Lien Waivr

Description

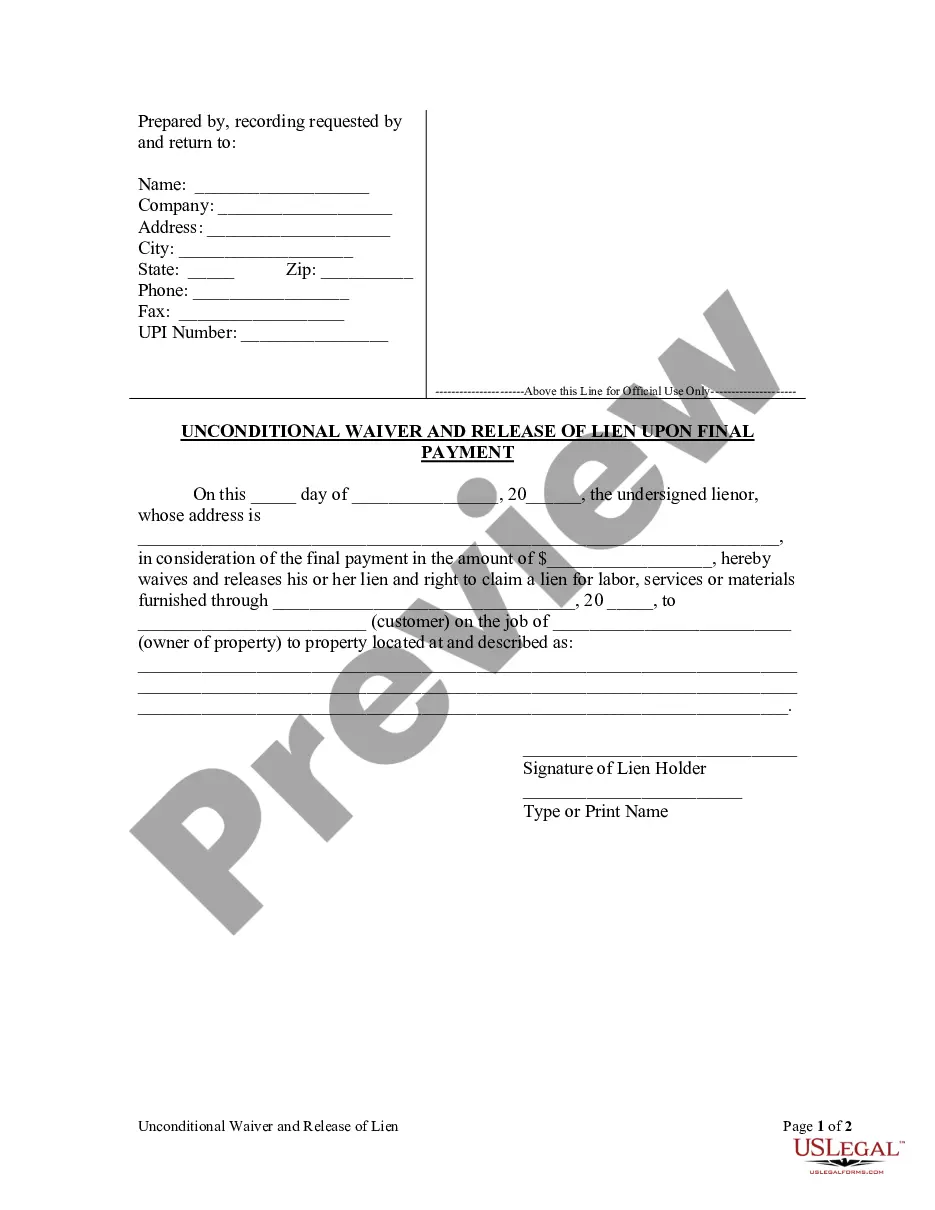

How to fill out South Dakota Unconditional Waiver And Release Of Claim Of Lien Upon Final Payment?

- Log in to your US Legal Forms account if you are an existing user. Ensure your subscription is active or renew it according to your payment plan.

- For newcomers, start by browsing through the extensive library. Use the Preview mode and check the form descriptions to select a template that corresponds with your local jurisdiction.

- Utilize the Search tab to find alternative templates if necessary, ensuring you locate the correct document for your needs.

- Click the Buy Now button once you've found your desired form and choose a suitable subscription plan. Account registration will be required to access the full resources.

- Complete the payment process by entering your credit card details or using PayPal for a hassle-free transaction.

- Download your form and save it on your device. You can also access it anytime from the My Forms menu in your profile.

Using US Legal Forms not only saves time but also guarantees that all legal documents are thoroughly vetted and easy to complete, giving users confidence in their legal transactions.

Start leveraging the comprehensive resources of US Legal Forms today to simplify your legal needs. Sign up now!

Form popularity

FAQ

To fill out a lien affidavit, start by entering the name of the debtor and the amount owed. Include a brief description of the debt and the property in question. Ensure you sign and date the affidavit, then submit it to the relevant county or court office. Using a reliable platform like US Legal Forms can help you navigate this process efficiently.

Filling out a waiver of lien involves providing your name, address, and the property’s details where the work was performed. You must also include the amount for which you are waiving the lien. After filling out the form, sign and date it before submitting it to the appropriate county office or the requesting party. US Legal Forms can provide templates to streamline this process.

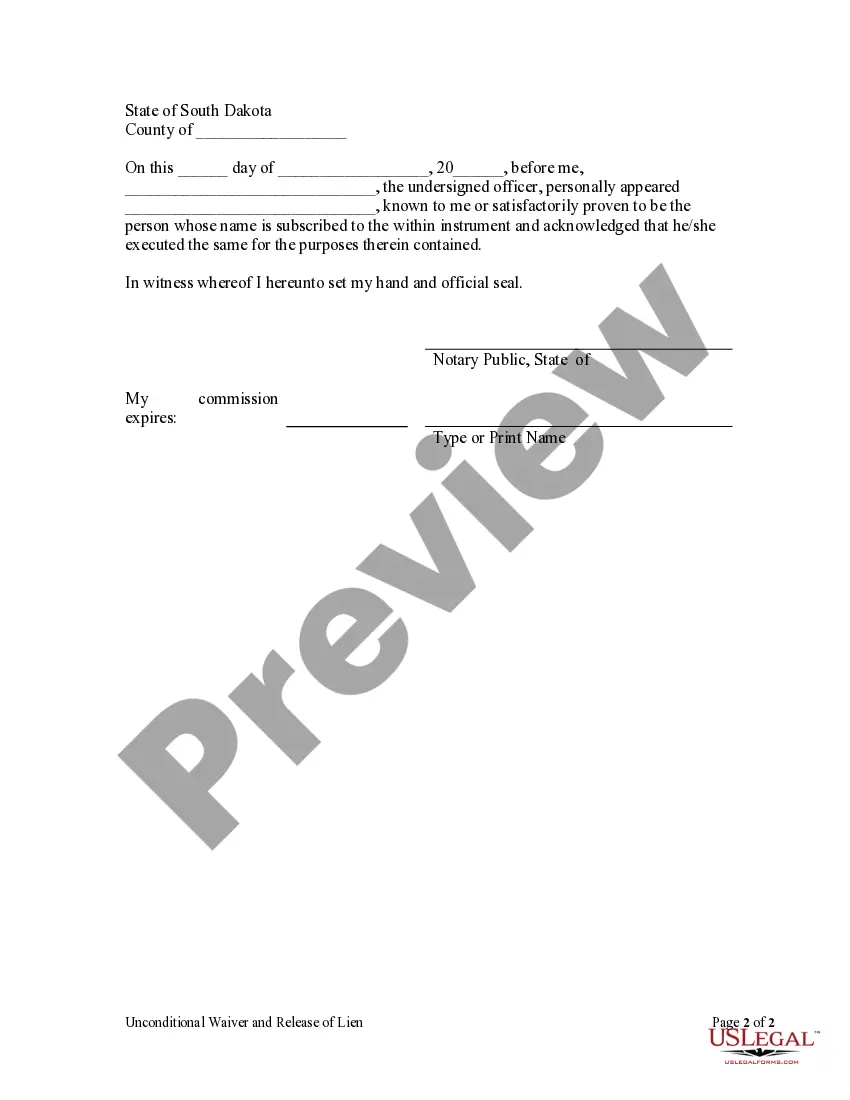

To write a letter releasing a lien, start with your contact information and date at the top. Clearly state that this letter serves as a lien release, include pertinent details like the lien's property address, and specify that the lien is being released. Finally, sign the letter and provide a copy to the lien holder, ensuring that you retain one for your records.

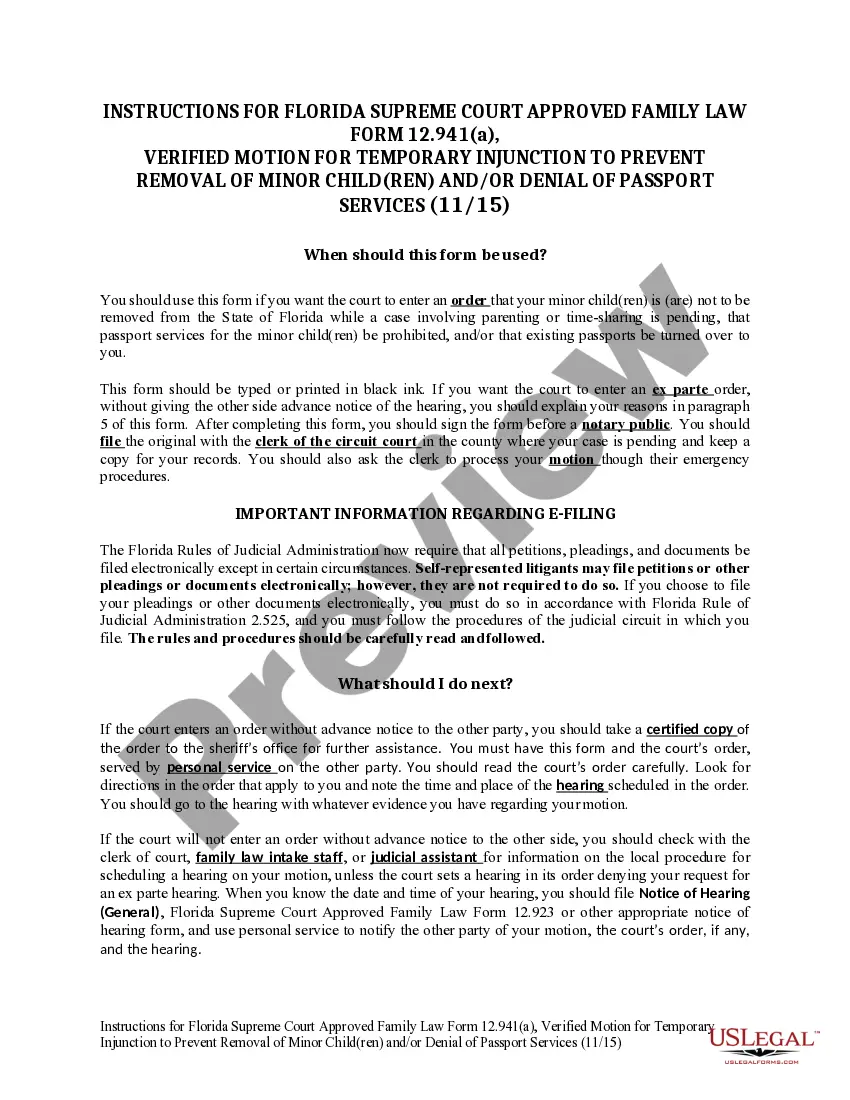

Yes, lien waivers are legal documents that protect parties involved in construction and real estate transactions. They provide assurance that a contractor or subcontractor will not pursue a lien against a property for unpaid services. However, it is crucial to understand the specific laws in your state regarding lien waivers to ensure compliance.

To initiate a lien release, you need the original lien document, a completed lien release form, and identification to confirm your identity. Additionally, you may require proof of payment, showing that the debt has been settled. Utilizing US Legal Forms provides you with all the necessary documents and guidance needed for a smooth process.

To complete a lien release, you must first gather all necessary documents, including the original lien agreement. Next, fill out the lien release form accurately, then sign and date it. Finally, submit the completed form to the appropriate county office while keeping a copy for your records. Using a platform like US Legal Forms can simplify this process.

A lien release is vital for anyone wishing to sell or refinance a property. Without it, potential buyers or lenders may view the property as encumbered, which can complicate transactions. By securing a lien release, you enhance the property’s marketability and avoid disputes. Understanding how to effectively use lien waivr in this context can greatly improve your real estate dealings.

A lien waiver is a legal document that relinquishes the right to file a lien against a property. By signing a lien waiver, a contractor confirms they received payment, and thus, they waive their claim to place a lien on the property for unpaid work. Understanding lien waivr allows you to safeguard your property interests and manage risks effectively during financial transactions.

A lien release serves as a formal document stating that a lien is no longer valid against a property. This release protects property owners and clears their title, facilitating smoother transactions in the future. By obtaining a lien release, you can eliminate potential disputes over payments. Leveraging lien waivr ensures this process is clear and accessible.

The responsibility for filing a lien release usually falls on the party who initially filed the lien. This is often a contractor or subcontractor who has received payment for work done. To ensure a smooth transition, understanding how lien waivr works can streamline the release process. Working with experts can help you manage this effective documentation accurately.