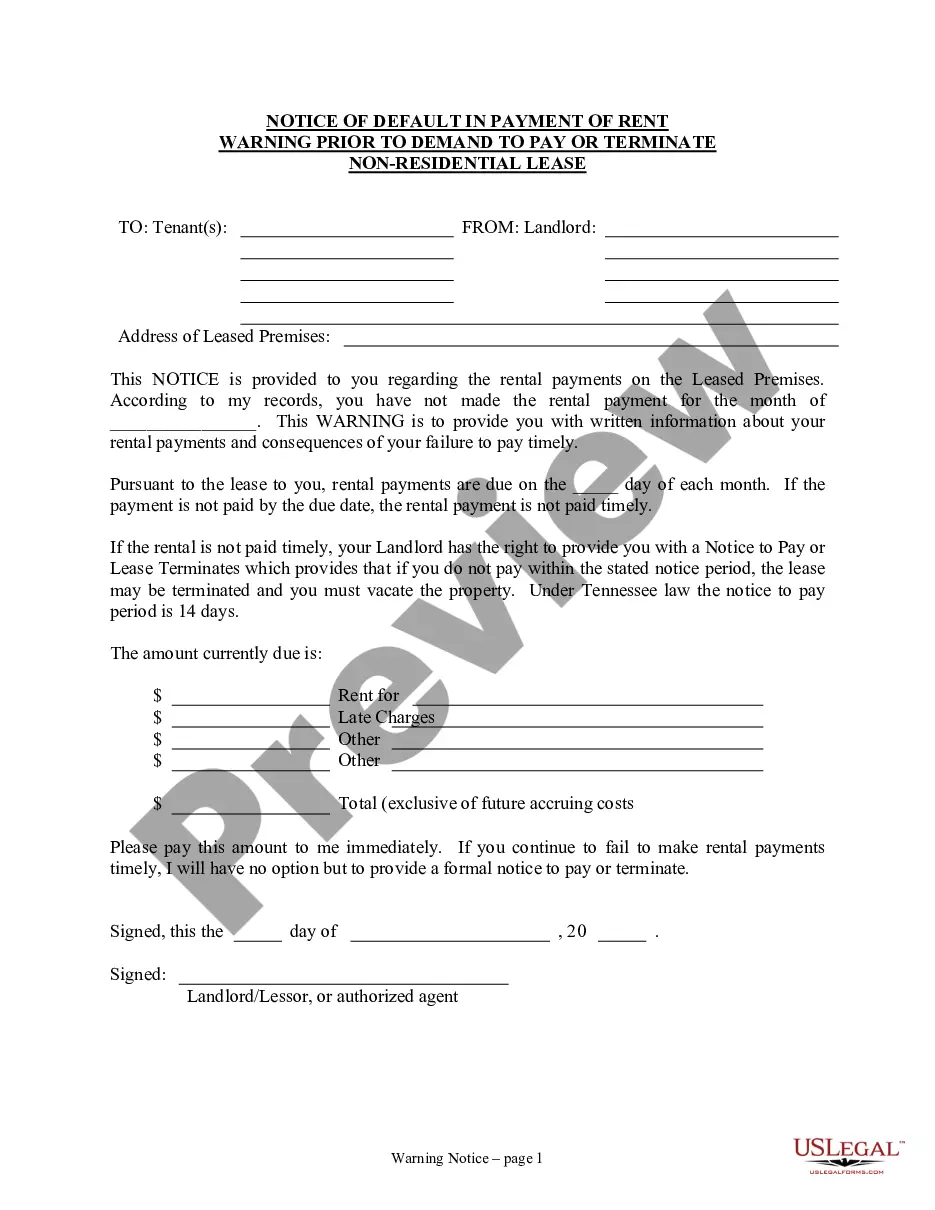

This Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Non-Residential or Commercial Property form is for use by a Landlord to inform Tenant of Tenant's default in the payment of rent as a warning prior to a pay or terminate notice. The form advises the Tenant of the due date of rent and the consequences of late payment. This form may be used where you desire to remind the Tenant of payment terms, the default, demand payment and inform the Tenant that under the laws of this state or lease, the Landlord may terminate if rent is not paid timely.

Late fee notice on invoice is a formal communication sent by a business to a customer to convey additional charges imposed due to late payment of an invoice. It serves as a reminder and encourages prompt settlement of outstanding payments. A late fee notice typically includes important information such as the invoice number, customer details, due date, the outstanding amount, the exact late fee amount, and the new total payable amount. Late fee notices on invoices aim to emphasize the importance of timely payments to maintain a healthy business-customer relationship. These notices help businesses to recover potential financial losses incurred as a result of delayed payments, and also ensure that customers are reminded of their payment obligations. There are different types of late fee notices on invoices, depending on the severity of the delay. They can be categorized as follows: 1. Standard Late Fee Notice: This notice is sent when a customer fails to make payment within the agreed-upon payment terms. It includes a reasonable amount to cover administration costs and is relatively lenient, encouraging prompt payment without imposing substantial penalties. 2. Progressive/Penalty Late Fee Notice: This notice is sent when payment has been significantly delayed, usually beyond the initial agreed-upon payment terms. It includes a more substantial late fee to incentivize the customer to settle the outstanding amount as soon as possible. 3. Final Warning Late Fee Notice: This notice is sent when all previous attempts to recover the late payment have been unsuccessful. It emphasizes the severity of the situation and typically warns the customer about potential legal action if the payment is not made promptly. 4. Restrictive Late Fee Notice: This notice is sent to recurring customers or clients with a history of late payments. In addition to the late fee, it may include additional consequences such as withholding services, products, or discounts until the payment is received. In conclusion, late fee notices on invoices play a crucial role in maintaining cash flow and ensuring timely payments. By clearly communicating the consequences of late payments, businesses can encourage customers to settle outstanding amounts promptly and minimize potential financial losses.