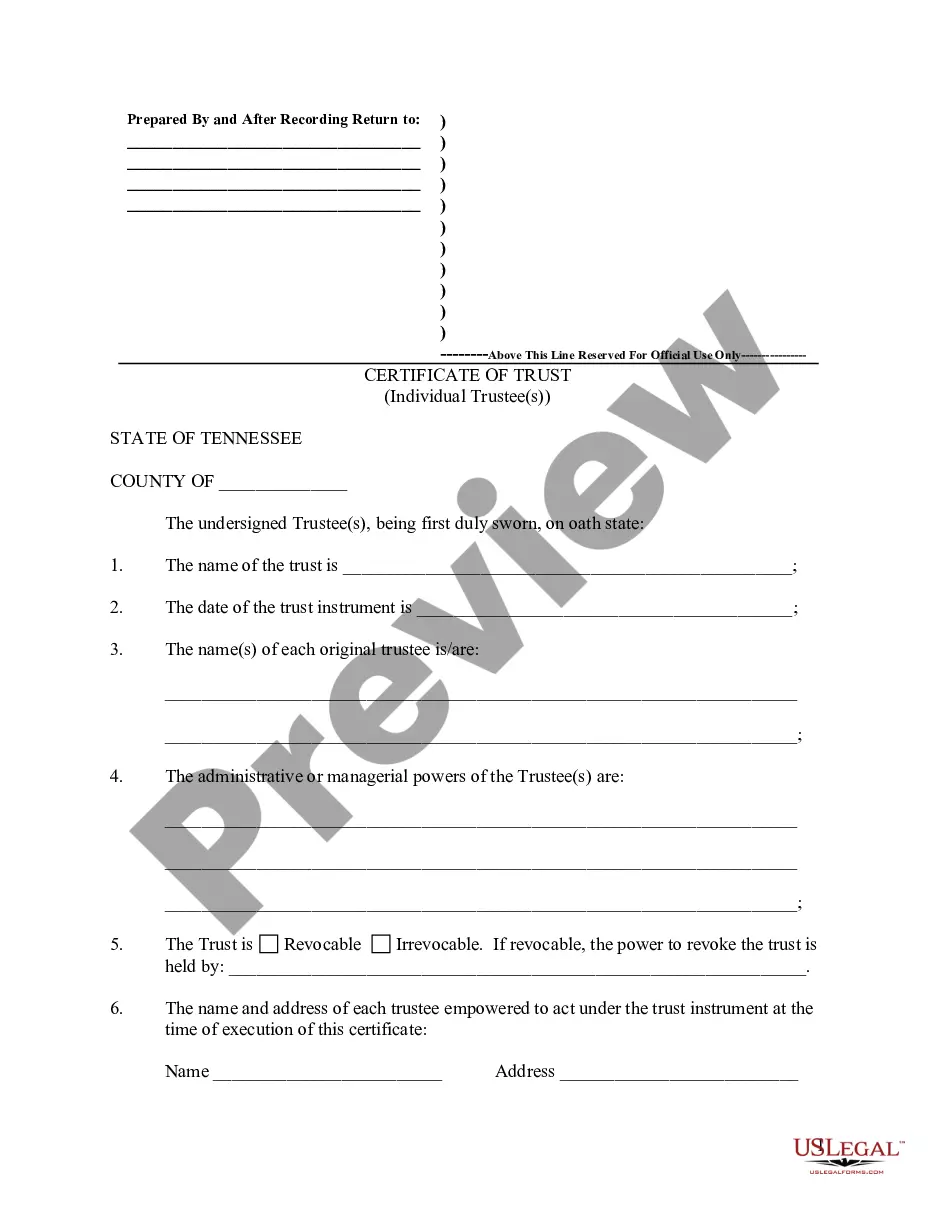

This is a certificate of trust for filing evidence of a trust without having to record the entire trust document. The individual trustee may present a certification of trust to

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Tennessee Community Property Trust Form

Description

Form popularity

FAQ

Filing Married Filing Separately (MFS) in a community property state involves dividing income and expenses between partners based on state-specific community property laws. You'll need to accurately report half of the total community income and deductions on each partner's tax return. Using the Tennessee community property trust form can simplify asset division and ensure compliance with these unique filing requirements.

Yes, you can put your house in a trust in Tennessee using the appropriate paperwork. Creating a trust for your property helps manage your assets more effectively and can provide tax benefits. To begin, simply complete a Tennessee community property trust form to ensure your house is governed by your wishes.

People in Tennessee often put property in a trust to facilitate efficient management and distribution of their assets. Trusts offer benefits such as avoiding probate, providing privacy, and ensuring that assets are distributed according to the owner's wishes. By using the Tennessee community property trust form, individuals can take advantage of these benefits while protecting their loved ones.

One common mistake parents make when setting up a trust fund is failing to clearly define the terms and conditions of the trust. This lack of clarity can lead to conflicts or misunderstandings among beneficiaries. It’s essential to use a reliable Tennessee community property trust form, as it helps ensure that your intentions are explicitly stated, thus minimizing potential issues in the future.

A Tennessee community property trust is a legal arrangement that allows married couples to hold their property as community property. This trust simplifies the management of shared assets and provides a streamlined process for transferring property upon death. By using the Tennessee community property trust form, couples can enjoy benefits like increased asset protection and possible tax advantages.

Creating a trust in Tennessee involves several steps, including determining the type of trust you need, drafting the trust document, and funding the trust with your assets. You may want to consult with a legal expert to ensure you comply with all state laws. Tools like the Tennessee community property trust form make this process simpler and more effective, allowing you to establish a trust that meets your specific needs.

Trusts can sometimes lead to complexity and administrative burden, which may not be ideal for all individuals. The ongoing management of a trust may require professional help, adding to expenses. Furthermore, if a trust is not appropriately funded, it can fail to serve its intended purpose. To navigate these challenges, many choose reliable resources like the Tennessee community property trust form.

Not all assets are suitable for a revocable trust. Typically, retirement accounts should not be placed in a trust due to tax implications. Similarly, life insurance policies may need to stay outside of a trust to maintain flexibility. However, for those interested in effective management, a Tennessee community property trust form might provide a practical solution for ensuring your remaining assets are well-organized.

Placing your house in a trust may limit your ability to use home equity freely. Additionally, transferring ownership can incur fees and affect your mortgage, as the lender may require approval. Some individuals also worry about losing control over their property. If you are considering this, the Tennessee community property trust form offers a structured way to manage such assets.

The benefits of a community trust include simplified administration of shared assets, potential tax savings, and privacy regarding estate plans. This type of trust allows couples to align their interests and secure their financial future together. By completing a Tennessee community property trust form, you can ensure that both partners are treated fairly and equitably when it comes to asset distribution.