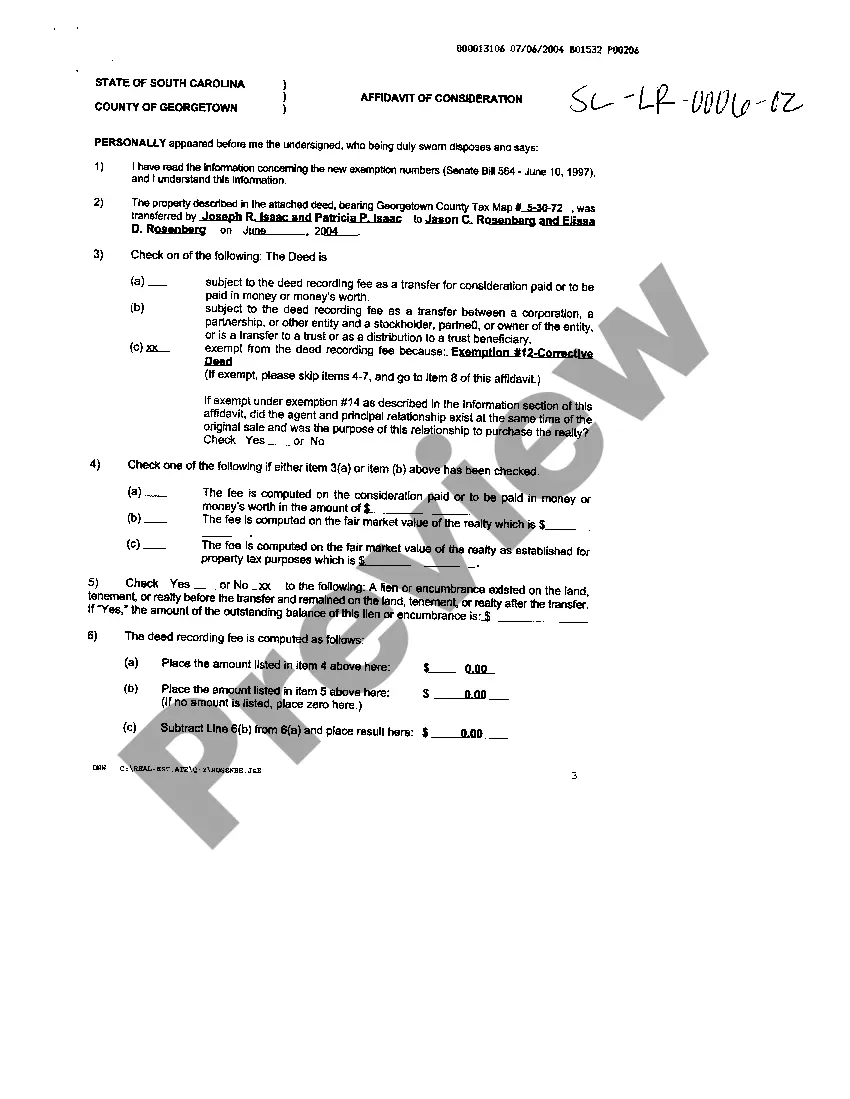

Affidavit Of Consideration South Carolina Withholding

Description

How to fill out South Carolina Affidavit Of Consideration?

It’s no secret that you can’t become a legal professional immediately, nor can you learn how to quickly draft Affidavit Of Consideration South Carolina Withholding without the need of a specialized background. Creating legal documents is a long venture requiring a particular education and skills. So why not leave the creation of the Affidavit Of Consideration South Carolina Withholding to the pros?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court papers to templates for internal corporate communication. We know how important compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s start off with our platform and obtain the document you require in mere minutes:

- Discover the document you need with the search bar at the top of the page.

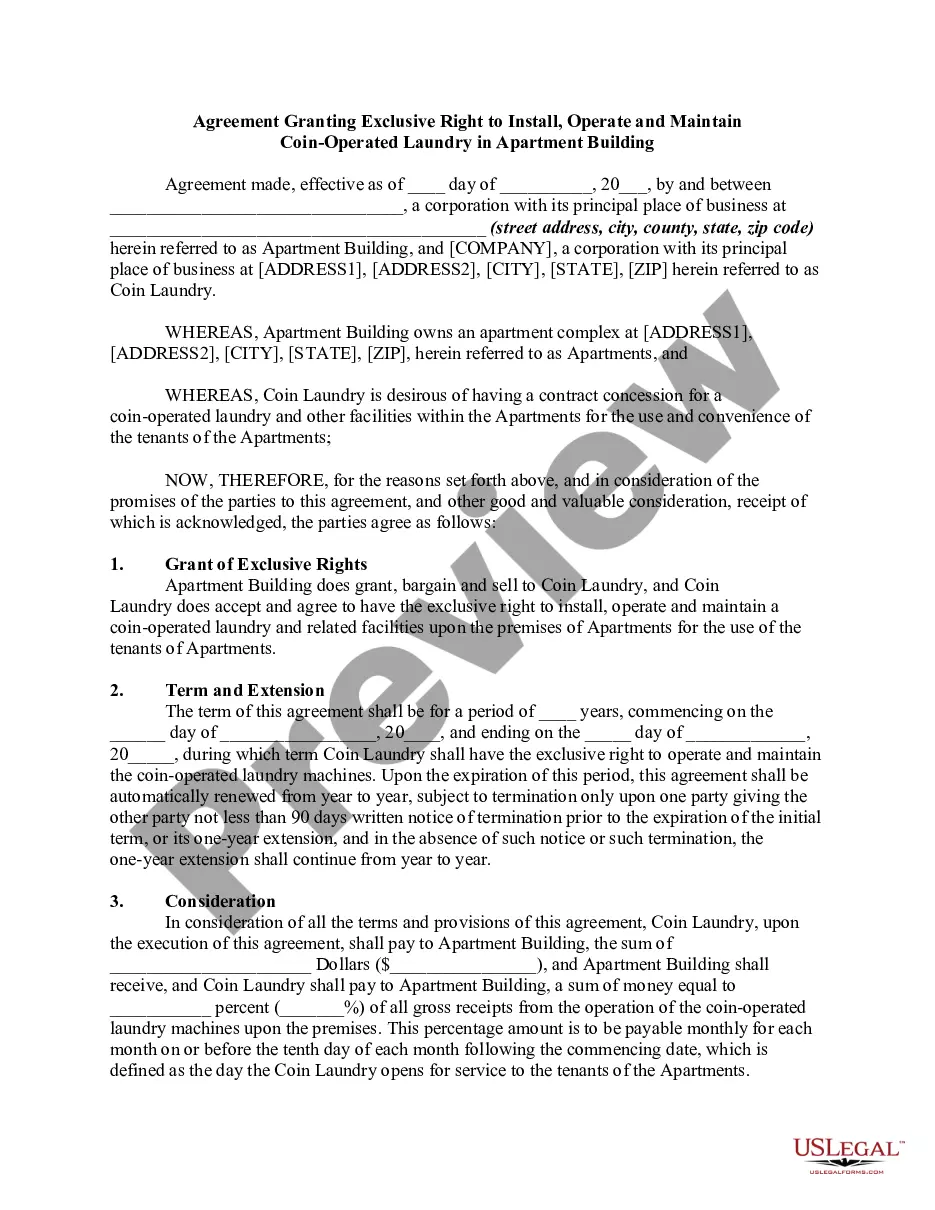

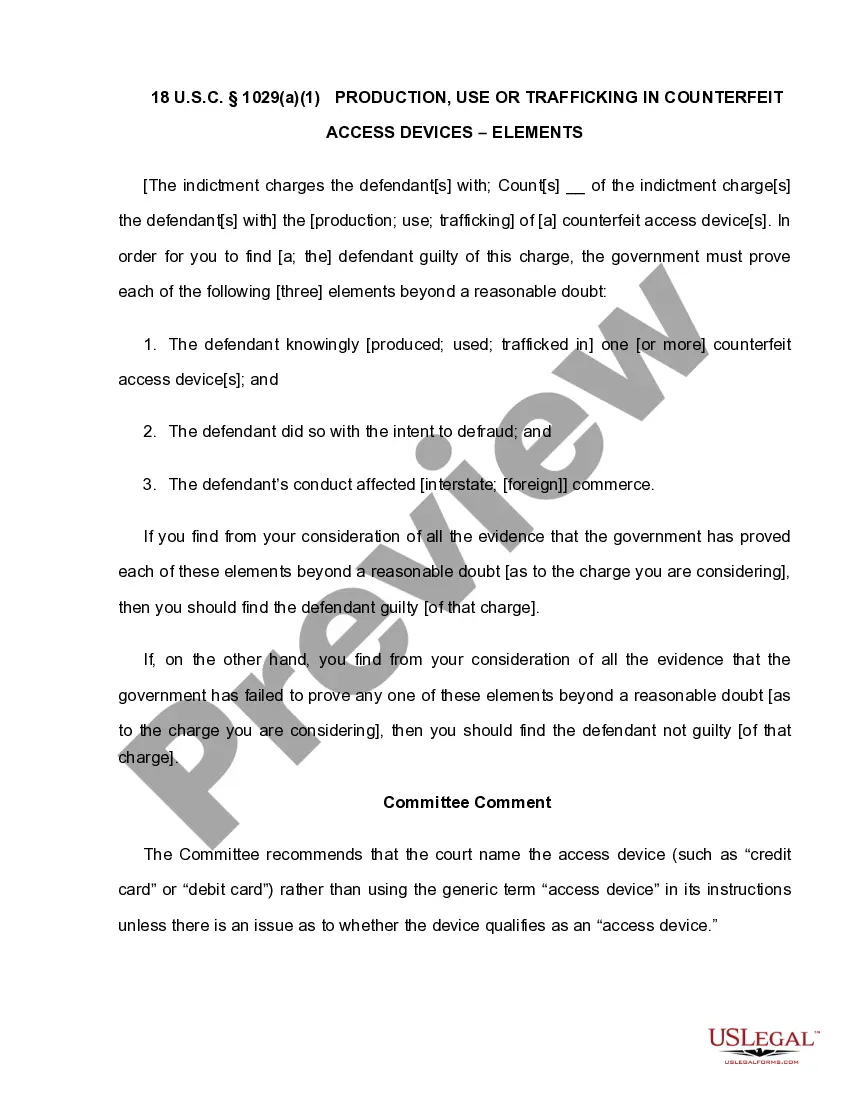

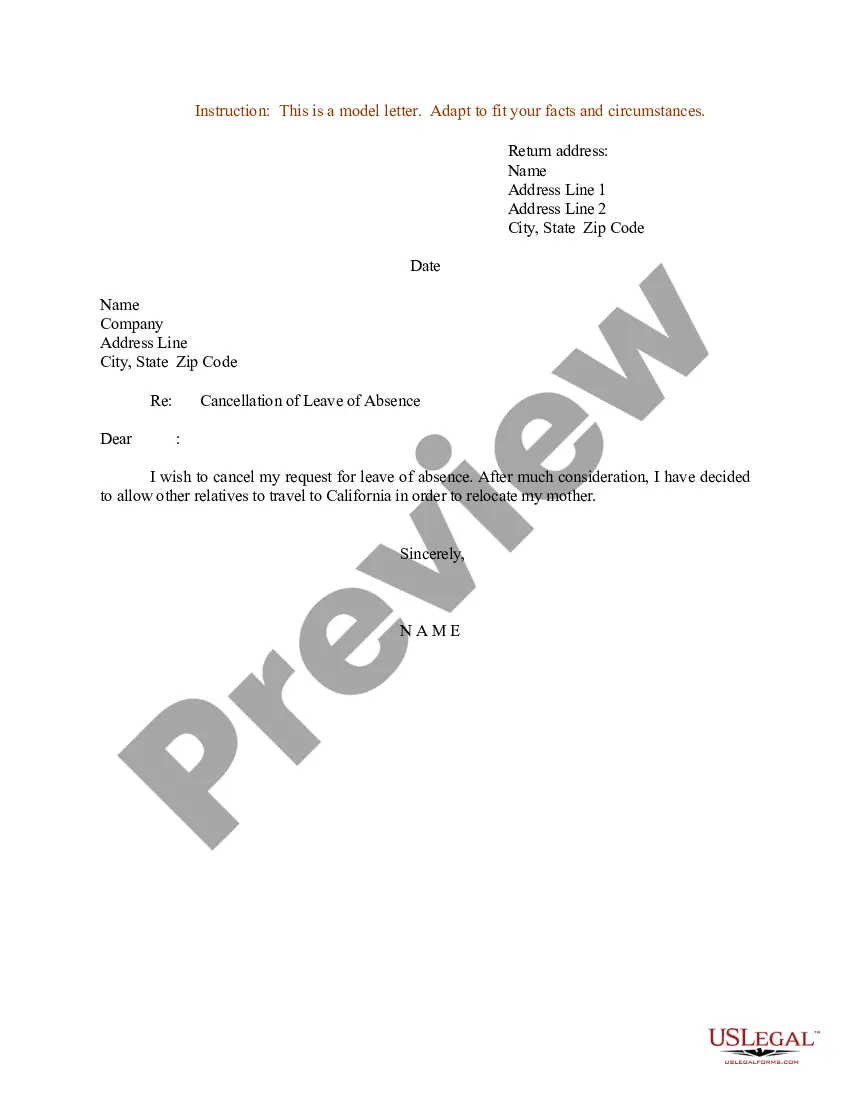

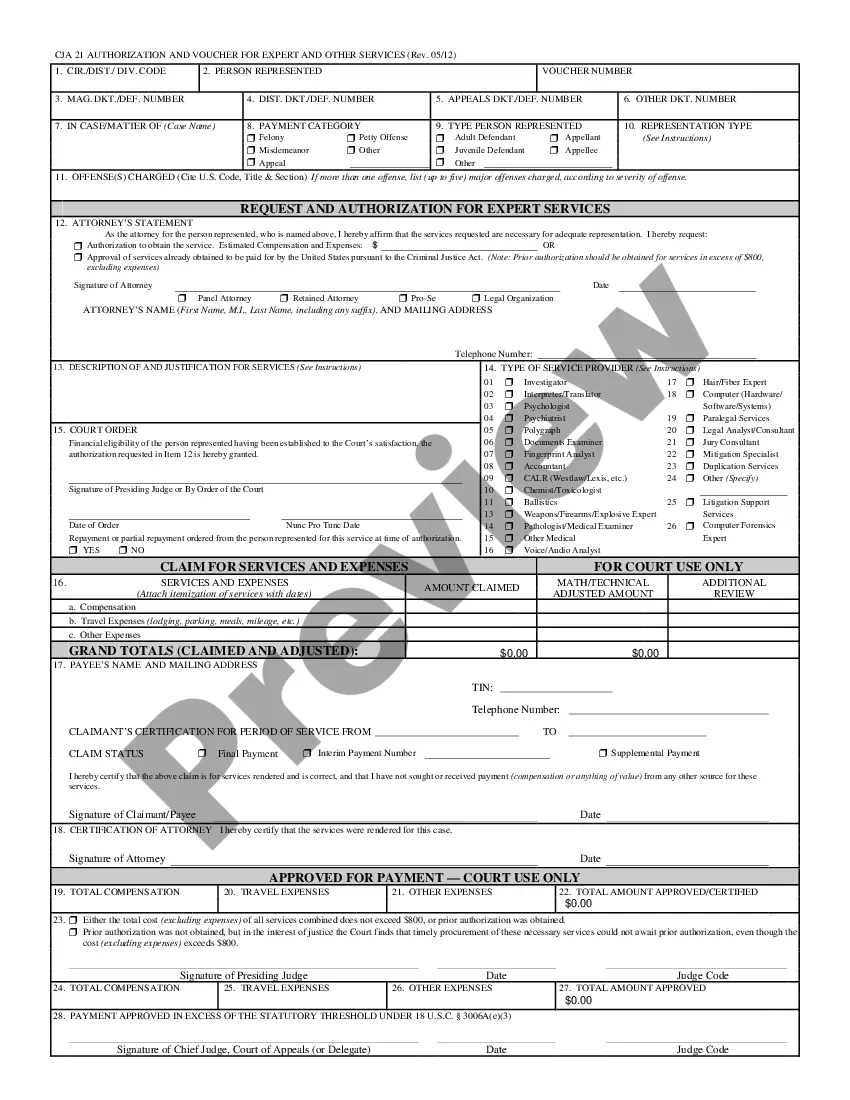

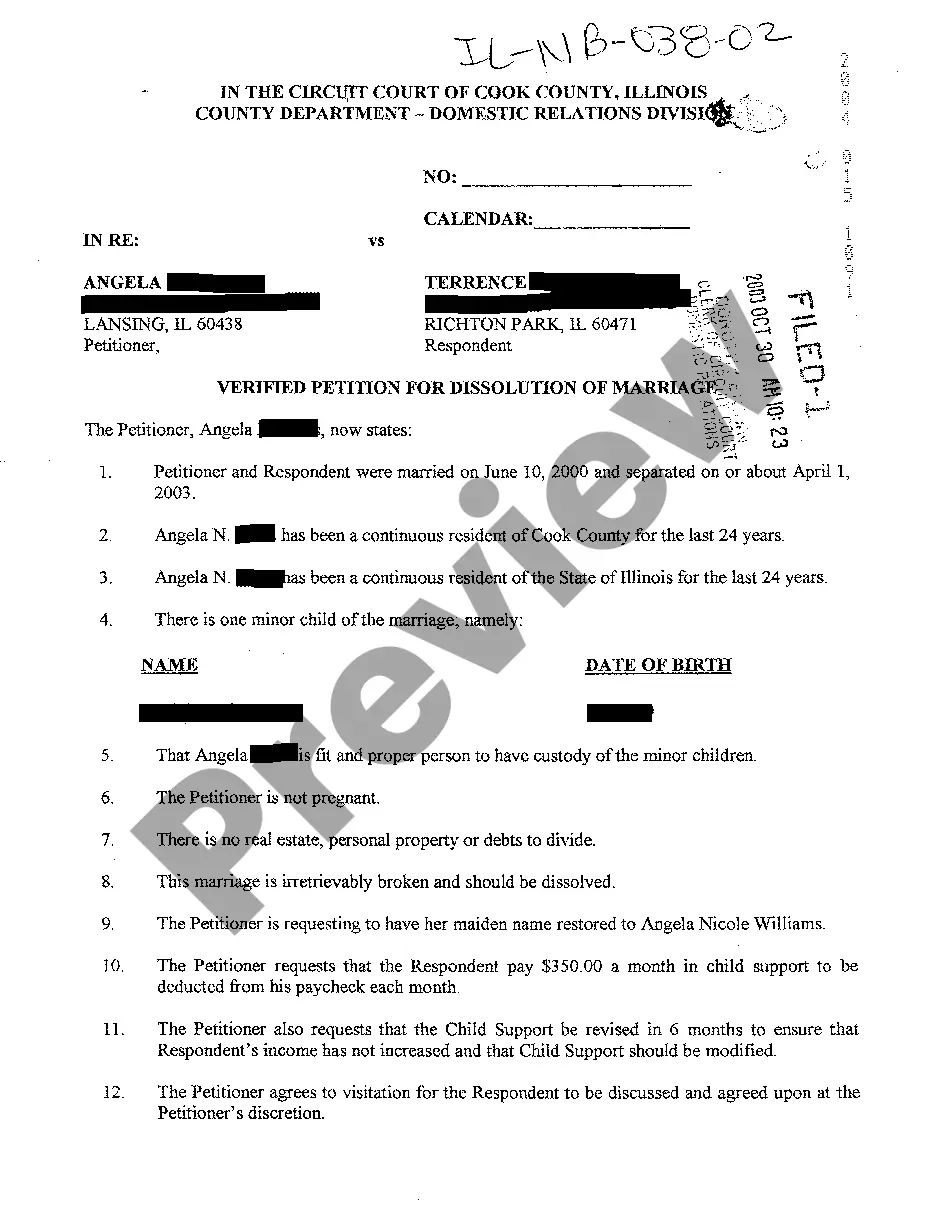

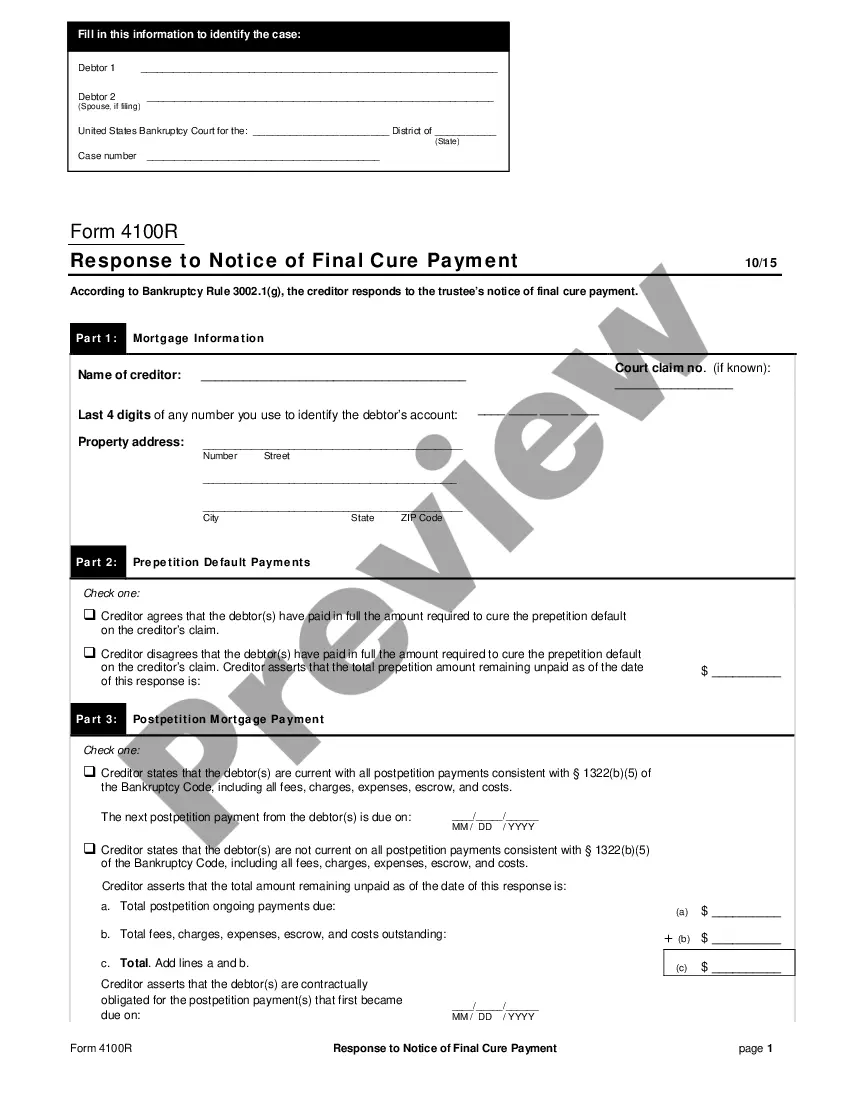

- Preview it (if this option available) and read the supporting description to figure out whether Affidavit Of Consideration South Carolina Withholding is what you’re looking for.

- Begin your search over if you need a different template.

- Set up a free account and choose a subscription plan to purchase the template.

- Choose Buy now. As soon as the transaction is complete, you can download the Affidavit Of Consideration South Carolina Withholding, complete it, print it, and send or mail it to the necessary individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your paperwork-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

File and pay online at MyDORWAY.dor.sc.gov. Do not mail when filing online. You must file a return even if no SC Income Tax has been withheld during the quarter. You must file a WH-1606 if the account was open for any portion of the calendar year.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

South Carolina employers must submit and remit payroll taxes withheld from employee wages. The frequency of payments depends on the amount withheld. If the total withholding amount is less than $500 per quarter, payments are due quarterly by the last day of the month following the end of the quarter.

The withholding amount is 7% of the gain recognized on the sale by a nonresident individual, partnership, trust, or estate, or 5% of the gain recognized on the sale by a nonresident corporation or other nonresident entity, if the seller provides the buyer with a Seller's Affidavit stating the amount of gain.