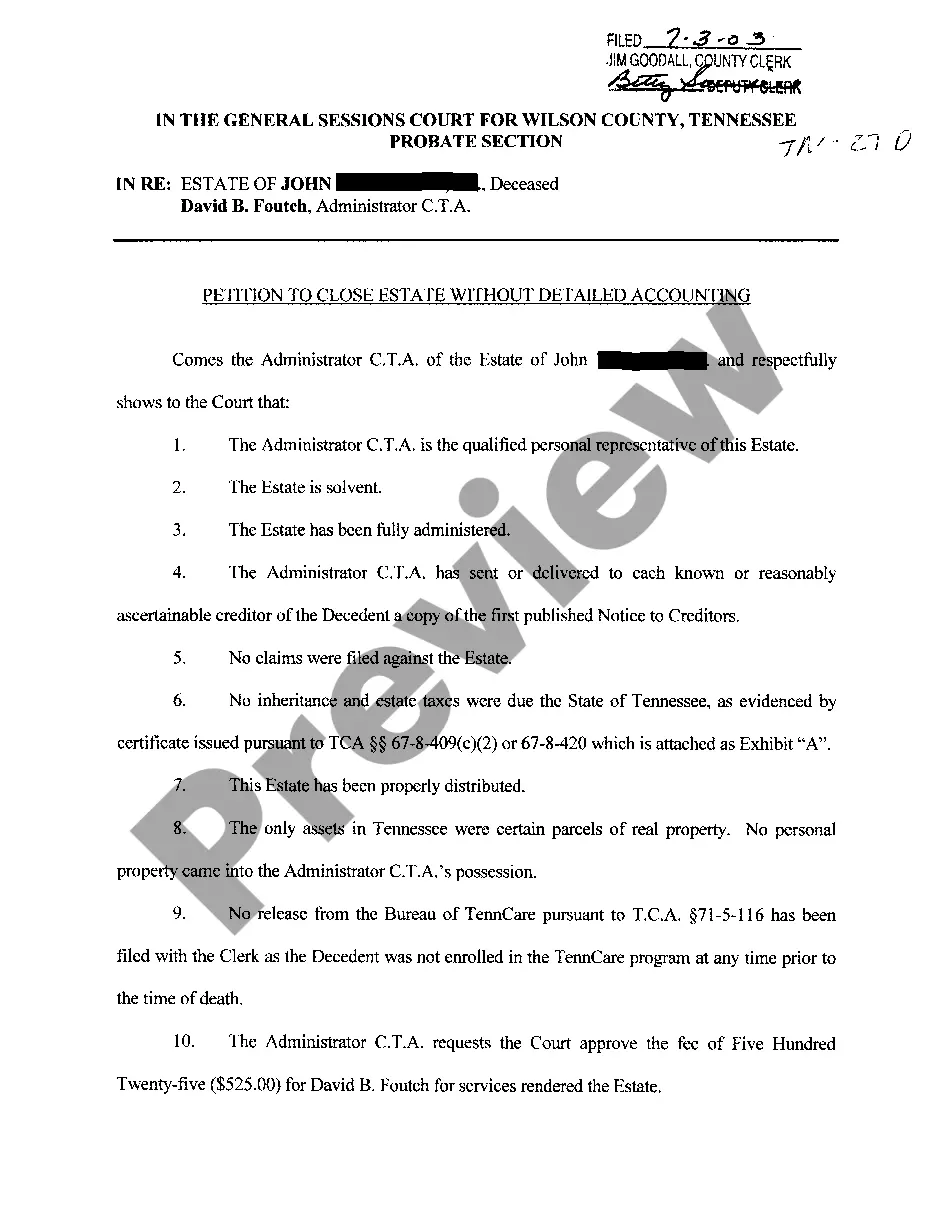

How to fill out Tennessee Petition To Close Estate Without Detailed Accounting?

Navigating through the red tape of official documents and templates can be daunting, particularly if one is not engaged in that professionally.

Even locating the appropriate template for the Petition To Close Estate With Irs will be labor-intensive, as it must be authentic and accurate to the very last numeral.

However, you will considerably reduce the time spent selecting an appropriate template from a reliable source.

Obtain the correct document in a few easy steps: Enter the document’s name in the search box. Find the suitable Petition To Close Estate With Irs among the results. Review the outline of the sample or view its preview. If the template meets your needs, click Buy Now. Proceed to select your subscription plan. Use your email and create a password to sign up for an account at US Legal Forms. Choose a credit card or PayPal payment method. Save the template document on your device in your preferred format. US Legal Forms can save you time and effort verifying whether the form you found online is appropriate for your requirements. Establish an account and enjoy unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of finding the correct documents online.

- US Legal Forms serves as a single destination you need to obtain the latest samples of forms, ask about their usage, and download these examples to complete them.

- This is a repository with over 85,000 forms applicable in various areas.

- When searching for a Petition To Close Estate With Irs, you will not need to doubt its authenticity as all the forms are verified.

- Having an account at US Legal Forms will ensure you have access to all the essential samples at your fingertips.

- Store them in your history or add them to the My documents collection.

- You can retrieve your saved forms from any device by clicking Log In at the library site.

- If you don’t yet have an account, you can always look up again for the template you seek.

Form popularity

FAQ

Form 56 and Form 2848 serve different purposes in dealing with the IRS. Form 56 is used to inform the IRS of an executor or fiduciary's appointment, while Form 2848 grants power of attorney to a designated individual, allowing them to act on behalf of the executor. When you plan to petition to close the estate with the IRS, understanding these forms ensures you take the right steps to manage the estate effectively.

An IRS estate tax closing letter is a document issued by the IRS that confirms the estate's tax return has been processed and there are no outstanding tax liabilities. This letter serves as a crucial step in your petition to close the estate with the IRS, as it provides formal closure on tax matters. Securing this letter gives peace of mind to the executor and heirs that the estate’s tax issues are resolved.

Yes, an executor typically needs to file Form 56 to notify the IRS of their role in administering the estate. This form notifies the IRS that the executor is responsible for handling the decedent’s tax matters, which is vital for successfully proceeding with your petition to close the estate with the IRS. By filing Form 56, you ensure that the IRS communicates directly with you regarding any estate tax obligations.

The IRS can pursue tax liabilities for an estate typically for three years from the date the estate tax return is filed. However, this time frame can extend if the estate did not report all its income or if it filed a fraudulent return. If you are navigating this process, it's beneficial to file a Petition to close estate with IRS promptly. Being proactive can help protect the estate and ensure compliance.

Closing a trust with the IRS typically involves filing a final tax return for the trust. You must report all trust income and distributions for the tax year. Additionally, you may need to file a Petition to close estate with IRS, depending on the trust's circumstances. Consult a tax advisor to ensure compliance with all IRS regulations during this process.

To request an estate closing letter from the IRS, you begin by filing IRS Form 4506-A. This form allows you to request information related to the estate's tax return. When you submit your Petition to close estate with IRS, include supporting documents to expedite processing. You can also call the IRS directly for guidance on your specific situation.

The time it takes for the IRS to close an estate can vary based on several factors, including the complexity of the estate and the completeness of the filings. Generally, it can take several months for the IRS to process a petition to close an estate. If all documents, including Form 56 and estate tax closing letters, are submitted correctly, it may expedite the process. Using services like US Legal Forms can help ensure everything is in order for a quicker closure.

If you do not file Form 56, the IRS may remain unaware of the appointed fiduciary managing the estate. This oversight can lead to complications with tax filings and estate administration. It is critical for anyone petitioning to close an estate with the IRS to submit this form to ensure all parties are recognized by the IRS. Neglecting it can result in delays and potential tax liabilities for the estate.

Yes, a successor trustee needs to file Form 56 if they are responsible for managing the deceased person's estate. This filing informs the IRS of their role and ensures that the estate’s tax filings are handled correctly. Filing this form is essential when you petition to close an estate with the IRS; it clarifies the trustee’s authority over the estate and its tax obligations. Doing so minimizes potential complications that could arise during the closing process.

Form 56 for a deceased person is used to notify the IRS about the appointment of a fiduciary responsible for the estate's tax duties. This form is crucial in highlighting who will handle tax filings and is beneficial for settling any tax issues on behalf of the deceased. If you are managing an estate, submitting Form 56 is a vital step when you petition to close an estate with the IRS. It ensures that the IRS has accurate information about the estate's administration.