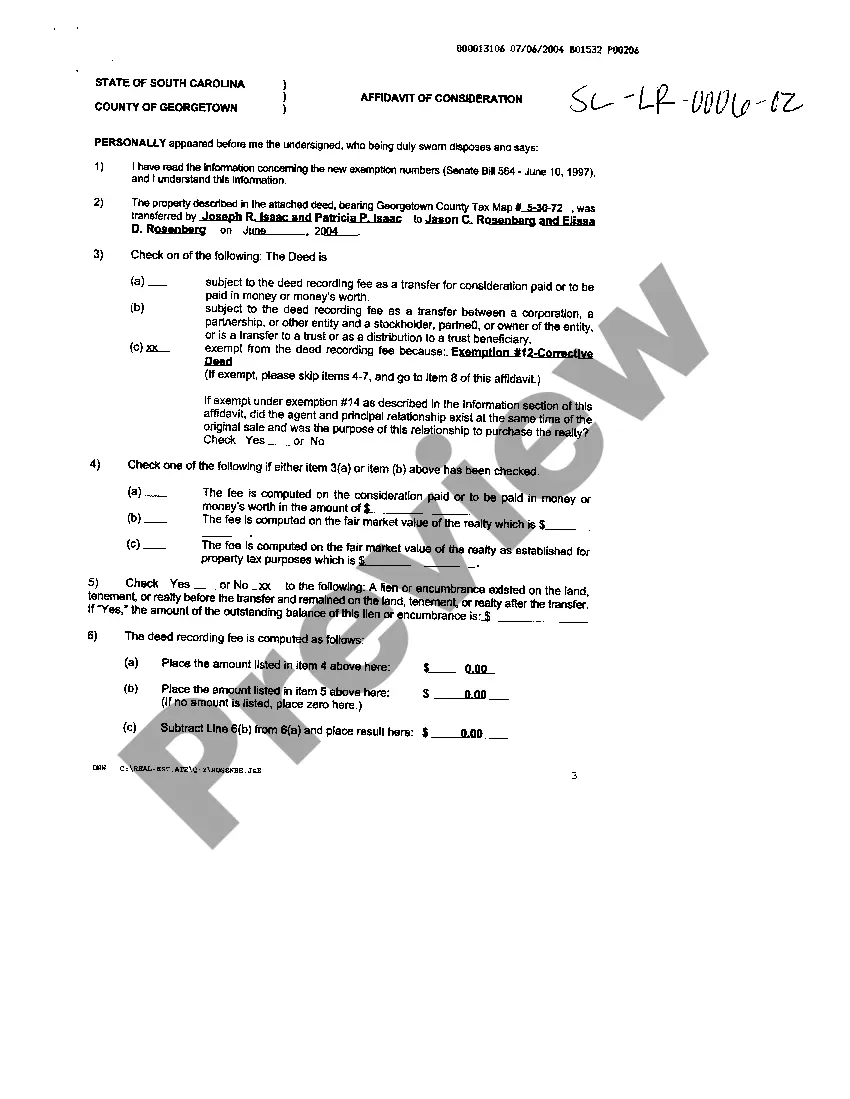

South Carolina Affidavit Of Consideration With Seller

Description

How to fill out South Carolina Affidavit Of Consideration?

Legal papers management may be overpowering, even for the most skilled professionals. When you are interested in a South Carolina Affidavit Of Consideration With Seller and do not have the a chance to commit searching for the appropriate and updated version, the processes could be stress filled. A strong web form catalogue could be a gamechanger for everyone who wants to manage these situations effectively. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available anytime.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any requirements you could have, from individual to organization paperwork, in one place.

- Use innovative resources to finish and handle your South Carolina Affidavit Of Consideration With Seller

- Gain access to a resource base of articles, instructions and handbooks and resources connected to your situation and needs

Save time and effort searching for the paperwork you need, and make use of US Legal Forms’ advanced search and Review feature to locate South Carolina Affidavit Of Consideration With Seller and download it. For those who have a subscription, log in to your US Legal Forms account, search for the form, and download it. Review your My Forms tab to see the paperwork you previously saved as well as to handle your folders as you see fit.

If it is the first time with US Legal Forms, create an account and obtain limitless use of all advantages of the platform. Here are the steps to take after getting the form you want:

- Validate this is the right form by previewing it and looking at its description.

- Ensure that the sample is recognized in your state or county.

- Pick Buy Now once you are ready.

- Select a monthly subscription plan.

- Find the file format you want, and Download, complete, eSign, print out and send your document.

Take advantage of the US Legal Forms web catalogue, supported with 25 years of expertise and stability. Transform your daily document management in a smooth and intuitive process today.

Form popularity

FAQ

The withholding amount is 7% of the gain recognized on the sale by a nonresident individual, partnership, trust, or estate, or 5% of the gain recognized on the sale by a nonresident corporation or other nonresident entity, if the seller provides the buyer with a Seller's Affidavit stating the amount of gain.

The withholding amount is 7% of the gain recognized on the sale by a nonresident individual, partnership, trust, or estate, or 5% of the gain recognized on the sale by a nonresident corporation or other nonresident entity, if the seller provides the buyer with a Seller's Affidavit stating the amount of gain.

Under the withholding statute, the purchaser is liable for the collection and payment of seven (7%) percent of the amount realized on the sale by the nonresident seller or five (5%) percent of the amount realized on the sale if the seller is a nonresident corporation.

Long-term capital gains are included in South Carolina taxable income and taxed at rates up to 7%. However, you can subtract up to 44% of your net South Carolina capital gains, so if you sell a home in South Carolina for a $100,000 profit, your South Carolina tax on that gain would be approximately $3,920.

The South Carolina Code of Laws, Section 12-8-580, says that the purchasers are to withhold 7% of gain for individuals and 5% of gain for corporations that are considered a non-resident seller.