Tennessee Qualified Income Trust Form

Description

Form popularity

FAQ

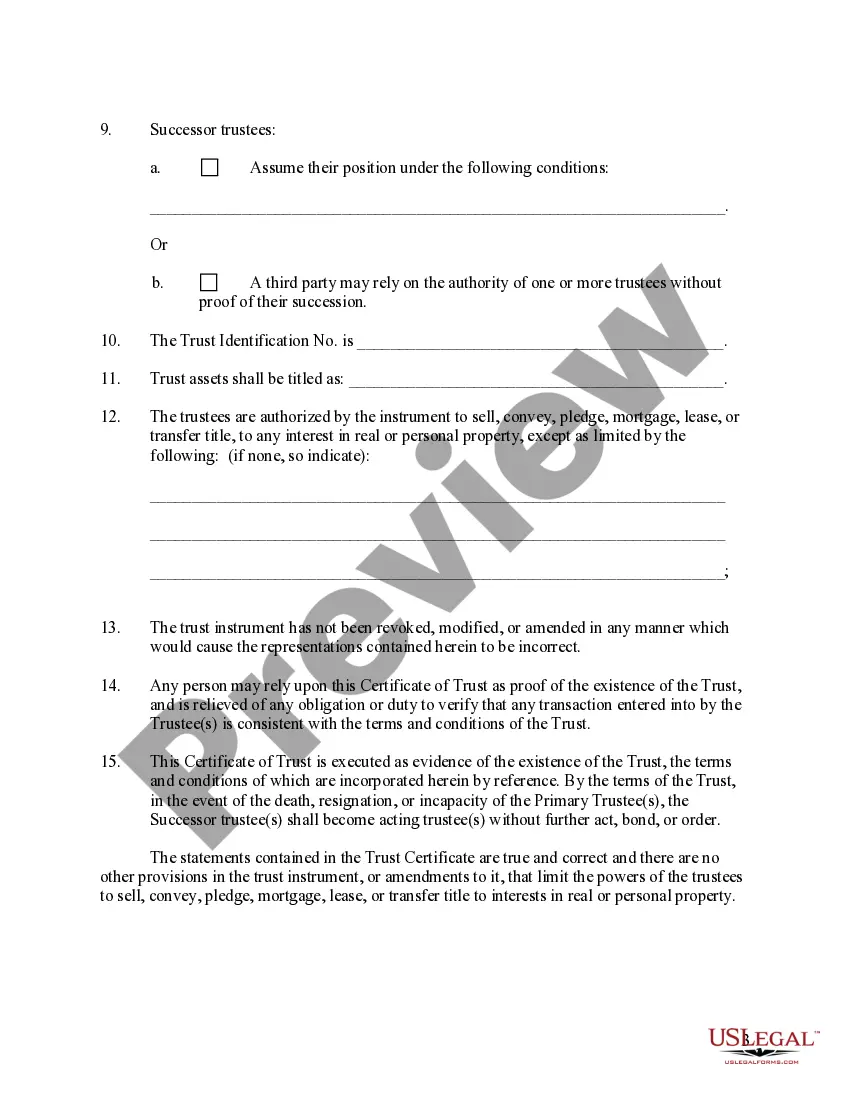

A qualified income trust in Tennessee is designed to allow individuals to qualify for Medicaid benefits despite having income that exceeds certain limits. This trust helps manage excess income by placing it in a trust, thus making you eligible for essential healthcare services. The Tennessee qualified income trust form is crucial in this process, as it outlines the trust's provisions. Understanding its nuances can help you make informed decisions for your financial future.

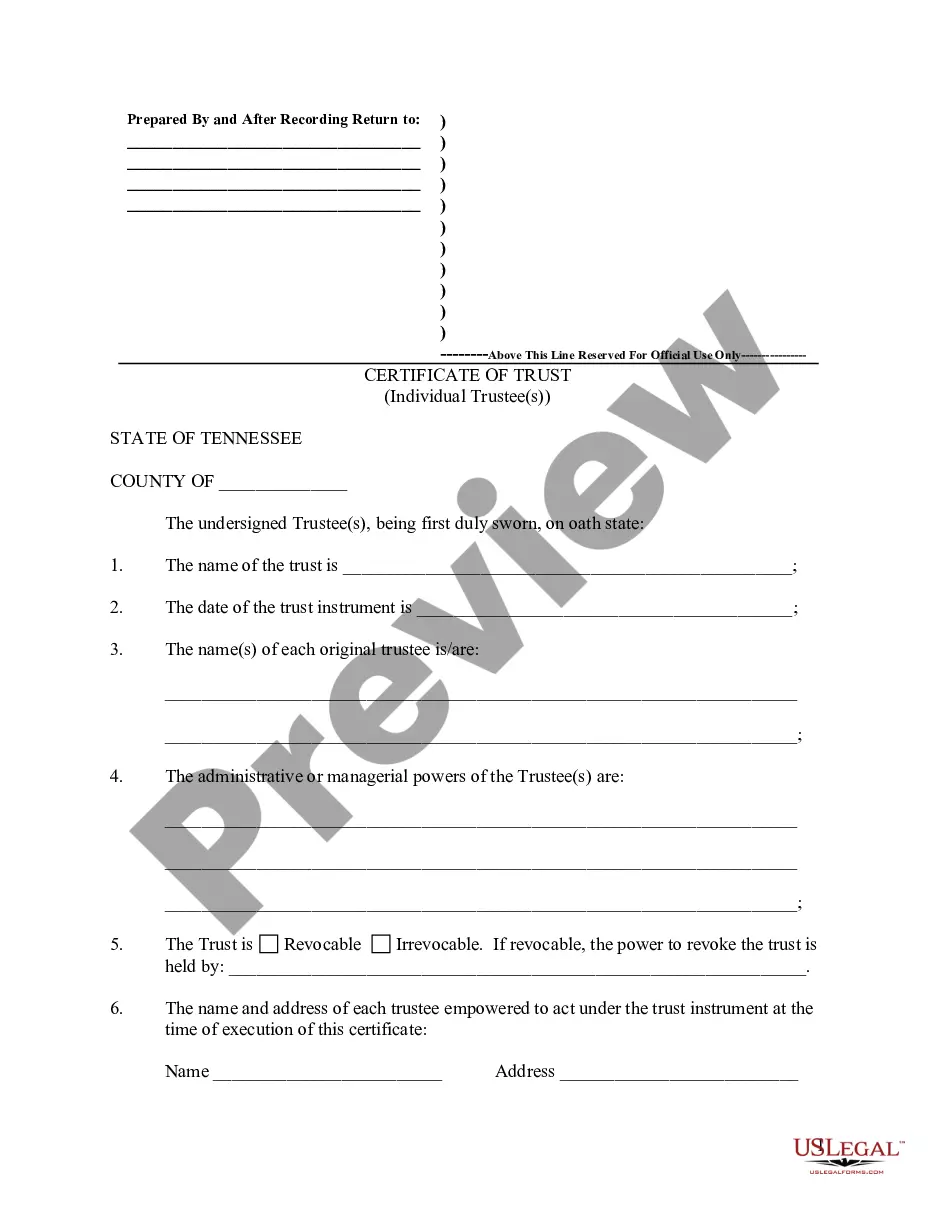

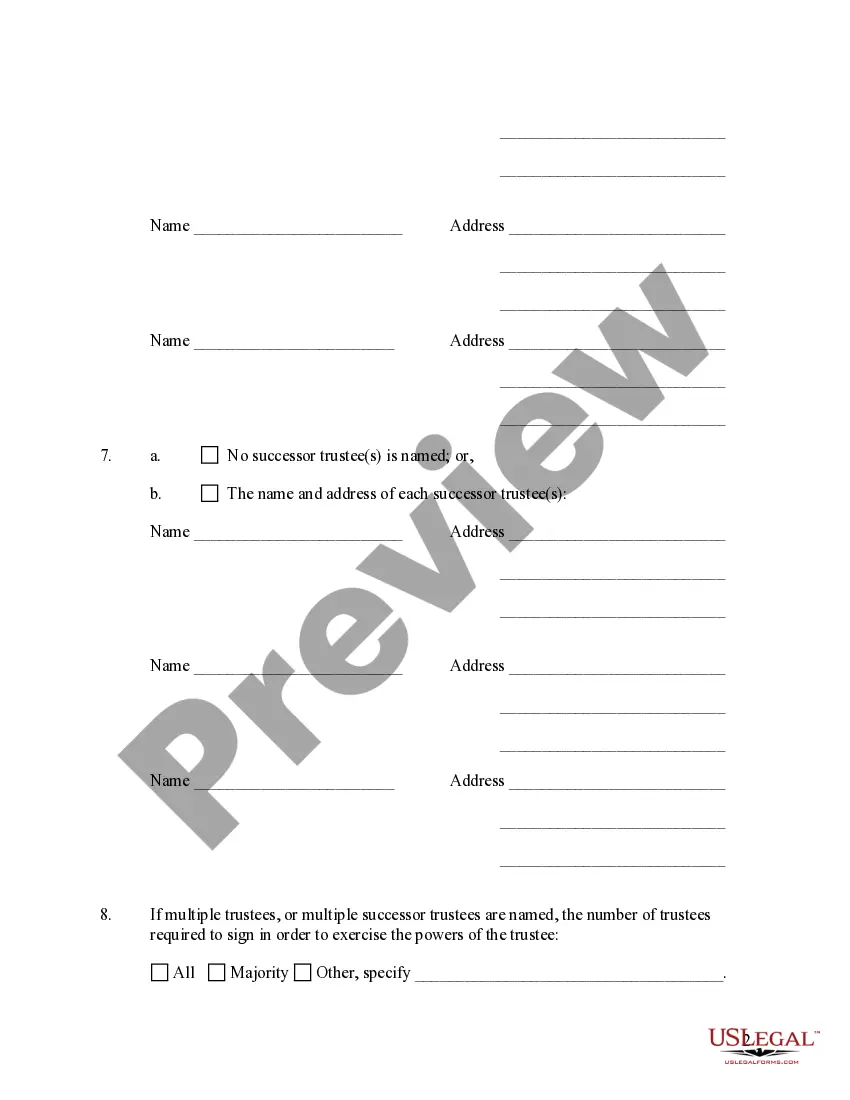

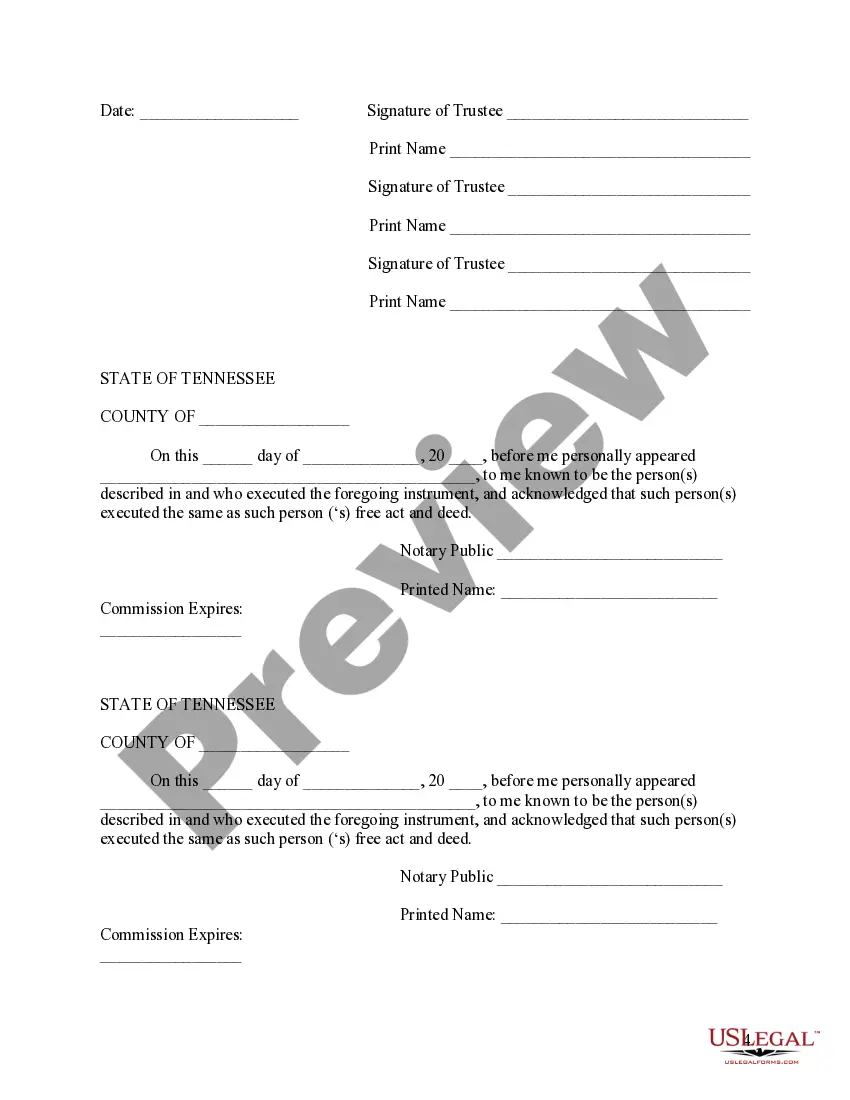

Setting up a qualified income trust starts with completing the Tennessee qualified income trust form, which details your income and assets. After filling out the form, you need to establish the trust by designating a trustee and transferring income into the trust. Following this, you should notify the relevant authorities. It’s often beneficial to consult with a legal expert to ensure you follow all necessary steps correctly.

While it's not legally required to have a lawyer to set up a Miller trust, working with one is advisable. A qualified attorney can guide you through the complexities of the Tennessee qualified income trust form, ensuring all legal requirements are met. They can help you avoid common pitfalls, saving you time and potential issues later. Therefore, having legal assistance can make the process smoother and more secure.

Setting up a QIT account involves filling out the Tennessee qualified income trust form and gathering necessary support documents. It's essential to understand your financial needs and how the trust will benefit you. If needed, consider seeking guidance from professionals who are experienced with trust setups. By following these steps carefully, you’ll establish an account that protects your assets and complies with state regulations.

To set up a QIT account in Tennessee, begin by completing the Tennessee qualified income trust form. You will need to gather relevant financial information and consult with an attorney specializing in elder law or estate planning if necessary. After completing the form, submit it along with any required documentation to the appropriate state agency. This process ensures that you meet all state requirements and can properly manage your trust funds.

To get a qualified income trust, begin by downloading the Tennessee qualified income trust form from reliable sources. Complete the form with accurate details about your financial situation and intended use of the trust. After filling it out, submit it to the relevant authority for approval. Consider using uslegalforms for user-friendly templates and guidance throughout the entire process.

The primary purpose of an income trust is to protect assets while enabling recipients to qualify for government benefits, such as Medicaid. By placing income in the trust, individuals can reduce their countable income, facilitating access to essential health services. This trust structure helps maintain financial stability and ensures beneficiaries receive critical care without losing their income. Utilizing the Tennessee qualified income trust form makes this process straightforward.

A qualified income trust functions by allowing individuals to set aside a portion of their income in order to meet Medicaid eligibility requirements. The income placed in the trust does not count against the individual’s limit, making it possible to receive benefits. The trust then distributes funds for qualifying expenses, ensuring that recipients can maintain their standard of living. You can find the necessary resources and forms online to establish your trust easily.

The requirements for a qualified income trust generally include establishing the trust for a specific purpose, such as maintaining Medicaid eligibility. The trust must have a specific income limit and must include provisions that align with Tennessee laws. Additionally, you’ll need to specify who will benefit from the trust. It’s important to review the Tennessee qualified income trust form carefully to ensure all requirements are met.

To get a qualified income trust, you can start by filling out the Tennessee qualified income trust form. It’s crucial to gather all necessary documentation, including proof of income and expenses. Once completed, submit the form to the appropriate agency to ensure compliance with state regulations. Using platforms like uslegalforms can help simplify this process and provide you with the correct templates.