Living Trust For House

Description

How to fill out South Carolina Living Trust For Husband And Wife With One Child?

Locating a primary source for obtaining the most up-to-date and pertinent legal templates is a significant part of dealing with red tape.

Selecting the appropriate legal documents requires precision and meticulousness, which is why it is essential to acquire samples of Living Trust For House solely from trustworthy providers, such as US Legal Forms.

Once you possess the form on your device, you can modify it using the editor or print it out and fill it in manually. Remove the complications associated with your legal documentation. Browse the extensive US Legal Forms collection where you can discover legal templates, evaluate their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your example.

- Examine the form’s description to determine if it meets the criteria of your state and locality.

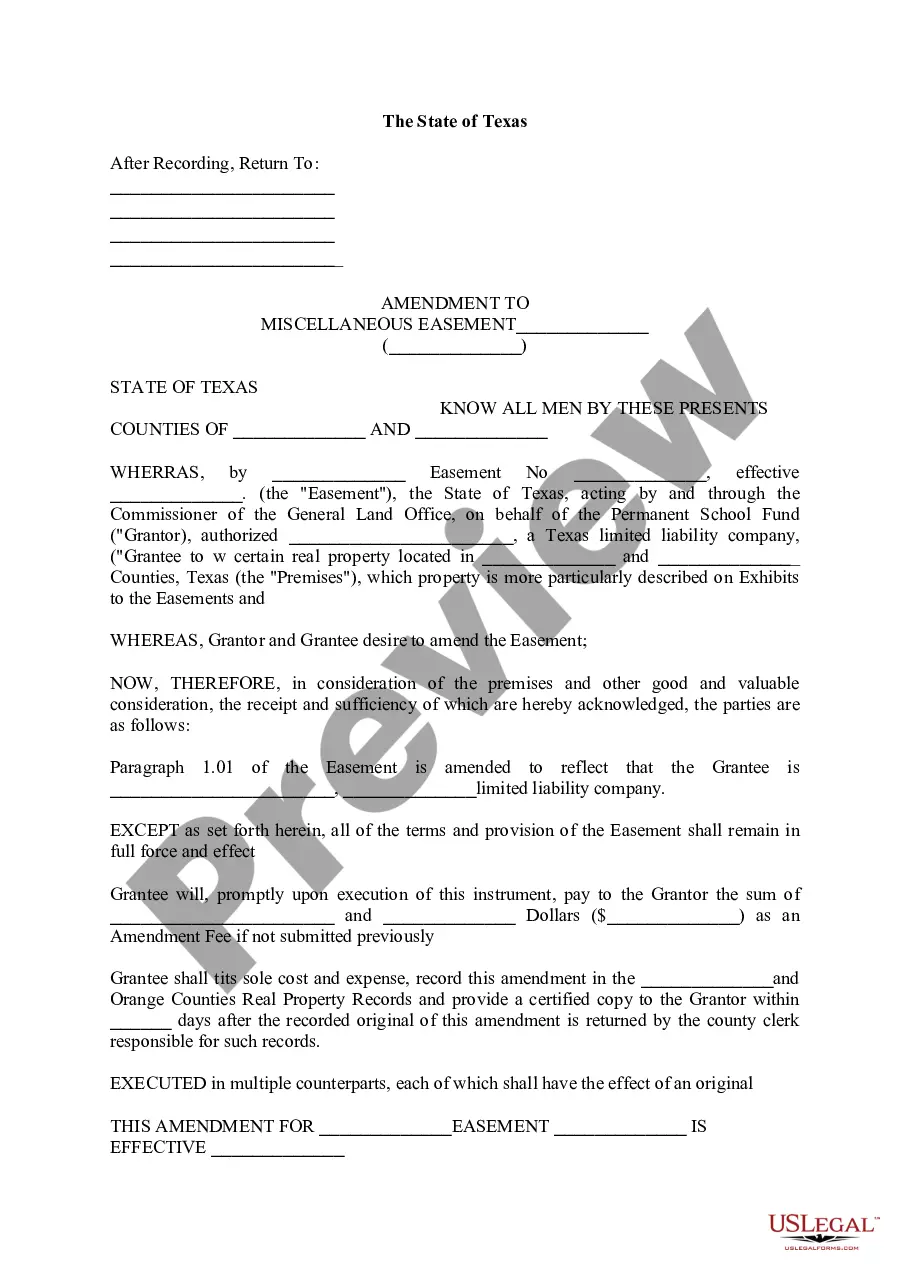

- Access the form preview, if available, to confirm the form aligns with your needs.

- If the Living Trust For House does not meet your criteria, return to the search to find the suitable template.

- When you are confident about the form's suitability, download it.

- If you are a registered member, click Log in to verify and gain access to your selected forms in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Choose the pricing option that best meets your needs.

- Proceed with the registration to finalize your order.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Living Trust For House.

Form popularity

FAQ

A living trust for house may come with disadvantages that you should consider. For instance, you still need to file tax returns and deal with property management under the trust. Furthermore, a living trust does not protect your assets from creditors or lawsuits, which might be a concern depending on your financial situation.

The best trust for your house is often a living trust. A living trust for house allows you to retain control over your property while providing a clear plan for its management and distribution after your passing. Unlike a will, a living trust can help your heirs avoid probate, making the transfer process smoother and faster.

One of the biggest mistakes parents make when setting up a trust fund is not clearly defining their wishes and the distributions of assets. This lack of clarity can lead to confusion and disputes among heirs. Establishing a well-thought-out living trust for house is essential to ensure your loved ones fully understand your intentions. Resources provided by uslegalforms can assist in creating a comprehensive trust that resolves potential conflicts.

Whether your trust needs to file a tax return depends on its structure and income. Generally, revocable living trusts do not file separate federal tax returns as their income is reported on the owner's personal tax return. However, if your living trust for house generates significant income, it might require its own tax return. Consulting with a tax expert can provide clarity on your obligations.

If you do not file taxes on a trust, you may incur penalties and interest fees from the IRS. The trust may be subject to additional taxes or face issues when distributing assets to beneficiaries. Maintaining proper tax filings for your living trust for house is crucial to prevent complications and ensure that your wishes are honored. Utilizing platforms like uslegalforms can help simplify your trust's tax management.

You do not need to file your living trust with the court, as living trusts are private documents. However, if you transfer assets like a house into your living trust, you may want to inform your financial institutions or other involved parties. Additionally, keeping your documents updated helps ensure ease of access and compliance. Overall, a living trust for house simplifies the transfer of property and preserves your intentions.

Many individuals choose to put their house in a living trust to streamline the inheritance process for their loved ones. A living trust for house helps avoid the lengthy probate process, which can be both time-consuming and costly. Furthermore, this option allows for flexibility and control during your lifetime, as you can manage the trust assets as needed. Overall, a living trust can ensure that your wishes regarding your home are honored with less legal hassle down the line.

Deciding whether to gift a house or place it in a living trust depends on your goals. A living trust for house offers benefits such as avoiding probate and maintaining privacy after your passing. Additionally, placing your house in a trust may provide control over how the property is managed and accessed by your heirs. It is wise to consult with a legal expert to understand the specific advantages of a living trust for your unique situation.

The best way to put your house in a living trust is to create a trust document that clearly outlines your wishes. Once you establish the living trust for your house, you should transfer the title of your property into the trust's name. This process often requires filing specific forms with your local government office. Using a platform like US Legal Forms can guide you through each step, ensuring your house is properly included in your living trust.