South Carolina Title For Car

Description

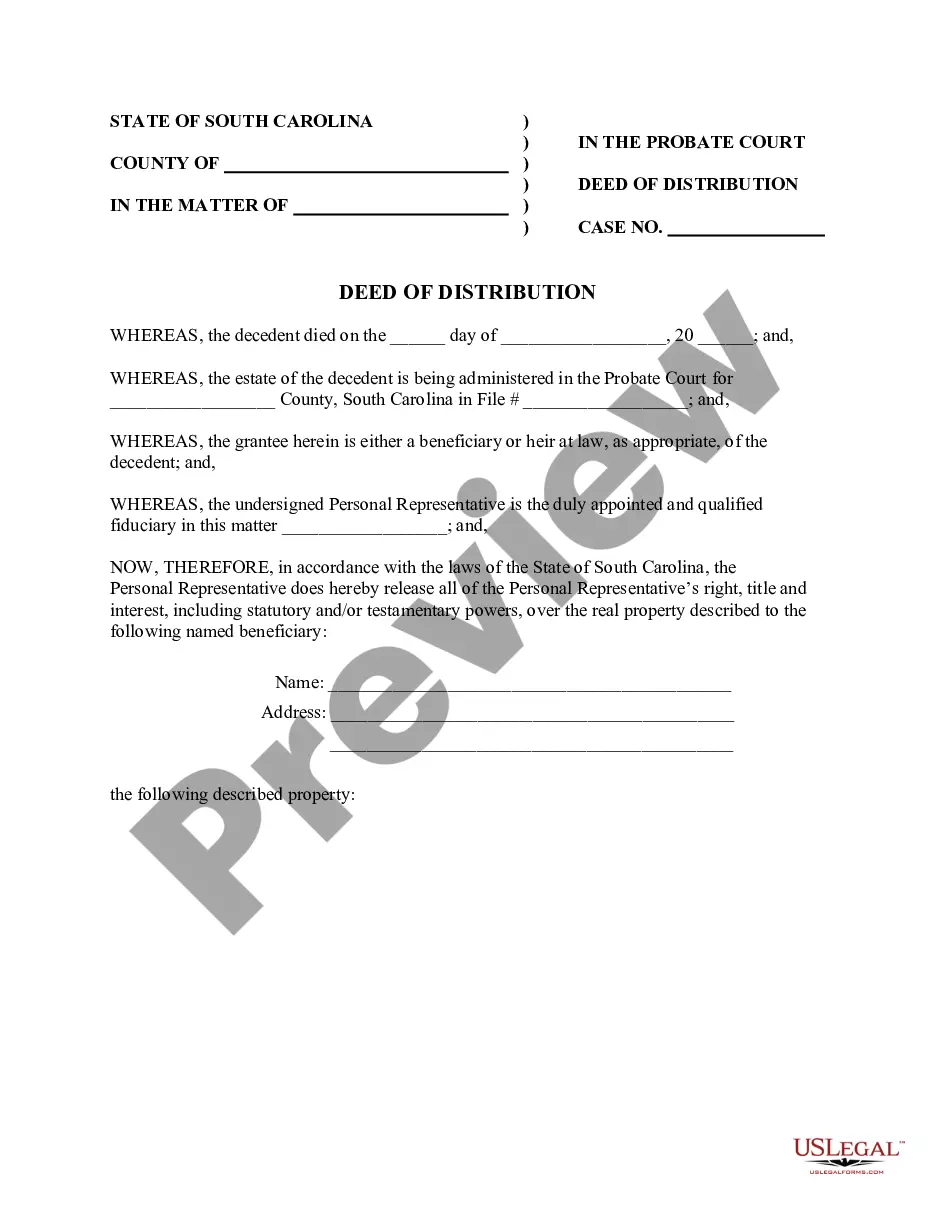

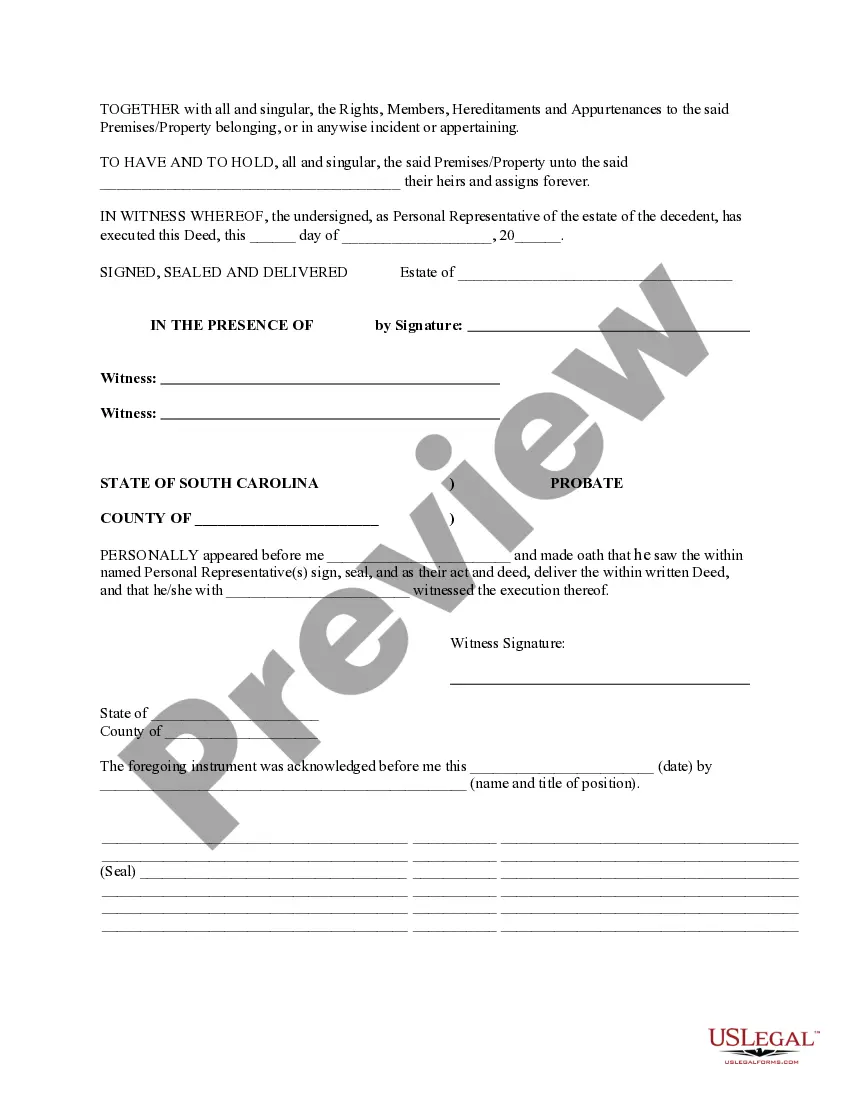

How to fill out South Carolina Deed Of Distribution - Personal Representative To Beneficiary?

Managing legal paperwork and procedures can be a lengthy addition to your day.

South Carolina Title For Car and similar forms often necessitate searching for them and grasping how to fill them out correctly.

Thus, whether you are handling financial, legal, or personal issues, utilizing a comprehensive and user-friendly online catalog of forms as needed will greatly assist you.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific forms and a variety of tools that simplify document completion.

Simply Log In to your account, locate South Carolina Title For Car, and obtain it immediately from the My documents section. You can also access previously saved forms.

- Explore the collection of relevant documents available with a single click.

- US Legal Forms offers state- and county-specific forms accessible for download at any time.

- Protect your document management processes with excellent support that lets you generate any form in just a few minutes without extra or hidden charges.

Form popularity

FAQ

Here's what every debt letter should include: Date of the letter. Lawyer's name, firm, and address. Client's name and address. A subject line that states its purpose. The precise amount the client owed your firm and the date when the payment was due. Instructions on how to pay the debt and the new deadline.

A legitimate debt collector should be able to tell you their company name and mailing address, as well as information about the debt they say you owe. The debt collector should provide information about themselves and their collection agency.

To take legal action to collect a debt, the creditor (the person or company owed money) files a lawsuit against the debtor (the person who owes the money). Once a debt collection lawsuit is filed with the court, the creditor must give the debtor notice of the lawsuit (service).

Debt collectors cannot make false or misleading statements. For example, they cannot lie about the debt they are collecting or the fact that they are trying to collect debt, and they cannot use words or symbols that falsely make their letters to you seem like they're from an attorney, court, or government agency.

Debt collectors are legally obligated to send you a debt validation letter. If you don't receive a debt validation letter, or it lacks detail, you can make a debt verification request. You can file a complaint with the Consumer Federal Protection Bureau or the Federal Trade Commission.

The debt may be completely , canceled, discharged, forgiven or beyond the period for collection. In any case, the scammer will use all sorts of techniques to get you to pay ? intimidation, lies, harassment, etc. Before you pay any debt to any collector, confirm that the debt is real and valid.

How to Spot Debt Collectors. Not everyone who calls and says you owe a debt is a real debt collector who is collecting a real debt. Some are scammers who are just trying to take your money.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and to who, as well as when you need to pay the debt. If you're still uncertain about the debt you're being asked to pay, you can request a debt verification letter to get more information.