Limited Limited

Description

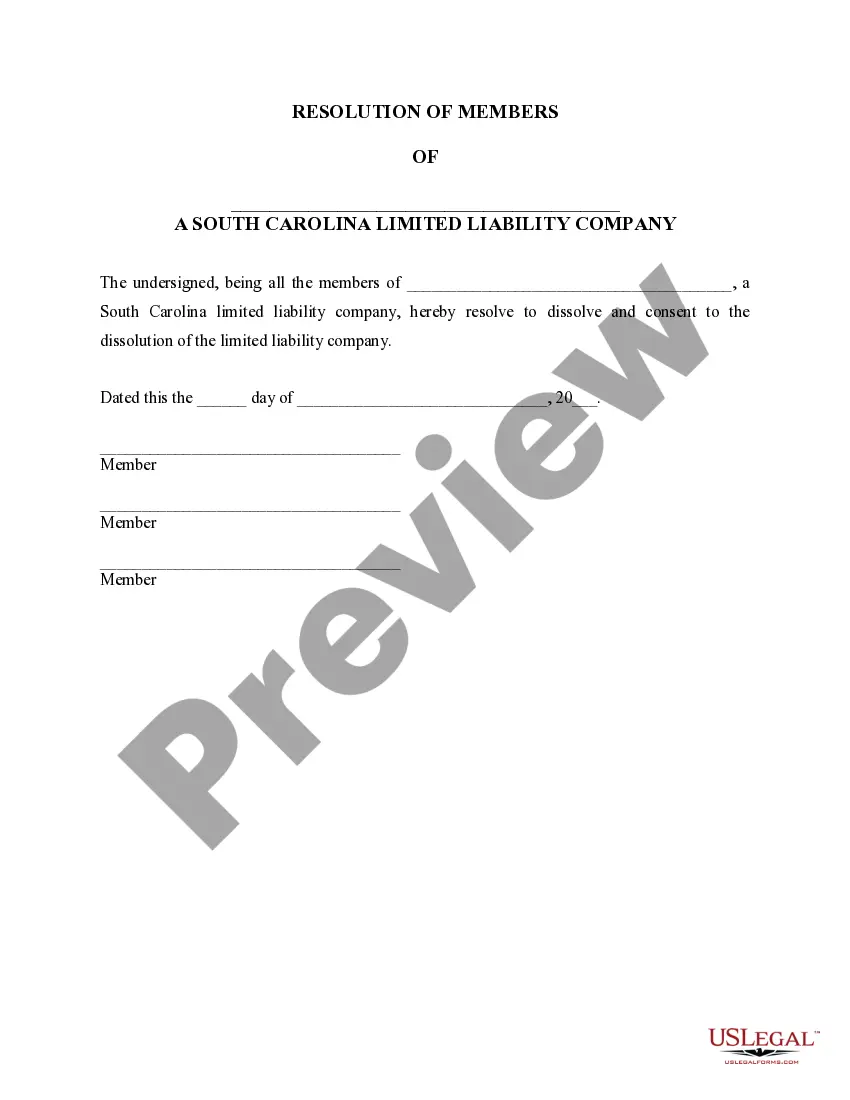

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

- If you're a returning user, log in to your account and access your desired form by clicking the Download button. Ensure your subscription is up to date, or renew it according to your payment plan.

- For first-time users, begin by exploring the Preview mode and reading the form description. Make sure the selected form aligns with your needs and adheres to local jurisdiction regulations.

- If your initial choice isn't suitable, utilize the Search tab to find a more appropriate template that matches your requirements.

- After identifying the correct form, select the Buy Now button and choose your preferred subscription plan, creating an account to unlock the library's resources.

- Proceed with your purchase by entering your credit card information or using your PayPal account to complete the transaction.

- Finally, download the form to your device for completion, and access it anytime from the My Forms section of your profile.

By following these straightforward steps, you can efficiently utilize US Legal Forms to meet your legal paperwork needs. The platform’s robust library, featuring over 85,000 editable forms, significantly reduces the time it takes to find and fill out legal documents.

Ready to streamline your legal document process? Explore US Legal Forms today and gain access to premium expert assistance!

Form popularity

FAQ

In the United States, 'Ltd' stands for 'Limited,' designating a company structure that limits the liability of its owners or shareholders. This designation is often used interchangeably with 'Inc.' or 'LLC,' highlighting various business structures that mitigate personal financial risk. Understanding the implications of establishing a limited liability company in the US is essential for entrepreneurs. USLegalForms offers valuable resources and tools to help you successfully navigate the formation process.

The abbreviation 'AS Ltd' stands for 'Aktieselskab Limited,' a term used mainly in Scandinavian countries to denote a type of limited company. This structure allows for shared ownership, functioning similarly to other limited companies around the globe. It provides shareholders with limited liability, ensuring their personal assets are protected. If you're considering forming such a company, consulting resources like USLegalForms can guide you through the legal requirements.

The expression 'Ltd. Ltd.' typically signifies a limited liability company, indicating a specific business structure that limits the financial liability of its owners. This structure protects personal assets from business debts and liabilities, which is highly beneficial for entrepreneurs. Companies registered as 'Ltd.' often enjoy certain tax advantages and operational flexibility. Engaging with a platform like USLegalForms can help you navigate the complexities of forming a limited liability company.

The phrase 'limit limited' generally refers to constraints placed on a product or service that defines its availability or access. This term often appears in business and legal contexts, indicating that certain options become restricted or capped. Understanding limit limited conditions is crucial for businesses to manage their offerings effectively. By recognizing these limits, businesses can avoid potential legal issues and maintain compliance.

In Roblox, the term 'limited and limited u' refers to items that developers issue in restricted quantities, creating a sense of exclusivity among players. These limited items can hold value over time, making them sought-after commodities in the game. Players often seek to buy or trade these items to enhance their gaming experience. Limited limited items can significantly affect gameplay and player engagement.

The rarest Roblox limited is often debated, but many consider items like 'Dominus' series to be among the rarest Limiteds. These unique items can fetch extraordinary prices on the resale market due to their scarcity. It's essential to continuously monitor the Roblox community and various user platforms to find updates on rare Limiteds. Understanding the demand and history behind each Limited can enhance your collection strategy.

Yes, Roblox continues to release Limited items, keeping the Limited limited feature alive and exciting. Players can look forward to new Limiteds that enhance their avatar customization options. Each release presents an opportunity to own a unique item, creating value for collectors. Staying updated through Roblox announcements can help you snag the latest Limiteds as they drop.

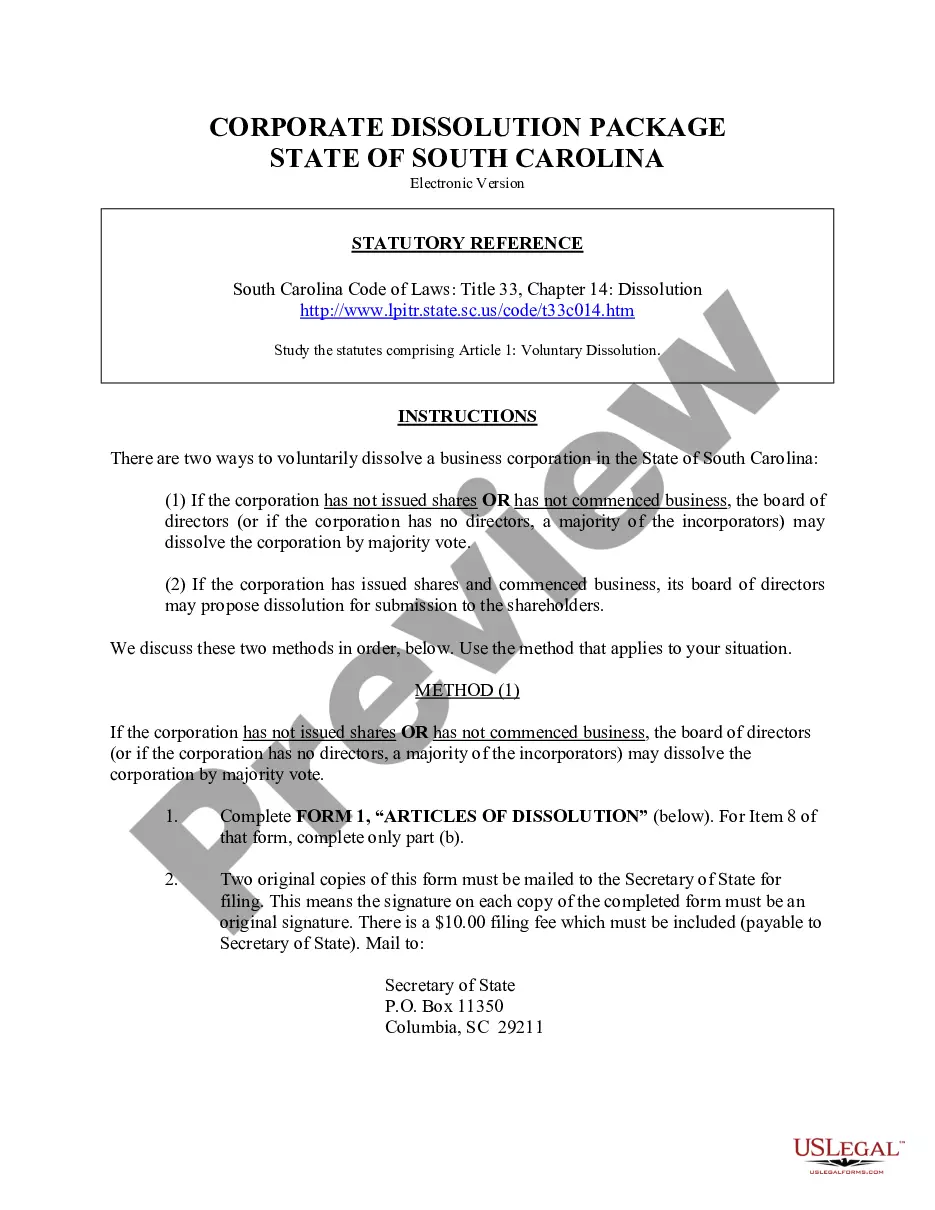

While you can technically create a Limited limited LLC and leave it inactive, it's still subject to state fees and requirements. This includes annual reports or maintaining a registered agent. If you're considering starting an LLC, evaluate its purpose and potential benefits. uslegalforms offers resources to help you manage your LLC effectively, even if you choose not to actively engage with it.

Filing your Limited limited LLC separately often refers to filing tax documents apart from your personal income tax return. Depending on your situation, you may be able to file as a partnership or corporation. Consult tax professionals for tailored advice, and consider using uslegalforms to understand your filing options better.

Yes, you can file your Limited limited LLC by yourself, as most states provide forms for self-filing. However, the process can be intricate and requires attention to detail. To make the process smoother, you might want to leverage services like uslegalforms, which can walk you through the filing steps and requirements.