Closing Costs With Va Loan

Description

How to fill out South Carolina Closing Statement?

Creating legal documents from the ground up can occasionally feel somewhat daunting.

Certain situations may necessitate extensive research and significant financial investment.

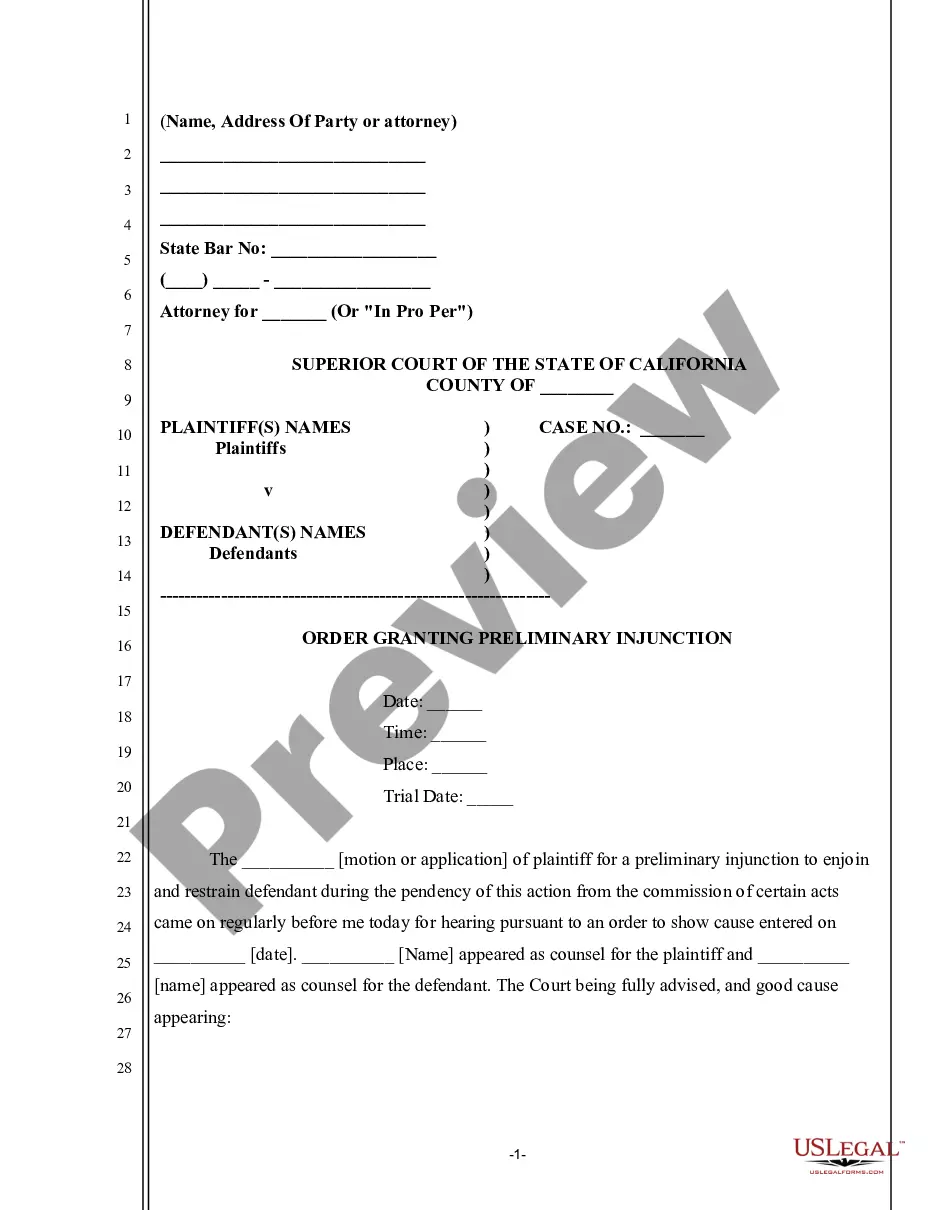

If you’re searching for a more direct and economical method of preparing Closing Costs With Va Loan or other paperwork without unnecessary complications, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal affairs.

- With just a few clicks, you can easily access state- and county-specific forms meticulously crafted by our legal professionals.

- Utilize our platform whenever you need a dependable service through which you can swiftly locate and download the Closing Costs With Va Loan.

- If you’re familiar with our website and have created an account previously, simply Log In to your account, find the form, and download it or re-download it at any time in the My documents tab.

- No account? No problem. It takes minimal time to register and explore the catalog.

Form popularity

FAQ

Buyer closing costs in Virginia typically include various fees and expenses associated with finalizing a real estate transaction. These costs can encompass loan origination fees, title insurance, appraisal fees, and recording fees. When you're considering closing costs with a VA loan, it's important to note that some of these fees can be negotiated or covered by the seller, which may help reduce your overall expenses.

You'll pay this fee when you close your VA-backed or VA direct home loan. You can pay the VA funding fee in either of these ways: Include the funding fee in your loan and pay it off over time (called financing), or. Pay the full fee all at once at closing.

Can VA loan closing costs get rolled into your loan? Although you can't include all of your closing costs in your mortgage, the VA does allow you to roll your VA funding fee into your total loan amount. By financing your funding fee with the rest of your loan, you'll instead repay the amount over time.

Average closing costs for Virginia range from 2% to 5% of the total loan amount. The average amount is about $3,425 for a $200,000 mortgage. That is just less than 2% of the loan amount and slightly more than the national average of $3,160.

Here are the VA non-allowable fees that you need to consider. Real estate attorney fees: Attorney fees are not allowed for VA home loans. Real estate broker fees: You cannot pay for real estate broker fees when buying a home with a VA loan. Agent or REALTOR® fees: VA borrowers cannot pay real estate agent fees.

One Percent. Flat Charge. In addition to the ?itemized fees and charges,? the lender may charge the veteran a flat charge not to exceed one percent of the loan amount.