Rent Non Payment

Description

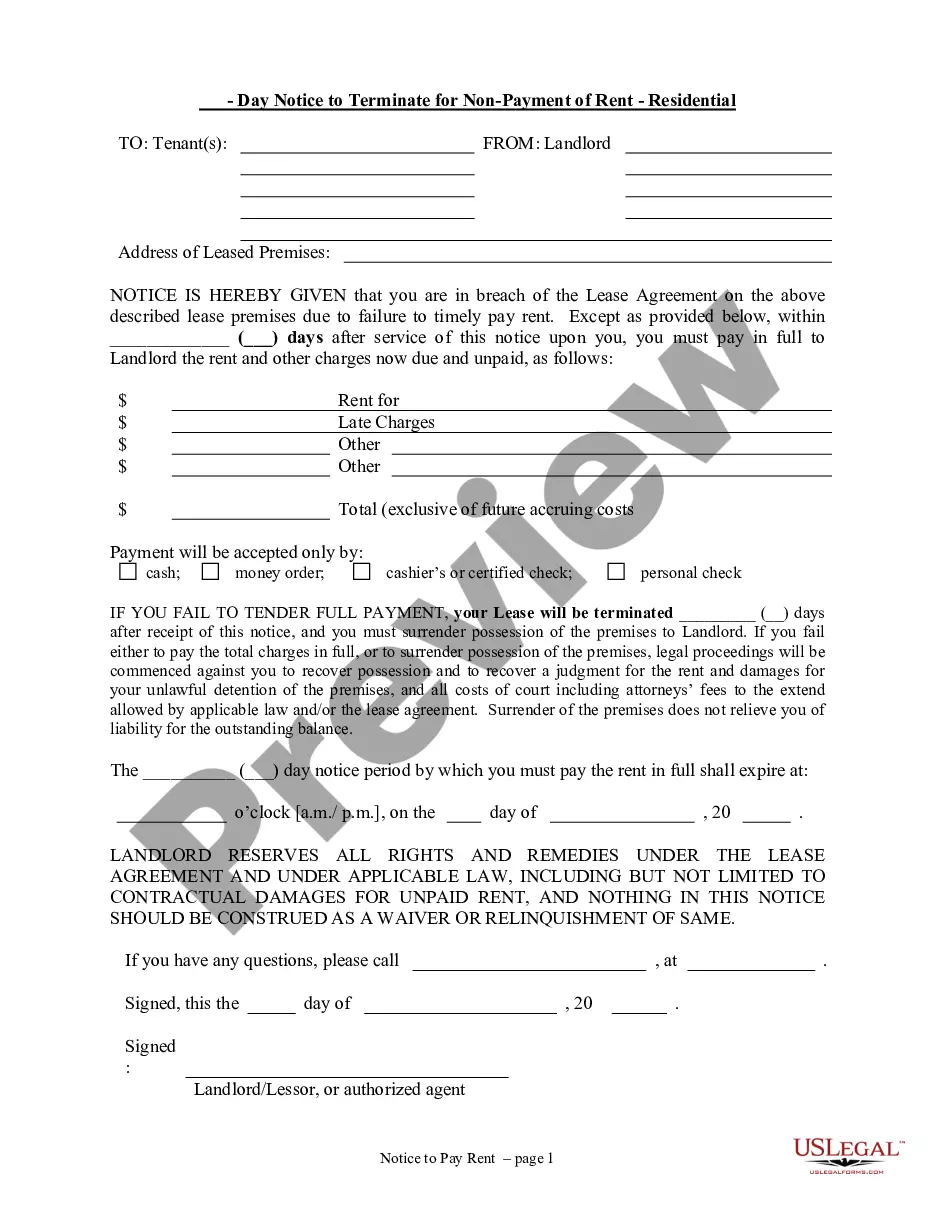

How to fill out Tennessee Notice To Terminate For Nonpayment Of Rent - Residential?

- Log in to your US Legal Forms account. If you haven't registered yet, create an account to get started.

- Search for 'rent non payment' in the form library to find the template tailored for your situation.

- Preview the selected form to ensure it meets your needs and complies with local jurisdiction requirements.

- Choose the appropriate subscription plan that grants access to the form. Click on the Buy Now button to proceed.

- Complete the transaction by entering your payment information. US Legal Forms accepts various payment methods for your convenience.

- Download the completed form and save it on your device. Visit the My Forms section in your account anytime you need to access it again.

US Legal Forms not only streamlines the process of obtaining essential legal documentation but also offers unmatched support. With access to premium experts, you can ensure your forms are completed accurately and effectively.

Take control of your rental situations with the right legal forms. Visit US Legal Forms today to find the documentation you need!

Form popularity

FAQ

A tenant may stay in the property during the eviction process, which can take several weeks to months, depending on the circumstances. Consequently, if rent non payment occurs, landlords must follow legal procedures to evict tenants. Understanding the timeline and guidelines is vital to protect your rights. Resources like US Legal Forms can help you navigate these complexities.

In California, the timeline for rent non payment depends on the lease agreement. Typically, landlords can begin the eviction process after a rent payment is at least five days late. However, a tenant can occupy the property during this grace period, which offers a brief window for resolving any financial issues. It’s crucial to communicate with your landlord to seek alternatives if you face difficulties.

In New York, a tenant can technically stay in the property until the eviction process is complete, even if they are not paying rent. The timeline for eviction can stretch several months due to court proceedings. Once a landlord files for eviction due to rent non payment, the tenant will typically receive a notice and then have a period to respond in court. Being aware of these rights can help both parties make informed decisions.

If you face rent non payment, you can still claim unpaid rent as a loss on your taxes. To do this, you need to report the unpaid rent amount on your tax return, as it may qualify as a non-business bad debt. Keep records of rental agreements and any communication with your tenant regarding the unpaid rent. Consulting a tax professional may also help you navigate this area effectively.

To write a letter addressing rent non payment, start by clearly stating your reason for not paying. Be honest and provide any details about your financial situation, ensuring that you express your intention to resolve the matter. Include a proposed timeline for payment and offer to discuss potential plans with your landlord. It's essential to keep the letter professional and respectful to maintain a positive relationship.