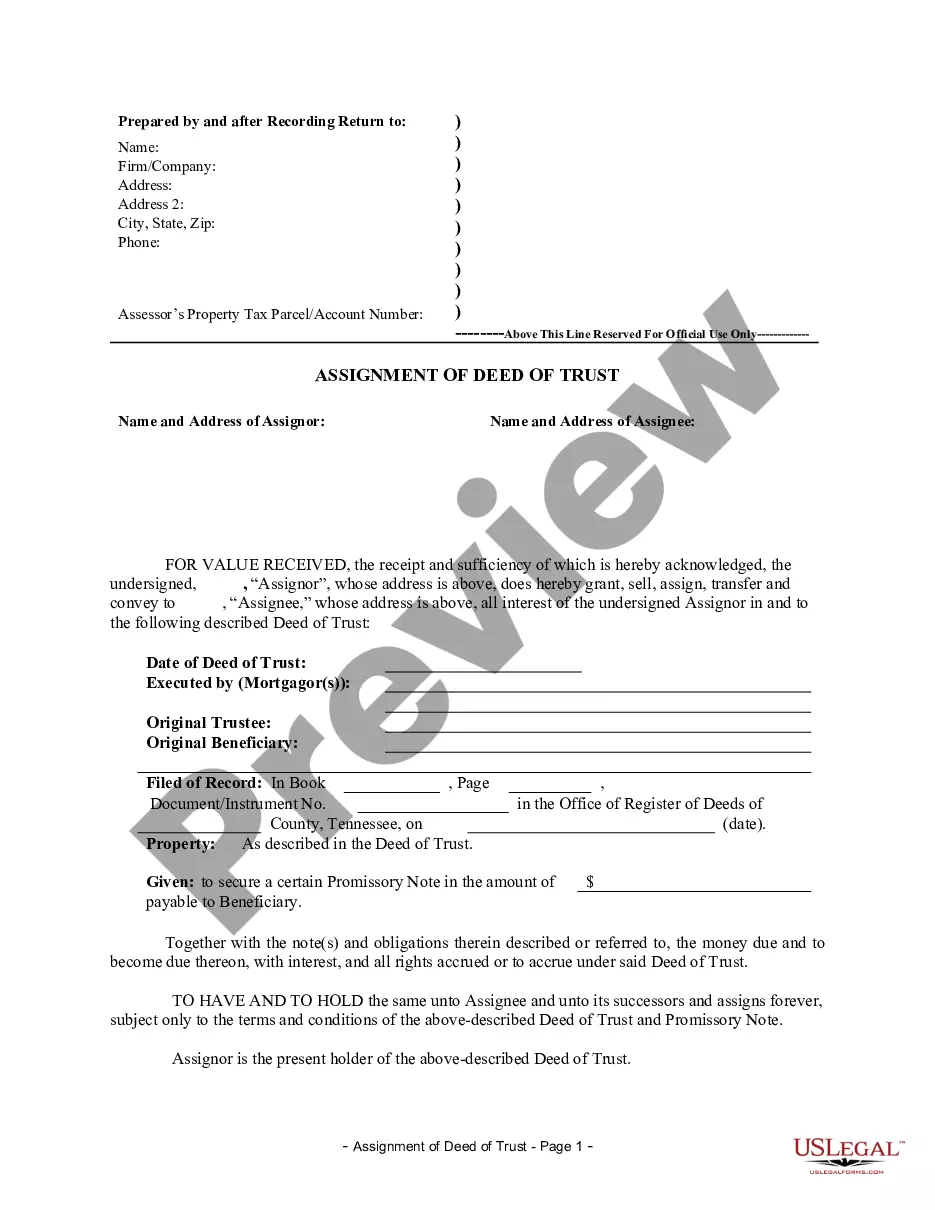

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Tennessee Deed Of Trust With No Maturity Date

Description

How to fill out Tennessee Deed Of Trust With No Maturity Date?

There's no longer a need to spend countless hours searching for legal documents to fulfill your local state mandates. US Legal Forms has gathered all of these in one location and made them easier to access.

Our platform provides more than 85,000 templates for various business and personal legal situations categorized by state and purpose. All forms are properly drafted and verified for legitimacy, ensuring you can confidently acquire an up-to-date Tennessee Deed Of Trust With No Maturity Date.

If you are acquainted with our service and already possess an account, make sure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all obtained documentation whenever necessary by navigating to the My documents section in your profile.

Print your form to fill it manually or upload the document if you prefer to use an online editor. Preparing legal documentation in compliance with federal and state laws and regulations is quick and straightforward with our library. Try US Legal Forms today to keep your paperwork organized!

- If you've never interacted with our service before, the process will involve a few additional steps to finish.

- Here's how new users can acquire the Tennessee Deed Of Trust With No Maturity Date from our collection.

- Examine the page content carefully to ensure it includes the sample you require.

- To do so, utilize the form description and preview options if available.

- Make use of the search bar above to look for another template if the previous one doesn't suit your needs.

- Click Buy Now beside the template title once you find the right one.

- Select the most appropriate pricing plan and create an account or Log In.

- Complete your subscription payment with a credit card or through PayPal to proceed.

- Select the file format for your Tennessee Deed Of Trust With No Maturity Date and download it to your device.

Form popularity

FAQ

Missing a debt review payment can lead to challenges in your financial management process. For individuals in Tennessee, this could affect your agreements related to a Tennessee deed of trust with no maturity date. It's vital to communicate with your debt counselor to explore possible solutions and stay on track with your financial commitments.

Yes, Tennessee does use a deed of trust as part of its real estate financing process. A Tennessee deed of trust with no maturity date serves as a secure method for lenders to protect their interests in the property. Borrowers should understand this tool as it may offer flexibility and protection in their financing arrangements.

A Trust Deed, such as a Tennessee deed of trust with no maturity date, typically remains on your credit file for several years. Generally, it can affect your credit report for up to seven years from the date of completion or foreclosure. Therefore, maintaining timely payments can help remove any negative reporting earlier, allowing you to rebuild your credit.

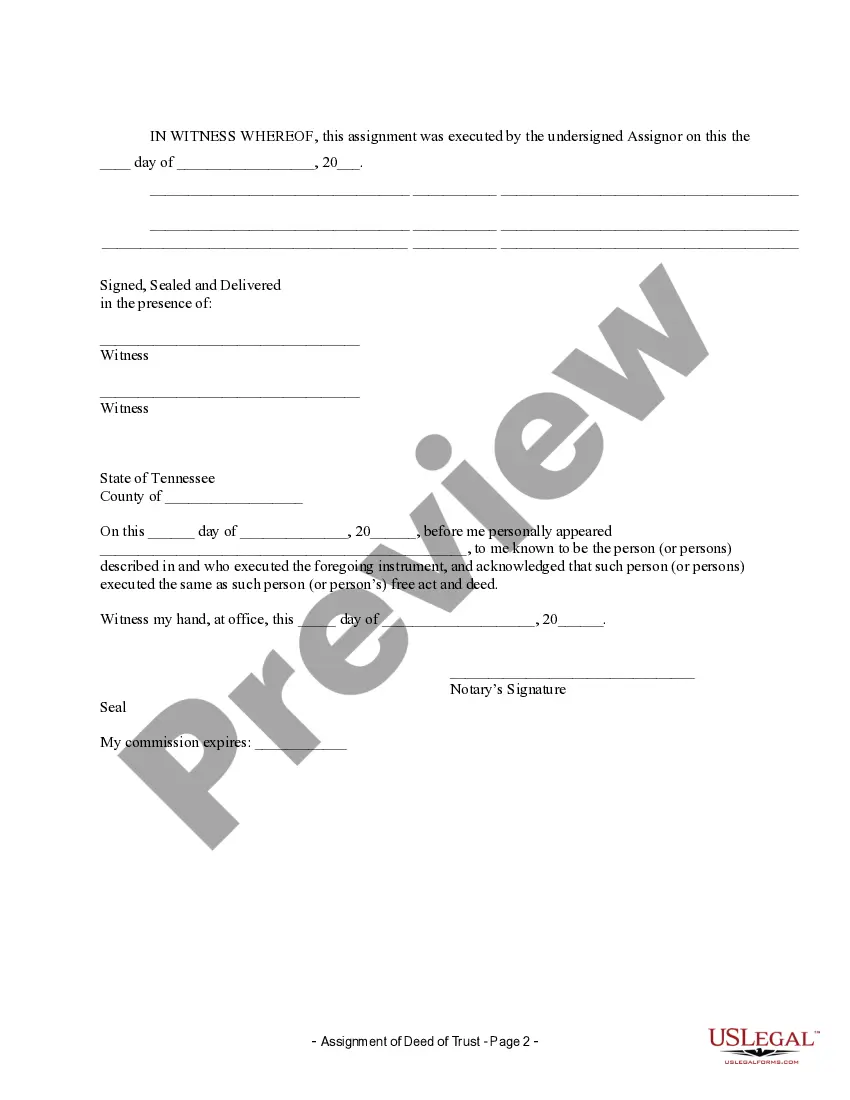

A deed in Tennessee must contain essential elements such as the names of the parties involved, a legal description of the property, and the date of the transaction. Additionally, the deed must be signed by the grantor and notarized. If you’re utilizing a Tennessee deed of trust with no maturity date, ensure that all prescribed details are accurate and complete to facilitate a smooth process. Consider using US Legal Forms to access templates that ensure compliance.

To record a deed in Tennessee, you need to prepare the deed according to state requirements. Next, submit it to the local county register's office where the property is located. Recording your Tennessee deed of trust with no maturity date ensures it is legally recognized against the property. This process protects your interests and provides public notice of your ownership.

The duration of a trust deed can vary, but in the case of a Tennessee deed of trust with no maturity date, it can last indefinitely unless specific conditions require its termination. This allows for ongoing financial arrangements between the involved parties. Thus, understanding the implications can ensure that you're meeting all obligations and avoiding complications.

An unreleased deed of trust indicates that the borrower has not completed all obligations or that the trust has not been formally closed. This can create complications for future property transactions or refinancing. Understanding how a Tennessee deed of trust with no maturity date applies helps clarify risks and responsibilities tied to unreleased documents.

In Tennessee, a lien typically does expire if it is not renewed or enforced within a specific timeframe. For instance, a lien for property taxes becomes invalid after 10 years unless action is taken. Thus, it's essential to understand how the Tennessee deed of trust with no maturity date interacts with potential liens. Being proactive can help protect your investment.

To file a quitclaim deed in Tennessee, start by preparing the deed with accurate property information and the signatures of the involved parties. Then, you must record the deed at the local county register of deeds office. If you have a Tennessee deed of trust with no maturity date, this step could be crucial in establishing clear ownership rights. Utilizing a platform like uslegalforms can help streamline this process and ensure all necessary details are covered.

In Tennessee, the grantor, or person transferring the property, must sign the quitclaim deed. Additionally, the grantee, or person receiving the property, may also choose to sign, although this is not mandatory. Engaging with a Tennessee deed of trust with no maturity date can provide clarity on the obligations of both parties involved. It’s recommended to have this document notarized to ensure its legal standing.