Tennessee Utma Age Of Majority With Parents

Description

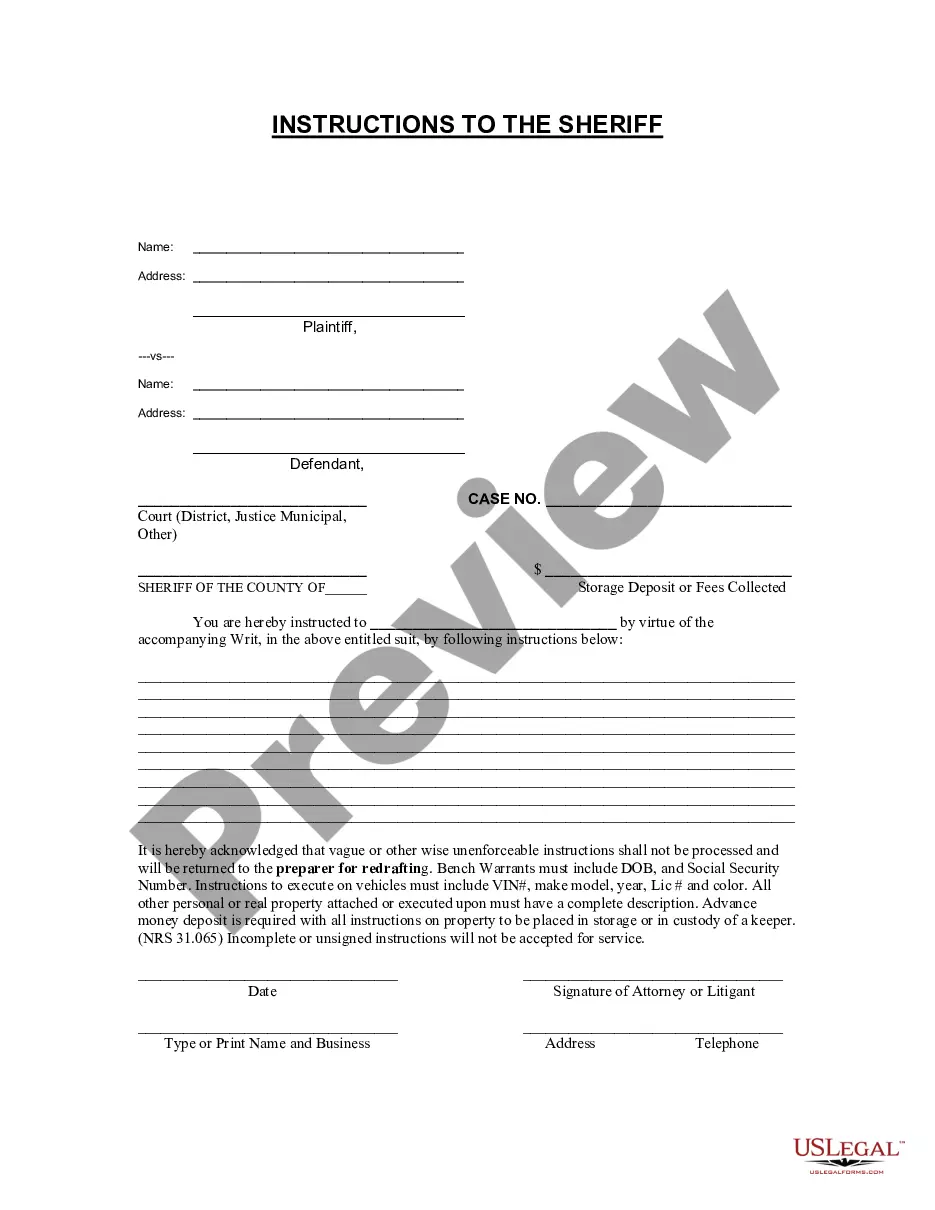

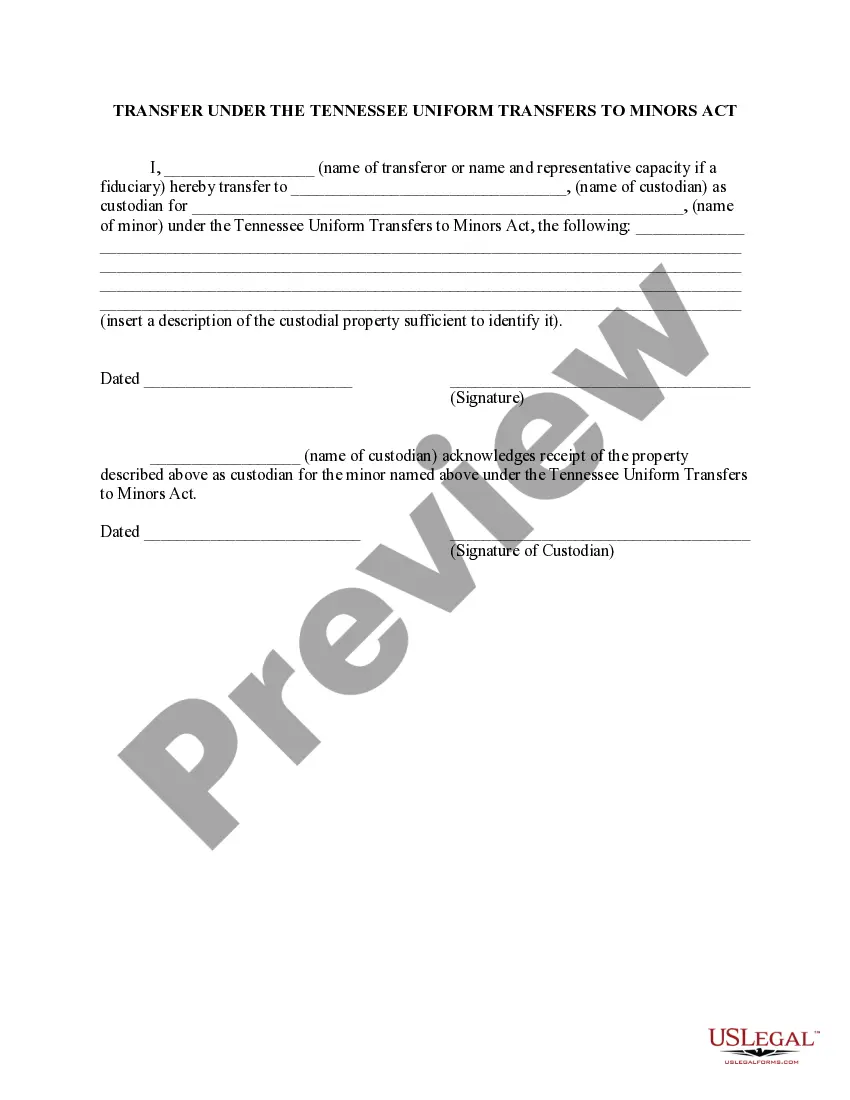

How to fill out Transfer Under The Tennessee Uniform Transfers To Minors Act?

Managing legal documents can be exasperating, even for experienced professionals.

When you are looking for a Tennessee Utma Age Of Majority With Parents and lack the time to search for the accurate and up-to-date version, the process can be challenging.

US Legal Forms accommodates any needs you may have, from personal to business documentation, all in one location.

Utilize cutting-edge tools to complete and oversee your Tennessee Utma Age Of Majority With Parents.

Here are the steps to follow after downloading the form you need: Verify that this is the correct form by previewing it and checking its details. Ensure that the template is accepted in your state or county. Click Buy Now when you are prepared. Choose a subscription plan. Select the format you require, and Download, fill out, sign, print, and send your documents. Enjoy the US Legal Forms online library, backed by 25 years of expertise and trustworthiness. Streamline your daily document management into a simple and intuitive process today.

- Access a valuable resource library of articles, guides, handbooks, and materials pertinent to your situation and needs.

- Save time and effort in locating the documents you require, and use US Legal Forms’ advanced search and Review feature to find Tennessee Utma Age Of Majority With Parents and obtain it.

- If you possess a monthly subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check the My documents tab to view the documents you have previously downloaded and manage your folders as desired.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- A comprehensive online form library could be a transformative solution for those who want to handle these situations proficiently.

- US Legal Forms is a frontrunner in digital legal forms, offering over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can access legal and business forms specific to your state or county.

Form popularity

FAQ

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

Anyone can contribute to a UTMA account, but their contribution is considered an irrevocable gift. This means only the custodian has the right to withdraw funds, and it has to be for the child's benefit. The custodian has a fiduciary duty to act in the child's best interest.

UGMA/UTMA account assets can be transferred into a new account established by the now adult beneficiary as a sole or joint owner. To get an account application, contact your financial professional or find one by using our financial professional locator. For additional assistance, contact us.

Age of Majority and Trust Termination StateUGMAUTMATennessee1821Texas1821Utah2121Vermont21N/A49 more rows

The statutory age of majority for UTMA purposes is 21 for transfers by irrevocable gift or pursuant to a will or trust. The UTMA age of majority for transfers other than by gift, will, or trust is set as the State's standard age of majority, which is 18.