Tennessee Llc Operating Agreement With Preferred Return

Description

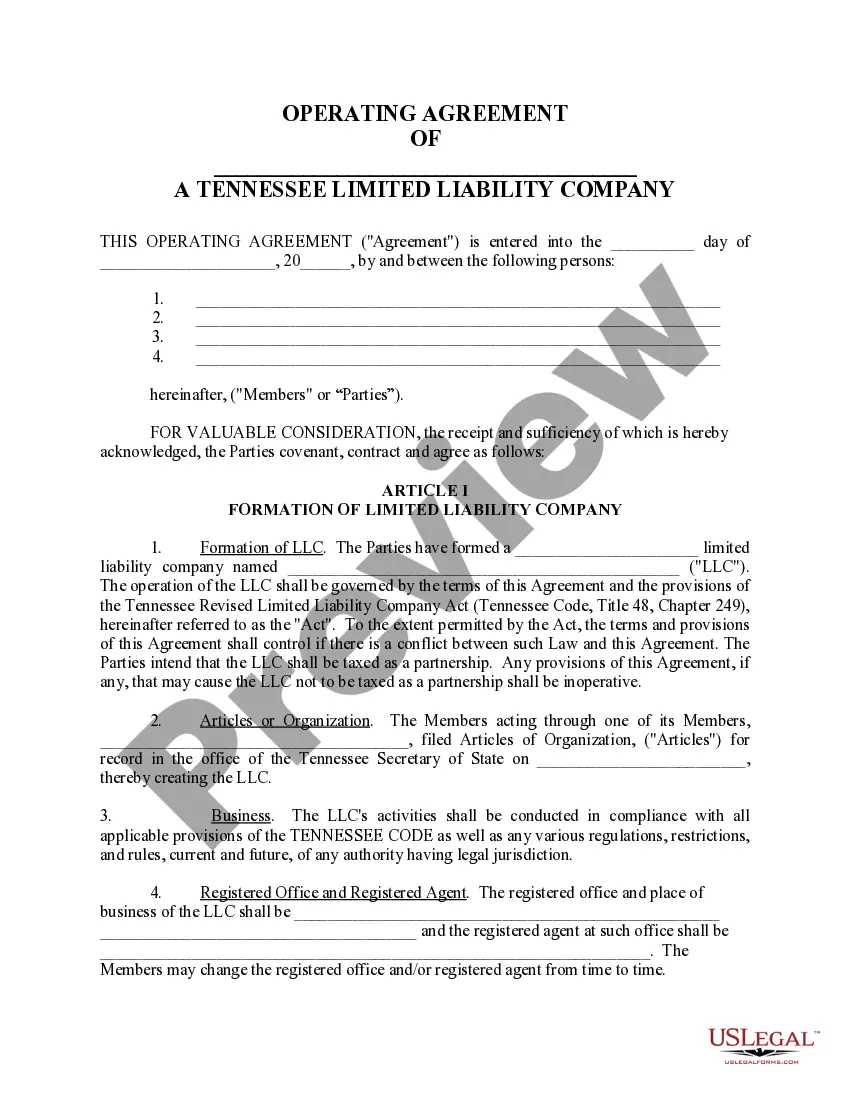

How to fill out Tennessee Limited Liability Company LLC Operating Agreement?

Finding a go-to place to access the most current and appropriate legal samples is half the struggle of working with bureaucracy. Discovering the right legal files needs precision and attention to detail, which is the reason it is important to take samples of Tennessee Llc Operating Agreement With Preferred Return only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the details concerning the document’s use and relevance for the circumstances and in your state or region.

Consider the listed steps to complete your Tennessee Llc Operating Agreement With Preferred Return:

- Make use of the library navigation or search field to find your sample.

- Open the form’s description to see if it suits the requirements of your state and region.

- Open the form preview, if available, to make sure the form is the one you are searching for.

- Get back to the search and locate the proper template if the Tennessee Llc Operating Agreement With Preferred Return does not fit your needs.

- If you are positive about the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Choose the pricing plan that suits your requirements.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by choosing a transaction method (credit card or PayPal).

- Choose the file format for downloading Tennessee Llc Operating Agreement With Preferred Return.

- Once you have the form on your gadget, you may modify it using the editor or print it and finish it manually.

Remove the inconvenience that comes with your legal documentation. Explore the extensive US Legal Forms collection to find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

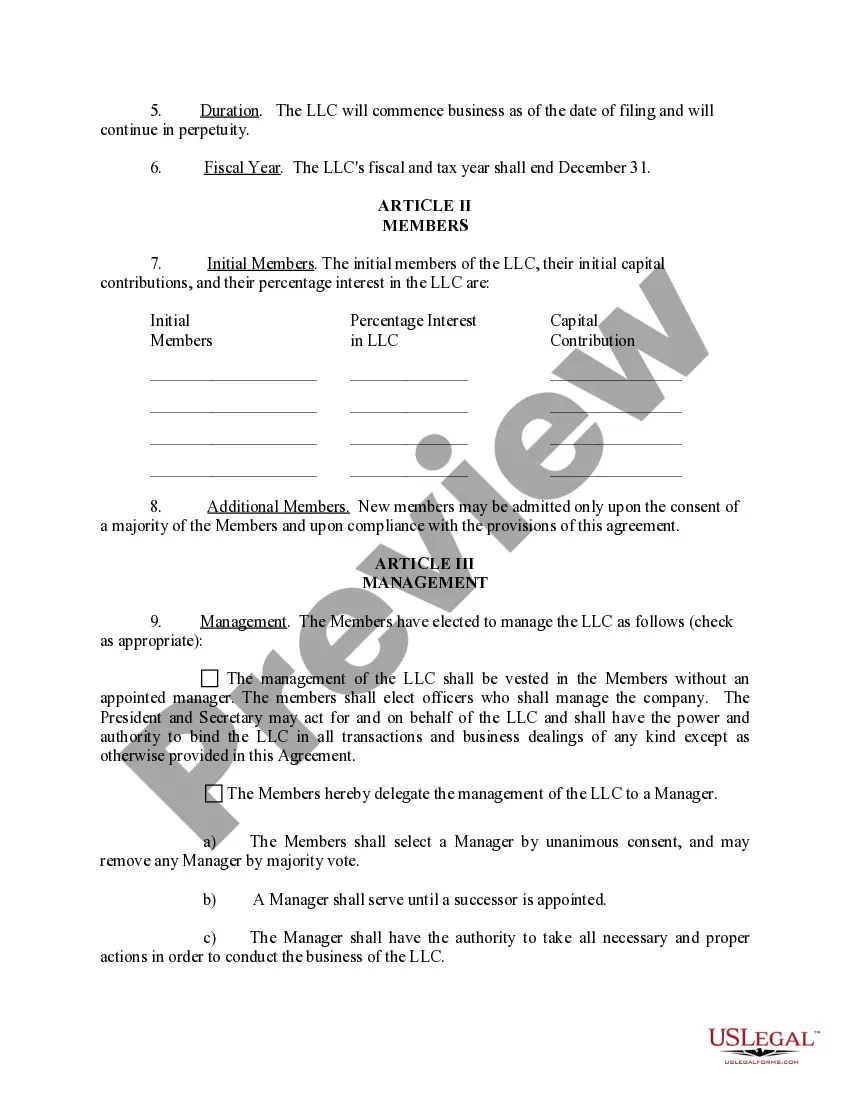

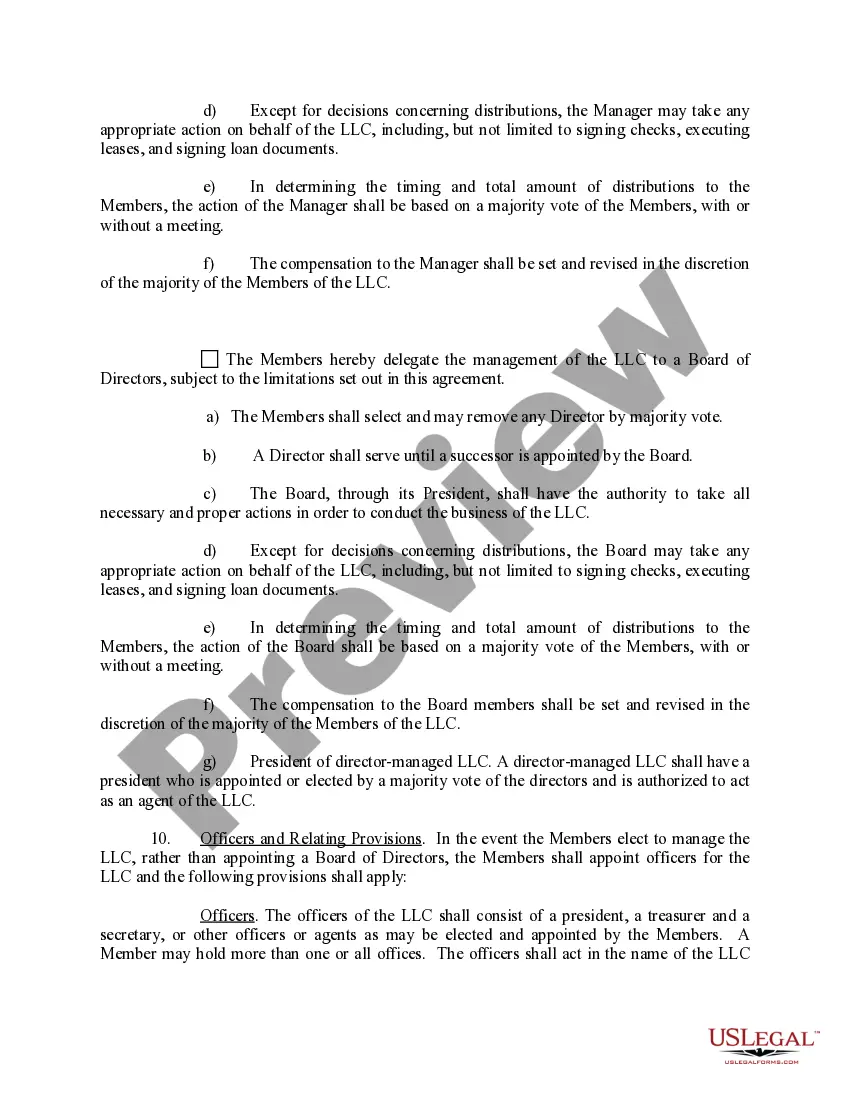

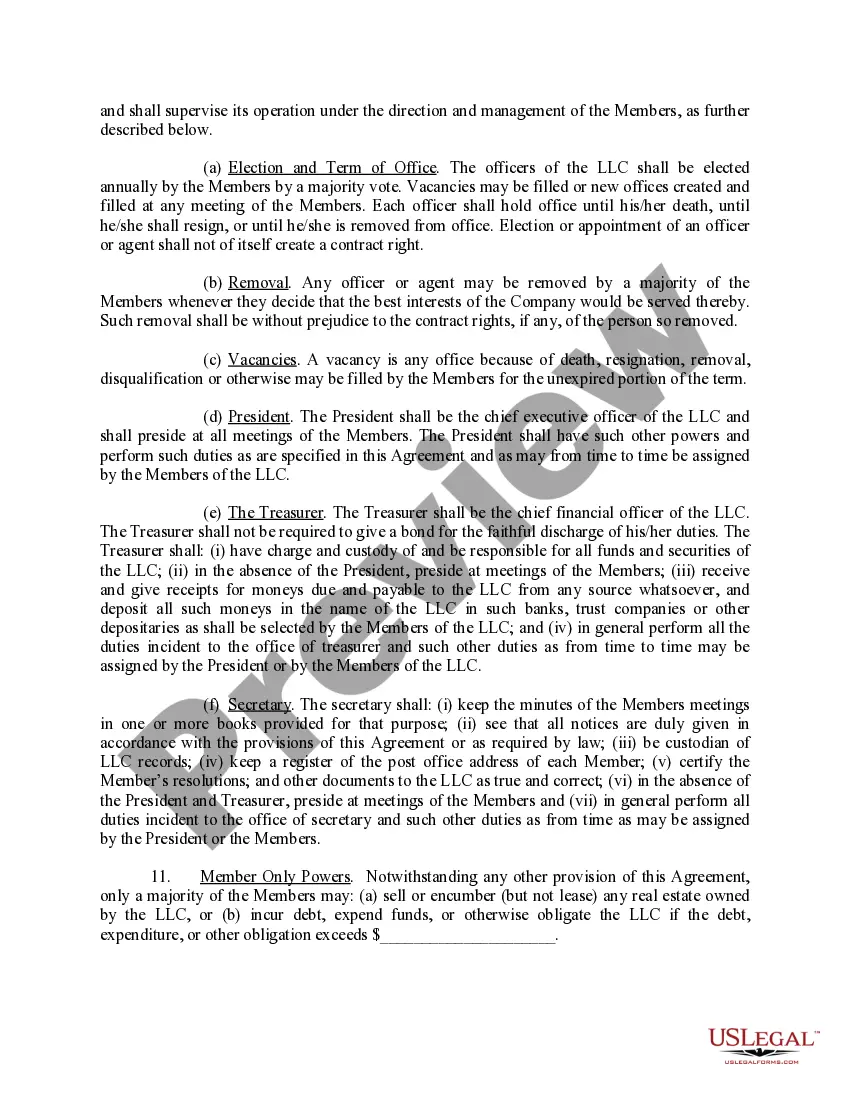

LLC operating agreements usually provide much more information, and almost all the provisions for how the business will be managed, and the rights, duties, and liabilities of members and managers are contained in the operating agreement. An operating agreement is a private document.

?Preferred Return? means the return to a Member that would accrue on Unreturned Capital at eight percent (8%) per annum (cumulative, but not compounded); provided, however, such amount shall not begin to accrue on any Capital Contribution, or any portion thereof, as applicable, until such time as the Company transfers ...

While Tennessee does not require LLCs to have an operating agreement, it is highly recommended to create one. An operating agreement is an internal document that outlines the management structure, member roles, voting procedures, and other essential operating rules for your LLC.

A Tennessee single-member LLC operating agreement is a legal document that is provided specifically for use by a sole proprietor who would like to establish the policies, procedures, daily activities among other aspects of their company.

Nope, Tennessee law doesn't require you to file your operating agreement with the state. Your operating agreement is an internal document your LLC should keep on record.