Power Attorney For Finances

Description

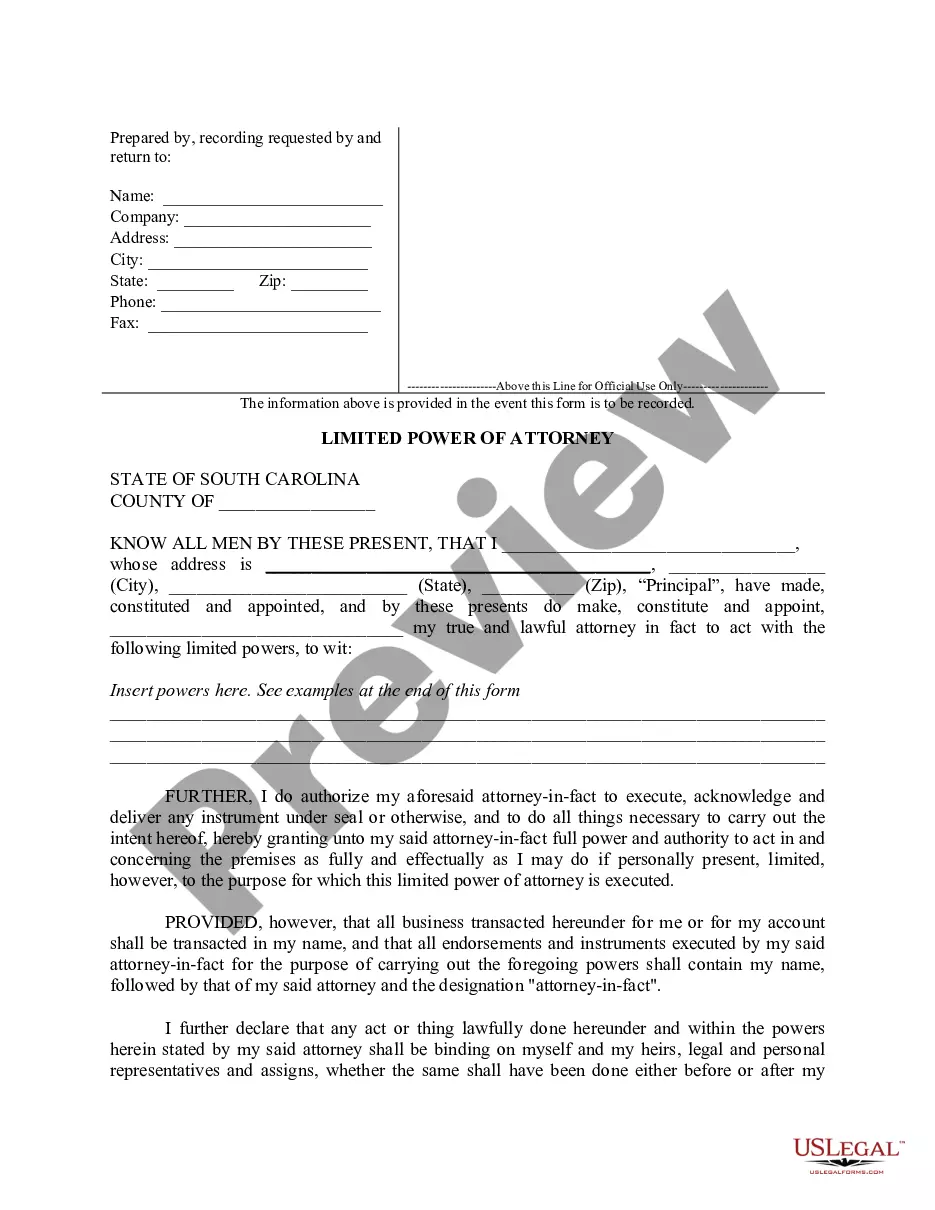

How to fill out South Carolina Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- If you're a returning user, visit the US Legal Forms website and log in to your account. Ensure your subscription is active before proceeding to download the form you need.

- For new users, start by browsing the extensive library. Check the preview and descriptions to find the correct power attorney template that fulfills your requirements based on local jurisdiction.

- If you encounter any discrepancies, utilize the search feature to locate the appropriate form. Once you’ve confirmed it matches your needs, you can move forward.

- Purchase the document by clicking 'Buy Now' and selecting a subscription plan that suits you. You will need to register for an account for full access to your purchased forms.

- Complete your payment using a credit card or PayPal and ensure the transaction is successful.

- Finally, download the form to your device. You can also access it anytime through the My Forms section in your profile.

US Legal Forms is an excellent resource for securing a power attorney for finances, thanks to its vast collection of over 85,000 legal forms. This library ensures you have access to the right document, making the entire process straightforward.

Take action today and simplify your financial management with US Legal Forms. Start your journey to effective document preparation now!

Form popularity

FAQ

In Maryland, a power of attorney for finances must be in writing, signed by the principal, and witnessed by two individuals or acknowledged by a notary. The document should clearly state the powers granted to the agent. Additionally, it’s beneficial to understand state-specific laws and regulations regarding powers of attorney, as these can vary. US Legal Forms offers templates and information tailored to Maryland's requirements, ensuring you create a compliant document.

To activate a power of attorney for finances, you must ensure that the document is signed and notarized according to state laws. Typically, the agent named in the document can start using the power once the principal becomes incapacitated or if the principal chooses to activate it. It is essential to inform financial institutions and any relevant parties about the activation. Using tools and resources from US Legal Forms can help you navigate this process smoothly.

In New York, you do not necessarily need a lawyer to get a power of attorney for finances. You can create a valid document on your own, but having legal guidance can ensure that your specific wishes are clearly reflected in the document. Moreover, a lawyer can help you understand the implications of granting someone power over your finances. For a secure and comprehensive solution, consider using the platforms like US Legal Forms, which provide templates and guidance.

Legally, individuals who can access your bank account include you and anyone you authorize through a power of attorney. This document allows others to handle your financial matters, from managing deposits to making withdrawals. Without a power attorney for finances in place, access remains restricted to you alone. Setting up a power of attorney ensures your financial affairs can be managed even when you are unable to do so yourself.

Writing a simple power of attorney for finances involves a few straightforward steps. First, name your agent and specify their powers regarding your financial affairs. Next, include your personal information and sign the document in the presence of a witness or notary. Platforms like US Legal Forms provide templates that streamline this process, making it easy to draft a legally binding document tailored to your needs.

A power of attorney can make bank withdrawals if the document grants that specific authority. Generally, this allows your agent to manage your financial accounts effectively. However, it is crucial to clearly state the limitations and permissions within the power of attorney document. To create a comprehensive financial power attorney, check the resources available on the US Legal Forms platform.

Yes, a power of attorney can be responsible for managing financial matters as outlined in the document. This includes handling bank accounts, paying bills, and making investment decisions on your behalf. The level of authority granted depends on how the power of attorney is structured. If you want to ensure your affairs are handled according to your wishes, consider drafting a power attorney for finances through a reliable resource.

To establish a power of attorney for finances in New Jersey, you need to complete a written document that clearly states your wishes. Both you and your designated agent must sign the document. Additionally, it's highly recommended that the document be notarized to ensure its validity. Utilizing a platform like US Legal Forms can simplify the process, offering templates that meet state requirements.

To establish power of attorney in Louisiana, specific requirements must be met. The document must be in writing and signed by the principal and two witnesses or notarized. It should clearly outline the powers granted and comply with state laws. Using platforms like US Legal Forms can simplify the creation of this essential document by providing templates tailored to Louisiana's requirements.

Certain decisions are beyond the jurisdiction of a power of attorney for finances. First, you cannot make healthcare-related decisions unless specified in a separate document. Second, you cannot alter the principal's will. Third, you are unable to make decisions that contravene state laws or the principal’s explicit wishes. Understanding these limitations is essential for any agent.