Leaseforless

Description

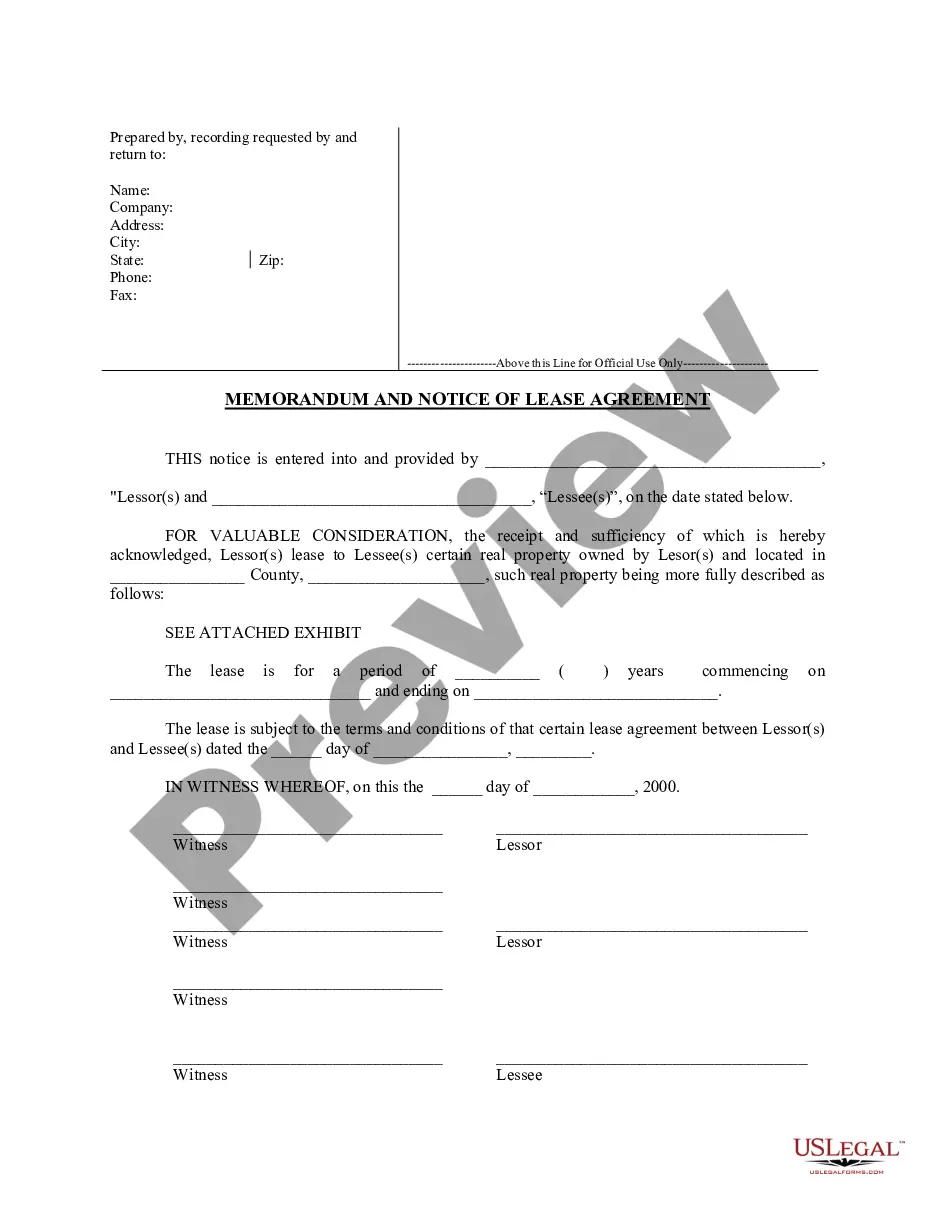

How to fill out South Carolina Notice Of Lease For Recording?

- If you're a returning user, log in to your account and check your subscription status. Ensure it's active before downloading any forms.

- For first-time users, browse the Preview mode and descriptions of templates to find the right form that meets your specific requirements.

- Should you need a different document, utilize the Search tab to find the appropriate form that corresponds with your local jurisdiction.

- When you've selected the right document, click the Buy Now button and choose your preferred subscription plan. Registration will be required for account access.

- Complete your purchase by entering your credit card details or using your PayPal account to finalize the subscription.

- After purchasing, download the template to your device and access it later through the My Forms section of your profile.

US Legal Forms offers more than just documents; it provides a robust collection that surpasses competitors at a similar cost. You can also connect with premium experts for assistance, ensuring your forms are accurate and legally sound.

Take the stress out of legal paperwork today! Start using US Legal Forms and take advantage of Leaseforless to manage your legal documents effortlessly.

Form popularity

FAQ

Yes, you can lease your car to your LLC if you are the owner of the vehicle. This arrangement allows for potential tax deductions and can create a beneficial financial structure for your business. When considering this option, especially in terms of expenses, finding the right lease through Leaseforless can provide you with the best rates and terms.

Filing Form 433-F requires you to collect your financial information, including income, expenses, and assets. This form is often used when an individual is negotiating a debt with the IRS. To simplify the process and improve your understanding, seek resources or assistance from a service like uslegalforms, which provides guidance on legal forms including tax-related paperwork.

You typically do not need to file Form 4684 for standard car lease deductions. This form is used mainly for losses from casualty, theft, or other involuntary conversions. To ensure compliance and maximize your deductions, you might consider consulting the features offered by uslegalforms or using Leaseforless for proper guidance.

Yes, an LLC can write off a car lease if the car is used for business purposes. Similar to vehicle payments, you should maintain records of your business-related driving to validate your expenses. Choosing Leaseforless allows LLCs to secure beneficial vehicle leases that align with their operational budget.

An LLC can write off vehicle payments if the car is used for business. You need to keep detailed records of your business mileage to support your deductions. Using Leaseforless may help you find a suitable vehicle for your LLC's operations while managing costs effectively.

Yes, you can write off your car lease as a business expense if you use the vehicle for business purposes. The IRS allows you to deduct a portion of the lease payment based on the percentage of business use. To maximize your savings, consider using Leaseforless to find an affordable lease that meets your business needs.

The 90% rule for leases indicates that you should aim to keep 90% of a leased vehicle's value when the lease term ends. This means you should avoid excessive wear or mileage, which can lead to steep penalties when returning the vehicle. Understanding this rule can significantly impact the lease drawdown process and help you manage costs effectively. Keeping this in mind allows you to Leaseforless while enjoying your vehicle.

When leasing, the 1% rule suggests that your monthly lease payment should not exceed 1% of the vehicle's total MSRP. This guideline ensures that you stay within a reasonable budget, which is especially important for maintaining long-term financial health. Adopting this strategy can empower you to make informed choices while allowing you to Leaseforless and get the most value from your lease.

To fill out a 15 H form, start by providing your identifying information and income details. Follow the instructions on the form carefully to avoid errors. Make sure to double-check your figures to ensure accuracy. If you need additional help, Leaseforless offers valuable resources to assist with this process.

Filling out the EPA declaration form requires you to provide specific project or product details as well as your contact information. Follow the form's guidelines and ensure all fields are completed accurately. Missing information may delay processing. Leaseforless provides templates and tutorials to help ensure your compliance.