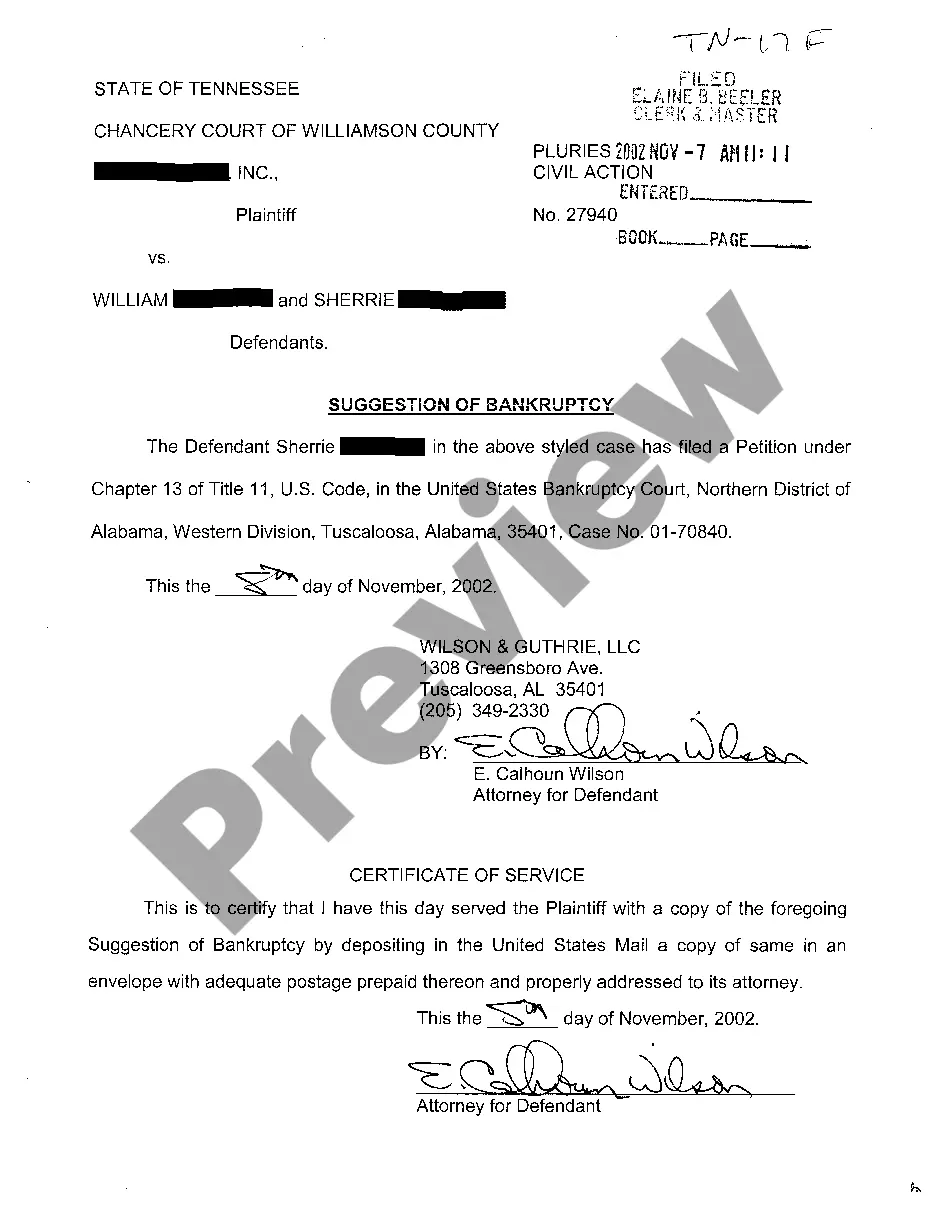

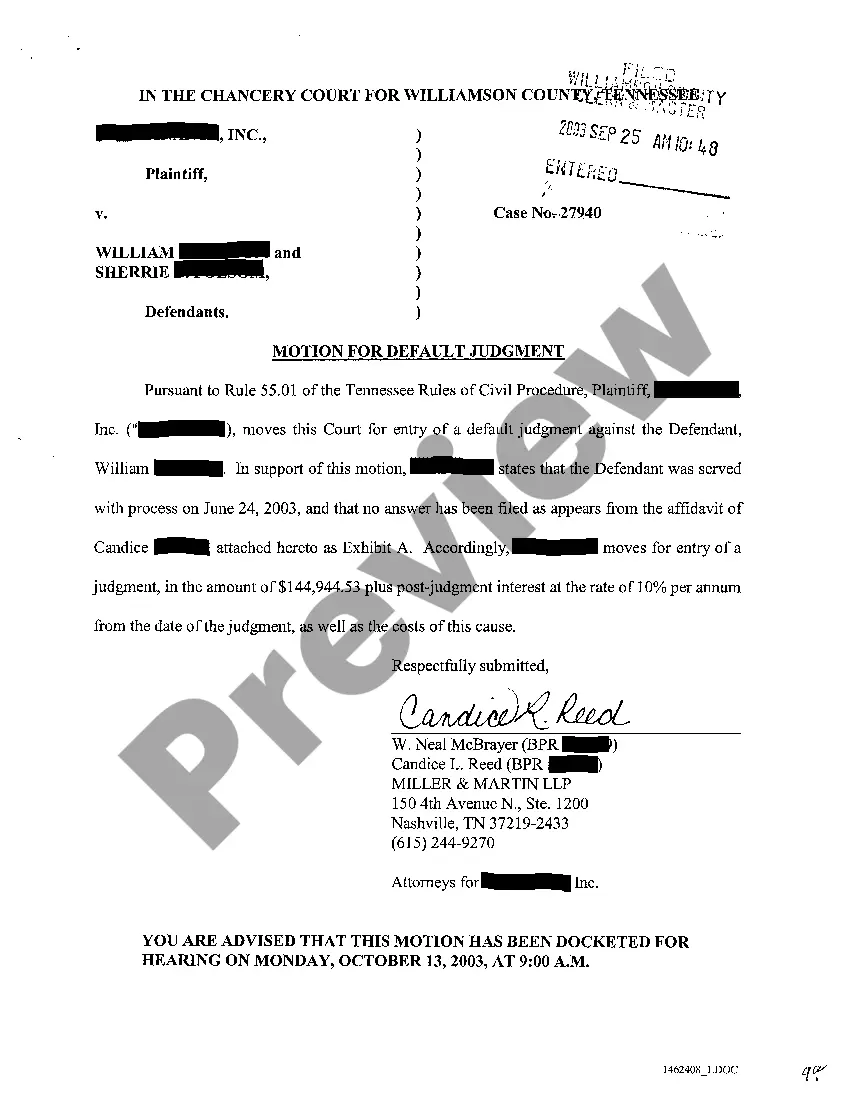

Suggestion Of Bankruptcy Form For Businesses

Description

How to fill out Tennessee Suggestion Of Bankruptcy By Defendant To The Court?

Maneuvering through the red tape of official documents and formats can be challenging, particularly for those who do not engage in it professionally.

Even locating the appropriate format for the Suggestion Of Bankruptcy Form For Businesses can be labor-intensive, as it must be valid and precise to the very last detail.

Nevertheless, you will need to invest significantly less time sourcing a suitable template from a trusted source.

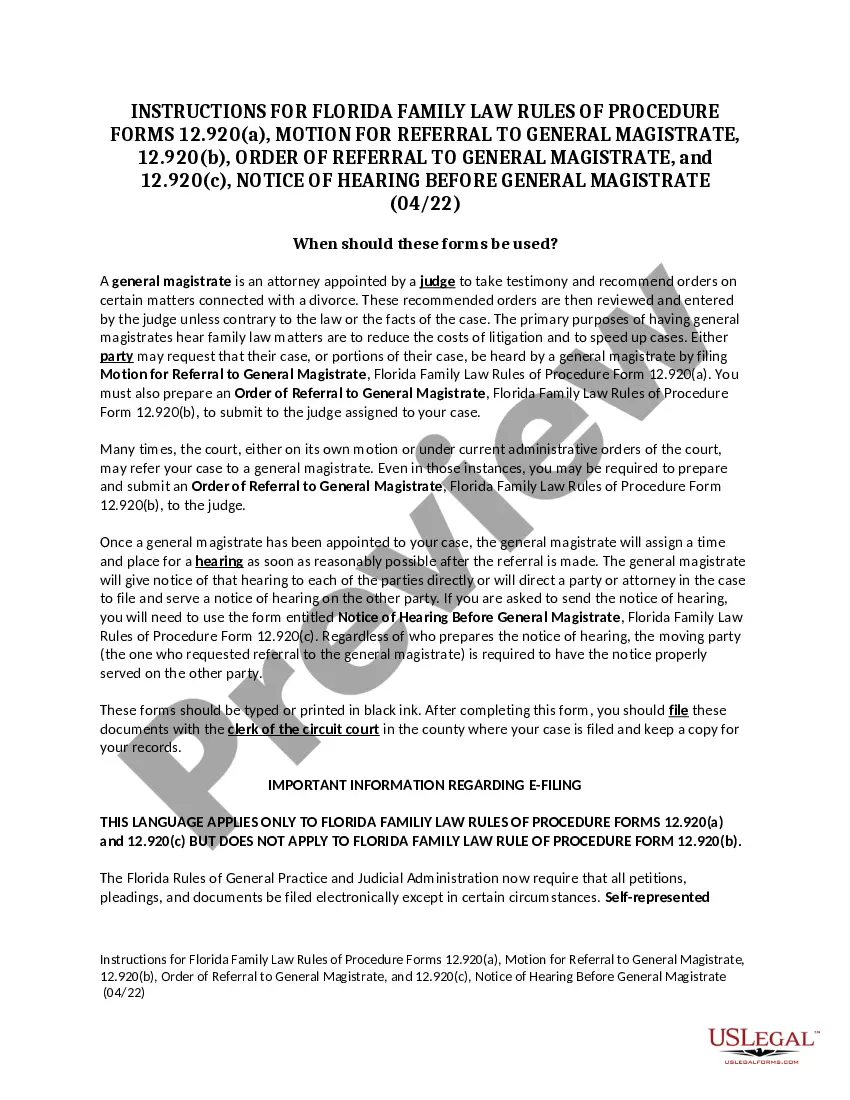

Acquire the correct document in a few straightforward steps: Input the title of the document in the search box. Locate the appropriate Suggestion Of Bankruptcy Form For Businesses within the results. Review the description of the sample or view its preview. If the template meets your requirements, click Buy Now. Then, select your subscription plan. Utilize your email and create a password to set up an account at US Legal Forms. Choose a credit card or PayPal payment method. Finally, download the template document to your device in your preferred format. US Legal Forms will save you time and effort in determining whether the form you discovered online is appropriate for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of finding the correct documents online.

- It serves as a comprehensive source where one can access the latest examples of forms, review their usage, and download these templates for completion.

- This is a repository containing over 85,000 forms applicable across various professional fields.

- When searching for a Suggestion Of Bankruptcy Form For Businesses, you can trust its authenticity as all forms are vetted.

- Having an account at US Legal Forms ensures that you have all the necessary documents at your fingertips.

- You can save them in your history or add them to the My documents collection.

- Your saved documents can be accessed from any device simply by clicking Log In on the library site.

- If you do not yet possess an account, you can always initiate a new search for the template you require.

Form popularity

FAQ

When considering bankruptcy, businesses typically have several options available. Common choices include Chapter 7, which involves liquidating the business's assets, and Chapter 11, which allows for reorganization and management of debts while continuing operations. Another option is Chapter 13, which is mainly for sole proprietors and offers a repayment plan. It is advisable to explore each option thoroughly and consult a professional for the best suggestion of bankruptcy form for businesses tailored to your unique situation.

Chapter 11 bankruptcy stands out as the most popular option for small businesses facing financial distress. This route allows for reorganization without shutting down, giving business owners a chance to keep their operations running. By using the right suggestion of bankruptcy form for businesses, entrepreneurs can strategically manage their debts while working toward recovery. Engaging with a platform like uslegalforms can assist you in navigating these complex waters efficiently.

A suggestion of bankruptcy filing form is a document that outlines the type of bankruptcy a business intends to file. It serves as a formal request to the court and may include financial statements and lists of creditors. Utilizing a dedicated service like uslegalforms can streamline this process, providing you with the necessary templates and guidance to ensure accuracy in your submission. Understanding this form is crucial for your bankruptcy journey.

Chapter 11 is often regarded as the best bankruptcy option for small businesses that wish to remain operational while settling debts. This form allows business owners to restructure their finances through a court-approved plan, ensuring some control during the process. By choosing the right suggestion of bankruptcy form for businesses, owners can protect their company’s assets and work towards a fresh start. It’s advisable to consult experts in the field to make an informed decision.

You can obtain bankruptcy paperwork from various sources, including local bankruptcy courthouses and official legal websites. Additionally, platforms like USLegalForms offer easy access to the suggestion of bankruptcy form for businesses to ensure you have the right documentation. Using these resources can simplify the process and help you navigate the complexities of filing for bankruptcy.

Certain criteria can disqualify you from filing for bankruptcy, including previous bankruptcy filings within a specific timeframe and cases of fraudulent behavior. If you have not completed the required credit counseling, your application may also be rejected. To ensure you meet the legal requirements, you might want to look into the suggestion of bankruptcy form for businesses, which provides clarity on the necessary steps and qualifications.

Filing for bankruptcy is not mandatory when you decide to close a business, but it can provide a structured way to handle outstanding debts. If your business cannot meet its financial obligations, a suggestion of bankruptcy form for businesses can help you manage your debts and possibly discharge some liabilities. However, the decision should be based on your unique financial situation. It’s worthwhile to consider consulting a professional for guidance.

Choosing between Chapter 7 and Chapter 13 often depends on your business circumstances. Chapter 7 allows for quick liquidation of assets but may not be ideal for businesses looking to continue operations. In contrast, Chapter 13 offers a repayment plan which can be beneficial if you wish to maintain your business and manage debts over time. For tailored suggestions, consider using our platform for a suggestion of bankruptcy form for businesses.