Dakota Codified Laws Foreclosure

Description

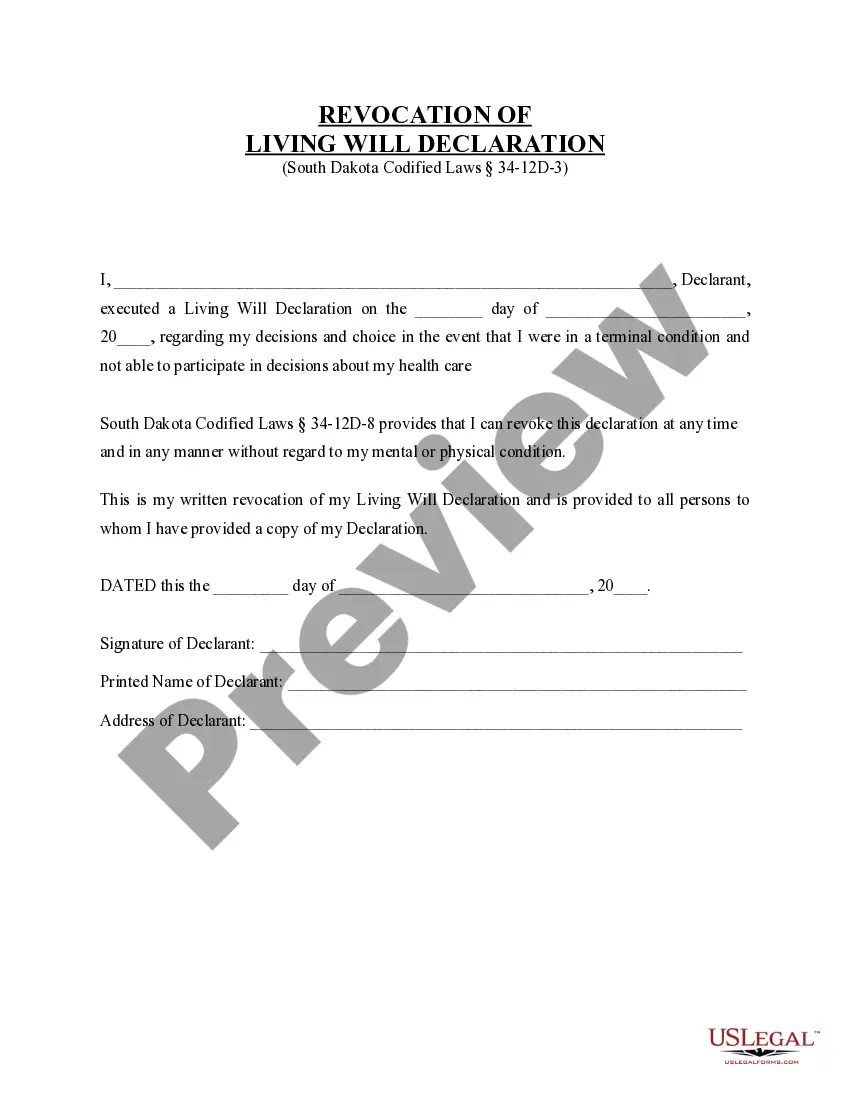

How to fill out South Dakota Revocation Of Statutory Living Will?

Drafting legal documents from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more cost-effective way of creating Dakota Codified Laws Foreclosure or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of more than 85,000 up-to-date legal forms addresses virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-compliant templates diligently put together for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can easily locate and download the Dakota Codified Laws Foreclosure. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to set it up and navigate the library. But before jumping directly to downloading Dakota Codified Laws Foreclosure, follow these tips:

- Check the form preview and descriptions to ensure that you are on the the document you are searching for.

- Make sure the form you select complies with the requirements of your state and county.

- Choose the right subscription option to buy the Dakota Codified Laws Foreclosure.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and transform document execution into something simple and streamlined!

Form popularity

FAQ

In general, the borrower gets one year to redeem the home after a South Dakota foreclosure sale. (S.D. Codified Laws § 21-52-11). But if the mortgage is a short-term redemption mortgage, the redemption period is 180 days after the purchaser from the foreclosure sale records a certificate of sale in the land records.

Judicial foreclosure. This requires that the process go through a court where the borrower can raise defenses. Non-judicial foreclosure. This is done without filing a court action and is carried out by a series of steps, including required written notices under a "power of sale" clause in the mortgage or deed of trust.

Redemption is the right to repay the amount paid for real property or any interest thereon, sold on foreclosure of a real estate mortgage or on special or general execution against the property of a judgment debtor, or upon the foreclosure of any lien upon such real property other than a lien for taxes or special ...

The nonjudicial process is pretty straightforward: The lender serves the borrower a notice of sale at least 21 days before the sale date and publishes the notice in a newspaper once a week for four weeks. (S.D. Codified Laws § 21-48-6.1, § 21-48-6). Then the lender can sell the property at a foreclosure sale.