Owner Any Paid For This Article

Description

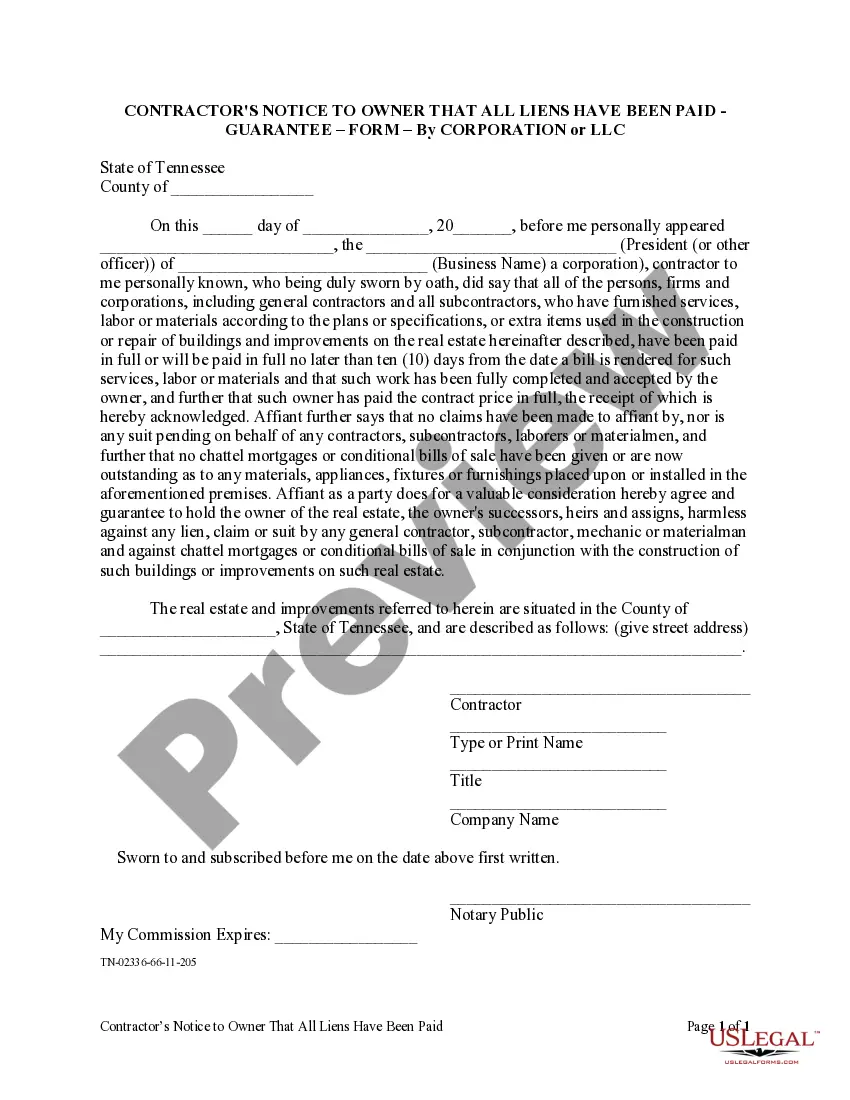

How to fill out Tennessee Contractor's Notice To Owner That All Liens Paid In Full - Corporation?

- Log in to your account if you're a returning user, ensuring your subscription is valid. If it has expired, renew your plan to continue accessing the forms.

- For first-time users, start by reviewing the form previews and descriptions. This is crucial to find the document that specifically meets your legal requirements.

- If needed, use the Search tab to locate another template. It’s important to find the right form that aligns with your jurisdiction.

- Once you've identified the correct document, click the Buy Now button and select your preferred subscription plan. An account registration is necessary to get access.

- Proceed to checkout by entering your payment information through credit card or PayPal for your subscription.

- Finally, download the form to your device. You can manage and access your documents anytime via the My Forms menu in your profile.

In conclusion, US Legal Forms offers an extensive range of legal documents that are easy to access, fill out, and customize. By following these steps, you can efficiently navigate the platform and obtain the forms you need.

Don't hesitate to take control of your legal documentation—start using US Legal Forms today!

Form popularity

FAQ

Documenting an owner's draw involves keeping detailed records of the amounts withdrawn and the dates of each transaction. You should prepare a draw form that outlines the specifics to ensure transparency and accountability. Consistent documentation is essential for effective business management and tax compliance. For assistance, US Legal Forms offers comprehensive resources to help you create and manage these records.

Reporting an owner's draw on your 1040 tax form is relatively straightforward, as the draw itself isn't taxed directly. Instead, you report business income and expenses on Schedule C, which flows into your 1040. Ensure you account for your draws correctly, as they can affect your taxable earnings. Considering resources like US Legal Forms can help clarify these tax reporting procedures.

Choosing between an owner's draw and a salary depends on your business structure and personal financial needs. If you operate as a sole proprietor or LLC, an owner's draw may provide flexibility without the burden of payroll taxes. However, paying yourself a salary could establish a consistent income stream and help ensure tax compliance. Consider evaluating your situation to determine which option is best for your unique circumstances.

An owner's draw is not classified as an expense in traditional accounting practice. Instead, it represents a distribution of profits from the business to the owner. When you take a draw, it reduces the total equity in the business rather than impacting its profitability directly. For thorough understanding and compliance, consider visiting USLegalForms, where you can find resources to manage draws appropriately.

Yes, an owner's salary is considered an expense for the business, as it reflects compensation for work done. This salary reduces the overall profit of the business, which can affect how much tax you owe. However, it’s crucial to distinguish between an owner’s salary and an owner's draw to avoid confusion in your financial records. Tools available on USLegalForms can help you determine the best approach to record these expenses accurately.

When reporting an owner's draw on taxes, it's important to understand that it is not treated as a salary but rather as a distribution of profits. You should report this on your personal tax return, especially if you are a sole proprietor or a member of a partnership. Make sure to keep accurate records of the amounts drawn for accurate reporting. By using resources like USLegalForms, you can find the necessary documentation to ensure your reporting aligns with tax regulations.

To make yourself the owner of a file, access its properties, then find the security settings. You’ll need to change the ownership to your user account. This process may vary slightly depending on your operating system, but if you encounter challenges, resources from US Legal can provide straightforward guidance.

Changing file ownership usually requires navigating to the file properties and accessing security settings. Once there, you can update the owner to a different user. Ensuring the correct owner can enhance file security and accessibility, so if you require assistance, US Legal offers tools to help.

To find the owner of a file, right-click on the file and select 'Properties,' then look under 'Security.' The owner is usually listed in the 'Advanced' settings. If you're having trouble locating this information, guidance from platforms like US Legal can simplify the process.

Changing the ownership of a file involves accessing its properties, often through a right-click. You'll need to choose the 'Owner' option in the permissions settings, allowing you to specify a new owner. This ensures that the file's administrator can manage it effectively. For more tips on file management, US Legal has valuable resources to assist you.