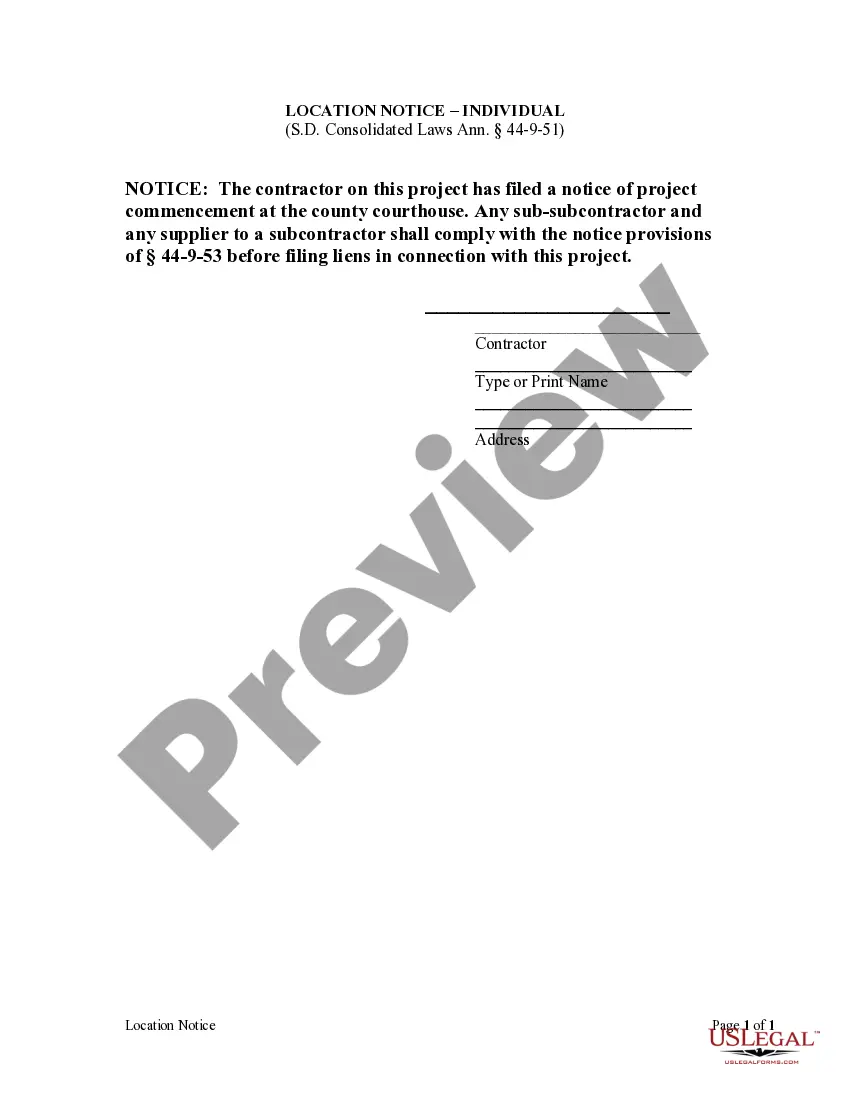

Any person filing a notice of project commencement shall post the name and address of the contractor and location notice at the job site. The location notice shall contain the following statement: The contractor on this project has filed a notice of project commencement at the county courthouse. Any sub-subcontractor and any supplier to a subcontractor shall comply with the notice provisions of ?§ 44-9-53 before filing liens in connection with this project.

South Dakota Individual Foreclosures And Tax Lien Sales

Description

Form popularity

FAQ

South Dakota does not tax certain items like groceries, prescription drugs, or some types of services. These exemptions can benefit residents by lowering their overall tax burden. Knowing what is not taxed can help individuals in South Dakota individual foreclosures and tax lien sales with better financial decisions.

Yes, South Dakota imposes a personal property tax on certain types of property, including business inventory and equipment. This tax is distinct from real property taxes on real estate. Understanding personal property tax is essential when navigating through South Dakota individual foreclosures and tax lien sales, as it affects overall property valuation.

The state sales tax rate in South Dakota is currently 4.5%, but local municipalities can add their own tax on top of that. The total sales tax rate may vary from one location to another. Individuals engaging in foreclosures or tax lien sales should factor these rates into their purchases and financial assessments.

Owner occupied status in South Dakota refers to properties where the owner resides. This status can influence taxes and exemptions, particularly in relation to foreclosures and tax lien sales. Owners may benefit from certain advantages which can affect their financial liability and property tax assessments.

The foreclosure redemption period in South Dakota usually lasts for 120 days after the sale of the foreclosed property. During this time frame, homeowners can reclaim their property by paying the total amount owed. This period provides a critical opportunity for individuals facing financial difficulties linked to individual foreclosures and tax lien sales. Knowing your redemption options can make a significant difference in your financial recovery.

The 37-day foreclosure rule establishes a timeframe within which a lender must notify the homeowner of the foreclosure sale. This requirement helps ensure that homeowners are adequately informed before any actions are taken. Being aware of this rule protects the rights of individuals facing foreclosure in South Dakota. Stay vigilant to avoid complications related to individual foreclosures and tax lien sales.

The 120-day rule for foreclosure provides homeowners a set period to redeem their property after a foreclosure sale. Homeowners can reclaim their property by paying the total amount owed during this timeframe. Understanding this rule is essential for anyone facing individual foreclosures and tax lien sales in South Dakota. Knowledge of your rights can empower you during the foreclosure process.

In South Dakota, individuals aged 65 and older may qualify for property tax relief programs. This can significantly ease the financial burden associated with property taxes. However, these programs may vary by county, so you should research local options. Knowing your rights regarding property taxes can help you navigate South Dakota individual foreclosures and tax lien sales effectively.

The foreclosure redemption period is a timeframe during which a homeowner can reclaim their property from foreclosure by paying the owed amount. In South Dakota, this period typically lasts for 120 days from the date of the foreclosure sale. This rule allows homeowners to regain control, provided they can settle their debts. Understanding this period is crucial for those facing individual foreclosures and tax lien sales.

In South Dakota, property taxes are based on the assessed value of a property, multiplied by the local tax rate. This assessment takes into account the property’s market value, which is determined by the county assessor. Understanding how property taxes are calculated is important when considering South Dakota individual foreclosures and tax lien sales, as it impacts overall investment viability.